Regional Management Corp. Offers Assistance to Customers Impacted by Hurricane Helene

September 30 2024 - 2:45PM

Business Wire

Regional Management Corp. (NYSE: RM), a diversified consumer

finance company operating through its Regional Finance

subsidiaries, is offering borrower assistance programs to provide

relief to customers in the Southeast who have been impacted by

Hurricane Helene. The programs provide a variety of options to

eligible customers, including loan payment deferrals, loan

modifications, and certain fee waivers. Regional Finance team

members also stand ready to assist eligible customers in filing

personal property and other credit insurance claims.

“Hurricane Helene had a devastating impact on many communities

where we operate,” said Robert W. Beck, President and Chief

Executive Officer of Regional Management Corp. “Our thoughts are

with our customers and team members in the affected areas, many of

whom suffered damages to their homes and remain without power. We

are thankful for first responders, healthcare workers, utility

companies, government agencies, and others who have been working

tirelessly to assist and restore our communities. I also want to

extend a special thank you to our team members in the impacted

areas (including our headquarters in Greenville) and across the

country who have stepped up since Friday—by working nights and over

the weekend—to support our customers and communities in the areas

affected by the storm. We have a truly special team at Regional,

and we remain ready and eager to support our customers throughout

the recovery.”

Regional Finance is headquartered in the Upstate of South

Carolina. Impacted customers should call 877-762-8011 to discuss

assistance options and credit insurance claims filing.

About Regional Management Corp.

Regional Management Corp. (NYSE: RM) is a diversified consumer

finance company that provides attractive, easy-to-understand

installment loan products primarily to customers with limited

access to consumer credit from banks, thrifts, credit card

companies, and other lenders. Regional Management operates under

the name “Regional Finance” online and in branch locations in 19

states across the United States. Most of its loan products are

secured, and each is structured on a fixed-rate, fixed-term basis

with fully amortizing equal monthly installment payments, repayable

at any time without penalty. Regional Management sources loans

through its multiple channel platform, which includes branches,

centrally managed direct mail campaigns, digital partners, and its

consumer website. For more information, please visit

www.RegionalManagement.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240930938823/en/

Investor Relations Garrett Edson, (203) 682-8331

investor.relations@regionalmanagement.com

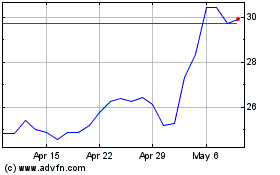

Regional Management (NYSE:RM)

Historical Stock Chart

From Oct 2024 to Nov 2024

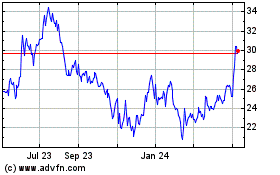

Regional Management (NYSE:RM)

Historical Stock Chart

From Nov 2023 to Nov 2024