Current Report Filing (8-k)

March 02 2020 - 4:17PM

Edgar (US Regulatory)

0001423221

false

--10-31

0001423221

2020-02-26

2020-02-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

February 27, 2020

(Date of earliest event reported)

QUANEX BUILDING PRODUCTS CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

1-33913

|

|

26-1561397

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification

No.)

|

|

1800 West Loop South, Suite 1500,

Houston, Texas

|

|

77027

|

|

(Address of principal

executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code: 713-961-4600

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

¨

|

Soliciting

material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

¨

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

¨

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b)

of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which

registered

|

|

Common Stock, par value $0.01 per share

|

|

NX

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.02. Termination of a Material Definitive

Agreement.

The information included

below under Item 5.02 is incorporated herein by reference.

Item 5.02. Departure of Directors or

Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On February 27, 2020,

the Board of Directors (the “Board”) of Quanex Building Products Corporation (the “Company”) approved a

new Executive Severance Policy (the “Policy”). The Policy provides for the payment of severance benefits to the Company’s

named executive officers and certain other key employees in the event of a “Qualifying Termination,” as such term is

defined in the Policy. The amount of benefits to be paid under the policy depends upon (i) whether the Qualifying Termination has

occurred in connection within 24 months of a Change in Control (as such term is defined in the Policy) or otherwise, and (ii) the

participant’s placement within one of three tiers. Tier 1 covers the Company’s President and Chief Executive Officer;

Tier 2 covers the Company’s Section 16 Officers; and Tier 3 covers certain key employees. The Policy includes a time-limited

double trigger provision in the event of a Change in Control (as such term is defined in the Policy).

Set forth below is

a short summary of the benefits that would be payable to each participant tier in the event of a Qualifying Termination under certain

circumstances:

|

Executive Tier

|

Type of Qualifying Termination

|

Severance Benefits to be Paid

|

Tier 1

(President & CEO)

|

Qualifying Termination

without Change in Control

|

· 2x

base salary plus 2x target annual bonus;

· Pro-rata

annual bonus for year of termination based on actual Company performance; and

· COBRA coverage for 18 months.

|

Qualifying Termination

within 24 months of Change in Control

|

· 2.5x base salary plus 2.5x target annual bonus;

· Pro-rata target annual bonus; and

· COBRA coverage for 18 months.

|

Tier 2

(Section 16 Officers)

|

Qualifying Termination

without Change in Control

|

· 1.5x base salary plus 1.5x target annual bonus;

· Pro-rata annual bonus for year of termination based on actual Company performance; and

· COBRA coverage for 18 months.

|

Qualifying Termination

within 24 months of Change in Control

|

· 2x base salary plus 2x target annual bonus;

· Pro-rata target annual bonus; and

· COBRA coverage for 18 months.

|

Tier 3

(Certain Key Employees)

|

Qualifying Termination

without Change in Control

|

· 1x base salary plus 1x target annual bonus;

· Pro-rata annual bonus for year of termination based on actual Company performance; and

· COBRA coverage for 12 months

|

Qualifying Termination

within 24 months of Change in Control

|

· 1.5x base salary plus 1.5x target annual bonus;

· Pro-rata target annual bonus; and

· COBRA coverage for 18 months

|

A participant’s

inclusion in the Policy requires approval of the Company’s Compensation and Management Development Committee (the “Compensation

Committee”). The Compensation Committee has determined that the Policy will not cover the Company’s Executive Chairman

role, and is thus not applicable to the Company’s Chairman, Mr. William Griffiths.

With the exception

of the severance and change in control agreements currently in place between the Company and Mr. Griffiths, the Policy will supersede

any severance arrangements or change in control agreements currently in place between the Company and any executives. As such,

the following agreements are no longer applicable, and each respective officer will sign a waiver and termination of any severance

or change in control rights applicable under such agreement:

|

|

·

|

Change in Control Agreement between the Company and Scott Zuehlke, effective January 25, 2016, filed as Exhibit 10.2 to the Registrant’s Current Report on Form 8-K (Reg. No. 001-33913), as filed with the Securities and Exchange Commission on January 27, 2016.

|

|

|

·

|

Change in Control Agreement between the Company and George Wilson, effective August 1, 2017, filed as Exhibit 10.2 of the Registrant’s Current Report on Form 8-K (Reg. No. 001-33919) as filed with the Securities and Exchange Commission on July 27, 2017.

|

|

|

·

|

Any severance provisions included in that certain Agreement between Quanex Building Products Corporation and Mark A. Livingston, effective January 30, 2019, filed as Exhibit 10.49 to the Company’s Annual Report on Form 10-K (Reg. No. 001-33913) for the fiscal year ended October 31, 2019.

|

The foregoing discussion

is qualified in its entirety by reference to the full text of the Policy, which is attached to this Current Report on Form 8-K

as Exhibit 10.1 and incorporated by reference herein.

Item 5.03. Amendments to Articles of

Incorporation or Bylaws.

Amendment to Bylaws

On February 27, 2020,

the Board of Directors (the “Board”) of Quanex Building Products Corporation (the “Company”) approved an

amendment to Section 4.4 of the Company’s Third Amended and Restated Bylaws (the “Bylaws”) to provide that Board

members may be removed with or without cause by a simple majority of the Company’s stockholders. This amendment served to

remove the supermajority requirement that had previously been applicable for removal of directors without cause.

The foregoing discussion

is qualified in its entirety by reference to the full text of the Fourth Amended and Restated Bylaws of the Company, which is attached

to this Current Report on Form 8-K as Exhibit 3.1 and incorporated by reference herein.

Item 5.07. Submission of Matters to a Vote of Security Holders

On February 27, 2020,

the Company held its Annual Meeting of Stockholders, pursuant to notice and proxy mailed on or about January 29, 2020, to the Company’s

stockholders of record as of January 8, 2020. There were 33,083,338 shares of common stock entitled to vote at the meeting,

and a total of 29,961,513 shares were represented at the meeting in person or by proxy.

At the Annual Meeting,

eight directors were elected for terms expiring at the Company’s 2021 Annual Meeting, with the following tabulation of votes

for each nominee:

|

Director Nominee

|

|

Votes For

|

|

|

Votes Against

|

|

|

Abstain

|

|

|

Broker Non-Votes

|

|

|

Percent of Shares Cast in Favor *

|

|

|

Robert R. Buck

|

|

|

28,133,001

|

|

|

|

367,695

|

|

|

|

7,520

|

|

|

|

1,453,297

|

|

|

|

98.68

|

%

|

|

Susan F. Davis

|

|

|

27,823,902

|

|

|

|

675,210

|

|

|

|

9,104

|

|

|

|

1,453,297

|

|

|

|

97.60

|

%

|

|

William C. Griffiths

|

|

|

28,069,691

|

|

|

|

430,706

|

|

|

|

7,819

|

|

|

|

1,453,297

|

|

|

|

98.46

|

%

|

|

Donald R. Maier

|

|

|

28,137,942

|

|

|

|

362,578

|

|

|

|

7,696

|

|

|

|

1,453,297

|

|

|

|

98.70

|

%

|

|

Meredith W. Mendes

|

|

|

28,291,122

|

|

|

|

208,102

|

|

|

|

8,993

|

|

|

|

1,453,297

|

|

|

|

99.24

|

%

|

|

Joseph D. Rupp

|

|

|

27,817,723

|

|

|

|

682,681

|

|

|

|

7,813

|

|

|

|

1,453,297

|

|

|

|

97.58

|

%

|

|

Curtis M. Stevens

|

|

|

28,111,507

|

|

|

|

389,867

|

|

|

|

6,842

|

|

|

|

1,453,297

|

|

|

|

98.61

|

%

|

|

George L. Wilson

|

|

|

28,202,920

|

|

|

|

299,295

|

|

|

|

6,002

|

|

|

|

1,453,297

|

|

|

|

98.93

|

%

|

*Excludes Abstentions and Broker Non-Votes

In addition to the

election of directors, stockholders at the Annual Meeting voted on and approved the following actions:

|

|

·

|

Approved the new Quanex Building Products Corporation 2020 Omnibus Incentive Plan (the “2020

OIP”). A copy of the 2020 OIP as approved by the shareholders is filed as Exhibit 10.2 to this Current Report on Form 8-K.

|

|

|

·

|

Provided an advisory “say on pay” vote approving the Company’s executive compensation

programs; and

|

|

|

·

|

Ratified the Audit Committee’s appointment of Grant Thornton LLP as the Company’s independent

auditor for the fiscal year ending October 31, 2020;

|

The tabulation of

votes for these proposals is set forth below:

|

Proposal

|

|

Votes For

|

|

|

Votes

Against

|

|

|

Abstain

|

|

|

Broker

Non-

Votes

|

|

|

Percent of

Shares Cast

in Favor *

|

|

|

Approval of Quanex Building Products Corporation 2020 Omnibus

Incentive Plan

|

|

|

27,710,028

|

|

|

|

774,473

|

|

|

|

23,716

|

|

|

|

1,453,297

|

|

|

|

97.20

|

%

|

|

Advisory Vote to Approve Executive Compensation

|

|

|

27,838,059

|

|

|

|

648,703

|

|

|

|

21,455

|

|

|

|

1,453,297

|

|

|

|

97.65

|

%

|

|

Ratification of Company’s Independent Auditor

|

|

|

29,924,592

|

|

|

|

29,377

|

|

|

|

7,544

|

|

|

|

0

|

|

|

|

99.88

|

%

|

*Excludes Abstentions and Broker Non-Votes

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

|

|

|

|

|

(d)Exhibits.

|

The following exhibits are being filed herewith:

|

Exhibit

Index

SIGNATURE

Pursuant to the requirements of Section

12 of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

QUANEX BUILDING PRODUCTS CORPORATION

|

|

|

|

(Registrant)

|

|

|

|

|

|

March 2, 2020

|

|

/s/

Paul B. Cornett

|

|

(Date)

|

|

Paul B. Cornett

|

|

|

|

Senior Vice President – General Counsel and Secretary

|

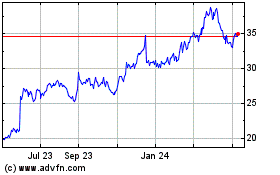

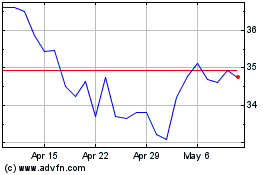

Quanex (NYSE:NX)

Historical Stock Chart

From May 2024 to Jun 2024

Quanex (NYSE:NX)

Historical Stock Chart

From Jun 2023 to Jun 2024