Board Approves 100% Dividend Increase and

Authorizes $60 Million Share Repurchase

Program Strong Free Cash Flow Generation

Facilitates Deleveraging and Return of Capital to

Shareholders Significant Margin Expansion in

NA Cabinet Components Segment Healthy

Underlying Growth Continues in NA and EU Engineered Components

Segments

Quanex Building Products Corporation

(NYSE:NX) (“Quanex” or the “Company”) today announced its results

for the three months ended July 31, 2018. The Company also

announced today a significant increase in the return of capital to

shareholders through a 100% increase in the quarterly cash dividend

and a $60 million share repurchase authorization.

Bill Griffiths, Chairman, President and Chief

Executive Officer, stated, “We delivered solid third quarter

results, driven by improved operational efficiency and margin

expansion of 200 basis points in our North American Cabinet

Components segment, despite ongoing inflationary pressures.

Underlying growth remains healthy in our North American and

European Engineered Components segments.

“We are also pleased that our strong free cash

flow generation in the third quarter facilitated a further

reduction of our leverage ratio to 2.0x Net Debt to LTM Adjusted

EBITDA as of July 31, 2018. In addition, our Board of

Directors has approved a robust capital return program, including

both a 100% increase to our quarterly cash dividend and a $60

million share repurchase program, which reflects our strong balance

sheet, commitment to returning capital to shareholders and

confidence in our prospects for growth and value creation.

“As part of a strategic review process, our

Board of Directors and management team, with the support of outside

advisors, recently undertook a thorough review of Quanex’s strategy

and business, and evaluated a broad range of strategic alternatives

to maximize shareholder value. Our Board of Directors

unanimously concluded that the best path forward for the Company

and its shareholders at this time is the continued execution of our

strategic plan and the accelerated return of capital. We

remain open to and will continue to consider all opportunities to

create additional shareholder value.”

Third Quarter 2018 Results

Summary

The Company reported the following selected financial

results:

| |

|

Three Months Ended July 31, |

|

Nine Months Ended July 31, |

| |

|

2018 |

|

2017 |

|

2018 |

|

2017 |

| Net Sales |

|

$239.8 |

|

$229.4 |

|

$645.7 |

|

$634.4 |

| Net Income |

|

$10.8 |

|

$10.2 |

|

$19.8 |

|

$8.0 |

| Diluted EPS |

|

$0.31 |

|

$0.29 |

|

$0.56 |

|

$0.23 |

| |

|

|

|

|

|

|

|

|

| Adjusted Net

Income |

|

$11.6 |

|

$11.5 |

|

$15.1 |

|

$13.9 |

| Adjusted Diluted

EPS |

|

$0.33 |

|

$0.33 |

|

$0.43 |

|

$0.40 |

| Adjusted EBITDA |

|

$30.8 |

|

$32.2 |

|

$65.7 |

|

$65.7 |

| |

|

|

|

|

|

|

|

|

| Cash provided by

operating activities |

|

$26.8 |

|

$29.7 |

|

$48.5 |

|

$46.5 |

| Free Cash Flow |

|

$21.0 |

|

$20.2 |

|

$27.4 |

|

$19.4 |

(See Non-GAAP Terminology Definitions and Disclaimers section,

Non-GAAP Financial Measure Disclosure table, Selected Segment Data

table and Free Cash Flow Reconciliation table for additional

information)

Similar to the first half of 2018, the increase

in net sales during the third quarter was largely driven by market

growth combined with price increases mostly related to raw material

inflation recovery and a favorable foreign exchange impact.

(See Sales Analysis table for additional information)

The increase in net income for the third quarter

of 2018 was primarily driven by lower depreciation and amortization

coupled with a lower effective tax rate.

Adjusted EBITDA decreased slightly during the

third quarter of 2018 mainly due to the negative impact of

inflationary pressures combined with an increase in selling,

general and administrative expense as results for the third quarter

of 2017 included a benefit of $2.0 million related to a legal

expense reimbursement from one of Quanex’s insurance

carriers.

As of July 31, 2018, the Company’s leverage

ratio of Net Debt to LTM Adjusted EBITDA decreased to 2.0x.

(See Non-GAAP Terminology Definitions and Disclaimers section for

additional information)

Strategy Update and Recent

Events

Quanex is committed to driving operational

improvement and creating shareholder value. As part of a

strategic review process, the Company’s Board of Directors (the

“Board”) and management team, with Citi as financial advisor,

recently completed a comprehensive review of Quanex’s overall

strategy, capital structure and capital allocation

priorities. As part of that review process, the Board

evaluated a broad range of strategic alternatives, including a

potential sale of the Company, and carefully considered feedback

from shareholders.

The Board unanimously concluded that, at this

time, Quanex is best positioned to drive value for shareholders

through the continued successful execution of its strategy and

continued focus on driving improved performance and returning

capital to shareholders.

As such, the Board declared a quarterly cash

dividend of $0.08 per share on the Company’s common stock,

representing a 100% increase compared to the prior dividend,

payable September 28, 2018, to shareholders of record on September

14, 2018.

In addition, Quanex’s Board of Directors

authorized a $60 million share repurchase program representing

approximately 10% of common shares outstanding based on the

Company’s stock price and share count as of July 31, 2018.

Repurchases under the new program will be made in open market

transactions or privately negotiated transactions, subject to

market conditions, applicable legal requirements and other relevant

factors. The program does not have an expiration date or a

limit on the number of shares that may be purchased.

The Board will continue to consider all

opportunities to further enhance shareholder value now and in the

future.

Conference Call and Webcast

Information

The Company has scheduled a conference call for

Friday, September 7, 2018, at 11:00 a.m. ET (10:00 a.m. CT).

To participate in the conference call dial (877) 388-2139 for

domestic callers and (541) 797-2983 for international callers, in

both cases using the conference passcode 3847158, and ask for the

Quanex call a few minutes prior to the start time. A link to

the live audio webcast will also be available on the Company’s

website at http://www.quanex.com in the Investors section under

Presentations & Events. A telephonic replay of the call

will be available approximately two hours after the live broadcast

ends and will be accessible through September 14, 2018. To

access the replay dial (855) 859-2056 for domestic callers and

(404) 537-3406 for international callers, in both cases referencing

conference passcode 3847158.

About Quanex

Quanex Building Products Corporation is an

industry-leading manufacturer of components sold to Original

Equipment Manufacturers (OEMs) in the building products

industry. Quanex designs and produces energy-efficient

fenestration products in addition to kitchen and bath cabinet

components.

For more information contact Scott Zuehlke, Vice

President, Investor Relations & Treasurer, at 713-877-5327 or

scott.zuehlke@quanex.com.

Non-GAAP Terminology Definitions and

Disclaimers

Adjusted Net Income (Loss) (defined as net

income further adjusted to exclude purchase price accounting

inventory step-ups, transaction costs, gain/loss on the sale of

fixed assets, restructuring charges, other net adjustments related

to foreign currency transaction gain/loss and effective tax rates

reflecting impacts of adjustments on a with and without basis) and

Adjusted EPS are non-GAAP financial measures that Quanex believes

provide a consistent basis for comparison between periods and more

accurately reflects operational performance, as they are not

influenced by certain income or expense items not affecting ongoing

operations. EBITDA (defined as net income or loss before interest,

taxes, depreciation and amortization and other, net) and Adjusted

EBITDA (defined as EBITDA further adjusted to exclude purchase

price accounting inventory step-ups, transaction costs, gain/loss

on the sale of fixed assets, and restructuring charges) are

non-GAAP financial measures that the Company uses to measure

operational performance and assist with financial

decision-making. When Quanex provides expectations for

Adjusted EBITDA on a forward-looking basis, a reconciliation of the

differences between the non-GAAP expectations and corresponding

GAAP measures is generally not available without unreasonable

effort. Net Debt is calculated using the sum of current

maturities of long-term debt and long-term debt, minus cash and

cash equivalents. The leverage ratio of Net Debt to LTM

Adjusted EBITDA is a financial measure that the Company believes is

useful to investors and financial analysts in evaluating Quanex’s

leverage. In addition, with certain limited adjustments, this

leverage ratio is the basis for a key covenant in the Company’s

credit agreement. Free Cash Flow is a non-GAAP measure

calculated using cash provided by operating activities less capital

expenditures. Quanex believes that the presented non-GAAP

measures provide a consistent basis for comparison between periods,

and will assist investors in understanding the Company’s financial

performance when comparing results to other investment

opportunities. The presented non-GAAP measures may not be the

same as those used by other companies. Quanex does not intend

for this information to be considered in isolation or as a

substitute for other measures prepared in accordance with U.S.

GAAP.

Forward Looking Statements

Statements that use the words “estimated,”

“expect,” “could,” “should,” “believe,” “will,” “might,” or similar

words reflecting future expectations or beliefs are forward-looking

statements. The forward-looking statements include, but are not

limited to, the Company’s future operating results, future

financial condition, future uses of cash and other expenditures,

expenses and tax rates, expectations relating to Quanex’s industry,

and the Company’s future growth, including any guidance discussed

in this press release. The statements and guidance set forth

in this release are based on current expectations. Actual

results or events may differ materially from this release.

For a complete discussion of factors that may affect Quanex’s

future performance, please refer to the Company’s Annual Report on

Form 10-K for the fiscal year ended October 31, 2017, under the

sections entitled “Cautionary Note Regarding Forward-Looking

Statements” and “Risk Factors”. Any forward-looking

statements in this press release are made as of the date hereof,

and Quanex undertakes no obligation to update or revise any

forward-looking statements to reflect new information or

events.

| |

| QUANEX BUILDING PRODUCTS

CORPORATIONCONDENSED CONSOLIDATED STATEMENTS OF

INCOME (LOSS)(In thousands, except per share

data)(Unaudited) |

|

|

| |

|

Three Months Ended July 31, |

|

Nine Months Ended July 31, |

| |

|

|

2018 |

|

|

|

2017 |

|

|

|

2018 |

|

|

|

2017 |

|

| |

|

|

|

|

|

|

|

|

| Net sales |

|

$ |

239,821 |

|

|

$ |

229,367 |

|

|

$ |

645,699 |

|

|

$ |

634,406 |

|

| Cost of sales |

|

|

185,610 |

|

|

|

176,758 |

|

|

|

508,791 |

|

|

|

494,647 |

|

| Selling, general and

administrative |

|

|

24,190 |

|

|

|

20,478 |

|

|

|

72,049 |

|

|

|

74,839 |

|

| Restructuring

charges |

|

|

243 |

|

|

|

864 |

|

|

|

851 |

|

|

|

3,083 |

|

| Depreciation and

amortization |

|

|

12,691 |

|

|

|

13,915 |

|

|

|

39,274 |

|

|

|

43,701 |

|

| Operating income |

|

|

17,087 |

|

|

|

17,352 |

|

|

|

24,734 |

|

|

|

18,136 |

|

| Interest expense |

|

|

(2,641 |

) |

|

|

(2,575 |

) |

|

|

(7,584 |

) |

|

|

(7,126 |

) |

| Other, net |

|

|

(62 |

) |

|

|

46 |

|

|

|

150 |

|

|

|

572 |

|

| Income before income

taxes |

|

|

14,384 |

|

|

|

14,823 |

|

|

|

17,300 |

|

|

|

11,582 |

|

| Income tax (expense)

benefit |

|

|

(3,631 |

) |

|

|

(4,608 |

) |

|

|

2,536 |

|

|

|

(3,631 |

) |

| Net income |

|

$ |

10,753 |

|

|

$ |

10,215 |

|

|

$ |

19,836 |

|

|

$ |

7,951 |

|

| |

|

|

|

|

|

|

|

|

| Income per common

share, basic |

|

$ |

0.31 |

|

|

$ |

0.30 |

|

|

$ |

0.57 |

|

|

$ |

0.23 |

|

| Income per common

share, diluted |

|

$ |

0.31 |

|

|

$ |

0.29 |

|

|

$ |

0.56 |

|

|

$ |

0.23 |

|

| |

|

|

|

|

|

|

|

|

| Weighted average common

shares outstanding: |

|

|

|

|

|

|

|

|

| Basic |

|

|

34,840 |

|

|

|

34,224 |

|

|

|

34,766 |

|

|

|

34,141 |

|

| Diluted |

|

|

35,120 |

|

|

|

34,924 |

|

|

|

35,124 |

|

|

|

34,771 |

|

| |

|

|

|

|

|

|

|

|

| Cash dividends per

share |

|

$ |

0.04 |

|

|

$ |

0.04 |

|

|

$ |

0.12 |

|

|

$ |

0.12 |

|

| |

|

|

|

|

|

|

|

|

| QUANEX BUILDING PRODUCTS

CORPORATIONCONDENSED CONSOLIDATED BALANCE

SHEETS(In thousands)(Unaudited) |

| |

| |

|

July 31, 2018 |

|

October 31, 2017 |

|

ASSETS |

|

|

|

|

| Current assets: |

|

|

|

|

| Cash and

cash equivalents |

|

$ |

12,400 |

|

|

$ |

17,455 |

|

| Accounts

receivable, net |

|

|

80,236 |

|

|

|

79,411 |

|

|

Inventories, net |

|

|

87,105 |

|

|

|

87,529 |

|

| Prepaid

and other current assets |

|

|

8,636 |

|

|

|

7,406 |

|

| Total

current assets |

|

|

188,377 |

|

|

|

191,801 |

|

| Property, plant and

equipment, net |

|

|

205,304 |

|

|

|

211,131 |

|

| Goodwill |

|

|

221,587 |

|

|

|

222,194 |

|

| Intangible assets,

net |

|

|

127,071 |

|

|

|

139,778 |

|

| Other assets |

|

|

9,184 |

|

|

|

8,975 |

|

| Total

assets |

|

$ |

751,523 |

|

|

$ |

773,879 |

|

| |

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

| Current

liabilities: |

|

|

|

|

| Accounts

payable |

|

$ |

44,871 |

|

|

$ |

44,150 |

|

| Accrued

liabilities |

|

|

31,693 |

|

|

|

38,871 |

|

| Income

taxes payable |

|

|

2,405 |

|

|

|

2,192 |

|

| Current

maturities of long-term debt |

|

|

16,120 |

|

|

|

21,242 |

|

| Total

current liabilities |

|

|

95,089 |

|

|

|

106,455 |

|

| Long-term debt |

|

|

193,654 |

|

|

|

218,184 |

|

| Deferred pension and

postretirement benefits |

|

|

6,612 |

|

|

|

4,433 |

|

| Deferred income

taxes |

|

|

16,765 |

|

|

|

21,960 |

|

| Other liabilities |

|

|

15,640 |

|

|

|

16,000 |

|

| Total

liabilities |

|

|

327,760 |

|

|

|

367,032 |

|

| Stockholders’

equity: |

|

|

|

|

| Common

stock |

|

|

374 |

|

|

|

375 |

|

|

Additional paid-in-capital |

|

|

253,806 |

|

|

|

255,719 |

|

| Retained

earnings |

|

|

240,025 |

|

|

|

225,704 |

|

|

Accumulated other comprehensive loss |

|

|

(27,601 |

) |

|

|

(25,076 |

) |

| Treasury

stock at cost |

|

|

(42,841 |

) |

|

|

(49,875 |

) |

| Total

stockholders’ equity |

|

|

423,763 |

|

|

|

406,847 |

|

| Total

liabilities and stockholders' equity |

|

$ |

751,523 |

|

|

$ |

773,879 |

|

| |

|

|

|

|

| QUANEX BUILDING PRODUCTS

CORPORATION |

|

| CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOW |

|

| (In thousands) |

|

| (Unaudited) |

|

| |

|

|

|

|

| |

Nine Months Ended July 31, |

|

| |

|

2018 |

|

|

2017 (1) |

|

| Operating

activities: |

|

|

|

|

| Net

income |

$ |

19,836 |

|

|

$ |

7,951 |

|

|

|

Adjustments to reconcile net income to cash provided by operating

activities: |

|

|

|

|

|

Depreciation and amortization |

|

39,274 |

|

|

|

43,701 |

|

|

|

Stock-based compensation |

|

1,002 |

|

|

|

4,305 |

|

|

| Deferred

income tax |

|

(5,788 |

) |

|

|

(1,847 |

) |

|

| Other,

net |

|

404 |

|

|

|

1,136 |

|

|

| Changes

in assets and liabilities: |

|

|

|

|

|

(Increase) decrease in accounts receivable |

|

(1,247 |

) |

|

|

6,923 |

|

|

| Decrease

(increase) in inventory |

|

310 |

|

|

|

(8,576 |

) |

|

| Increase

in other current assets |

|

(1,242 |

) |

|

|

(379 |

) |

|

| Increase

(decrease) in accounts payable |

|

1,161 |

|

|

|

(3,145 |

) |

|

| Decrease

in accrued liabilities |

|

(7,565 |

) |

|

|

(11,327 |

) |

|

| Increase

in income taxes payable |

|

231 |

|

|

|

4,349 |

|

|

| Increase

in deferred pension and postretirement benefits |

|

2,179 |

|

|

|

2,537 |

|

|

| Increase

in other long-term liabilities |

|

210 |

|

|

|

1,226 |

|

|

| Other,

net |

|

(312 |

) |

|

|

(389 |

) |

|

| Cash provided by

operating activities |

|

48,453 |

|

|

|

46,465 |

|

|

| Investing

activities: |

|

|

|

|

|

Acquisitions, net of cash acquired |

|

- |

|

|

|

(8,497 |

) |

|

| Capital

expenditures |

|

(21,098 |

) |

|

|

(27,098 |

) |

|

| Proceeds

from disposition of capital assets |

|

260 |

|

|

|

1,232 |

|

|

| Cash used for investing

activities |

|

(20,838 |

) |

|

|

(34,363 |

) |

|

| Financing

activities: |

|

|

|

|

|

Borrowings under credit facilities |

|

33,500 |

|

|

|

53,500 |

|

|

|

Repayments of credit facility borrowings |

|

(62,750 |

) |

|

|

(74,125 |

) |

|

|

Repayments of other long-term debt |

|

(1,394 |

) |

|

|

(2,240 |

) |

|

| Common

stock dividends paid |

|

(4,202 |

) |

|

|

(4,127 |

) |

|

| Issuance

of common stock |

|

3,767 |

|

|

|

6,379 |

|

|

| Payroll

tax paid to settle shares forfeited upon vesting of stock |

|

(960 |

) |

|

|

(976 |

) |

|

| Cash used for financing

activities |

|

(32,039 |

) |

|

|

(21,589 |

) |

|

| Effect of

exchange rate changes on cash and cash equivalents |

|

(631 |

) |

|

|

(248 |

) |

|

| Decrease in cash and

cash equivalents |

|

(5,055 |

) |

|

|

(9,735 |

) |

|

| Cash and cash

equivalents at beginning of period |

|

17,455 |

|

|

|

25,526 |

|

|

| Cash and cash

equivalents at end of period |

$ |

12,400 |

|

|

$ |

15,791 |

|

|

| |

|

|

|

|

| (1) Updated

to reflect adoption of ASU 2016-09. |

|

| |

|

|

|

|

| QUANEX BUILDING PRODUCTS

CORPORATIONFREE CASH FLOW

RECONCILIATION(In thousands)(Unaudited) |

|

|

| The

following table reconciles the Company's calculation of Free Cash

Flow, a non-GAAP measure, to its most directly comparable GAAP

measure. The Company defines Free Cash Flow as cash provided

by operating activities less capital expenditures. |

| |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended July 31, |

|

Nine Months Ended July 31, |

| |

|

|

2018 |

|

|

|

2017 |

|

|

|

2018 |

|

|

|

2017 |

|

| Cash provided by

operating activities |

|

$26,838 |

|

|

$29,736 |

|

|

|

$48,453 |

|

|

|

$46,465 |

|

| Capital

expenditures |

|

|

(5,885) |

|

|

|

(9,548) |

|

|

|

(21,098) |

|

|

|

(27,098) |

|

| Free Cash Flow |

|

$20,953 |

|

|

$20,188 |

|

|

$27,355 |

|

|

$19,367 |

|

| |

|

|

|

|

|

|

|

|

| QUANEX BUILDING PRODUCTS

CORPORATIONNON-GAAP FINANCIAL MEASURE

DISCLOSURE(In thousands, except per share

data)(Unaudited) |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

Nine Months Ended |

|

| Reconciliation

of Adjusted Net Income and Adjusted EPS |

|

July 31, 2018 |

|

|

July 31, 2017 |

|

|

July 31, 2018 |

|

|

July 31, 2017 |

|

| |

|

Net Income |

|

Diluted EPS |

|

|

Net Income |

|

Diluted EPS |

|

|

Net Income |

|

Diluted EPS |

|

|

Net Income |

|

Diluted EPS |

|

| Net income as

reported |

|

$ |

10,753 |

|

|

$ |

0.31 |

|

|

|

$ |

10,215 |

|

|

$ |

0.29 |

|

|

|

$ |

19,836 |

|

|

$ |

0.56 |

|

|

|

$ |

7,951 |

|

|

$ |

0.23 |

|

|

| Reconciling items from

below |

|

|

828 |

|

|

|

0.02 |

|

|

|

|

1,277 |

|

|

|

0.04 |

|

|

|

|

(4,727 |

) |

|

|

(0.13 |

) |

|

|

|

5,965 |

|

|

|

0.17 |

|

|

| Adjusted net income and

adjusted EPS |

|

$ |

11,581 |

|

|

$ |

0.33 |

|

|

|

$ |

11,492 |

|

|

$ |

0.33 |

|

|

|

$ |

15,109 |

|

|

$ |

0.43 |

|

|

|

$ |

13,916 |

|

|

$ |

0.40 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation

of Adjusted EBITDA |

|

Three Months Ended July 31, 2018 |

|

|

Three Months Ended July 31, 2017 |

|

|

Nine Months Ended July 31, 2018 |

|

|

Nine Months Ended July 31, 2017 |

|

| |

|

Reconciliation |

|

|

|

|

Reconciliation |

|

|

|

|

Reconciliation |

|

|

|

|

Reconciliation |

|

|

|

| Net income as

reported |

|

$ |

10,753 |

|

|

|

|

|

$ |

10,215 |

|

|

|

|

|

$ |

19,836 |

|

|

|

|

|

$ |

7,951 |

|

|

|

|

| Income tax expense

(benefit) |

|

|

3,631 |

|

|

|

|

|

|

4,608 |

|

|

|

|

|

|

(2,536 |

) |

|

|

|

|

|

3,631 |

|

|

|

|

| Other, net |

|

|

62 |

|

|

|

|

|

|

(46 |

) |

|

|

|

|

|

(150 |

) |

|

|

|

|

|

(572 |

) |

|

|

|

| Interest expense |

|

|

2,641 |

|

|

|

|

|

|

2,575 |

|

|

|

|

|

|

7,584 |

|

|

|

|

|

|

7,126 |

|

|

|

|

| Depreciation and

amortization |

|

|

12,691 |

|

|

|

|

|

|

13,915 |

|

|

|

|

|

|

39,274 |

|

|

|

|

|

|

43,701 |

|

|

|

|

| EBITDA |

|

|

29,778 |

|

|

|

|

|

|

31,267 |

|

|

|

|

|

|

64,008 |

|

|

|

|

|

|

61,837 |

|

|

|

|

| Reconciling items from

below |

|

|

1,027 |

|

|

|

|

|

|

899 |

|

|

|

|

|

|

1,649 |

|

|

|

|

|

|

3,892 |

|

|

|

|

| Adjusted EBITDA |

|

$ |

30,805 |

|

|

|

|

|

$ |

32,166 |

|

|

|

|

|

$ |

65,657 |

|

|

|

|

|

$ |

65,729 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciling

Items |

|

Three Months Ended July 31, 2018 |

|

|

Three Months Ended July 31, 2017 |

|

|

Nine Months Ended July 31, 2018 |

|

|

Nine Months Ended July 31, 2017 |

|

| |

|

Income Statement |

|

Reconciling Items |

|

|

Income Statement |

|

Reconciling Items |

|

|

Income Statement |

|

Reconciling Items |

|

|

Income Statement |

|

Reconciling Items |

|

| Net sales |

|

$ |

239,821 |

|

|

$ |

- |

|

|

|

$ |

229,367 |

|

|

$ |

- |

|

|

|

$ |

645,699 |

|

|

$ |

- |

|

|

|

$ |

634,406 |

|

|

$ |

- |

|

|

| Cost of sales |

|

|

185,610 |

|

|

|

- |

|

|

|

|

176,758 |

|

|

|

- |

|

|

|

|

508,791 |

|

|

|

- |

|

|

|

|

494,647 |

|

|

|

(104 |

) |

(1 |

) |

| Selling, general and

administrative |

|

|

24,190 |

|

|

|

(784 |

) |

(2 |

) |

|

|

20,478 |

|

|

|

(35 |

) |

(2 |

) |

|

|

72,049 |

|

|

|

(798 |

) |

(2 |

) |

|

|

74,839 |

|

|

|

(705 |

) |

(2 |

) |

| Restructuring

charges |

|

|

243 |

|

|

|

(243 |

) |

(3 |

) |

|

|

864 |

|

|

|

(864 |

) |

(3 |

) |

|

|

851 |

|

|

|

(851 |

) |

(3 |

) |

|

|

3,083 |

|

|

|

(3,083 |

) |

(3 |

) |

| EBITDA |

|

|

29,778 |

|

|

|

1,027 |

|

|

|

|

31,267 |

|

|

|

899 |

|

|

|

|

64,008 |

|

|

|

1,649 |

|

|

|

|

61,837 |

|

|

|

3,892 |

|

|

| Depreciation and

amortization |

|

|

12,691 |

|

|

|

- |

|

|

|

|

13,915 |

|

|

|

(1,277 |

) |

(4 |

) |

|

|

39,274 |

|

|

|

(852 |

) |

(5 |

) |

|

|

43,701 |

|

|

|

(5,502 |

) |

(4 |

) |

| Operating income |

|

|

17,087 |

|

|

|

1,027 |

|

|

|

|

17,352 |

|

|

|

2,176 |

|

|

|

|

24,734 |

|

|

|

2,501 |

|

|

|

|

18,136 |

|

|

|

9,394 |

|

|

| Interest expense |

|

|

(2,641 |

) |

|

|

- |

|

|

|

|

(2,575 |

) |

|

|

- |

|

|

|

|

(7,584 |

) |

|

|

- |

|

|

|

|

(7,126 |

) |

|

|

- |

|

|

| Other, net |

|

|

(62 |

) |

|

|

79 |

|

(6 |

) |

|

|

46 |

|

|

|

(39 |

) |

(6 |

) |

|

|

150 |

|

|

|

(88 |

) |

(6 |

) |

|

|

572 |

|

|

|

(514 |

) |

(6 |

) |

| Income before income

taxes |

|

|

14,384 |

|

|

|

1,106 |

|

|

|

|

14,823 |

|

|

|

2,137 |

|

|

|

|

17,300 |

|

|

|

2,413 |

|

|

|

|

11,582 |

|

|

|

8,880 |

|

|

| Income tax (expense)

benefit |

|

|

(3,631 |

) |

|

|

(278 |

) |

(7 |

) |

|

|

(4,608 |

) |

|

|

(860 |

) |

(7 |

) |

|

|

2,536 |

|

|

|

(7,140 |

) |

(7 |

) |

|

|

(3,631 |

) |

|

|

(2,915 |

) |

(7 |

) |

| Net income (loss) |

|

$ |

10,753 |

|

|

$ |

828 |

|

|

|

$ |

10,215 |

|

|

$ |

1,277 |

|

|

|

$ |

19,836 |

|

|

$ |

(4,727 |

) |

|

|

$ |

7,951 |

|

|

$ |

5,965 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per

share |

|

$ |

0.31 |

|

|

|

|

|

$ |

0.29 |

|

|

|

|

|

$ |

0.56 |

|

|

|

|

|

$ |

0.23 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1)

Relates solely to purchase price accounting inventory step-up

impact from HL Plastics acquisition. |

|

| (2)

Transaction and advisory fees and in 2017, loss on sale of fixed

assets related to the closure of a plant and a one-time employee

benefit adjustment. |

|

| (3)

Restructuring charges relate to the closure of several

manufacturing plant facilities. |

|

| (4)

Accelerated depreciation and amortization for restructured PP&E

and intangible assets. |

|

| (5)

Accelerated depreciation for a plant re-layout in the North

American Cabinet Components segment. |

|

| (6)

Foreign currency transaction losses (gains). |

|

| (7) Impact

on a with and without basis. Nine months ended July 31, 2018

includes $6.5 million adjustment related to the Tax Cuts and Jobs

Act. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| QUANEX BUILDING PRODUCTS

CORPORATIONSELECTED SEGMENT DATA(In

thousands)(Unaudited) |

|

|

| This table

provides operating income (loss), EBITDA, and Adjusted EBITDA by

reportable segment. Non-operating expense and income tax

expense are not allocated to the reportable segments. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

NA Engineered Components |

|

EU Engineered Components |

|

NA Cabinet Components |

|

Unallocated Corp & Other |

|

Total |

| Three months

ended July 31, 2018 |

|

|

|

|

|

|

|

|

|

|

| Net

sales |

|

$ |

133,397 |

|

|

$ |

42,661 |

|

|

$ |

65,114 |

|

|

$ |

(1,351 |

) |

|

$ |

239,821 |

|

| Cost of

sales |

|

|

100,999 |

|

|

|

30,840 |

|

|

|

54,755 |

|

|

|

(984 |

) |

|

|

185,610 |

|

| Selling,

general and administrative |

|

|

13,147 |

|

|

|

5,535 |

|

|

|

3,584 |

|

|

|

1,924 |

|

|

|

24,190 |

|

|

Restructuring charges |

|

|

240 |

|

|

|

- |

|

|

|

3 |

|

|

|

- |

|

|

|

243 |

|

|

Depreciation and amortization |

|

|

6,741 |

|

|

|

2,352 |

|

|

|

3,432 |

|

|

|

166 |

|

|

|

12,691 |

|

| Operating

income (loss) |

|

|

12,270 |

|

|

|

3,934 |

|

|

|

3,340 |

|

|

|

(2,457 |

) |

|

|

17,087 |

|

|

Depreciation and amortization |

|

|

6,741 |

|

|

|

2,352 |

|

|

|

3,432 |

|

|

|

166 |

|

|

|

12,691 |

|

|

EBITDA |

|

|

19,011 |

|

|

|

6,286 |

|

|

|

6,772 |

|

|

|

(2,291 |

) |

|

|

29,778 |

|

|

Transaction and advisory fees |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

784 |

|

|

|

784 |

|

|

Restructuring charges |

|

|

240 |

|

|

|

- |

|

|

|

3 |

|

|

|

- |

|

|

|

243 |

|

| Adjusted

EBITDA |

|

$ |

19,251 |

|

|

$ |

6,286 |

|

|

$ |

6,775 |

|

|

$ |

(1,507 |

) |

|

$ |

30,805 |

|

| Adjusted

EBITDA Margin % |

|

|

14.4% |

|

|

|

14.7% |

|

|

|

10.4% |

|

|

|

|

|

12.8% |

|

| |

|

|

|

|

|

|

|

|

|

|

| Three months

ended July 31, 2017 |

|

|

|

|

|

|

|

|

|

|

| Net

sales |

|

$ |

126,446 |

|

|

$ |

40,359 |

|

|

$ |

63,839 |

|

|

$ |

(1,277 |

) |

|

$ |

229,367 |

|

| Cost of

sales |

|

|

94,169 |

|

|

|

29,002 |

|

|

|

54,538 |

|

|

|

(951 |

) |

|

|

176,758 |

|

| Selling,

general and administrative |

|

|

11,829 |

|

|

|

5,162 |

|

|

|

3,968 |

|

|

|

(481 |

) |

|

|

20,478 |

|

|

Restructuring charges |

|

|

727 |

|

|

|

- |

|

|

|

137 |

|

|

|

- |

|

|

|

864 |

|

|

Depreciation and amortization |

|

|

7,899 |

|

|

|

2,391 |

|

|

|

3,491 |

|

|

|

134 |

|

|

|

13,915 |

|

| Operating

income |

|

|

11,822 |

|

|

|

3,804 |

|

|

|

1,705 |

|

|

|

21 |

|

|

|

17,352 |

|

|

Depreciation and amortization |

|

|

7,899 |

|

|

|

2,391 |

|

|

|

3,491 |

|

|

|

134 |

|

|

|

13,915 |

|

|

EBITDA |

|

|

19,721 |

|

|

|

6,195 |

|

|

|

5,196 |

|

|

|

155 |

|

|

|

31,267 |

|

|

Transaction and advisory fees |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

35 |

|

|

|

35 |

|

|

Restructuring charges |

|

|

727 |

|

|

|

- |

|

|

|

137 |

|

|

|

- |

|

|

|

864 |

|

| Adjusted

EBITDA |

|

$ |

20,448 |

|

|

$ |

6,195 |

|

|

$ |

5,333 |

|

|

$ |

190 |

|

|

$ |

32,166 |

|

| Adjusted

EBITDA Margin % |

|

|

16.2% |

|

|

|

15.3% |

|

|

|

8.4% |

|

|

|

|

|

14.0% |

|

| |

|

|

|

|

|

|

|

|

|

|

| Nine months

ended July 31, 2018 |

|

|

|

|

|

|

|

|

|

|

| Net

sales |

|

$ |

350,280 |

|

|

$ |

115,481 |

|

|

$ |

183,705 |

|

|

$ |

(3,767 |

) |

|

$ |

645,699 |

|

| Cost of

sales |

|

|

269,156 |

|

|

|

83,261 |

|

|

|

159,066 |

|

|

|

(2,692 |

) |

|

|

508,791 |

|

| Selling,

general and administrative |

|

|

40,393 |

|

|

|

17,218 |

|

|

|

12,894 |

|

|

|

1,544 |

|

|

|

72,049 |

|

|

Restructuring charges |

|

|

728 |

|

|

|

- |

|

|

|

123 |

|

|

|

- |

|

|

|

851 |

|

|

Depreciation and amortization |

|

|

20,561 |

|

|

|

7,328 |

|

|

|

10,957 |

|

|

|

428 |

|

|

|

39,274 |

|

| Operating

income (loss) |

|

|

19,442 |

|

|

|

7,674 |

|

|

|

665 |

|

|

|

(3,047 |

) |

|

|

24,734 |

|

|

Depreciation and amortization |

|

|

20,561 |

|

|

|

7,328 |

|

|

|

10,957 |

|

|

|

428 |

|

|

|

39,274 |

|

|

EBITDA |

|

|

40,003 |

|

|

|

15,002 |

|

|

|

11,622 |

|

|

|

(2,619 |

) |

|

|

64,008 |

|

|

Transaction and advisory fees |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

798 |

|

|

|

798 |

|

|

Restructuring charges |

|

|

728 |

|

|

|

- |

|

|

|

123 |

|

|

|

- |

|

|

|

851 |

|

| Adjusted

EBITDA |

|

$ |

40,731 |

|

|

$ |

15,002 |

|

|

$ |

11,745 |

|

|

$ |

(1,821 |

) |

|

$ |

65,657 |

|

| Adjusted

EBITDA Margin % |

|

|

11.6% |

|

|

|

13.0% |

|

|

|

6.4% |

|

|

|

|

|

10.2% |

|

| |

|

|

|

|

|

|

|

|

|

|

| Nine months

ended July 31, 2017 |

|

|

|

|

|

|

|

|

|

|

| Net

sales |

|

$ |

343,694 |

|

|

$ |

106,133 |

|

|

$ |

188,359 |

|

|

$ |

(3,780 |

) |

|

$ |

634,406 |

|

| Cost of

sales |

|

|

260,479 |

|

|

|

75,304 |

|

|

|

161,704 |

|

|

|

(2,840 |

) |

|

|

494,647 |

|

| Selling,

general and administrative |

|

|

38,770 |

|

|

|

15,132 |

|

|

|

12,739 |

|

|

|

8,198 |

|

|

|

74,839 |

|

|

Restructuring charges |

|

|

2,207 |

|

|

|

- |

|

|

|

876 |

|

|

|

- |

|

|

|

3,083 |

|

|

Depreciation and amortization |

|

|

26,377 |

|

|

|

6,753 |

|

|

|

10,160 |

|

|

|

411 |

|

|

|

43,701 |

|

| Operating

income (loss) |

|

|

15,861 |

|

|

|

8,944 |

|

|

|

2,880 |

|

|

|

(9,549 |

) |

|

|

18,136 |

|

|

Depreciation and amortization |

|

|

26,377 |

|

|

|

6,753 |

|

|

|

10,160 |

|

|

|

411 |

|

|

|

43,701 |

|

|

EBITDA |

|

|

42,238 |

|

|

|

15,697 |

|

|

|

13,040 |

|

|

|

(9,138 |

) |

|

|

61,837 |

|

|

Transaction and advisory fees |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

327 |

|

|

|

327 |

|

| Mexico

restructuring, loss on sale of fixed assets |

|

|

- |

|

|

|

- |

|

|

|

190 |

|

|

|

- |

|

|

|

190 |

|

| One-time

employee benefit adjustment |

|

|

- |

|

|

|

- |

|

|

|

188 |

|

|

|

- |

|

|

|

188 |

|

|

PPA-Inventory Step-up |

|

|

- |

|

|

|

104 |

|

|

|

- |

|

|

|

- |

|

|

|

104 |

|

|

Restructuring charges |

|

|

2,207 |

|

|

|

- |

|

|

|

876 |

|

|

|

- |

|

|

|

3,083 |

|

| Adjusted

EBITDA |

|

$ |

44,445 |

|

|

$ |

15,801 |

|

|

$ |

14,294 |

|

|

$ |

(8,811 |

) |

|

$ |

65,729 |

|

| Adjusted

EBITDA Margin % |

|

|

12.9% |

|

|

|

14.9% |

|

|

|

7.6% |

|

|

|

|

|

10.4% |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| QUANEX BUILDING PRODUCTS

CORPORATIONSALES ANALYSIS(In thousands)(Unaudited) |

|

|

| |

|

Three Months Ended |

|

Nine Months Ended |

| |

|

July 31, 2018 |

|

July 31, 2017 |

|

July 31, 2018 |

|

July 31, 2017 |

| |

|

|

|

|

|

|

|

|

| NA

Engineered Components: |

|

|

|

|

|

|

|

| |

United States -

fenestration (1) |

$ |

112,914 |

|

|

$ |

107,193 |

|

|

$ |

297,700 |

|

|

$ |

289,231 |

|

| |

International -

fenestration |

|

11,851 |

|

|

|

9,959 |

|

|

|

27,758 |

|

|

|

24,945 |

|

| |

United States -

non-fenestration (2) |

|

4,675 |

|

|

|

7,060 |

|

|

|

13,518 |

|

|

|

19,590 |

|

| |

International -

non-fenestration |

|

3,957 |

|

|

|

2,234 |

|

|

|

11,304 |

|

|

|

9,928 |

|

| |

|

$ |

133,397 |

|

|

$ |

126,446 |

|

|

$ |

350,280 |

|

|

$ |

343,694 |

|

| EU

Engineered Components (3): |

|

|

|

|

|

|

|

| |

United States -

fenestration |

$ |

- |

|

|

$ |

190 |

|

|

$ |

- |

|

|

$ |

304 |

|

| |

International -

fenestration (4) |

|

34,881 |

|

|

|

35,087 |

|

|

|

97,597 |

|

|

|

94,528 |

|

| |

International -

non-fenestration |

|

7,780 |

|

|

|

5,082 |

|

|

|

17,884 |

|

|

|

11,301 |

|

| |

|

$ |

42,661 |

|

|

$ |

40,359 |

|

|

$ |

115,481 |

|

|

$ |

106,133 |

|

| NA

Cabinet Components: |

|

|

|

|

|

|

|

| |

United States -

fenestration |

$ |

3,650 |

|

|

$ |

4,322 |

|

|

$ |

10,500 |

|

|

$ |

12,316 |

|

| |

United States -

non-fenestration (5) |

|

60,843 |

|

|

|

59,237 |

|

|

|

171,547 |

|

|

|

174,404 |

|

| |

International -

non-fenestration |

|

621 |

|

|

|

280 |

|

|

|

1,658 |

|

|

|

1,639 |

|

| |

|

$ |

65,114 |

|

|

$ |

63,839 |

|

|

$ |

183,705 |

|

|

$ |

188,359 |

|

|

Unallocated Corporate & Other: |

|

|

|

|

|

|

|

| |

Eliminations |

$ |

(1,351 |

) |

|

$ |

(1,277 |

) |

|

$ |

(3,767 |

) |

|

$ |

(3,780 |

) |

| |

|

$ |

(1,351 |

) |

|

$ |

(1,277 |

) |

|

$ |

(3,767 |

) |

|

$ |

(3,780 |

) |

| |

|

|

|

|

|

|

|

|

| Net

Sales |

$ |

239,821 |

|

|

$ |

229,367 |

|

|

$ |

645,699 |

|

|

$ |

634,406 |

|

| |

|

|

|

|

|

|

|

|

| (1)

Reflects the loss of revenue associated with eliminated products of

$2.6 million and $11.7 million for the three and nine months ended

July 31, 2018. |

| (2)

Reflects the loss of revenue associated with eliminated products of

$2.1 million and $7.5 million for the three and nine months ended

July 31, 2018. |

| (3)

Reflects a gain of $1.1 million and $7.9 million in revenue

associated with foreign currency exchange rate impacts for the

three and nine months ended July 31, 2018. |

| (4)

Reflects loss of revenue associated with eliminated products of

$1.8 million and $6.5 million for the three and nine months ended

July 31, 2018. |

| (5)

Reflects the loss of revenue associated with eliminated products of

$0.2 million and $3.9 million for the three and nine months ended

July 31, 2018. |

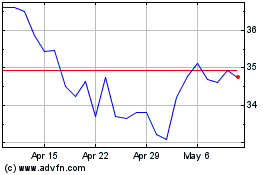

Quanex (NYSE:NX)

Historical Stock Chart

From Jun 2024 to Jul 2024

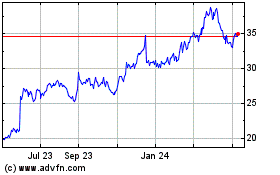

Quanex (NYSE:NX)

Historical Stock Chart

From Jul 2023 to Jul 2024