Quanex Corporation Sells $125 Million Convertible Senior Debentures

May 11 2004 - 1:38PM

PR Newswire (US)

Quanex Corporation Sells $125 Million Convertible Senior Debentures

HOUSTON, May 11 /PRNewswire-FirstCall/ -- Quanex Corporation

announced today that on May 5, 2004, it completed the sale of $125

million aggregate principal amount of its 2.50% Convertible Senior

Debentures due 2034 (the Debentures). Quanex closed the sale of

$100 million aggregate principal amount of the Debentures and the

initial purchasers exercised their option to purchase an additional

$25 million aggregate principal amount. The Debentures are

convertible into shares of Quanex common stock, upon the occurrence

of certain events, at a conversion price of $57.50 per share.

Quanex will use the net proceeds to repay a portion of the amounts

outstanding under its revolving credit agreement and for general

corporate purposes, including potential acquisitions. This Quanex

press release does not constitute an offer to sell or the

solicitation of an offer to buy securities. The Debentures, and the

Quanex common stock issuable upon conversion of the Debentures,

have not been registered under the Securities Act of 1933, as

amended (the Securities Act) or the securities laws of any other

jurisdiction. Unless they are registered, the Debentures and the

common stock issuable upon their conversion, may be offered or sold

only in transactions that are exempt from registration under the

Securities Act and other applicable securities laws. Accordingly,

Quanex made the offering of the Debentures only to "qualified

institutional buyers" in reliance on Rule 144A under the Securities

Act. Statements that use the words "expect," "should," "could,"

"intend," "will," "might," or similar words reflecting future

expectations or beliefs are forward-looking statements. The

statements above are based on current expectations. Actual results

or events may differ materially from this release. Factors that

could impact future results may include, without limitation, the

effect of both domestic and global economic conditions, the impact

of competitive products and pricing, and the availability and cost

of raw materials. For a more complete discussion of factors that

may affect the Company's future performance, please refer to the

Company's most recent 10-K filing of December 29, 2003 under the

Securities Exchange Act of 1934, in particular the sections titled,

"Private Securities Litigation Reform Act" contained therein.

Contacts: Jeff Galow, 713/877-5327 Valerie Calvert, 713/877-5305

http://www.newscom.com/cgi-bin/prnh/20010522/DATU048

http://www.newscom.com/cgi-bin/prnh/20031231/QUANEXLOGO

http://photoarchive.ap.org/ DATASOURCE: Quanex Corporation CONTACT:

Jeff Galow, +1-713-877-5327, or Valerie Calvert, +1-713-877-5305,

both of Quanex Corporation Web site: http://www.quanex.com/

Copyright

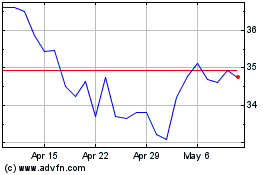

Quanex (NYSE:NX)

Historical Stock Chart

From Jun 2024 to Jul 2024

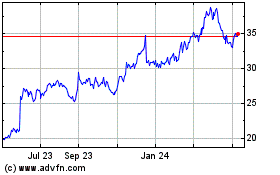

Quanex (NYSE:NX)

Historical Stock Chart

From Jul 2023 to Jul 2024