Quanex Building Products Corporation Reports Third Quarter 2013 Results

September 04 2013 - 7:00AM

Consolidated Net Income of $5.0 Million or $0.13

Per Diluted Share EPG Net Sales Increase 17.0%; Operating Income

Improves to $18.6 Million ERP Project Stopped; Company to Focus on

Revenue and Profit Growth Initiatives

Quanex Building Products

Corporation (NYSE:NX), a leading manufacturer of

fenestration products for the global window and door industry,

today released fiscal 2013 third quarter results for the period

ended July 31, 2013.

- Consolidated third quarter 2013 net sales increased 8.9 percent

to $259.2 million, compared to $237.9 million a year ago.

- Third quarter 2013 net income was $5.0 million, or $0.13 per

diluted share compared to net income of $1.5 million, or $0.04 per

diluted share in the year ago quarter.

- Consolidated third quarter EBITDA, a non-GAAP measure, was

$19.3 million, compared to $10.6 million a year ago.

- Year-to-date consolidated 2013 net sales were $677.3 million,

compared to $593.9 million a year ago.

- Year-to-date consolidated net loss was $10.5 million compared

to a loss of $17.5 million a year ago.

- Consolidated year-to-date EBITDA, a non-GAAP measure, was $17.4

million, compared to $2.5 million a year ago.

The 2013 year-to-date results, when measured against comparable

prior year periods, benefitted from the inclusion of sales related

to the Aluminite acquisition completed in December 2012 and the

elimination of 2012 strike-related costs at Nichols

Aluminum. Adjusting for these items, third quarter and

year-to-date results improved as a result of higher sales across

all divisions under the Engineered Products Group (EPG) segment and

cost savings associated with the company's insulating glass systems

facility consolidation that occurred in 2012. This was

partially offset by higher information technology and Enterprise

Resource Planning (ERP) implementation costs.

Dividend Declared

On August 29, 2013, the Board of Directors declared a quarterly

cash dividend of $0.04 per share on the company's common stock,

payable September 30, 2013, to shareholders of record on September

16, 2013.

Engineered Products Group (EPG) is focused on

providing window and door OEMs with fenestration components,

products, and systems. Key end markets are residential repair &

remodel (R&R) and new home construction.

| (in millions) |

|

|

|

|

| |

Q3 2013 |

Q3 2012 |

YTD 2013 |

YTD 2012 |

| Net sales |

$156.8 |

$134.1 |

$388.1 |

$342.2 |

| Operating income |

18.6 |

13.1 |

27.3 |

14.9 |

| EBITDA |

26.6 |

20.0 |

50.9 |

35.9 |

- Global EPG sales for the 12 months ended July 31, 2013 were up

11.2%. EPG's North American domestic fenestration sales, the most

comparable sales figure to those reported by Ducker, increased

11.5% (3.4% excluding Aluminite) from the previous 12 months.

- Preliminary U.S. window shipments as reported by Ducker

increased 10.1% over the 12 months ended June 30, 2013, driven by a

27.6% increase in new construction units. U.S. window

shipments to the residential R&R market as reported by Ducker

increased 1.3% for the 12 month period ended June 30, 2013. A

greater portion of EPG's sales are tied to R&R versus new

construction.

- EPG sales results continue to be negatively impacted by lower

vinyl pricing, higher industry sales of lower performance windows

typically installed in new construction and continued weak R&R

sales.

Aluminum Sheet Products Group is a leading

provider of aluminum sheet coil through its Nichols Aluminum

operation. Key end markets are residential R&R, new home

construction and transportation.

| (in millions, except for

spread) |

| |

Q3 2013 |

Q3 2012 |

YTD 2013 |

YTD 2012 |

| Net sales |

$105.2 |

$107.0 |

$299.5 |

$261.0 |

| Operating loss |

(0.5) |

(3.2) |

(5.2) |

(16.2) |

| EBITDA |

1.3 |

(1.5) |

(0.0) |

(10.1) |

| Shipped pounds |

77 |

75 |

213 |

180 |

| Spread per pound |

0.39 |

0.38 |

|

|

- The improvement in shipped pounds was primarily due to

increased seasonal demand for aluminum sheet product.

- Profitability was negatively impacted by product mix, with

increased demand for mill finished product, which commands a lower

price when compared to painted sheet.

- Spread improved $0.01 per pound to $0.39 per pound compared to

$0.38 per pound in the year ago quarter, but was down sequentially

when compared to the $0.42 per pound result achieved in the second

quarter of 2013.

- Spread at Nichols remains challenging primarily due to a larger

reduction in aluminum prices compared to the reduction in scrap

aluminum prices, as well as a tight scrap supply market.

- Nichols Aluminum's shipments for the 12 months ended July 31,

2013, increased 16.5%.

- Industry shipments as reported by the Aluminum Association

decreased 0.6% over the same period.

Corporate and Other Items

- Corporate expenses in the quarter were $11.0 million compared

to $8.4 million in the year ago quarter primarily due to higher ERP

expenses of $2.0 million, (including $1.7 million of higher

depreciation) and $1.1 million in higher IT-related costs,

partially offset by $0.6 million in lower stock-based compensation

costs.

- In August 2013, following a management recommendation, the

company's board of directors voted to cease the implementation of

the ERP project. The proposal was made based on management's

belief that investments made in initiatives that will drive greater

revenue growth and profitability will be more impactful to

increasing shareholder value than continuing to invest in the ERP

system.

- Total cash of $16.1 million.

- No outstanding borrowings against the revolving credit

facility.

- Cash provided by operating activities for the first nine months

of 2013 was $6.6 million.

- Available capacity under the company's revolving credit

facility was approximately $82.5 million.

Conference Call Information

Quanex will host its conference call today, September 4, 2013 at

9:00 a.m. (Eastern) to discuss its results and outlook. The call

will be available via webcast at www.quanex.com in the Investors

section.

Forward Looking Statement

Statements that use the words "estimated," "expect," "could,"

"should," "believe," "will," "might," or similar words reflecting

future expectations or beliefs are forward-looking statements. The

forward-looking statements include, but are not limited to, future

operating results of Quanex, the financial condition of Quanex,

future uses of cash and other expenditures, expenses and tax rates,

expectations relating to the company's ERP project, expectations

relating to the company's industry, and the company's future

growth. The statements in this release are based on current

expectations. Actual results or events may differ materially from

this release. Factors that could impact future results may include,

without limitation, the effect of both domestic and global economic

conditions, the impact of competitive products and pricing, the

availability and cost of raw materials, and customer demand. For a

more complete discussion of factors that may affect the company's

future performance, please refer to the company's Form 10-K filing

on December 31, 2012, under the Securities Exchange Act of 1934

("Exchange Act"), in particular the section titled, "Private

Securities Litigation Reform Act" contained therein.

For additional information,

please visit www.quanex.com

| QUANEX BUILDING PRODUCTS

CORPORATION |

| CONDENSED CONSOLIDATED

STATEMENTS OF INCOME |

| (In thousands, except per share

data) |

| (Unaudited) |

| |

|

|

|

|

| Three Months

Ended July 31, |

|

Nine Months Ended

July 31, |

| 2013 |

2012 |

|

2013 |

2012 |

| |

|

|

|

|

| $ 259,174 |

$ 237,905 |

Net sales |

$ 677,345 |

$ 593,928 |

| 215,182 |

200,663 |

Cost of sales |

576,835 |

510,542 |

| 24,683 |

26,659 |

Selling, general and administrative |

83,063 |

80,936 |

| 12,193 |

9,131 |

Depreciation and amortization |

33,389 |

28,381 |

| 7,116 |

1,452 |

Operating income

(loss) |

(15,942) |

(25,931) |

| (182) |

(108) |

Interest expense |

(495) |

(348) |

| (46) |

21 |

Other, net |

(128) |

199 |

| 6,888 |

1,365 |

Income (loss) before income

taxes |

(16,565) |

(26,080) |

| (1,919) |

166 |

Income tax benefit (expense) |

6,068 |

8,578 |

| $ 4,969 |

$ 1,531 |

Net income (loss) |

$ (10,497) |

$ (17,502) |

| |

|

|

|

|

| |

|

Earnings (loss) per common

share: |

|

|

| $ 0.13 |

$ 0.04 |

Basic |

$ (0.28) |

$ (0.48) |

| $ 0.13 |

$ 0.04 |

Diluted |

$ (0.28) |

$ (0.48) |

| |

|

|

|

|

| |

|

Weighted average common shares

outstanding: |

|

|

| 36,856 |

36,637 |

Basic |

36,838 |

36,584 |

| 37,413 |

37,163 |

Diluted |

36,838 |

36,584 |

| |

|

|

|

|

| $ 0.04 |

$ 0.04 |

Cash dividends per share |

$ 0.12 |

$ 0.12 |

| |

| |

| QUANEX BUILDING PRODUCTS

CORPORATION |

| CONDENSED CONSOLIDATED BALANCE

SHEETS |

|

|

| (In thousands) |

|

|

| (Unaudited) |

| |

|

|

| |

July 31, 2013 |

October 31, 2012 |

| Assets |

|

|

| Cash and equivalents |

$ 16,073 |

$ 71,255 |

| Accounts receivable, net |

99,051 |

85,644 |

| Inventories, net |

67,839 |

65,904 |

| Deferred income taxes |

24,497 |

20,439 |

| Prepaid and other current assets |

6,592 |

7,628 |

| Total current assets |

214,052 |

250,870 |

| Property, plant and equipment, net |

176,033 |

168,877 |

| Deferred income taxes |

12,381 |

8,911 |

| Goodwill |

71,302 |

68,331 |

| Intangible assets, net |

80,757 |

78,380 |

| Other assets |

17,036 |

14,169 |

| Total assets |

$ 571,561 |

$ 589,538 |

| |

|

|

| Liabilities and stockholders'

equity |

|

|

| Accounts payable |

$ 78,479 |

$ 80,985 |

| Accrued liabilities |

45,357 |

46,459 |

| Current maturities of long-term debt |

375 |

368 |

| Total current liabilities |

124,211 |

127,812 |

| Long-term debt |

753 |

1,033 |

| Deferred pension and postretirement

benefits |

5,862 |

6,873 |

| Liability for uncertain tax

positions |

5,416 |

6,736 |

| Non-current environmental reserves |

9,037 |

9,827 |

| Other liabilities |

13,008 |

15,430 |

| Total liabilities |

158,287 |

167,711 |

| Total stockholders' equity |

413,274 |

421,827 |

| Total liabilities and

stockholders' equity |

$ 571,561 |

$ 589,538 |

| |

|

|

| |

|

|

| QUANEX BUILDING PRODUCTS

CORPORATION |

|

|

| CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOW |

|

|

| (In thousands) |

| (Unaudited) |

| |

|

|

| |

Nine Months Ended

July 31, |

| |

2013 |

2012 |

| Operating activities: |

|

|

| Net loss |

$ (10,497) |

$ (17,502) |

| Adjustments to reconcile net loss to cash

provided by operating activities: |

|

|

| Depreciation and amortization |

33,389 |

28,381 |

| Stock-based compensation |

3,856 |

3,180 |

| Deferred income tax benefit |

(6,862) |

(9,437) |

| Excess tax benefit from share-based

compensation |

(172) |

(413) |

| Restructuring charges |

— |

1,206 |

| Other, net |

698 |

2,133 |

| Changes in assets and liabilities, net of

effects from acquisitions and dispositions: |

|

|

| Increase in accounts receivable |

(9,642) |

(7,114) |

| Decrease (increase) in inventory |

3,095 |

(7,515) |

| Decrease (increase) in other current

assets |

241 |

(757) |

| Increase (decrease) in accounts

payable |

(2,990) |

10,242 |

| Increase (decrease) in accrued

liabilities |

(6,883) |

5,789 |

| Increase (decrease) in income taxes |

1,622 |

(771) |

| Decrease in deferred pension and

postretirement benefits |

(1,011) |

(1,572) |

| Increase in other long-term

liabilities |

1,229 |

488 |

| Other, net |

504 |

(351) |

| Cash provided by operating activities |

6,577 |

5,987 |

| Investing activities: |

|

|

| Acquisitions, net of cash acquired |

(22,096) |

— |

| Capital expenditures |

(34,517) |

(31,710) |

| Proceeds from disposition of capital

assets |

335 |

36 |

| Proceeds from property insurance

claim |

— |

479 |

| Cash used for investing activities |

(56,278) |

(31,195) |

| Financing activities: |

|

|

| Borrowings under credit facility |

23,500 |

— |

| Repayments of credit facility

borrowings |

(23,500) |

— |

| Repayments of other long-term debt |

(364) |

(339) |

| Common stock dividends paid |

(4,446) |

(4,413) |

| Issuance of common stock |

909 |

2,501 |

| Excess tax benefit from share-based

compensation |

172 |

413 |

| Debt issuance costs |

(1,163) |

— |

| Purchase of treasury stock |

— |

(1,284) |

| Cash used for financing activities |

(4,892) |

(3,122) |

| |

|

|

| Effect of exchange rate changes on cash

and equivalents |

(589) |

1,003 |

| |

|

|

| Decrease in cash and equivalents |

(55,182) |

(27,327) |

| Cash and equivalents at beginning of

period |

71,255 |

89,619 |

| Cash and equivalents at end of period |

$ 16,073 |

$ 62,292 |

| |

| |

| QUANEX BUILDING PRODUCTS

CORPORATION |

| SEGMENT

INFORMATION |

| (In thousands) |

| (Unaudited) |

| |

|

|

|

|

| Three Months

Ended July 31, |

|

Nine Months Ended

July 31, |

| 2013 |

2012 |

|

2013 |

2012 |

| |

|

Net Sales: |

|

|

| $ 156,823 |

$ 134,060 |

Engineered Products |

$ 388,099 |

$ 342,223 |

| 105,198 |

107,024 |

Aluminum Sheet Products |

299,493 |

261,017 |

| 262,021 |

241,084 |

Building Products |

687,592 |

603,240 |

| |

|

|

|

|

| (2,847) |

(3,179) |

Eliminations |

(10,247) |

(9,312) |

| |

|

|

|

|

|

$ 259,174 |

$ 237,905 |

Net Sales |

$ 677,345 |

$ 593,928 |

| |

|

|

|

|

| |

|

Operating Income

(Loss) |

|

|

| $ 18,561 |

$ 13,063 |

Engineered Products |

$ 27,303 |

$ 14,949 |

| (490) |

(3,162) |

Aluminum Sheet Products |

(5,187) |

(16,213) |

| 18,071 |

9,901 |

Building Products |

22,116 |

(1,264) |

| |

|

|

|

|

| (10,955) |

(8,449) |

Corporate & Other |

(38,058) |

(24,667) |

| |

|

|

|

|

| $ 7,116 |

$ 1,452 |

Operating Income (Loss) |

$ (15,942) |

$ (25,931) |

| |

| |

| QUANEX BUILDING PRODUCTS

CORPORATION |

| NON-GAAP FINANCIAL

MEASURE DISCLOSURE |

| (In thousands) |

| (Unaudited) |

| |

| EBITDA is a non-GAAP financial

measure that Quanex management uses to measure its operational

performance and assist with financial decision-making. We believe

this non-GAAP measure provides a consistent basis for comparison

between periods, and will assist investors in understanding our

financial performance, including under market conditions outlined

in our forward-looking guidance. The company does not intend for

this information to be considered in isolation or as a substitute

for other measures prepared in accordance with GAAP. |

| |

| Three Months

Ended July 31, 2013 |

|

Nine Months Ended

July 31, 2013 |

| Engineered

Products |

Aluminum Sheet

Products |

Corporate &

Other |

Quanex |

|

Engineered

Products |

Aluminum Sheet

Products |

Corporate &

Other |

Quanex |

| |

|

|

$ 4,969 |

Net income (loss) |

|

|

|

$ (10,497) |

| |

|

|

1,919 |

Income tax expense (benefit) |

|

|

|

(6,068) |

| |

|

|

46 |

Other, net |

|

|

|

128 |

| |

|

|

182 |

Interest expense |

|

|

|

495 |

| 18,561 |

(490) |

(10,955) |

7,116 |

Operating income

(loss) |

27,303 |

(5,187) |

(38,058) |

(15,942) |

| 8,067 |

1,820 |

2,306 |

12,193 |

Depreciation and amortization |

23,637 |

5,173 |

4,579 |

33,389 |

| 26,628 |

1,330 |

(8,649) |

19,309 |

EBITDA |

50,940 |

(14) |

(33,479) |

17,447 |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Three Months

Ended July 31, 2012 |

|

Nine Months Ended

July 31, 2012 |

| Engineered

Products |

Aluminum Sheet

Products |

Corporate &

Other |

Quanex |

|

Engineered

Products |

Aluminum Sheet

Products |

Corporate &

Other |

Quanex |

| |

|

|

$ 1,531 |

Net income (loss) |

|

|

|

$ (17,502) |

| |

|

|

(166) |

Income tax expense (benefit) |

|

|

|

(8,578) |

| |

|

|

(21) |

Other, net |

|

|

|

(199) |

| |

|

|

108 |

Interest expense |

|

|

|

348 |

| 13,063 |

(3,162) |

(8,449) |

1,452 |

Operating income (loss) |

14,949 |

(16,213) |

(24,667) |

(25,931) |

| 6,911 |

1,697 |

523 |

9,131 |

Depreciation and amortization |

20,961 |

6,154 |

1,266 |

28,381 |

| 19,974 |

(1,465) |

(7,926) |

10,583 |

EBITDA |

35,910 |

(10,059) |

(23,401) |

2,450 |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Financial Statistics as

of July 31, 2013 |

|

|

|

|

|

| Book value per common share: |

$11.15 |

|

|

|

|

|

| Total debt to

capitalization: |

0.3% |

|

|

|

|

|

| Return on invested

capital: |

(2.2%) |

|

|

|

|

|

| Actual number of common shares

outstanding: |

37,049,551 |

|

|

|

|

|

CONTACT: Financial Contact: Marty Ketelaar,

713-877-5402;

Media Contact: Valerie Calvert,

713-877-5305

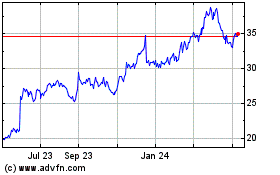

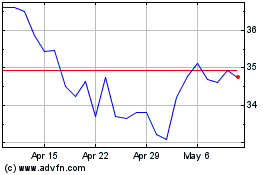

Quanex (NYSE:NX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Quanex (NYSE:NX)

Historical Stock Chart

From Jul 2023 to Jul 2024