Protective Life Corporation (NYSE: PL) today reported results for

the third quarter of 2008. Highlights include: Net loss of $1.40

per diluted share, compared to net income of $1.02 per share in the

third quarter of 2007. Included in the current quarter�s net loss

was net realized investment losses of $2.28 per share compared to

net realized investment gains of $0.05 per share in the third

quarter of 2007. The $2.28 per share of net realized investment

losses in the third quarter of 2008 included $1.85 per share of

other-than-temporary impairments. Operating income for the third

quarter was $0.88 per diluted share, compared to $0.97 per share in

the third quarter of 2007. Operating income differs from the GAAP

measure, net income, in that it excludes realized investment gains

(losses) and related amortization. The tables below reconcile

operating income to net income for the Company and its business

segments. John D. Johns, Protective�s Chairman, President and Chief

Executive Officer commented: �We are disappointed to report a net

loss for the third quarter. Losses and impairments we incurred on

investments in Lehman, FNMA, FHLMC, Washington Mutual and some

housing-related bonds more than negated the solid earnings we

reported on an operating basis in our core segments. Our core

operating earnings, adjusted for fair value accounting items, were

strong and in line with our overall expectations for the quarter.

We were particularly pleased with the earnings reported in our Life

Marketing and Stable Value segments, both of which were up

significantly in the quarter. The Acquisitions segment continued to

provide a steady stream of earnings. The Asset Protection segment

had a reasonable quarter in the face of deteriorating and

challenging conditions in the auto industry, its primary channel

for product distribution. Our annuity sales continue to be strong.

As we look to the future, we expect the business environment to

remain challenging. We do not see an immediate reversal in the

volatile capital and credit markets. We are, however, comfortable

with our strong liquidity position, and we expect to see our

capital ratios strengthening over the next two quarters,

stabilizing within the historic range for our ratings category. We

believe that our straightforward business platform enhances our

ability to manage through the current business environment, and we

are hopeful that we may begin to see some improvement and

rationalization in product pricing and return expectations as the

industry adjusts to the current economic turmoil.� FINANCIAL

HIGHLIGHTS Pre-tax other than temporary impairments on investments

during the period totaled $202.6 million, excluding $20.0 million

of impairments reimbursed to the company through modified

coinsurance agreements under which third-party reinsurers bear the

ultimate investment risk related to these securities. The following

summarizes the 2008 impairments: � Pre-Tax Impairments (Net of

Modco) Three Months � Nine Months Ended Ended September 30, 2008

(Dollars in Millions) Freddie Mac $ 7.1 $ 7.1 Fannie Mae 21.9 21.9

Lehman 92.4 92.4 Washington Mutual 45.3 45.3 Alt A Bonds � 35.9 �

115.9 Total $ 202.6 $ 282.6 � At September 30, 2008, below

investment grade securities were 5.2% of the fixed income portfolio

and problem loans and foreclosed properties were 0.4% of the

commercial loan portfolio. Life Marketing segment operating income

was $52.2 million for the three months ended September 30, 2008,

representing an increase of $12.2 million, or 30.6%, from the three

months ended September 30, 2007. Acquisitions segment operating

income was $33.0 million and increased $2.6�million, or 8.7%, for

the three months ended September 30, 2008 compared to the three

months ended September 30, 2007. Annuities segment operating income

was $0.6 million for the three months ended September 30, 2008,

representing a decrease of $5.9 million, or 91.4%, compared to the

three months ended September 30, 2007. Stable Value Products

segment operating income was $28.2 million and increased

$15.1�million, or 115.0%, for the three months ended September 30,

2008 compared to the three months ended September 30, 2007. Asset

Protection segment operating income was $8.2 million, representing

a decrease of $1.7 million, or 17.4%, for the three months ended

September 30, 2008 compared to the three months ended September 30,

2007. Operating income return on average equity for the twelve

months ended September 30, 2008 was 9.9%. Net income return on

average equity for the same period was 1.4%. For information

relating to non-GAAP measures (operating income, share-owners�

equity per share excluding other comprehensive income, operating

return on average equity, and net income return on average equity)

in this press release, please refer to the disclosure at the end of

this press release. All per share results used throughout this

press release are presented on a diluted basis, unless otherwise

noted. � � THIRD QUARTER CONSOLIDATED RESULTS � ($ in thousands;

net of income tax) � 3Q2008 3Q2007 � Operating income $ 62,452 $

69,561 Realized investment gains (losses) and related amortization

Investments (227,759 ) 27,996 Derivatives � 65,299 � � (24,565 )

Net Income (Loss) ($100,008 ) $ 72,992 � � ($ per share; net of

income tax) 3Q2008 3Q2007 � Operating income $ 0.88 $ 0.97 Realized

investment gains (losses) and related amortization Investments

(3.19 ) 0.39 Derivatives � 0.91 � � (0.34 ) Net Income (Loss)

($1.40 ) $ 1.02 BUSINESS SEGMENT OPERATING INCOME BEFORE INCOME TAX

The table below sets forth business segment operating income before

income tax for the periods shown: � � OPERATING INCOME BEFORE

INCOME TAX ($ in thousands) � 3Q2008 3Q2007 � Life Marketing $

52,222 $ 39,974 Acquisitions 33,021 30,375 Annuities 556 6,436

Stable Value Contracts 28,184 13,107 Asset Protection 8,186 9,905

Corporate & Other � (32,173 ) � 2,342 Total Pretax Operating

Income $ 89,996 � $ 102,139 � In the Life Marketing and Asset

Protection segments, pre-tax operating income equals segment income

before income tax for all periods. In the Stable Value Products,

Annuities, Acquisitions and Corporate & Other segments,

operating income excludes realized investment gains (losses),

periodic settlements on derivatives, and related amortization of

DAC and VOBA as set forth in the table below: ($ in thousands) �

3Q2008 � 3Q2007 � Operating income before income tax $ 89,996 � $

102,139 � Realized investment gains (losses) Stable Value Contracts

4,984 (333 ) Annuities (14,419 ) (266 ) Acquisitions (40,002 ) (351

) Corporate & Other (199,289 ) 6,404 Less: periodic settlements

on derivatives Corporate & Other 1,915 132 Related amortization

of deferred policy acquisition costs and value of businesses

acquired Acquisitions (1,776 ) 261 Annuities � 1,073 � � (217 )

Income (Loss) before income tax � ($159,942 ) $ 107,417 � � Income

(loss) before income tax (which, unlike operating income before

income tax, does not exclude realized gains (losses) net of the

related amortization of DAC and VOBA and participating income from

real estate ventures) for the Acquisitions segment was a loss of

$5.2 million for the third quarter of 2008 and income of $29.8

million for the third quarter of 2007. Income (loss) before income

tax for the Annuities segment was a loss of $14.9 million for the

third quarter of 2008 and income of $6.4 million for the third

quarter of 2007. Income before income tax for the Stable Value

segment was $33.2 million for the third quarter of 2008 and $12.8

million for the third quarter of 2007. Income before income tax for

the Corporate & Other segment was a loss of $233.4 million for

the third quarter of 2008 and income of $8.6 million for the third

quarter of 2007. The sales statistics given in this press release

are used by the Company to measure the relative progress of its

marketing efforts. These statistics were derived from the Company�s

various sales tracking and administrative systems and were not

derived from the Company�s financial reporting systems or financial

statements. These statistics attempt to measure only one of many

factors that may affect future business segment profitability, and

therefore are not intended to be predictive of future

profitability. SALES The table below sets forth business segment

sales for the periods shown: � � ($ in millions) � 3Q2008 3Q2007 �

Life Marketing $ 35.4 $ 62.9 Annuities 472.2 511.0 Stable Value

Contracts 685.0 572.2 Asset Protection 104.2 144.6 � REVIEW OF

BUSINESS SEGMENTS LIFE MARKETING: Pre-tax operating income was

$52.2 million for the three months ended September 30, 2008,

representing an increase of $12.2 million, or 30.6%, from the three

months ended September 30, 2007. The increase was primarily due to

net favorable prospective unlocking of $8.8 million in the

segment�s universal life and BOLI lines. In addition, higher

investment income and lower expenses partially offset the lower

earnings in the segment�s marketing subsidiaries. Life Marketing

sales were $35.4 million, down 43.8% compared to $62.9 million in

the third quarter of 2007. Term insurance sales in the current

quarter were $23.0 million compared to $36.3 million in the prior

year�s quarter. Universal life insurance sales in the third quarter

of 2008 were $12.3 million compared to $26.6 million in the third

quarter of 2007. ACQUISITIONS: Pre-tax operating income was $33.0

million and increased $2.6�million, or 8.7%, for the three months

ended September 30, 2008 compared to the three months ended

September 30, 2007. The increase was primarily due to lower

operating expenses on the Chase Insurance Group block and improved

mortality results, partially offset by expected runoff of the block

of business. ANNUITIES: Pre-tax operating income was $0.6 million

for the three months ended September 30, 2008, representing a

decrease of $5.9 million, or 91.4%, compared to the three months

ended September 30, 2007. The third quarter of 2008 included $4.8

million of negative fair value changes on the equity indexed

annuity product line and embedded derivatives associated with the

variable annuity guaranteed minimum withdrawal benefit (�GMWB�)

rider. In addition, unfavorable mortality in the segment�s single

premium immediate annuity (�SPIA�) block reduced earnings by $3.9

million. These decreases were partially offset by the continued

growth of the single premium deferred annuity (�SPDA�) line which

accounted for a $3.2 million increase in earnings compared to the

prior year�s quarter. Annuity account values were $8.2 billion as

of September 30, 2008, an increase of 9.8% over the prior year.

Total annuity sales decreased 7.6% to $472.2 million in the third

quarter of 2008 compared to the prior year�s quarter. Fixed annuity

sales were $339.8 million in the third quarter of 2008 compared to

$363.7 million in the prior year�s quarter. Variable annuity sales

were $132.4 million in the third quarter of 2008 compared to $147.3

million in the third quarter of 2007. STABLE VALUE PRODUCTS:

Pre-tax operating income was $28.2 million, representing an

increase of $15.1�million, or 115.0%, for the three months ended

September 30, 2008 compared to the prior year�s quarter. The

increase in operating earnings resulted from the combination of

higher average balances, slightly higher asset yields, and lower

liability costs. In addition, $3.0 million in other income was

generated in the third quarter 2008 from the early retirement of a

funding agreement backing a medium term note. Lower liability costs

resulted from the increased sales of attractively priced

institutional funding agreements. As a result, the operating spread

increased 61�basis points to 170 basis points for the three months

ended September 30, 2008, compared to an operating spread of 109

basis points during the prior year�s quarter. Sales were $685.0

million in third quarter 2008 compared to sales in the third

quarter of 2007 of $572.2 million. Deposit balances ended the

quarter at $6.0 billion, up 20.7% compared to $5.0 billion in the

third quarter of 2007. ASSET PROTECTION: Pre-tax operating income

was $8.2 million, representing a decrease of $1.7 million, or

17.4%, for the three months ended September 30, 2008 compared to

the prior year�s quarter. The decrease was primarily the result of

a $2.1 million decrease in service contract income due to lower

auto and marine volume and higher loss ratios in certain programs.

Also contributing to the decrease was $0.7 million of lower

earnings in the discontinued products. Offsetting this loss was

$1.1 million of higher earnings in the Guaranteed Asset Protection

product and an increase in credit insurance earnings of $0.3

million for the three months ended September 30, 2008 compared to

the prior year�s quarter. CORPORATE & OTHER: Pre-tax operating

loss was $32.2 million representing a decrease in operating income

of $34.5�million for the three months ended September 30, 2008

compared to the prior year�s quarter. The decrease was primarily

due to mark-to-market adjustments on a $387.5 million portfolio of

securities designated for trading. This trading portfolio

negatively impacted the three months ended September 30, 2008 by

approximately $20.0 million, an $18.2 million less favorable impact

than in the three months ended September 30, 2007. In addition,

total participating mortgage income in the current quarter was $1.6

million representing a decrease of $10.7 million, caused by the

current economic environment. 2008 GUIDANCE Due to extraordinary

market volatility and the potential impact of fair value accounting

on reported results, Protective will not be updating its full-year

2008 guidance. In lieu of a guidance revision, management will

discuss the prospects for its operating units during its 3Q08

earnings call scheduled as below. CONFERENCE CALL There will be a

conference call for management to discuss the quarterly results

with analysts and professional investors on November 4, 2008 at

9:00 a.m. Eastern. Analysts and professional investors may access

this call by calling 1-800-895-0231 (international callers

1-785-424-1054) and giving the conference ID: Protective. A

recording of the call will be available from 12:00 p.m. Eastern

November 4, 2008 until midnight November 11, 2008. The recording

may be accessed by calling 1-800-723-0520 (international callers

1-402-220-2653). The public may listen to a simultaneous webcast of

the call on the homepage of the Company's web site at

www.protective.com. A recording of the webcast will also be

available from 9:00�a.m. Eastern November 4, 2008 until midnight

November 11, 2008. Supplemental financial information is available

on the Company�s web site at www.protective.com in the

Analyst/Investor section under the financial report library titled

Supplemental Financial Information. INFORMATION RELATING TO

NON-GAAP MEASURES Throughout this press release, GAAP refers to

accounting principles generally accepted in the United States of

America. Consolidated and segment operating income are defined as

income before income tax excluding net realized investment gains

(losses) net of the related amortization of deferred policy

acquisition costs (�DAC�) and value of businesses acquired (�VOBA�)

and participating income from real estate ventures. Periodic

settlements of derivatives associated with corporate debt and

certain investments and annuity products are included in realized

gains (losses) but are considered part of consolidated and segment

operating income because the derivatives are used to mitigate risk

in items affecting consolidated and segment operating income.

Management believes that consolidated and segment operating income

provides relevant and useful information to investors, as it

represents the basis on which the performance of the Company�s

business is internally assessed. Although the items excluded from

consolidated and segment operating income may be significant

components in understanding and assessing the Company�s overall

financial performance, management believes that consolidated and

segment operating income enhances an investor�s understanding of

the Company�s results of operations by highlighting the income

(loss) attributable to the normal, recurring operations of the

Company�s business. As prescribed by GAAP, certain investments are

recorded at their market values with the resulting unrealized gains

(losses) affected by a related adjustment to DAC and VOBA, net of

income tax, reported as a component of share-owners� equity. The

market values of fixed maturities increase or decrease as interest

rates change. The Company believes that an insurance company�s

share-owners� equity per share may be difficult to analyze without

disclosing the effects of recording accumulated other comprehensive

income, including unrealized gains (losses) on investments.

RECONCILIATION OF SHARE-OWNERS� EQUITY PER SHARE EXCLUDING

ACCUMULATED OTHER COMPREHENSIVE INCOME PER SHARE ($ per common

share outstanding as of September 30, 2008) Total share-owners�

equity per share � $ 21.81 Less: Accumulated other comprehensive

income per share � (13.28 ) � Total share-owners� equity per share

excluding accumulated other comprehensive income $ 35.09 �

Operating income return on average equity and net income return on

average equity are measures used by management to evaluate the

Company�s performance. Operating income return on average equity

for the twelve months ended September 30, 2008 is calculated by

dividing operating income for this period by the average ending

balance of share-owners� equity (excluding accumulated other

comprehensive income) for the five most recent quarters. Net income

return on average equity for the twelve months ended September 30,

2008, is calculated by dividing net income for this period by the

average ending balance of share-owners� equity (excluding

accumulated other comprehensive income) for the five most recent

quarters. � � CALCULATION OF OPERATING INCOME RETURN ON AVERAGE

EQUITY ROLLING TWELVE MONTHS ENDED SEPTEMBER 30, 2008 � Numerator:

($ in thousands) Three Months Ended Dec. 31,2007 � Mar. 31, 2008 �

June 30, 2008 � Sept. 30, 2008 Twelve Months Ended Sept. 30, 2008 �

Net income (loss) $ 60,886 $ 35,882 $ 38,184 $ (100,008 ) $ 34,944

Net of: Realized investment gains(losses), net of income tax

Investments 12,222 (18,229 ) (73,067 ) (228,216 ) (307,290 )

Derivatives (17,022 ) 2,979 43,509 66,544 96,010 Related

amortization of DAC and VOBA, net of income tax (754 ) (698 ) 322

457 (673 ) Add back: Derivative gains related to Corp. debt and

investments, net of income tax � 127 � � 315 � � 1,161 � � 1,245 �

� 2,848 � Operating Income $ 66,567 � $ 52,145 � $ 68,581 � $

62,452 � $ 249,745 � � � � Denominator: � Share-Owners� Equity

Accumulated Other Comprehensive Income Share-Owners� Equity

Excluding Accumulated Other Comprehensive Income � September 30,

2007 $ 2,405,623 $ (85,711 ) $ 2,491,334 December 31, 2007

2,456,761 (80,529 ) 2,537,290 March 31, 2008 2,163,860 (379,948 )

2,543,808 June 30, 2008 2,081,742 (486,222 ) 2,567,964 September

30, 2008 1,524,655 (928,205 ) � 2,452,860 � Total $ 12,593,256 �

Average $ 2,518,651 � Operating Income Return on Average Equity 9.9

% � � CALCULATION OF NET INCOME RETURN ON AVERAGE EQUITY ROLLING

TWELVE MONTHS ENDED SEPTEMBER 30, 2008 � Numerator: ($ in

thousands) Three Months Ended Dec. 31,2007 � Mar. 31, 2008 � June

30, 2008 � Sept. 30, 2008 Twelve Months Ended Sept. 30, 2008 � Net

income (loss) $60,886 $35,882 $38,184 $(100,008) $34,944 � � �

Denominator: � Share-Owners� Equity Accumulated Other Comprehensive

Income Share-Owners� Equity Excluding Accumulated Other

Comprehensive Income � September 30, 2007 $ 2,405,623 $ (85,711 ) $

2,491,334 December 31, 2007 2,456,761 (80,529 ) 2,537,290 March 31,

2008 2,163,860 (379,948 ) 2,543,808 June 30, 2008 2,081,742

(486,222 ) 2,567,964 September 30, 2008 1,524,655 (928,205 ) �

2,452,860 � Total $ 12,593,256 � Average $ 2,518,651 � Net Income

Return on Average Equity 1.4 % � FORWARD-LOOKING STATEMENTS This

release and the supplemental financial information provided

includes �forward-looking statements� which express expectations of

future events and/or results. All statements based on future

expectations rather than on historical facts are forward-looking

statements that involve a number of risks and uncertainties, and

the Company cannot give assurance that such statements will prove

to be correct. The factors which could affect the Company�s future

results include, but are not limited to, general economic

conditions and the following known risks and uncertainties: the

Company is exposed to the risks of natural disasters, pandemics,

malicious and terrorist acts that could adversely affect the

Company�s operations; the Company operates in a mature, highly

competitive industry, which could limit its ability to gain or

maintain its position in the industry and negatively affect

profitability; a ratings downgrade or other negative action by a

ratings organization could adversely affect the Company; the

Company�s policy claims fluctuate from period to period resulting

in earnings volatility. and actual results could differ from

management�s expectations, including, but not limited to,

expectations of mortality, morbidity, casualty losses, persistency,

lapses, customer mix and behavior, and projected level of used

vehicle values; the Company�s results may be negatively affected

should actual experience differ from management�s assumptions and

estimates which by their nature are imprecise and subject to

changes and revision over time; the use of reinsurance, and any

change in the magnitude of reinsurance, introduces variability in

the Company�s statements of income; the Company could be forced to

sell investments at a loss to cover policyholder withdrawals;

interest rate fluctuations could negatively affect the Company�s

spread income or otherwise impact its business, including, but not

limited to, the volume of sales, the profitability of products,

investment performance, and asset liability management; equity

market volatility could negatively impact the Company�s business,

particularly with respect to the Company�s variable products,

including an increase in the rate of amortization of DAC and

estimated cost of providing minimum death benefit and minimum

withdrawal benefit guarantees relating to the variable products;

insurance companies are highly regulated and subject to numerous

legal restrictions and regulations, including, but not limited to,

restrictions relating to premium rates, reserve requirements,

marketing practices, advertising, privacy, policy forms,

reinsurance reserve requirements, acquisitions, and capital

adequacy, and the Company cannot predict whether or when regulatory

actions may be taken that could adversely affect the Company or its

operations; changes to tax law or interpretations of existing tax

law could adversely affect the Company, including, but not limited

to, the demand for and profitability of its insurance products and

the Company�s ability to compete with non-insurance products; the

Company may be required to establish a valuation allowance against

its deferred tax assets, which could materially adversely affect

the Company�s results of operations, financial condition and

capital position; financial services companies are frequently the

targets of litigation, including, but not limited to, class action

litigation, which could result in substantial judgments, and the

Company, like other financial services companies, in the ordinary

course of business is involved in litigation and arbitration;

publicly held companies in general and the financial services

industry in particular are sometimes the target of law enforcement

investigations and the focus of increased regulatory scrutiny; the

Company�s ability to maintain competitive unit costs is dependent

upon the level of new sales and persistency of existing business,

and a change in persistency may result in higher claims and/or

higher or more rapid amortization of deferred policy acquisition

costs and thus higher unit costs and lower reported earnings; the

Company�s investments, including, but not limited to, the Company�s

invested assets, derivative financial instruments and commercial

mortgage loan portfolio, are subject to market and credit risks,

and these risks could be heightened during periods of extreme

volatility or disruption in financial and credit markets; the

Company may not realize its anticipated financial results from its

acquisitions strategy, which is dependent on factors such as the

availability of suitable acquisitions, the availability of capital

to fund acquisitions and the realization of assumptions relating to

the acquisition; the Company may not be able to achieve the

expected results from its recent acquisition; the Company is

dependent on the performance of others, including, but not limited

to, distributors, third-party administrators, fund managers,

reinsurers and other service providers, and, as with all financial

services companies, its ability to conduct business is dependent

upon consumer confidence in the industry and its products; the

Company�s reinsurers could fail to meet assumed obligations,

increase rates, or be subject to adverse developments that could

affect the Company, and the Company�s ability to compete is

dependent on the availability of reinsurance, which has become more

costly and less available in recent years, or other substitute

capital market solutions; the success of the Company�s captive

reinsurance program and related marketing efforts is dependent on a

number of factors outside the control of the Company, including,

but not limited to, continued access to capital markets and the

overall tax position of the Company; computer viruses or network

security breaches could affect the data processing systems of the

Company or its business partners, and could damage the Company�s

business and adversely affect its financial condition and results

of operations; the Company�s ability to grow depends in large part

upon the continued availability of capital, which has been

negatively impacted by regulatory action and the volatility and

disruption in the capital and credit markets, and may be negatively

impacted in the future by an increase in guaranteed minimum death

and withdrawal benefit related policy liabilities in variable

products resulting from negative performance in the equity markets,

and future marketing plans are dependent on access to the capital

markets through securitization; and new GAAP and statutory

accounting rules or changes to existing GAAP and statutory

accounting rules could negatively impact the Company; the Company�s

risk management policies and procedures may leave it exposed to

unidentified or unanticipated risk, which could negatively affect

our business or result in losses; credit market volatility or

disruption could adversely impact the Company�s financial condition

or results from operations in several ways, including but not

limited to the following: causing market price and cash flow

variability in the Company�s fixed income portfolio, defaults on

principal or interest payments by issuers of the Company�s fixed

income investments, other than temporary impairments of the

Company�s fixed income investments; adversely impacting the

Company�s ability to efficiently access the capital markets to

finance its reserve, capital and liquidity needs; difficult

conditions in the economy generally could adversely affect the

Company�s business and results from operations; and there can be no

assurance that the actions of the U.S. Government or other

governmental and regulatory bodies for the purpose of stabilizing

the financial markets will achieve their intended effect. Please

refer to Exhibit 99 of the Company�s most recent Form 10-K/ 10-Q

for more information about these factors which could affect future

results.

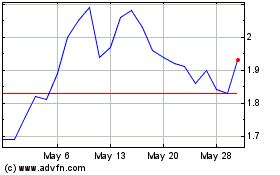

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From May 2024 to Jun 2024

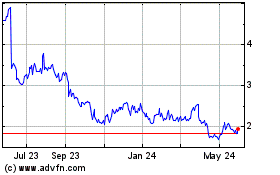

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Jun 2023 to Jun 2024