Protective Confirms Credit Exposures to Fannie Mae, Freddie Mac, Lehman Brothers and AIG

September 16 2008 - 1:00PM

Business Wire

Protective Life Corporation (NYSE:PL) today confirmed its credit

exposures relating to its investments in preferred stock issued by

the Federal National Mortgage Association (Fannie Mae) and the

Federal Home Loan Mortgage Corporation (Freddie Mac), debt and

preferred stock issued by Lehman Brothers Holdings, Inc., (Lehman)

and debt and preferred stock issued by American International

Group, Inc. (AIG). In the event that there is no recovery with

respect to such securities (an outcome that the Company believes is

unlikely), the Company expects that the resulting charge would

reduce the Company�s share-owners� equity per share by

approximately $2.12 as indicated in the attached table and at

www.protective.com. The Company�s share-owners� equity per share

excluding accumulated other comprehensive income (AOCI) at June 30,

2008 was $36.76. AOCI was ($6.96) per share at June 30, 2008. The

Company will determine the amount of any impairment charge relating

to these securities as of September 30, 2008. Share-owners� equity

per share excluding AOCI is a non-GAAP financial measure.

Share-owners� equity per share is a GAAP financial measure to which

share-owners� equity per share excluding AOCI may be compared.

Share-owners� equity per share at June 30, 2008, which includes

AOCI, was $29.80. FORWARD-LOOKING STATEMENTS This release includes

�forward-looking statements� which express expectations of future

events and/or results. All statements based on future expectations

rather than on historical facts are forward-looking statements that

involve a number of risks and uncertainties, and the Company cannot

give assurance that such statements will prove to be correct. The

factors which could affect the Company�s future results include,

but are not limited to, general economic conditions and the

following known trends and uncertainties: the Company�s

investments, including, but not limited to, the Company�s invested

assets, derivative financial instruments and commercial mortgage

loan portfolio, are subject to market and credit risks; the Company

is dependent on the performance of others, including, but not

limited to, reinsurers; and, as with all financial services

companies, its ability to conduct business is dependent upon

consumer confidence in the industry and its products; the Company�s

reinsurers could fail to meet assumed obligations, increase rates,

or be subject to adverse developments that could affect the

Company, and the Company�s ability to compete is dependent on the

availability of reinsurance, which has become more costly and less

available in recent years, or other substitute capital market

solutions; the success of the Company�s captive reinsurance program

and related marketing efforts is dependent on a number of factors

outside the control of the Company, including, but not limited to,

continued access to capital markets and the overall tax position of

the Company; the Company�s ability to grow depends in large part

upon the continued availability of capital which has been

negatively impacted by recent regulatory action and reserve

increase related to certain discontinued lines of business and may

be negatively impacted in the future by an increase in guaranteed

minimum death benefit related policy liabilities resulting from

negative performance in the equity markets, and future marketing

plans are dependent on access to the capital markets through

securitization; and new accounting or statutory rules or changes to

existing accounting or statutory rules could negatively impact the

Company; the Company�s risk management policies and procedures may

leave it exposed to unidentified or unanticipated risk, which could

negatively affect our business or result in losses; credit market

volatility could cause market price and cash flow variability in

the Company�s fixed income portfolio, resulting in defaults on

principal or interest payments on those securities or adverse

impact on the Company�s liquidity or ability to efficiently access

the capital markets to issue long term debt or fund statutory

reserves. Please refer to Exhibit 99 of the Company�s most recent

Form 10-K/10-Q for more information about these and other factors

which could affect future results. Protective Life Corporation

("PLC") - Supplemental Investment Portfolio Information Fannie Mae,

Freddie Mac, Lehman and AIG as of 9/15/08 - GAAP Amortized Cost as

of 8/31/08 (Dollars in millions, except per share amounts)

(Unaudited) � � � � � Fannie Mae (2) Freddie Mac (2) Lehman (5) AIG

(3) Senior Debt n/a n/a $ 44.3 $ 94.0 Subordinated Debt n/a n/a

32.0 - Junior Subordinated Debt n/a n/a 12.5 3.0 Preferred Stock

24.0 7.6 10.1 - Other (Common Stock, GICs, CDS, Securities Lending)

- - - - PLC Total (1) (4) $ 24.0 $ 7.6 $ 98.9 $ 97.0 � � (1)

Excludes Modco Trading Portfolio Holdings of: $ 2.6 $ - $ 19.3 $

34.1 � (The modco trading portfolio holdings support modified

coinsurance arrangements and the investment results are passed

directly to third-party reinsurers.) � (2) Excludes Debt of Fannie

Mae and Freddie Mac since these securities are not believed to be

at risk of default at this time. � (3) Includes $55.2 for American

International Group, $39.5 for American General Finance, and $2.3

for International Lease Finance. � (4) In the event there is no

recovery with respect to the securities (an outcome that the

Company believes is unlikely), the Company expects that the

resulting after-tax charge (assuming a 35% tax rate) would reduce

share-owners' equity per share by approximately $2.12. � (5) The

total for Protective Life Insurance Company, on a stand-alone

basis, is $98.6 million.

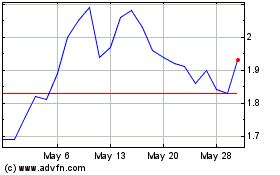

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Jun 2024 to Jul 2024

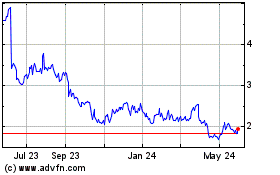

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Jul 2023 to Jul 2024