Protective Life Corporation (NYSE: PL) today reported results for

the second quarter of 2008. Highlights include: Net income was

$0.53 per diluted share, compared to $0.91 per share in the second

quarter of 2007. Included in the current quarter�s net income were

net realized investment losses of $0.43 per share compared to net

realized investment gains of $0.03 per share in the second quarter

of 2007. The $0.43 per share of net realized investment losses in

the second quarter of 2008 included $0.73 per share of

other-than-temporary impairments, which were partially offset by

$0.30 per share of gains on the sale of certain securities and

positive adjustments to derivatives. Operating income for the

second quarter was $0.96 per diluted share, compared to $0.88 per

share in the second quarter of 2007. Operating income differs from

the GAAP measure, net income, in that it excludes realized

investment gains (losses) and related amortization. The tables

below reconcile operating income to net income for the Company and

its business segments. John D. Johns, Protective�s Chairman,

President and Chief Executive Officer commented: � � � � "We were

pleased overall by our operating results in the second quarter.

Segment earnings in our Annuities, Stable Value and Acquisitions

lines were in line with or above our expectations for the quarter.

While our Life Marketing segment was slightly below our

expectations for the quarter, after adjusting for less than

expected favorable mortality, results were essentially in line with

our plan. Earnings in Asset Protection were below plan, due to the

impact of the sharp decline in U.S. auto and marine sales in the

quarter and certain legal expenses and settlements that were above

plan levels. In the Corporate & Other line, we were also

pleased by the recovery we experienced in our securities trading

account in the quarter. � At the same time, we were disappointed by

the fact that net income was negatively impacted by impairment

charges on a portfolio of Alt-A category securities we purchased in

2007. Notwithstanding these charges, our investment portfolios

performed well in a difficult credit environment, as we continue to

enjoy higher yields and wider spreads on our investments. We were

especially pleased by the solid credit performance we continued to

experience in our commercial mortgage portfolio. Problem mortgage

loans remain at historically low levels. � As we look to the second

half of the year, we expect credit market conditions to remain

challenging. Nevertheless, we are maintaining our disciplined

approach to investment management, and we are optimistic that our

securities and commercial mortgage loan portfolio will hold up well

in the circumstances. We are not, however, optimistic about

participating mortgage income over the remainder of the year. The

absence of liquidity in the real estate sector is having a

significant impact on sales activity in the participating loan

portfolio. While we do see increasing opportunities to originate

attractive participating loans, we do expect low levels of

participating mortgage income for the remainder of the year. � We

remain encouraged by our prospects in our retail marketing

businesses. We expect to have a record level of sales in our

Annuities line and continued positive fund flows in most product

lines. While life sales were somewhat below plan in the first half

of the year due, in part, to the late introduction of a new series

of universal life products, our expectation is that sales activity

will pick up in the second half as these and other new products are

introduced to the market. Overall, we think we are well positioned

in the annuities and life marketing lines for solid performance.

While Asset Protection is likely to remain under some sales and

earnings pressure so long as auto and marine sales are depressed,

we expect continued good performance from our in-force service

contract business. � Overall, we believe that our fundamentals

remain solid, notwithstanding the challenges presented by the

current macroeconomic environment, and we remain positive in our

longer-term outlook and expectations for our business." FINANCIAL

HIGHLIGHTS Life Marketing pre-tax operating income was $38.1

million compared to $37.8 million in the second quarter last year.

Pre-tax operating income for the Acquisitions segment was $34.5

million, up 12.0% from the same period last year. Pre-tax operating

income in the Annuities segment was $9.5 million compared to $6.7

million in the same period last year. The Annuities segment results

for second quarter 2008 were positively impacted by the effect of

$1.7 million of fair value changes, net of deferred acquisition

cost (DAC) amortization. The Stable Value Products segment reported

$17.5 million in pre-tax operating income, a 42.0% increase over

the same period last year. The Asset Protection segment reported

pre-tax operating income of $6.7 million compared to $11.5 million

in the same period last year. Operating income return on average

equity for the twelve months ended June 30, 2008 was 10.2%. Net

income return on average equity for the twelve months ended June

30, 2008 was 8.3%. At June 30, 2008, below investment grade

securities were 5.3% of invested assets, and problem mortgage loans

and foreclosed properties were 0.2% of the commercial mortgage loan

portfolio. As of June 30, 2008, the total market value of

securities supported by collateral classified as sub-prime was

$72.8 million, or 0.2% of total invested assets. Additionally, as

of June 30, 2008, residential mortgage-backed securities supported

by collateral classified as Alt-A totaled $754.7 million,

comprising 2.5% of total invested assets. Of the total Alt-A

securities, 92.5% are rated AAA. During the second quarter 2008,

the Company recorded pre-tax other-than-temporary impairments of

$80.0 million related to a portion of these securities not rated

AAA. The decline in the estimated fair value of these securities

resulted from factors including downgrades in rating, interest rate

changes, and the current distressed credit markets. These

other-than-temporary impairments resulted from our analysis of

circumstances and our belief that credit events, loss severity,

changes in credit enhancement, and/or other adverse conditions of

the respective issuers have caused, or will lead to, a deficiency

in the contractual cash flows related to these investments. 2008

GUIDANCE Based on current information, Protective is revising its

guidance with respect to expected 2008 operating income per diluted

share to a range of $3.60 to $3.80 per share from $3.80 to $4.15

per share. The reduction in guidance is primarily attributable to

expectations for limited opportunities of participating mortgage

income, reduced profits in the Asset Protection Division related to

the current macroeconomic environment for auto and marine sales,

and slower recovery of fair value items impacting the Annuities

segment and the trading portfolio. Protective�s 2008 guidance

excludes any reserve adjustments or unusual or unpredictable

benefits or charges that might occur during the rest of the year.

The 2008 guidance range is based upon many assumptions, including

but not limited to the following: the expected pattern of financial

results of life insurance business written under our capital

markets securitization structure; no substantial changes in credit

spreads, interest rates or the slope of the yield curve from

conditions existing on July 28, 2008; additional recovery of $10

million of mark-to-market losses on a trading portfolio from first

quarter 2008 in the second half of 2008; achieving our targeted

level of sales in our major retail product lines; the ongoing

impact of the ordinary course run-off of older policies; no

material change in the equity markets; and our view and

expectations as to the likely effect of the interest rate

environment on our business (including our view and expectations of

credit spreads, the yield curve, and the volume of prepayments and

income from both our securities portfolio and our participating

mortgage loan portfolio). The 2008 guidance also assumes that Life

Marketing mortality will be consistent with 2007 results for the

remainder of the year. Investment income from extraordinary sources

(primarily participating mortgage loan income and prepayment fees)

is expected to decline in 2008 compared to 2007 levels, but is

assumed to be replaced by higher levels of investment income from

the remaining investment portfolio. The 2008 guidance range also

assumes no further positive or negative unlocking of deferred

policy acquisition costs (�DAC�) or adjustments to value of

businesses acquired (�VOBA�), and diluted weighted average shares

outstanding of 71.6 million. The Company�s actual experience in

2008 will almost certainly differ from the expectations described

above, due to a number of factors including, but not limited to,

the risk factors set forth under �Forward Looking Statements� below

and in the Company�s most recent Form 10-K and Form 10-Q,

significant changes in earnings on investment products caused by

changes in interest rates and the equity markets, changes in fair

value affecting operating income, DAC and VOBA amortization, and

changes in our effective tax rate that are difficult to anticipate

or forecast. Accordingly, no assurance can be given that actual

results will fall within the expected guidance range. For

information relating to non-GAAP measures (operating income,

share-owners� equity per share excluding other comprehensive

income, operating return on average equity, and net income return

on average equity) in this press release, please refer to the

disclosure at the end of this press release. All per share results

used throughout this press release are presented on a diluted

basis, unless otherwise noted. SECOND QUARTER CONSOLIDATED RESULTS

� � � � � ($ in thousands; net of income tax) 2Q2008 2Q2007 �

Operating income $ 68,581 $ 62,799 Realized investment gains

(losses) and related amortization, net of certain derivative gains

(losses) � (30,397 ) � 2,306 � Net Income $ 38,184 � $ 65,105 � �

($ per share; net of income tax) 2Q2008 2Q2007 � Operating income $

0.96 $ 0.88 Realized investment gains (losses) and related

amortization Investments (1.02 ) (0.65 ) Derivatives � 0.59 � �

0.68 � Net Income $ 0.53 � $ 0.91 � � BUSINESS SEGMENT OPERATING

INCOME BEFORE INCOME TAX The table below sets forth business

segment operating income before income tax for the periods shown: �

OPERATING INCOME BEFORE INCOME TAX ($ in thousands) � � 2Q2008 � �

2Q2007 � LIFE MARKETING $ 38,127 $ 37,834 ACQUISITIONS 34,514

30,814 ANNUITIES 9,487 6,669 STABLE VALUE PRODUCTS 17,545 12,355

ASSET PROTECTION 6,664 11,522 CORPORATE & OTHER � (2,093 ) �

(1,300 ) $ 104,244 � $ 97,894 � � In the Life Marketing and Asset

Protection segments, pre-tax operating income equals segment income

before income tax for all periods. In the Stable Value Products,

Annuities, Acquisitions and Corporate & Other segments,

operating income excludes realized investment gains (losses) and

related amortization of DAC and VOBA as set forth in the table

below. � � � � ($ in thousands) 2Q2008 2Q2007 � Operating income

before income tax $ 104,244 $ 97,894 Realized investment gains

(losses) Stable Value Contracts 1,823 (583 ) Annuities 1,095 53

Acquisitions (3,824 ) 2,566 Corporate & Other (44,568 ) 2,578

Less: periodic settlements on derivatives Corporate & Other

1,786 237 Related amortization of deferred policy acquisition costs

and value of businesses acquired Acquisitions (535 ) 777 Annuities

� 40 � � 53 � Income before income tax $ 57,479 � $ 101,441 � �

Income before income tax (which, unlike operating income before

income tax, does not exclude realized gains (losses) net of the

related amortization of DAC and VOBA and participating income from

real estate ventures) for the Acquisitions segment was $31.2

million for the second quarter of 2008 and $32.6 million for the

second quarter of 2007. Income before income tax for the Annuities

segment was $10.5 million for the second quarter of 2008 and $6.7

million for the second quarter of 2007. Income before income tax

for the Stable Value segment was $19.4 million for the second

quarter of 2008 and $11.8 million for the second quarter of 2007.

Income before income tax for the Corporate & Other segment was

a loss of $48.4 million for the second quarter of 2008 and income

of $1.0 million for the second quarter of 2007. The sales

statistics given in this press release are used by the Company to

measure the relative progress of its marketing efforts. These

statistics were derived from the Company�s various sales tracking

and administrative systems and were not derived from the Company�s

financial reporting systems or financial statements. These

statistics attempt to measure only one of many factors that may

affect future business segment profitability, and, therefore, are

not intended to be predictive of future profitability. SALES The

table below sets forth business segment sales for the periods

shown: ($ in millions) � � 2Q2008 � � 2Q2007 � LIFE MARKETING $

41.1 $ 64.7 ANNUITIES 552.2 428.8 STABLE VALUE PRODUCTS 587.8 135.0

ASSET PROTECTION 119.6 150.2 � BUSINESS SEGMENT HIGHLIGHTS LIFE

MARKETING: Life Marketing pre-tax operating income was $38.1

million compared to $37.8 million in second quarter last year. Term

and universal life mortality had an unfavorable impact to earnings

of $0.8 million in the second quarter of 2008, approximately $1.5

million more favorable than the prior year�s quarter. Investment

income in the second quarter of 2007 included approximately $4.0

million of investment income that is now allocated to the Corporate

& Other segment as a result of the completion of the AXXX

securitization. Life Marketing sales were $41.1 million, down 36.4%

compared to $64.7 million in the second quarter of 2007. Term

insurance sales in the current quarter were $26.9 million compared

to $44.0 million in the prior year�s quarter. Universal life

insurance sales in the second quarter of 2008 were $12.6 million

compared to $18.5 million in the second quarter of 2007.

ACQUISITIONS: Pre-tax operating income was $34.5 million for the

second quarter of 2008, up 12.0% compared to $30.8 million in the

second quarter of 2007. The current quarter reflected lower

expenses related to the Chase Insurance Group acquisition, which

was partially offset by expected runoff of the acquired blocks.

ANNUITIES: Pre-tax operating income in the Annuities segment was

$9.5 million in the second quarter of 2008, up from $6.7 million in

the second quarter of 2007. The Annuities segment results for

second quarter 2008 were positively impacted by the net effect of

$1.7 million of fair value changes, net of DAC amortization,

related to the variable annuity GMWB rider and the Equity Indexed

Annuity product. Annuity account values were $8.1 billion as of

June 30, 2008, an increase of 14.1% over the prior year. The

Annuities segment had positive cash flows in all of its product

portfolios in the second quarter of 2008. Total annuity sales

increased 28.8% to $552.2 million in the second quarter of 2008

compared to the prior year�s quarter. Fixed annuity sales were

$436.8 million in the second quarter of 2008 compared to $305.6

million in the prior year�s quarter. Variable annuity sales were

$115.4 million in the second quarter of 2008 compared to $123.3

million in the second quarter of 2007. STABLE VALUE PRODUCTS:

Pre-tax operating income in the Stable Value Products segment was

$17.5 million in the second quarter of 2008, compared to $12.4

million in the second quarter of 2007. Operating spreads widened in

the second quarter of 2008 to 134 basis points as compared to 104

basis points in the second quarter of 2007. Sales were $587.8

million in second quarter 2008 compared to sales in the second

quarter of 2007 of $135.0 million. Deposit balances ended the

quarter at $5.4 billion, up 13.2% compared to $4.8 billion in the

second quarter of 2007. ASSET PROTECTION: The Asset Protection

segment had pre-tax operating income of $6.7 million in the second

quarter of 2008 compared to $11.5 million in the prior year�s

second quarter. The decrease was primarily the result of lower

service contract earnings due to lower sales and lower earnings in

Inventory Protection and Guaranteed Asset Protection products.

Sales were $119.6 in the second quarter of 2008 compared to $150.2

in the same period last year. CORPORATE & OTHER: This segment

consists primarily of net investment income on unallocated capital,

interest expense on all debt, various other items not associated

with the other segments and ancillary run-off lines of business.

The segment reported a pre-tax operating loss of $2.1 million in

the second quarter of 2008, compared to $1.3 million of operating

loss in the second quarter of 2007. The loss in the second quarter

of 2008 includes a gain of $5.3 million related to the

mark-to-market on a $418 million portfolio of securities designated

for trading. Participating mortgage income in the current quarter

was $1.7 million or $3.4 million lower than the second quarter of

2007 (both periods exclude $2.0 million that was allocated to the

other business segments). CONFERENCE CALL There will be a

conference call for management to discuss the quarterly results

with analysts and professional investors on August 6, 2008 at 9:00

a.m. Eastern. Analysts and professional investors may access this

call by calling 1-800-862-9098 (international callers

1-785-424-1051) and giving the conference ID: Protective. A

recording of the call will be available from 12:00 p.m. Eastern

August 6, 2008 until midnight August 13, 2008. The recording may be

accessed by calling 1-800-283-4595 (international callers

1-402-220-0873). The public may listen to a simultaneous webcast of

the call on the homepage of the Company's web site at

www.protective.com. A recording of the webcast will also be

available from 12:00�p.m. Eastern August 6, 2008 until midnight

August 13, 2008. Supplemental financial information is available on

the Company�s web site at www.protective.com in the

Analyst/Investor section under the financial report library titled

Supplemental Financial Information. INFORMATION RELATING TO

NON-GAAP MEASURES Throughout this press release, GAAP refers to

accounting principles generally accepted in the United States of

America. Consolidated and segment operating income are defined as

income before income tax excluding net realized investment gains

(losses) net of the related amortization of deferred policy

acquisition costs (�DAC�) and value of businesses acquired (�VOBA�)

and participating income from real estate ventures. Periodic

settlements of derivatives associated with corporate debt and

certain investments and annuity products are included in realized

gains (losses) but are considered part of consolidated and segment

operating income because the derivatives are used to mitigate risk

in items affecting consolidated and segment operating income.

Management believes that consolidated and segment operating income

provides relevant and useful information to investors, as it

represents the basis on which the performance of the Company�s

business is internally assessed. Although the items excluded from

consolidated and segment operating income may be significant

components in understanding and assessing the Company�s overall

financial performance, management believes that consolidated and

segment operating income enhances an investor�s understanding of

the Company�s results of operations by highlighting the income

(loss) attributable to the normal, recurring operations of the

Company�s business. As prescribed by GAAP, certain investments are

recorded at their market values with the resulting unrealized gains

(losses) affected by a related adjustment to DAC and VOBA, net of

income tax, reported as a component of share-owners� equity. The

market values of fixed maturities increase or decrease as interest

rates change. The Company believes that an insurance company�s

share-owners� equity per share may be difficult to analyze without

disclosing the effects of recording accumulated other comprehensive

income, including unrealized gains (losses) on investments. The

2008 earnings guidance presented in this release is based on the

financial measure operating income per diluted share. Net income

per diluted share is the most directly comparable GAAP measure. A

quantitative reconciliation of Protective�s net income per diluted

share to operating income per diluted share is not calculable on a

forward-looking basis because it is not possible to provide a

reliable forecast of realized investment gains and losses, which

typically vary substantially from period to period. RECONCILIATION

OF SHARE-OWNERS� EQUITY PER SHARE EXCLUDING ACCUMULATED OTHER

COMPREHENSIVE INCOME PER SHARE � ($ per common share outstanding as

of June 30, 2008) � Total share-owners� equity per share � � $

29.80 Less: Accumulated other comprehensive income per share �

(6.96 ) � Total share-owners� equity per share excluding

accumulated other comprehensive income $ 36.76 � � Operating income

return on average equity and net income return on average equity

are measures used by management to evaluate the Company�s

performance. Operating income return on average equity for the

twelve months ended June 30, 2008 is calculated by dividing

operating income for this period by the average ending balance of

share-owners� equity (excluding accumulated other comprehensive

income) for the five most recent quarters. Net income return on

average equity for the twelve months ended June 30, 2008, is

calculated by dividing net income for this period by the average

ending balance of share-owners� equity (excluding accumulated other

comprehensive income) for the five most recent quarters.

CALCULATION OF OPERATING INCOME RETURN ON AVERAGE EQUITY ROLLING

TWELVE MONTHS ENDED JUNE 30, 2008 � � Numerator:($ in thousands) �

Three Months Ended � TwelveMonths Ended Sept. 30, 2007 � Dec.

31,2007 � Mar. 31,2008 � June 30,2008 June 30,2008 � Net income $

72,992 $ 60,886 $ 35,882 $ 38,184 $�207,944 Net of: Realized

investment gains (losses), net of income tax Investments 28,024

12,222 (18,229 ) (73,067 ) (51,050 ) Derivatives (24,479 ) (17,022

) 2,979 43,509 4,987 Related amortization of DAC, net of income tax

(29 ) (754 ) (698 ) 322 (1,159 ) Add back: Derivative gains related

to Corp. debt and investments, net of income tax � 85 � � 127 � �

315 � � 1,161 � 1,688 � Operating Income $ 69,561 � $ 66,567 � $

52,145 � $ 68,581 � $�256,854 � � � � � � � � Denominator:

Share-Owners� Equity Accumulated Other Comprehensive Income

Share-Owners� Equity Excluding Accumulated Other Comprehensive

Income � June 30, 2007 $2,293,542 $(139,132 ) $2,432,674 September

30, 2007 2,405,623 (85,711 ) 2,491,334 December 31, 2007 2,456,761

(80,529 ) 2,537,290 March 31, 2008 2,163,860 (379,948 ) 2,543,808

June 30, 2008 2,081,742 (486,222 ) 2,567,964 � Total $12,573,070 �

Average $2,514,614 � Operating Income Return on Average Equity 10.2

% � � CALCULATION OF NET INCOME RETURN ON AVERAGE EQUITY ROLLING

TWELVE MONTHS ENDED JUNE 30, 2008 � ($ in thousands) � Numerator:

Net income � three months ended September 30, 2007 � � $ 72,992 Net

income � three months ended December 31, 2007 60,886 Net income �

three months ended March 31, 2008 35,882 Net income � three months

ended June 30, 2008 � 38,184 Net income � rolling twelve months

ended June 30, 2008 $ 207,944 � � � � � � � Denominator:

Share-Owners� Equity Accumulated Other Comprehensive Income

Share-Owners� Equity Excluding Accumulated Other Comprehensive

Income � June 30, 2007 $2,293,542 $(139,132 ) $2,432,674 September

30, 2007 2,405,623 (85,711 ) 2,491,334 December 31, 2007 2,456,761

(80,529 ) 2,537,290 March 31, 2008 2,163,860 (379,948 ) 2,543,808

June 30, 2008 2,081,742 (486,222 ) 2,567,964 � Total $12,573,070 �

Average $2,514,614 � Net Income Return on Average Equity 8.3 %

FORWARD-LOOKING STATEMENTS This release and the supplemental

financial information provided includes �forward-looking

statements� which express expectations of future events and/or

results. All statements based on future expectations rather than on

historical facts are forward-looking statements that involve a

number of risks and uncertainties, and the Company cannot give

assurance that such statements will prove to be correct. The

factors which could affect the Company�s future results include,

but are not limited to, general economic conditions and the

following known trends and uncertainties: the Company is exposed to

the risks of natural disasters, pandemics, malicious and terrorist

acts that could adversely affect the Company�s operations; the

Company operates in a mature, highly competitive industry, which

could limit its ability to gain or maintain its position in the

industry and negatively affect profitability; a ratings downgrade

could adversely affect the Company�s ability to compete; the

Company�s policy claims fluctuate from period to period resulting

in earnings volatility, and actual results could differ from

management�s expectations, including, but not limited to,

expectations of mortality, morbidity, casualty losses, persistency,

lapses, customer mix and behavior, and projected level of used

vehicle values; the Company�s results may be negatively affected

should actual experience differ from management�s assumptions and

estimates which by their nature are imprecise and subject to

changes and revision over time; the use of reinsurance, and any

change in the magnitude of reinsurance, introduces variability in

the Company�s statements of income; the Company could be forced to

sell investments at a loss to cover policyholder withdrawals;

interest rate fluctuations could negatively affect the Company�s

spread income or otherwise impact its business, including, but not

limited to, the volume of sales, the profitability of products,

investment performance, and asset liability management; equity

market volatility could negatively impact the Company�s business,

particularly with respect to the Company�s variable products,

including an increase in the rate of amortization of DAC and

estimated cost of providing minimum death benefit guarantees

relating to the variable products; insurance companies are highly

regulated and subject to numerous legal restrictions and

regulations, including, but not limited to, restrictions relating

to premium rates, reserve requirements, marketing practices,

advertising, privacy, policy forms, reinsurance reserve

requirements, acquisitions, and capital adequacy, and the Company

cannot predict whether or when regulatory actions may be taken that

could adversely affect the Company or its operations; changes to

tax law or interpretations of existing tax law could adversely

affect the Company, including, but not limited to, the demand for

and profitability of its insurance products and the Company�s

ability to compete with non-insurance products; financial services

companies are frequently the targets of litigation, including, but

not limited to, class action litigation, which could result in

substantial judgments, and the Company, like other financial

services companies, in the ordinary course of business is involved

in litigation and arbitration; publicly held companies in general

and the financial services industry in particular are sometimes the

target of law enforcement investigations and the focus of increased

regulatory scrutiny; the Company�s ability to maintain low unit

costs is dependent upon the level of new sales and persistency of

existing business, and a change in persistency may result in higher

claims and/or higher or more rapid amortization of deferred policy

acquisition costs and thus higher unit costs and lower reported

earnings; the Company�s investments, including, but not limited to,

the Company�s invested assets, derivative financial instruments and

commercial mortgage loan portfolio, are subject to market and

credit risks; the Company may not realize its anticipated financial

results from its acquisitions strategy, which is dependent on

factors such as the availability of suitable acquisitions, the

availability of capital to fund acquisitions and the realization of

assumptions relating to the acquisition; the Company may not be

able to achieve the expected results from its recent acquisition;

the Company is dependent on the performance of others, including,

but not limited to, distributors, third-party administrators, fund

managers, reinsurers and other service providers, and, as with all

financial services companies, its ability to conduct business is

dependent upon consumer confidence in the industry and its

products; the Company�s reinsurers could fail to meet assumed

obligations, increase rates, or be subject to adverse developments

that could affect the Company, and the Company�s ability to compete

is dependent on the availability of reinsurance, which has become

more costly and less available in recent years, or other substitute

capital market solutions; the success of the Company�s captive

reinsurance program and related marketing efforts is dependent on a

number of factors outside the control of the Company, including,

but not limited to, continued access to capital markets and the

overall tax position of the Company; computer viruses or network

security breaches could affect the data processing systems of the

Company or its business partners, and could damage the Company�s

business and adversely affect its financial condition and results

of operations; the Company�s ability to grow depends in large part

upon the continued availability of capital, which has been

negatively impacted by recent regulatory action and reserve

increase related to certain discontinued lines of business and may

be negatively impacted in the future by an increase in guaranteed

minimum death benefit related policy liabilities resulting from

negative performance in the equity markets, and future marketing

plans are dependent on access to the capital markets through

securitization; and new accounting or statutory rules or changes to

existing accounting or statutory rules could negatively impact the

Company; the Company�s risk management policies and procedures may

leave it exposed to unidentified or unanticipated risk, which could

negatively affect our business or result in losses; credit market

volatility could cause market price and cash flow variability in

the Company�s fixed income portfolio, resulting in defaults on

principal or interest payments on those securities or adversely

impact the Company�s ability to efficiently access the capital

markets to issue long term debt or fund excess statutory reserves.

Please refer to Exhibit 99 of the Company�s most recent Form 10-K/

10-Q for more information about these factors which could affect

future results.

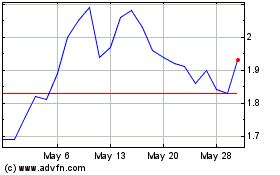

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Oct 2024 to Nov 2024

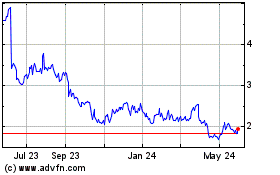

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Nov 2023 to Nov 2024