Current Report Filing (8-k)

June 28 2023 - 6:02AM

Edgar (US Regulatory)

0001110611FALSE00011106112023-06-222023-06-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

FORM 8-K

___________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 22, 2023

___________________

ON24, INC.

(Exact name of registrant as specified in its charter)

___________________

| | | | | | | | | | | | | | | | | |

| Delaware | | 001-39965 | | 94-3292599 | |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) | |

| | | | | | | | | | | | | | |

| 50 Beale Street, | 8th Floor | | |

| San Francisco, | CA | | 94105 |

| (Address of principal executive offices) | | (Zip Code) |

(415) 369-8000

(Registrant’s telephone number, including area code)

_______________________

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common stock, par value $0.0001 per share | | ONTF | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.05 Costs Associated with Exit or Disposal Activities.

On June 22, 2023, in an effort to streamline its organization, ON24, Inc. (the “Company”) committed to a restructuring plan to reduce expenses (the “Plan”). In connection with the Plan, the Company currently estimates it will incur a charge of between approximately $1.7 million to $2.0 million by the end of the second quarter of 2023, which consists primarily of cash severance, employee benefit, and related costs for the reduction in force. The Company previously announced the possibility of a second quarter 2023 restructuring charge when it released first quarter 2023 results on May 9, 2023, and the Company also then included such a potential charge in its outlook. The Company expects the Plan to be substantially complete by the end of the second quarter of 2023 but may incur additional charges in the following quarter. The estimates of expenses that the Company expects to incur in connection with the Plan are subject to a number of assumptions and actual results may differ materially. The Company may also incur additional expenses not currently contemplated due to events that may occur as a result of, or that are associated with, the Plan.

Item 9.01 Exhibits

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Date: June 27, 2023 | ON24, Inc. |

| | |

| By: | /s/ Steven Vattuone |

| | Steven Vattuone |

| | Chief Financial Officer |

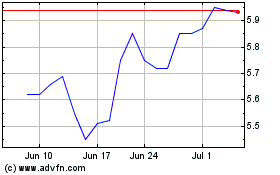

ON24 (NYSE:ONTF)

Historical Stock Chart

From May 2024 to Jun 2024

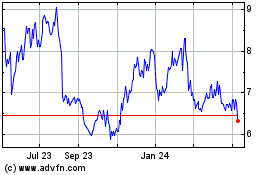

ON24 (NYSE:ONTF)

Historical Stock Chart

From Jun 2023 to Jun 2024