Omega Healthcare Investors, Inc. - Growth & Income

January 25 2012 - 7:00PM

Zacks

Omega Healthcare Investors, Inc. (OHI) offers investors

solid growth and exceptionally strong income at a reasonable price.

Estimates have been rising after the company

delivered better than expected third quarter results. It is a Zacks

#2 Rank (Buy).

The company also pays a divdend that yields a

stellar 7.9%. Valuation is attractive too, with shares trading at

less than 11x forward earnings.

REIT

Omega Healthcare is a real estate investment trust

(REIT) that provides financing and capital to the long-term

healthcare industry across the United States.

The company owns or holds mortgages on 399 skilled

nursing facilities, assisted living facilities and other specialty

hospitals in 35 states, which are operated by 49 third-party

healthcare companies.

It is headquartered in Hunt Valley, Maryland and

has a market cap of $2.1 billion.

7.9% Dividend

As a REIT, Omega Healthcare pays out the majority

of its earnings to shareholders through dividends to avoid paying

tax on that money. It currently yields a whopping 7.9%.

As you can see, the company has been steadily

increasing its dividend over the last several years:

On January 13, the company announced an increase in

its quarterly dividend to 41 cents per share. This marked the 6th

dividend increase since early 2010.

Third Quarter Results

Omega Healthcare also reported better than expected

results for the third quarter. Funds from operation (FFO) per share

came in at 48 cents, beating the Zacks Consensus Estimate of 46

cents. It was a 9% increase over the same quarter in 2010.

Total revenue rose 4% to $72.8 million, ahead of

the Zacks Consensus Estimate of $71.0 million. This was mostly

driven by a 4% increase in rental income.

Total operating expenses declined from 53.1% of

revenue to 40.4% due to lower general & administrative and

depreciation expenses.

Outlook

Analysts raised their estimates for 2012 following

better than expected Q3 results. This sent the stock to a Zacks #2

Rank (Buy).

The Zacks Consensus Estimate for 2011 is $1.79,

representing 8% growth over 2010. The 2012 consensus estimate is

currently $1.95, corresponding with 9% FFO growth.

Reasonable Valuation

The valuation picture looks very reasonable for

OHI. Shares trade at just 10.6x 12-month forward FFO, below the

industry median of 13.6x and its historical median of 11.2x.

Its price to book ratio of 2.4 is in-line with its

5-year median.

The Bottom Line

With rising estimates, solid growth projections, a

7.9% dividend yield and reasonable valuation, Omega Healthcare

offers investors attractive total return potential.

Todd Bunton is the Growth & Income Stock

Strategist for Zacks Investment Research and Co-Editor of the

Reitmeister Value Investor.

OMEGA HLTHCARE (OHI): Free Stock Analysis Report

To read this article on Zacks.com click here.

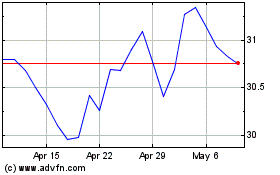

Omega Healthcare Investors (NYSE:OHI)

Historical Stock Chart

From May 2024 to Jun 2024

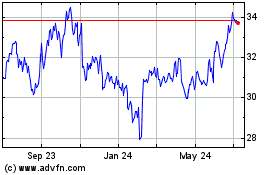

Omega Healthcare Investors (NYSE:OHI)

Historical Stock Chart

From Jun 2023 to Jun 2024