North American Energy Partners Inc. ("NAEP" or "the Company")

(TSX:NOA) (NYSE:NOA) today announced results for the three months

ended June 30, 2012, representing the first quarter of its 2013

fiscal year.

The Company has prepared its consolidated financial statements

in accordance with accounting principles generally accepted in the

United States (US GAAP). Except where otherwise specified, all

dollar amounts discussed are in Canadian dollars.

Highlights of the Three Months Ended June 30, 2012

-- Martin Ferron was appointed President and Chief Executive Officer of

NAEP on June 7, 2012.

-- Consolidated revenues increased 21.6% compared to the same period last

year.

-- Gross margin percentage improved to 7.7% from 3.4% last year.

-- Consolidated EBITDA increased to $10.6 million from $6.2 million last

year, despite a $2.5 million restructuring charge in the current period.

-- The Company implemented a business strategy to focus its operations on

two main business segments:

-- Heavy Construction and Mining, and

-- Commercial and Industrial Construction.

-- NAEP executed strategic asset sales in the amount of $22.2 million as

part of its fleet rightsizing initiative, resulting in net proceeds of

$8.7 million after the buyout of operating leases on some of the units.

Consolidated Financial Highlights

(dollars in thousands, Three Months Ended June 30,

except per share amounts) 2012 2011

----------------------------------------------------------------------------

Revenue $ 235,922 $ 194,023

Gross profit $ 18,188 $ 6,611

Gross profit margin 7.7% 3.4%

General and administrative expenses $ 17,718 $ 10,601

Operating income (loss) $ 225 $ (5,669)

Operating margin 0.1% -2.9%

Net loss $ (5,126) $ (9,014)

Per share information

Net loss - Basic $ (0.14) $ (0.25)

Net loss - Diluted $ (0.14) $ (0.25)

Consolidated EBITDA(1) $ 10,626 $ 6,176

Capital spending $ 14,956 $ 7,508

Cash and cash equivalents $ 91 $ 958

(1) For a definition of Consolidated EBITDA and reconciliation to net

income, see "Non-GAAP Financial Measures" and "Consolidated EBITDA"

below.

The Company reported improved financial results for the three

months ended June 30, 2012, with year-over-year gains in

consolidated revenues, gross profit and EBITDA. Consolidated gross

profit margins climbed to 7.7% from 3.4% during the same period

last year.

The improved results reflect stronger performance from the

Company's Commercial and Industrial Construction segment. Within

this segment, NAEP's piling operations had a particularly strong

quarter, while pipeline operations focused on executing higher-

margin, lower-risk maintenance work. The stronger segment results

also reflect a return to normal operating conditions in the current

period, compared to last year's adverse weather conditions. Current

year results from the Heavy Construction and Mining segment were

largely on par with last year's results including the return to

profitable activity on the Canadian Natural Resources Limited

(Canadian Natural) overburden removal and mining services contract

(the "Canadian Natural contract").

"Our near-term priorities are to: strengthen our balance sheet;

reduce our cost structure and business risk profile; regain

profitability and thereby restore shareholder confidence and

value." said Martin Ferron, NAEP's President and CEO. "To these

ends we have begun to implement a series of strategic initiatives,

including:

-- Simplifying the Company's organizational structure from three business

segments to two:

-- Heavy Construction and Mining: Mine support services and project

development for oil sands and other resource industry customers.

-- Commercial and Industrial Construction: Piling and pipeline

operations, structural steel construction, oil and gas tank

servicing, screwpile and pipeline anchor system manufacturing.

-- Restructuring the business, including:

-- Consolidating corporate head office functions and relocating senior

executives from Calgary to NAEP's offices in Acheson, Alberta;

-- Simplifying operational support infrastructure processes;

-- Eliminating 60 salaried positions and

-- Reducing fixed support costs related to equipment maintenance

activities.

-- Right-sizing the equipment fleet and reducing capital spend in line with

market demand.

-- Refocusing pipeline operations to reduce risk and achieve better

performance.

The business restructuring initiatives undertaken during the

three months ended June 30, 2012 resulted in a $2.5 million charge

to general and administrative (G&A) expenses and are expected

to generate ongoing annual G&A savings in excess of $12.0

million. The Company also completed $22.2 million of asset sales as

part of its fleet rightsizing, resulting in $8.7 million of net

proceeds after the buyout of operating leases on some of the

units.

"Upon joining NAEP in early June, I immediately set out the

business priorities explained above and I have been encouraged by

support in all parts of the organization" said Mr. Ferron. "We are

already seeing the benefit s from the newly implemented cost

reduction initiatives and these will help us weather the expected

weaker demand environment for mining support services, over the

coming quarters."

Segment Results

In an effort to optimize its cost structure and gain

efficiencies, the Company has consolidated the management and

support organization of its operations under two main business

segments:

-- Heavy Construction and Mining

-- Commercial and Industrial Construction

NAEP has aligned its organization and reporting under this new

structure and the chief operating decision makers will rely on the

information reported under this new structure to allocate resources

and assess the performance of these segments going forward. The

Company will begin reporting segmented results under these two

business segments effective for the three months ended June 30,

2012. All prior-year segment comparatives will also be reported

under this revised segmentation. For a more detailed discussion of

these new business segments and a recast of prior period segment

results under the new reporting structure see "Changes to the

Financial Reporting of Business Segments" below.

Heavy Construction and Mining

Three Months Ended June 30,

(dollars in thousands) 2012 2011

----------------------------------------------------------------------------

Segment revenue $ 165,450 $ 163,391

Segment profit 8,648 8,523

Segment margin 5.2% 5.2%

For the three months ended June 30, 2012, the Heavy Construction

and Mining segment achieved revenue of $165.5 million, similar to

the $163.4 million recorded during the same period last year.

Heavy civil construction activity was strong during the current

period, reflecting continued work on the shear key for Syncrude

Canada Limited's (Syncrude) Mildred Lake mine train relocation

project and increased activity at Suncor Energy Inc's (Suncor) Base

mine under the five-year master services agreement. Site

development activity also increased as NAEP continued to support

construction of Total's Joslyn mine and PetroChina's Dover SAGD

facility.

Partially offsetting these improvements was a significant

reduction in activity at Shell's mines, reflecting a slowing of

work on Shell's atmospheric fines drying (AFD) tailings project

until later in the year and reduced outsourcing by this

customer.

For the three months ended June 30, 2012, Heavy Construction and

Mining segment profit and margin were comparable to the same period

last year. The margin reflects a lower volume of high-margin, heavy

civil work at Shell's operations and additional materials costs on

Syncrude's shear key project. Helping to offset these impacts was

higher margins on work performed under the new terms of the

Canadian Natural overburden removal contract. By comparison,

revenue for this customer was realized at a zero margin during the

same period last year. Under recovered equipment costs to the

segment were comparable to the prior year, reflecting additional

equipment support costs and reduced mine services activity from the

Company's larger sized heavy construction fleet.

Commercial and Industrial Construction

Three Months Ended June 30,

(dollars in thousands) 2012 2011

----------------------------------------------------------------------------

Segment revenue $ 70,472 $ 30,632

Segment profit 10,476 192

Segment margin 14.9% 0.6%

For the three months ended June 30, 2012, revenue from the

Commercial and Industrial Construction segment increased 130.1%

compared to the three months ended June 30, 2011. Piling activity

was particularly strong during the current period, with robust

demand from oil sands customers and commercial markets and

favourable weather conditions supporting improved production

efficiencies. Gains were also achieved as the Company increased

structural steel construction activity at Thompson River's Mt.

Milligan Copper/Gold project in Northern British Columbia, achieved

significant international sales of manufactured screw piles, and

performed work under a multi-year pipeline integrity and

maintenance contract with a major Canadian pipeline operator.

Segment profit for the three months ended June 30, 2012

increased significantly to $10.5 million, from $0.2 million last

year, with segment margin climbing to 14.9% from 0.6%. The

bottom-line improvements reflect increased work volumes, with

higher margins on most of this activity. Piling margins achieved

the most significant gains, reflecting improved operating

conditions. Segment margins also benefited as the Company shifted

its focus to lower-risk, higher-margin pipeline maintenance and

integrity work.

Outlook

NAEP anticipates a continuation of strong activity in the

Commercial and Industrial Construction segment during the second

quarter to partially offset lower work volumes in the Heavy

Construction and Mining segment.

In the Heavy Construction and Mining segment, NAEP will continue

with the construction of the shear key foundation at Syncrude's

Mildred Lake mine relocation project through the remainder of the

fiscal year. The Company will also begin construction on the

recently awarded mechanically stabilized earth (MSE) wall at

Syncrude's mine relocation project in the second quarter. At

Suncor, tailings-related work, including MFT work, ditching and

limestone projects, is expected to provide steady volumes through

the summer, with reclamation projects providing added volumes

during the winter months. The Company does not expect to perform

any significant volumes of work at Shell once work on the AFD Phase

3 project comes to a close in the second quarter.

Near-term demand for mine support services is expected to be

weaker than normal due to project delays and deferrals and

insourcing by some customers. Additionally, civil construction

activity at PetroChina's Dover SAGD project and Total's Joslyn mine

is expected to ramp down in the second quarter as the Company's

work on these projects nears completion. Demand for reclamation and

tailings services, together with activity on mine expansion

projects and the continuation of overburden removal activity at

Canadian Natural, is expected to partially offset these

impacts.

In the Commercial and Industrial Construction segment, work at

the Mt. Milligan Copper/Gold Project in Northern British Columbia

is expected to remain steady through to the end of the calendar

year. Piling demand is also forecast to remain strong through

fiscal 2013, supported by sound industry fundamentals and a large

project backlog. The Company's pipeline operations will continue to

focus on executing the multi-year, cost- reimbursable pipeline

integrity contract with a major Canadian pipeline company. Tank

services activity is expected to strengthen through the summer

months, before entering the normal seasonal slowdown during the

winter months.

Overall, NAEP anticipates that the impact of lower activity

levels will be partially offset by the cost reductions realized

from new strategic initiatives and the increased focus on

performance, efficiency and risk management.

Conference Call and Webcast

Management will hold a conference call and webcast to discuss

its financial results for the three months ended June 30, 2012

tomorrow, Thursday, August 9, 2011 at 9:00 am Eastern time.

The call can be accessed by dialing:

Toll free: 1-877-407-8031 or International: 1-201-689-8031

A replay will be available through September 7, 2012 by

dialing:

Toll Free: 1-877-660-6853 or International: 1-201-612-7415

(Account: 286 Conference ID: 398523).

Changes to the Financial Reporting of Business Segments

As discussed above, the Company has implemented a strategy to

simplify its structure by aligning operations management and

support organizations under two main business segments:

-- Heavy Construction and Mining

-- Commercial and Industrial Construction

The operations activities that are managed and reported under

each segment are as follows:

Heavy Construction and Mining Segment

The Heavy Construction and Mining segment focuses primarily on

providing mining support, earthworks and below ground industrial

services for oil sands and other natural resource developers across

Canada. This includes activities such as:

-- Land clearing, stripping, muskeg removal and overburden removal to

expose the surface mining area;

-- Supply of labour and equipment to supplement customers' mining fleets

supporting surface mining activities;

-- General support mine services for surface and underground mine

operations and treatment plant operations, including road building and

maintenance, hauling of sand and gravel and relocation of treatment

plants;

-- Construction related to the expansion of existing projects, site

development and earthworks, underground utilities and infrastructure;

-- Construction and modification of tailing dams, dykes and ponds;

-- Reclamation of mined-out areas; and

-- Environmental and tailings management services to support oil sands

tailing pond reduction initiatives related to Alberta's Directive 074.

Commercial and Industrial Construction Segment

The Commercial and Industrial Construction segment focuses

primarily on providing below and above grade construction services

to commercial, industrial and public construction markets across

Canada. This includes activities such as:

-- Large and smaller-scale projects related to the installation of various

types of driven piles and drilled piles.

-- Design and installation of shoring / earth retention / stabilization

systems (secant pile, sheet pile, soldier pile and lagging walls) and

micro piles, with Canadian operations extending from British Columbia to

Ontario;

-- Design, fabrication and supply of helical (screw) piles and pipeline

anchor systems with sales in Canada, the US, Colombia, Malaysia,

Indonesia, Thailand, Russia and Australia;

-- Structural steel erection services;

-- Oil and gas storage tank construction, repair and maintenance services

across Canada;

-- Mainline pipe integrity testing, repair and maintenance services. This

will involve identifying weak portions of existing pipelines and

carrying out repairs to reduce the risk of future leaks or ruptures with

the capability to handle pipe diameters ranging from 2 to 60 inches in

remote geographical locations; and

-- Infrastructure development for oil and gas pipeline systems, including

gathering and processing, transmission, storage and distribution.

NAEP will begin reporting its segmented results under the Heavy

Construction and Mining and Commercial and Industrial Construction

segments effective for the three months ended June 30, 2012. All

prior-year segment comparatives will also be reported under the

revised business segments with the additional segmentation of

previously unallocated equipment costs, as described below.

Prior to this fiscal year, unallocated equipment costs were not

included in the segment financial results nor were they discussed

in segment analysis. The Company's methodology for allocating

equipment costs to projects is through the use of internal

equipment rates per operating hour of equipment utilized on a

project. The internal equipment rates are designed to cover all

variable equipment costs, including depreciation and repairs and

maintenance. In addition, the internal equipment rates per

operating hour have a component that covers fixed equipment costs,

including operating leases, fleet management costs, shop overheads

and capital costs. The fixed cost recovery component of the

internal equipment rates is developed based on planned equipment

operating hours for each category of equipment. Each equipment

category has a different fixed cost recovery component.

Unallocated equipment costs typically occur as a result of one

or more of the following events:

-- The reduced utilization of equipment results in lower operating hours,

reducing the recovery of fixed equipment costs;

-- A change in equipment mix on a project site results in a change in the

mix of equipment rates, reducing the recovery of fixed equipment costs;

and

-- Timing between periods for the recovery for variable repairs and

maintenance costs compared to when the actual repairs and maintenance

costs are incurred.

In an effort to improve reporting related to unallocated

equipment costs the Company has developed a process for segmenting

unallocated equipment costs which will allow NAEP to report such

costs within the revised segmented financial results for this and

future fiscal years.

Recast of Fiscal 2012 and Fiscal 2011 Segment Financial

Results

To allow for effective year-over-year comparisons of financial

results under the new business segmentation, the table below

recasts quarterly segmented financial summaries for the past two

years based on the new segmentation and the assignment of

unallocated equipment costs to each segment's financial

results.

New Business Segmentation Financial Summary

Fiscal 2012

% of % of

(dollars in

thousands) Q1 Revenue Q2 Revenue

----------------------------------------------------------------------------

Heavy

Construction

and Mining

Revenue $ 163,391 100.0% $ 159,305 100.0%

Segment profit 8,523 5.2% 18,350 11.5%

Commercial and

Industrial

Construction

Revenue $ 30,632 100.0% $ 86,081 100.0%

Segment profit 192 0.6% 15,902 18.5%

New Business

Segmentation

Financial Summary

Fiscal 2012

% of % of % of

(dollars in

thousands) Q3 Revenue Q4 Revenue Total Revenue

----------------------------------------------------------------------------

Heavy

Construction

and Mining

Revenue $ 159,915 100.0% $ 175,052 100.0% $ 657,663 100.0%

Segment profit 8,264 5.2% 410 0.2% 35,547 5.4%

Commercial and

Industrial

Construction

Revenue $ 124,715 100.0% $ 107,454 100.0% $ 348,882 100.0%

Segment profit 12,993 10.4% 1,389 1.3% 30,476 8.7%

Fiscal 2011

% of % of

(dollars in

thousands) Q1 Revenue Q2 Revenue

----------------------------------------------------------------------------

Heavy

Construction

and Mining

Revenue $ 163,018 100.0% $ 171,668 100.0%

Segment profit

(loss) 16,254 10.0% 24,064 14.0%

Commercial and

Industrial

Construction

Revenue $ 20,576 100.0% $ 63,190 100.0%

Segment profit

(loss) 427 2.1% 5,813 9.2%

Fiscal 2011

% of % of % of

(dollars in

thousands) Q3 Revenue Q4 Revenue Total Revenue

----------------------------------------------------------------------------

Heavy

Construction

and Mining

Revenue $ 185,325 100.0% $146,475 100.0% $ 666,486 100.0%

Segment profit

(loss) 22,985 12.4% (16,288) -11.1% 47,016 7.1%

Commercial and

Industrial

Construction

Revenue $ 79,761 100.0% $ 28,035 100.0% $ 191,562 100.0%

Segment profit

(loss) 8,988 11.3% (9) 0.0% 15,219 7.9%

Previous Business Segmentation Financial Summary

Fiscal 2012

% of % of

(dollars in

thousands) Q1 Revenue Q2 Revenue

----------------------------------------------------------------------------

Heavy

Construction

and Mining

Revenue $ 163,391 100.0% $ 159,719 100.0%

Segment profit 21,781 13.3% 21,788 13.6%

Piling

Revenue $ 31,534 100.0% $ 49,176 100.0%

Segment profit 2,589 8.2% 13,503 27.5%

Pipeline

Revenue $ (902) 100.0% $ 36,491 100.0%

Segment (loss)

profit (1,948) 216.0% 2,927 8.0%

Previous Business

Segmentation Financial

Summary

Fiscal 2012

% of % of % of

(dollars in

thousands) Q3 Revenue Q4 Revenue Total Revenue

----------------------------------------------------------------------------

Heavy

Construction

and Mining

Revenue $166,516 100.0% $181,094 100.0% $670,720 100.0%

Segment profit 19,580 11.8% 23,418 12.9% 86,567 12.9%

Piling

Revenue $ 51,697 100.0% $ 52,914 100.0% $185,321 100.0%

Segment profit 16,473 31.9% 13,447 25.4% 46,012 24.8%

Pipeline

Revenue $ 66,417 100.0% $ 48,498 100.0% $150,504 100.0%

Segment (loss)

profit (2,941) -4.4% (9,360) -19.3% (11,322) -7.5%

Fiscal 2011

% of % of

(dollars in

thousands) Q1 Revenue Q2 Revenue

----------------------------------------------------------------------------

Heavy

Construction

and Mining

Revenue $ 163,609 100.0% $ 171,628 100.0%

Segment

profit

(loss) 22,247 13.6% 22,234 13.0%

Piling

Revenue $ 19,146 100.0% $ 26,563 100.0%

Segment

profit 1,394 7.3% 4,782 18.0%

Pipeline

Revenue $ 839 100.0% $ 36,667 100.0%

Segment

(loss)

profit (723) -86.2% 879 2.4%

Fiscal 2011

% of % of % of

(dollars in

thousands) Q3 Revenue Q4 Revenue Total Revenue

----------------------------------------------------------------------------

Heavy

Construction

and Mining

Revenue $185,325 100.0% $ 146,475 100.0% $ 667,037 100.0%

Segment

profit

(loss) 20,293 10.9% (14,071) -9.6% $ 50,703 7.6%

Piling

Revenue $ 37,594 100.0% $ 22,256 100.0% $ 105,559 100.0%

Segment

profit 10,324 27.5% 1,955 8.8% $ 18,455 17.5%

Pipeline

Revenue $ 42,167 100.0% $ 5,779 100.0% $ 85,452 100.0%

Segment

(loss)

profit (1,641) -3.9% (1,549) -26.8% $ (3,034) -3.6%

Non-GAAP Financial Measures

This release contains non-GAAP financial measures. These

measures do not have standardized meanings under US GAAP and are

therefore unlikely to be comparable to similar measures used by

other companies. The non-GAAP financial measure disclosed by the

Company in this release is Consolidated EBITDA (as defined within

the credit agreement). The Company provides a reconciliation of

Consolidated EBITDA to net income reported in accordance with US

GAAP below. Investors and readers are encouraged to review the

reconciliation of this non-GAAP financial measure to reported net

income.

Consolidated EBITDA

Consolidated EBITDA is a measure defined by the Company's Credit

Agreement. This measure is defined as EBITDA (which is calculated

as net income before interest, income taxes, depreciation and

amortization) excluding the effects of unrealized foreign exchange

gain or loss, realized and unrealized gain or loss on derivative

financial instruments, non-cash stock-based compensation expense,

gain or loss on disposal of property, plant and equipment the

impairment of goodwill, the amendment related to the Canadian

Natural overburden removal contract and certain other non-cash

items included in the calculation of net income. The Credit

Agreement requires the Company to maintain a minimum interest

coverage ratio and a maximum senior leverage ratio, which are

calculated using Consolidated EBITDA. Non-compliance with these

financial covenants could result in the Company being required to

immediately repay all amounts outstanding under its credit

facility. Consolidated EBITDA should not be considered as an

alternative to operating income or net income as a measure of

operating performance or cash flows as a measure of liquidity.

Consolidated EBITDA has important limitations as an analytical tool

and should not be considered in isolation or as a substitute for

analysis of the Company's results as reported under US GAAP. For

example, Consolidated EBITDA:

-- does not reflect cash expenditures or requirements for capital

expenditures or capital commitments;

-- does not reflect changes in cash requirements for working capital needs;

-- does not reflect the interest expense or the cash requirements necessary

to service interest or principal payments on debt;

-- excludes tax payments that represent a reduction in cash available to

the Company; and

-- does not reflect any cash requirements for assets being depreciated and

amortized that may have to be replaced in the future.

Consolidated EBITDA also excludes unrealized foreign exchange

gains and losses and realized and unrealized gains and losses on

derivative financial instruments, which, in the case of unrealized

losses, may ultimately result in a liability that will need to be

paid and in the case of realized losses, represents an actual use

of cash during the period.

A reconciliation of net income to Consolidated EBITDA is as

follows:

Three Months Ended

June 30,

(dollars in thousands) 2012 2011

----------------------------------------------------------------------------

Net loss $ (5,126) $ (9,014)

Adjustments:

Interest expense 7,746 7,377

Income tax benefit (2,481) (3,610)

Depreciation 9,966 9,596

Amortization of intangible assets 1,144 1,878

Unrealized gain on derivative financial instruments (22) (337)

(Gain) loss on disposal of property, plant and

equipment (225) 398

Gain on disposal of assets held for sale (78) -

Stock-based compensation reversal 298 485

Equity in earnings of consolidated joint venture (596) (597)

----------------------

Consolidated EBITDA $ 10,626 $ 6,176

----------------------

----------------------

Forward-Looking Information

This release contains forward-looking information that is based

on expectations and estimates as of the date of this release.

Forward-looking information is information that is subject to known

and unknown risks and other factors that may cause future actions,

conditions or events to differ materially from the anticipated

actions, conditions or events expressed or implied by such

forward-looking information. Forward-looking information is

information that does not relate strictly to historical or current

facts and can be identified by the use of the future tense or other

forward-looking words such as "believe", "expect", "anticipate",

"intend", "plan", "estimate", "should", "may", "could", "would",

"target", "objective", "projection", "forecast", "continue",

"strategy", "position" or the negative of those terms or other

variations of them or comparable terminology.

Examples of such forward-looking information in this release

include but are not limited to, the following: that our near term

priorities are to: strengthen our balance sheet; reduce our cost

structure and business risk profile; regain profitability and

thereby restore shareholder confidence and value; that business

structuring initiatives are expected to generate ongoing annual

G&A savings in excess of $12.0 million; that the newly

implemented cost reductions initiatives will help us weather the

expected weaker demand environment for mining support services over

the coming quarters; that NAEP anticipates a continuation of strong

activity in the Commercial and Industrial segment during the second

quarter to offset lower work volumes in Heavy Construction and

Mining; that NAEP will continue with the construction of the shear

key foundation at Syncrude's Mildred Lake mine relocation project

through the remainder of the fiscal year; that the Company will

begin construction on the mechanically stabilized earth (MSE) wall

at Syncrude's mine relocation project in the second quarter; that

at Suncor, tailings-related work, including MFT work, ditching and

limestone projects, is expected to provide steady volumes through

the summer, with reclamation projects providing added volumes

during winter months; that the Company does not expect to perform

any significant volumes of work at Shell once work on the AFD Phase

3 project comes to a close in the second quarter; that near-term

demand for mine support services is expected to be weaker than

normal due to project delays and deferrals and insourcing by some

customers; that civil construction activity at PetroChina's Dover

SAGD project and Total's Joslyn mine is expected to ramp down in

the second quarter; that demand for reclamation and tailings

services, together with activity on mine expansion projects and the

continuation of overburden removal activity at Canadian Natural, is

expected to partially offset impacts of ramped down civil

construction activity at PetroChina's Dover SAGD project and

Total's Joslyn mine; that work at the Mt. Milligan Copper/Gold

Project in Northern British Columbia is expected to remain steady

through to the end of the calendar year; that Piling demand is

forecast to remain strong through fiscal 2013, supported by sound

industry fundamentals and a large project backlog; that the

Company's pipeline operations will continue to focus on executing

the multi-year, cost- reimbursable pipeline integrity contract with

a major Canadian pipeline company; that tank services activity is

expected to strengthen through the summer months, before entering

the normal seasonal slowdown during the winter months; that NAEP

anticipates that the impact of lower activity levels will be

partially offset by the cost reductions realized from new strategic

initiatives and the increased focus on performance, efficiency and

risk management.

There can be no assurance that forward-looking information will

prove to be accurate, as actual results and future events could

differ materially from those expected or estimated in such

statements. Accordingly, readers should not place undue reliance on

forward-looking information. Each of the forward-looking statements

in this news release is subject to significant risks and

uncertainties and is based on a number of assumptions which may

prove to be incorrect. The material factors or assumptions used to

develop the above forward-looking statements and the risks and

uncertainties that could cause actual results to differ materially

from the information presented in the above are discussed in NAEP's

Management Discussion & Analysis for the three months ended

June 30, 2012. While management anticipates that subsequent events

and developments may cause its views to change, the Company does

not intend to update this forward-looking information, except as

required by applicable securities laws. This forward-looking

information represents management's views as of the date of this

document and such information should not be relied upon as

representing their views as of any date subsequent to the date of

this document.

For more complete information about NAEP, you should read the

disclosure documents filed with the SEC and the CSA. You may obtain

these documents for free by visiting the SEC website at www.sec.gov

or SEDAR on the CSA website at www.sedar.com.

About the Company

North American Energy Partners Inc. (www.naepi.ca) is one of the

largest providers of heavy construction, mining, piling and

pipeline services in Western Canada. For more than 50 years, NAEP

has provided services to large oil, natural gas and resource

companies, with a principal focus on the Canadian oil sands. NAEP

maintains one of the largest independently owned equipment fleets

in the region.

Contacts: North American Energy Partners Inc. Kevin Rowand

Investor Relations (780) 969-5528 (780) 969-5599

(FAX)krowand@nacg.ca www.naepi.ca

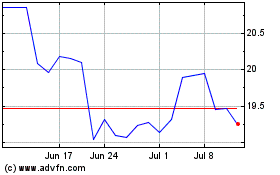

North American Construct... (NYSE:NOA)

Historical Stock Chart

From Jun 2024 to Jul 2024

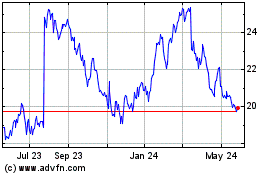

North American Construct... (NYSE:NOA)

Historical Stock Chart

From Jul 2023 to Jul 2024