North American Energy Partners Inc. ("NAEP" or "the Company") (TSX:

NOA) (NYSE: NOA) today announced results for the year and for the

three months ended March 31, 2011.

Conversion to US GAAP

The Company has prepared its consolidated financial statements

in conformity with accounting principles generally accepted in the

United States (US GAAP). All comparative financial information

contained herein has been revised to reflect the Company's results

as if they had been historically reported in accordance with US

GAAP. Unless otherwise specified, all dollar amounts discussed are

in Canadian dollars.

Overview of the Year Ended March 31, 2011

- Consolidated revenues for the year ended March 31, 2011

increased $99.1 million, compared to the same period last year.

- NAEP was awarded two new, long-term recurring services

contracts with major oil sands customers, being a four-year master

services agreement with Syncrude Canada Ltd. (Syncrude) for mining

services, reclamation and general construction services and a

three-year contract with Shell Canada Energy (Shell) to remove

muskeg at its Jackpine mine.

- The Piling segment achieved significant revenue and profit

increases on improving commercial and industrial construction

market demand.

- On November 1, 2010, NAEP acquired the assets of Cyntech

Corporation (Cyntech), a Calgary-based designer and manufacturer of

screw piles and pipeline anchoring systems, as well as a provider

of recurring tank maintenance services to the petro-chemical

industry.

- The Company recorded a revenue writedown of $42.5 million,

related to the long-term overburden removal contract with Canadian

Natural Resources Ltd. (Canadian Natural), described in further

detail below.

Consolidated Financial Highlights

Three Months

Year Ended March 31, Ended March 31,

(dollars in thousands,

except per share amounts) 2011 2010 2011 2010

----------------------------------------------------------------------------

Revenue $ 858,048 $758,965 $174,510 $220,569

Gross profit $ 58,136 $139,285 $(17,388) $ 32,723

Gross profit margin 6.8% 18.4% -10.0% 14.8%

General and administrative

expenses $ 59,932 $ 62,530 $ 14,435 $ 19,104

Operating (loss) income $ (10,829) $ 73,474 $(35,452) $ 13,127

Operating margin -1.3% 9.7% -20.3% 6.0%

Net (loss) income $ (34,650) $ 28,219 $(30,452) $ (943)

Per share information

Net (loss) income - basic $ (0.96) $ 0.78 $ (0.84) $ (0.03)

Net (loss) income - diluted $ (0.96) $ 0.77 $ (0.84) $ (0.03)

Consolidated EBITDA(1) $ 84,101 $121,644 $ 24,004 $ 26,428

Capital spending $ 36,957 $ 58,505 $ 5,503 $ 7,312

Cash and cash equivalents $ 722 $103,005 $ 722 $103,005

(1) For a definition of Consolidated EBITDA and reconciliation to net

income, see "Non-GAAP Financial Measures" and "Consolidated EBITDA"

at the end of this release.

"Activity levels in all three of our business segments increased

in fiscal 2011 as economic conditions improved and investment in

the oil sands ramped up," said Rod Ruston, NAEP's President and

CEO. "Our recurring revenue opportunities were enhanced with the

signing of new, long-term contracts with both Syncrude and Shell,

thus increasing our business with each of these customers and we

have the opportunity for further growth with the expected execution

of a new five-year contract with Suncor in the near future. In

addition, we have been tendering on a growing number of oil sands,

construction, piling and pipeline projects and we believe we are

well positioned to compete successfully for a significant portion

of this work. Our business outlook going forward is positive."

Financial results for the year and three months ended March 31,

2011 do not fully reflect the underlying improvement in NAEP's

business environment, primarily due to the above-mentioned revenue

writedown relating to the long-term overburden removal contract

with Canadian Natural at its Horizon Oil Sands project. The $42.5

million writedown reduced unbilled revenue by the same amount and

lowered net income by $31.8 million for the year. NAEP has formed a

joint working group with Canadian Natural to assess the

appropriateness of the indices as they relate to the Fort McMurray

market. This working group is expected to report back such that any

agreed adjustments to the indices can be made by August 31, 2011

(1).

(1) For a discussion of the revenue writedown see the Company's

press release dated May 18, 2011 and Management Discussion &

Analysis for the twelve months ended March 31, 2011.

Despite the negative financial impact of the revenue writedown,

consolidated revenue for the year ended March 31, 2011 increased

13.1% to $858.0 million from $759.0 million last year. This revenue

growth reflects increased mining services and project development

activity with a number of major oil sands mining customers and a

significant increase in piling activity as conditions in the

commercial and industrial construction markets strengthened.

Pipeline segment activity was also higher year-over-year primarily

as a result of two projects in northern British Columbia. For the

three months ended March 31, 2011, consolidated revenue declined to

$174.5 million, from $220.6 million last year, primarily reflecting

the negative impact of the revenue writedown, as well as a slight

decline in activity in the Heavy Construction and Mining and

Pipeline segments.

Gross profit for both the 12-month and three-month periods was

significantly below expectations due to the impact of the $42.5

million revenue writedown. Excluding the effect of the revenue

writedown, gross profit for the year ended March 31, 2011 would

have been $100.7 million or 11.2% of revenue, compared to $139.3

million or 18.4% of revenue last year. This change reflects

increased volumes of lower-margin overburden removal work in the

overall project mix, losses incurred on two Pipeline projects and

the impact of competitive pricing pressure in contracts secured

during the economic downturn. For the three months ended March 31,

2011, gross profit, excluding the effect of the writedown, would

have been $25.1 million or 11.6% of revenue, compared to $32.7

million or 14.8% during the same period last year. The weaker

margins in the most recent period reflect a loss on one lump-sum

Pipeline project and lower margins in the Piling segment, due to

project losses and start-up delays.

For the 12 months ended March 31, 2011, the Company recorded a

net loss of $34.7 million, compared to net income of $28.2 million

last year. Excluding the impact of the revenue writedown, net loss

would have been $2.9 million for the year. For the three months

ended March 31, 2011, net income, excluding the impact of the

revenue writedown, would have been $1.3 million, compared to a net

loss of $0.9 million during the same period last year. The

Company's cash balance as at March 31, 2011 was $102.3 million

lower than at March 31, 2010, reflecting completion of two

strategic initiatives earlier in the year. The first initiative was

the refinancing of the Company's senior notes in April 2010, which

reduced its cost of debt and total debt outstanding. The second

initiative was NAEP's entry into the screw piling market with the

acquisition of the assets of Cyntech in November 2010. The

remainder of cash drawdown is primarily due to higher working

capital requirements related to the Canadian Natural contract and

delays in close-out billings on our current-year Pipeline

contracts.

Subsequent Events

Work Suspension at Canadian Natural's Horizon Project

On May 18, 2011, NAEP was notified by its customer, Canadian

Natural, to suspend overburden removal activities at the Horizon

Oil Sands project until January 2, 2012. During this period

Canadian Natural will undertake repairs to its primary upgrading

facility, which was damaged in a fire in January 2011.

Although Canadian Natural is required to cover fixed costs on

contract-related equipment left idle by this suspension, NAEP will

seek to minimize costs for Canadian Natural and at the same time,

assist other customers by redeploying resources to other projects

in the region.

"Given our recent contract wins at Shell and Syncrude, as well

as the anticipated award of a new five-year contract with Suncor,

the availability of this equipment in the short term could provide

a valuable and timely addition to our general contract fleet," said

Mr. Ruston. "Furthermore, the work suspension at Canadian Natural

removes the only low-margin, recurring services activity in our

project mix. Our cash flow and margins are expected to improve if

we can increase service levels for other customers."

Bank Covenant Amendment

On May 20, 2011, the Company's lender syndicate approved an

amendment to NAEP's fourth amended and restated credit agreement

(the "Credit Agreement"). Under the amendment, the lenders will

exclude the $42.5 million revenue writedown when determining

Consolidated EBITDA-related covenant compliance for the year ended

March 31, 2011 and any future periods. The amendment enables NAEP

to remain in compliance with its bank covenants while it conducts

change order negotiations with Canadian Natural.

Segment Results

Heavy Construction and Mining

Three Months

Year Ended March 31, Ended March 31,

(dollars in thousands) 2011 2010 2011 2010

----------------------------------------------------------------------------

Segment revenue $ 667,037 $ 665,514 $ 146,475 $ 196,002

Segment profit (loss) 50,703 111,016 (14,071) 29,286

Segment margin 7.6% 16.7% -9.6% 14.9%

For the year ended March 31, 2011, the Heavy Construction &

Mining segment reported revenues of $667.0 million, up $1.5 million

from the prior year. Revenue gains associated with increased

activity at Syncrude, Suncor and Canadian Natural were largely

offset by the $42.5 million revenue writedown related to the

Canadian Natural contract. Recurring services revenues were also

impacted by reduced activity at Shell's sites during the

commissioning of the Jackpine mine.

For the three months ended March 31, 2011, revenue from the

Heavy Construction and Mining segment decreased by $49.5 million,

primarily due to the $42.5 million revenue writedown. Recurring

services revenues also decreased as a result of lower activity

levels at Shell's sites, partially offset by increased volumes of

work with Suncor and Syncrude. The higher volumes with Syncrude

reflect increased activity levels under the new four-year master

services agreement, while increased activity with Suncor reflects

increased demand for mine support services.

For the year ended March 31, 2011, Heavy Construction and Mining

segment margin was 7.6% of revenue, compared to 16.7% last year.

The reduction in segment margin reflects the negative impact of the

revenue writedown, increased volumes of lower-margin overburden

removal activity in the project mix, competitive pressures in the

market and the expanded use of higher-cost rental equipment to

support increased project development activity.

For the three months ended March 31, 2011, Heavy Construction

and Mining reported a negative segment margin of 9.6%, compared to

a segment profit margin of 14.9% during the same period last year,

mainly due to the revenue writedown.

Piling

Three Months

Year Ended March 31, Ended March 31,

(dollars in thousands) 2011 2010 2011 2010

----------------------------------------------------------------------------

Segment revenue $ 105,559 $ 68,531 $ 22,256 $ 18,263

Segment profit 18,455 11,288 1,955 2,149

Segment margin 17.5% 16.5% 8.8% 11.8%

For the year ended March 31, 2011, Piling segment revenues of

$105.6 million were up $37.0 million compared to the prior year.

This improvement reflects the resurgence of activity in the

commercial and industrial construction markets and an increase in

project development activity on oil sands projects. Revenue results

for the current fiscal year also include a $7.3 million

contribution from Cyntech, which was acquired by NAEP in November

2010. For the three months ended March 31, 2011, Piling segment

revenues increased to $22.3 million, up $4.0 million compared to

last year reflecting the Cyntech asset acquisition and continued

improvement in market conditions.

For the year ended March 31, 2011, Piling profit margin

increased to 17.5% of revenue from 16.5% of revenue last year. The

increase in profit margin reflects the benefits of improved

conditions in the commercial and industrial construction markets,

which offset the negative profit impact of adverse weather

conditions that delayed project start-ups earlier in the current

fiscal year.

For the three months ended March 31, 2011, Piling margins

decreased to 8.8% from 11.8% in the same period last year. Project

start-up delays resulting from an abnormally long and cold winter

in the Prairie provinces and a margin reduction on a larger

lump-sum contract were key contributors to this decline. Profit

margins for the prior-year period also benefited from the

processing of change orders related to large projects completed in

the period.

Pipeline

Three Months

Year Ended March 31, Ended March 31,

(dollars in thousands) 2011 2010 2011 2010

----------------------------------------------------------------------------

Segment revenue $ 85,452 $ 24,920 $ 5,779 $ 6,304

Segment loss (3,034) (3,851) (1,549) (5,152)

Segment margin -3.6% -15.5% -26.8% -81.7%

For the year ended March 31, 2011, the Pipeline segment reported

revenues of $85.5 million, a $60.5 million increase over a year

ago. The increased segment revenues primarily reflect the execution

of two large-diameter pipeline projects in northern BC, both of

which were substantially completed in the three months ended

December 31, 2010. Complementing these projects was an increase in

tailings-related pipeline projects in the oil sands. For the three

months ended March 31, 2011, Pipeline segment revenues were $5.8

million, compared to $6.3 million last year.

For the year ended March 31, 2011, the Pipeline segment recorded

a loss of $3.0 million, reflecting reduced productivity as a result

of unanticipated weather and ground conditions. Segment loss for

the prior year was $3.9 million due to production impacts related

to unfavourable weather, changes in construction methodology due to

unfavourable environmental conditions, as well as a higher

percentage of rented versus owned equipment. In accordance with the

terms of the contract, NAEP is currently working on a number of

change order requests related to the weather and environmental

impacts and to the significant changes to project scope. For the

three months ended March 31, 2011, the Pipeline segment incurred a

loss of $1.5 million, reflecting projected increases in summer

clean-up costs for the two completed pipeline projects.

Outlook

While the Company may experience some near-term impact to

revenue as a result of the seven-month work suspension on the

overburden removal contract with Canadian Natural, the anticipated

redeployment of resources to higher-margin projects could help to

offset some of this revenue reduction, while also having a positive

impact on margins and cash flow.

NAEP also anticipates some negative impact to first quarter

results due to the recent wild fires near Fort McMurray, which have

impacted the Company's ability to work at several customer sites

during the past two weeks. However, the Company's outlook for

fiscal 2012 continues to improve overall as a result of

strengthening general economic conditions, recently awarded and

anticipated long-term contracts with Shell, Syncrude and Suncor, as

well as increasing investment in the oil sands.

Suncor and Total have formed a strategic alliance to develop the

Fort Hills mine, Voyageur upgrader and Joslyn mine. Exxon continues

with construction of its Kearl project and Syncrude is planning a

number of major mining projects, including the relocation of four

mine trains. The resurgence of project development activity is

resulting in growing demand for the industrial construction, site

preparation and piling services NAEP provides. Oil sands operators

are also increasing spending on tailings and reclamation projects

in response to new environmental regulations. This, in turn, is

creating opportunities for NAEP's new Tailings and Environmental

Construction division to support the construction and operation of

the new reclamation processes.

With respect to the Piling segment, activity levels are expected

to increase in fiscal 2012 as a result of the growing project

development activity in the oil sands and an upsurge in commercial

construction opportunities in Toronto and Calgary. Given the

shorter-term, project-specific nature of piling contracts, margins

are expected to recover more quickly for this division than for

other parts of the business. NAEP is anticipating a strong year for

this segment in fiscal 2012.

In Pipeline, the Company is seeing improving margins and a

reduction in the risk profile expected to be borne by the

contractor.

"Overall, our long-term outlook for the business remains

positive," said Mr. Ruston. "With our new long-term contracts in

place, we are well positioned to capitalize on the many attractive

opportunities we see developing in our core markets."

Conference Call and Webcast

Management will hold a conference call and webcast to discuss

the fourth-quarter and full fiscal-year financial results tomorrow,

Friday, June 3, 2011 at 9:00 am Eastern time.

The call can be accessed by dialing:

Toll free: 1-877-407-9205 or International: 1-201-689-8054

A replay will be available through July 4, 2011 by dialing:

Toll Free: 1-877-660-6853 or International: 1-201-678-7415

(Account: 286 Conference ID: 373650).

Non-GAAP Financial Measures

This release contains non-GAAP financial measures. These

measures do not have standardized meanings under Canadian GAAP or

US GAAP and are therefore unlikely to be comparable to similar

measures used by other companies. The non-GAAP financial measure

disclosed by the Company in this release is Consolidated EBITDA (as

defined within the Credit Agreement). The Company provides a

reconciliation of Consolidated EBITDA to net income reported in

accordance with US GAAP below. Investors and readers are encouraged

to review the reconciliation of this non-GAAP financial measure to

reported net income.

Consolidated EBITDA

Consolidated EBITDA is a measure defined by the Company's Credit

Agreement. This measure is defined as EBITDA (which is calculated

as net income before interest, income taxes, depreciation and

amortization) excluding the effects of unrealized foreign exchange

gain or loss, realized and unrealized gain or loss on derivative

financial instruments, non-cash stock-based compensation expense,

gain or loss on disposal of property, plant and equipment the

impairment of goodwill, the amendment related to the Canadian

Natural overburden removal contract and certain other non-cash

items included in the calculation of net income. The Credit

Agreement requires the Company to maintain a minimum interest

coverage ratio and a maximum senior leverage ratio, which are

calculated using Consolidated EBITDA. Non-compliance with these

financial covenants could result in the Company being required to

immediately repay all amounts outstanding under its credit

facility. Consolidated EBITDA should not be considered as an

alternative to operating income or net income as a measure of

operating performance or cash flows as a measure of liquidity.

Consolidated EBITDA has important limitations as an analytical tool

and should not be considered in isolation or as a substitute for

analysis of the Company's results as reported under Canadian GAAP

or US GAAP. For example, Consolidated EBITDA:

- does not reflect cash expenditures or requirements for capital

expenditures or capital commitments;

- does not reflect changes in cash requirements for working

capital needs;

- does not reflect the interest expense or the cash requirements

necessary to service interest or principal payments on debt;

- excludes tax payments that represent a reduction in cash

available to the Company; and

- does not reflect any cash requirements for assets being

depreciated and amortized that may have to be replaced in the

future.

Consolidated EBITDA also excludes unrealized foreign exchange

gains and losses and realized and unrealized gains and losses on

derivative financial instruments, which, in the case of unrealized

losses, may ultimately result in a liability that will need to be

paid and in the case of realized losses, represents an actual use

of cash during the period.

A reconciliation of net (loss) income to Consolidated EBITDA is

as follows:

Three Months

Year Ended March 31, Ended March 31,

(dollars in thousands) 2011 2010 2011 2010

----------------------------------------------------------------------------

Net (loss) income $ (34,650) $ 28,219 $(30,452) $ (943)

Adjustments:

Interest expense 29,991 26,080 7,361 6,355

Income taxes (benefit) (6,448) 13,679 (10,305) 3,278

Depreciation 39,440 42,636 12,682 11,943

Amortization of intangible assets 3,540 1,719 1,288 281

Unrealized foreign exchange gain

on senior notes - (48,920) - (6,200)

Realized and unrealized (gain)

loss on derivative financial

instruments (2,305) 54,411 (1,965) 11,226

Loss on disposal of property,

plant and equipment and assets

held for sale 2,773 1,606 497 189

Stock-based compensation expense 2,191 2,258 529 277

Equity in loss (earnings) of

unconsolidated joint venture 2,720 (44) 1,844 22

Loss on debt extinguishment 4,324 - - -

Revenue writedown on Canadian

Natural project 42,525 - 42,525 -

------------------------------------------

Consolidated EBITDA $ 84,101 $121,644 $ 24,004 $ 26,428

------------------------------------------

------------------------------------------

Forward-Looking Information

This release contains forward-looking information that is based

on expectations and estimates as of the date of this release.

Forward-looking information is subject to known and unknown risks

and other factors that may cause future actions, conditions or

events to differ materially from the anticipated actions,

conditions or events expressed or implied by such forward-looking

information. Forward-looking information does not relate strictly

to historical or current facts and can be identified by the use of

the future tense or other forward-looking words such as "believe",

"expect", "anticipate", "intend", "plan", "estimate", "should",

"may", "could", "would", "target", "objective", "projection",

"forecast", "continue", "strategy", "position" or the negative of

those terms or other variations of them or comparable

terminology.

Examples of such forward-looking information in this release

include but are not limited to, the following: that the joint

working group formed with Canadian Natural will report

recommendations for changes to the contract indices such that any

agreed upon adjustments can be made by August 31, 2011; that the

availability of Canadian Natural overburden contract-related

equipment will provide a valuable and timely addition to NAEP's

general fleet; that the Company may experience some near-term

impact to revenue as a result of the recently announced work

suspension on the long-term overburden removal contract with

Canadian Natural; that NAEP will seek to minimize costs for

Canadian Natural and assist other customers by redeploying

resources to other projects in the region; that this redeployment

of resources to partially offset the expected decline in revenues

from Canadian Natural; that NAEP's cash flows and margins will

improve as service levels for customers increase; (that the new

five-year contract with Suncor will generate a significant volume

of work despite the lack of specified volumes in the contract;)

that the work suspension at Canadian Natural will reduce recurring

services revenues over the next nine months; that demand for

recurring services will grow at other sites and further expand as

Exxon's Kearl mine begins production in 2012; that activity levels

in the Piling segment will increase in fiscal 2012 as a result of

the growing project development activity in the oil sands and an

upsurge in commercial construction opportunities in markets like

Toronto and Calgary; that Piling margins will recover more quickly

than in other parts of the business; and that fiscal 2012 will be a

strong year for the Piling segment.

There can be no assurance that forward-looking information will

prove to be accurate, as actual results and future events could

differ materially from those expected or estimated in such

statements. Accordingly, readers should not place undue reliance on

forward-looking information. Each of the forward-looking statements

in this news release is subject to significant risks and

uncertainties and is based on a number of assumptions which may

prove to be incorrect. The material factors or assumptions used to

develop the above forward-looking statements and the risks and

uncertainties that could cause actual results to differ materially

from the information presented in the above are discussed in NAEP's

Management Discussion & Analysis for the three months and year

ended March 31, 2011. While management anticipates that subsequent

events and developments may cause its views to change, the Company

does not intend to update this forward-looking information, except

as required by applicable securities laws. This forward-looking

information represents management's views as of the date of this

document and such information should not be relied upon as

representing their views as of any date subsequent to the date of

this document.

For more complete information about NAEP, you should read the

disclosure documents filed with the SEC and the CSA. You may obtain

these documents for free by visiting the SEC website at www.sec.gov

or SEDAR on the CSA website at www.sedar.com.

About the Company

North American Energy Partners Inc. (www.naepi.ca) is one of the

largest providers of heavy construction, mining, piling and

pipeline services in Western Canada. For more than 50 years, NAEP

has provided services to large oil, natural gas and resource

companies, with a principal focus on the Canadian oil sands. NAEP

maintains one of the largest independently owned equipment fleets

in the region.

Contacts: North American Energy Partners Inc. Kevin Rowand

Investor Relations (780) 969-5528 (780) 969-5599 (FAX)

krowand@nacg.ca www.naepi.ca

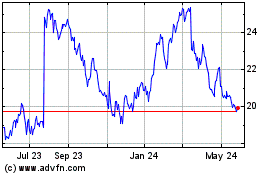

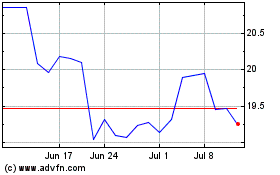

North American Construct... (NYSE:NOA)

Historical Stock Chart

From Jul 2024 to Aug 2024

North American Construct... (NYSE:NOA)

Historical Stock Chart

From Aug 2023 to Aug 2024