Genstar Portfolio Company Altra Holdings Completes IPO

December 21 2006 - 2:08PM

PR Newswire (US)

Genstar's Formation of Leading Power Transmission Company Goes

Public After Two Years SAN FRANCISCO, Dec. 21 /PRNewswire/ --

Genstar Capital, LLC, a middle market private equity firm that

focuses on investments in selected segments of the healthcare

services, life sciences, business services, and industrial

technology sectors, announced that its portfolio company Altra

Holdings, Inc. (NASDAQ:AIMC) closed its initial public offering

yesterday. Ten million common shares were sold in the offering at

$13.50 per share, 3,333,334 shares of which were sold by Altra

Holdings and 6,666,666 shares of which were sold by Genstar Capital

and the other selling stockholders. Gross proceeds from the public

offering were $135 million. Merrill Lynch served as the lead

underwriter. Altra Holdings, Inc. is a Quincy, MA-based provider of

mechanical power transmission and motion control products. Altra's

product portfolio includes industrial clutches and brakes, enclosed

gear drives, open gearing, couplings, engineered bearing

assemblies, linear components and other related products that are

used in a wide variety of high-volume manufacturing processes,

where reliability and accuracy are critical in both avoiding costly

down time and enhancing the overall efficiency of manufacturing

operations. Genstar created Altra Holdings, Inc. when it acquired

Colfax Power Transmission Group in December 2004 and combined it

with Kilian Manufacturing Corporation, which Genstar acquired in

October 2004. Canada's Caisse de Depot et placement du Quebec was

also a significant investor with Genstar in the formation of Altra

Holdings. Jean-Pierre L. Conte, Chairman and Managing Director of

Genstar, said, "Our knowledge of the mechanical power transmission

industry enabled us to create a leading player in the power

transmission industry and working with a superior management team

we have again demonstrated Genstar's ability to create value."

Another Genstar portfolio company, North American Energy Partners

(NYSE:NOA), went public in late November 2006, raising gross

proceeds of $200 million. Genstar Capital targets the industrial

technology industry because the drive to improve manufacturing

processes, increase operating efficiencies and raise worker

productivity will increase the demand for industrial technology

products and services well into the 21st century. The firm's other

investments in Wolverine Tube, Panolam Industries International,

Propex Inc., Woods Equipment Company, Prestolite Electric

Incorporated and Gentek Building Products, Inc. are representative

of its focus on the industrial technology industry. This press

release shall not constitute an offer to sell nor the solicitation

of an offer to buy nor shall there be any sales of these securities

in any state in which such offer, solicitation or sale would be

unlawful. About Genstar Capital, LLC Based in San Francisco,

Genstar Capital (http://www.gencap.com/) is a private equity firm

that makes leveraged investments in quality middle-market

companies. Genstar Capital works in partnership with management to

transform its portfolio companies into industry-leading businesses.

With more than $900 million of committed capital under management

and significant investing experience, Genstar focuses on selected

segments of the life sciences, business services, and industrial

technology sectors. DATASOURCE: Genstar Capital, LLC CONTACT: Chris

Tofalli for Genstar Capital, LLC, +1-914-834-4334 Web site:

http://www.gencap.com/

Copyright

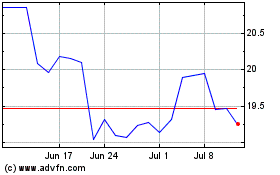

North American Construct... (NYSE:NOA)

Historical Stock Chart

From Jun 2024 to Jul 2024

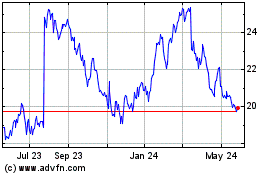

North American Construct... (NYSE:NOA)

Historical Stock Chart

From Jul 2023 to Jul 2024