Egan-Jones Recommends ELECTING ALL SEVEN Ancora Director Candidates and

Supports the Replacement of CEO Alan Shaw, Noting Jim Barber Has

“Best-in-Class Experience in Logistics and Transportation

Systems”

ISS, Glass Lewis and Egan-Jones Have Endorsed

Substantial Change, With All Three Recommending WITHHOLD Votes on Chair Amy Miles and Several

Tenured Incumbents

Visit www.MoveNSCForward.com to Obtain

Information on How to Vote “FOR” ALL

SEVEN Director Candidates on the BLUE Proxy Card

Ohio-based Ancora Holdings Group, LLC (collectively with its

affiliates, “Ancora” or “we”), which owns a large equity stake in

Norfolk Southern Corporation (NYSE: NSC) (“Norfolk Southern” or the

“Company”), today announced that all three independent proxy

advisory firms – Institutional Shareholder Services Inc. (“ISS”),

Glass, Lewis & Co. (“Glass Lewis”), and Egan-Jones Ratings

Company (“Egan-Jones”) – have now recommended that Norfolk Southern

shareholders vote “FOR” significant boardroom change at the

Company’s upcoming Annual Meeting of Shareholders (the “Annual

Meeting”) on May 9, 2024. Notably, all three proxy advisory firms

also recommend voting AGAINST Norfolk Southern’s proposed executive

compensation.

Frederick D. DiSanto, Chairman and Chief Executive Officer of

Ancora, and James Chadwick, President of Ancora Alternatives LLC,

commented:

“We’re pleased Egan-Jones is recommending shareholders vote on

the Blue proxy card for all of our director candidates, including

experienced Board member and proven network leader Jim Barber. All

three proxy advisory firms now support significant change at

Norfolk Southern. If shareholders support a majority change of the

Board, they can ensure that operationally proficient management

commences a network redesign and properly implements Precision

Scheduled Railroading. This three-year strategy, which differs

greatly from Norfolk Southern’s resilience railroading model, has

driven superior service, safety and long-term value at every other

publicly-traded Class I rail. Given the potential for Norfolk

Southern needing a new CEO after next month’s federal report on the

East Palestine derailment, now is the time to install proven

leadership who can execute a tried-and-true strategy that benefits

all stakeholders.”

In its recently issued report, Egan-Jones highlighted its

rationale for recommending shareholders vote “FOR” all seven Ancora

Nominees:1

- “[W]e strongly recommend that shareholders support the election

of Jim Barber as we believe that his best-in-class experience in

logistics and transportation systems will pave [the] way for the

Company to realign its strategies to achieve its targets and

increase business outlook.”

- “We support Ancora’s plan to replace Norfolk Southern’s current

CEO Alan Shaw […]”

- “A non-operational CEO has been at the helm long enough to show

his inability to put the pieces in place. The COO succession has

been problematic and expensive with the $25m buyout price tag on

the current COO Orr.”

- “We believe that the collective skills and expertise of the

seven Ancora Nominees will provide a pathway for growth and

competent railroad services and restore public trust at the same

time.”

Glass Lewis made the following points regarding the need for

change at Norfolk Southern in recommending shareholders elect six

Ancora nominees (including Jim Barber) and WITHHOLD on six

incumbents (including CEO Alan Shaw and Chair Amy Miles):2

- “We are also inclined to agree with Ancora’s critique of the

Company's current operating strategy as being one that relies on

inherently incompatible railroading concepts.”

- “Ancora’s candidates for the Company's top executive roles –

James Barber, Jr. as CEO and Jamie Boychuk as COO – have compelling

credentials and track records.”

- “[I]t’s not readily evident to us the Company's current

leadership had built up a sufficiently positive track record such

that investors might reasonably have the patience to allow

management to implement a relatively novel operating

strategy.”

- “Further, considering that railroad safety is currently at the

forefront of the minds of various key stakeholders, we believe a

“slash-and-burn” approach would likely be untenable […] Ancora

likely understands this line of thinking, as it has not called for

any draconian cost cuts and, instead, has made safety a stated

priority.”

In its report recommending shareholders vote FOR five of

Ancora’s director candidates, ISS noted the following:3

- “[Jim Barber] appears to be a capable candidate with experience

and skills that should be transferable to the railroad industry,

which makes him a credible director and CEO candidate.”

- “It would therefore be justifiable for shareholders who have

already lost faith in the current management team to support the

entire dissident slate.”

- “It is important to recognize that the dissident has also

articulated a plan that appears logical (the underlying model has

been implemented successfully at other Class I railroads), and has

assembled a credible management team that features a COO with

proven experience.”

- “In fact, the dissident has received public support from

several different types of shareholders, including labor unions, as

well as at least one large customer, which suggests that its

arguments have broad appeal.”

About Ancora

Founded in 2003, Ancora Holdings Group, LLC offers integrated

investment advisory, wealth management, retirement plan services

and insurance solutions to individuals and institutions across the

United States. The firm is a long-term supporter of union labor and

has a history of working with union groups and public pension plans

to deliver long-term value. Ancora’s comprehensive service offering

is complemented by a dedicated team that has the breadth of

expertise and operational structure of a global institution, with

the responsiveness and flexibility of a boutique firm. For more

information about Ancora, please visit https://ancora.net.

Advisors

Cadwalader, Wickersham & Taft LLP is serving as legal

advisor, with Longacre Square Partners LLC serving as

communications and strategy advisor and D.F. King & Co., Inc.

serving as proxy solicitor.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

The information herein contains “forward-looking statements.”

Specific forward-looking statements can be identified by the fact

that they do not relate strictly to historical or current facts and

include, without limitation, words such as “may,” “will,”

“expects,” “intends,” “believes,” “anticipates,” “plans,”

“estimates,” “projects,” “potential,” “targets,” “forecasts,”

“seeks,” “could,” “should” or the negative of such terms or other

variations on such terms or comparable terminology. Similarly,

statements that describe our objectives, plans or goals are

forward-looking. Forward-looking statements relate to future events

or future performance and involve known and unknown risks,

uncertainties, and other factors that may cause actual results,

levels of activity, performance or achievements or those of the

industry to be materially different from those expressed or implied

by any forward-looking statements. Norfolk Southern Corporation, a

Virginia corporation (“Norfolk Southern”), has also identified

additional risks relating to its business in its public filings

with the Securities and Exchange Commission (the “SEC”). Ancora

Alternatives LLC (“Ancora Alternatives”), and as applicable the

other participants in the proxy solicitation, have based these

forward-looking statements on current expectations, assumptions,

estimates, beliefs, and projections. While Ancora Alternatives and

the other participants, as applicable, believe these expectations,

assumptions, estimates, and projections are reasonable, such

forward-looking statements are only predictions and involve known

and unknown risks and uncertainties, many of which involve factors

or circumstances that are beyond the participants’ control. There

can be no assurance that any idea or assumption herein is, or will

be proven, correct. If one or more of the risks or uncertainties

materialize, or if the underlying assumptions of Ancora

Alternatives or any of the other participants described herein

prove to be incorrect, the actual results may vary materially from

outcomes indicated by these statements. Accordingly,

forward-looking statements should not be regarded as a

representation by Ancora Alternatives that the future plans,

estimates or expectations contemplated will ever be achieved. You

should not rely upon forward-looking statements as a prediction of

actual results and actual results may vary materially from what is

expressed in or indicated by the forward-looking statements. Except

to the extent required by applicable law, neither Ancora

Alternatives nor any participant will undertake and specifically

declines any obligation to disclose the results of any revisions

that may be made to any projected results or forward-looking

statements herein to reflect events or circumstances after the date

of such projected results or statements or to reflect the

occurrence of anticipated or unanticipated events.

Certain statements and information included herein have been

sourced from third parties. Ancora Alternatives does not make any

representations regarding the accuracy, completeness or timeliness

of such third party statements or information. Except as may be

expressly set forth herein, permission to cite such statements or

information has neither been sought nor obtained from such third

parties. Any such statements or information should not be viewed as

an indication of support from such third parties for the views

expressed herein.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

The participants in the proxy solicitation are Ancora Catalyst

Institutional, LP (“Ancora Catalyst Institutional”), Ancora Merlin

Institutional, LP, (“Ancora Merlin Institutional”), Ancora Merlin,

LP (“Ancora Merlin”), Ancora Catalyst, LP (“Ancora Catalyst”),

Ancora Bellator Fund, LP (“Ancora Bellator”), Ancora Impact Fund LP

Series AA (“Ancora Impact AA”) and Ancora Impact Fund LP Series BB

(“Ancora Impact BB”) (each of which is a series fund within Ancora

Impact Fund LP) (Ancora Catalyst Institutional, Ancora Merlin

Institutional, Ancora Merlin, Ancora Catalyst, Ancora Bellator,

Ancora Impact AA and Ancora Impact BB, collectively, the “Ancora

Funds”), Ancora Advisors, LLC (“Ancora Advisors”), The Ancora Group

LLC (“Ancora Group”), Ancora Family Wealth Advisors, LLC (“Ancora

Family Wealth”), Inverness Holdings LLC (“Inverness Holdings”),

Ancora Alternatives, Ancora Holdings Group, LLC (“Ancora Holdings”)

and Frederick DiSanto (collectively, the “Ancora Parties”); and

Betsy Atkins, James Barber, Jr., William Clyburn, Jr., Sameh Fahmy,

John Kasich, Gilbert Lamphere and Allison Landry (the “Ancora

Nominees” and, collectively with the Ancora Parties, the

“Participants”).

Ancora Alternatives and the other Participants have filed a

definitive proxy statement and accompanying BLUE proxy card (the

“Definitive Proxy Statement”) with the SEC on March 26, 2024 to be

used to solicit proxies for, among other matters, the election of

its slate of director nominees at the 2024 annual meeting of

shareholders of Norfolk Southern.

IMPORTANT INFORMATION AND WHERE TO FIND IT

ANCORA ALTERNATIVES STRONGLY ADVISES ALL SHAREHOLDERS OF NORFOLK

SOUTHERN TO READ THE DEFINITIVE PROXY STATEMENT, ANY AMENDMENTS OR

SUPPLEMENTS TO SUCH DEFINITIVE PROXY STATEMENT, AND OTHER PROXY

MATERIALS FILED BY ANCORA ALTERNATIVES AS THEY CONTAIN IMPORTANT

INFORMATION. SUCH PROXY MATERIALS ARE AVAILABLE AT NO CHARGE ON THE

SEC’S WEBSITE AT WWW.SEC.GOV AND AT ANCORA ALTERNATIVE’S WEBSITE AT

WWW.MOVENSCFORWARD.COM. THE DEFINITIVE PROXY STATEMENT AND

ACCOMPANYING PROXY CARD WILL BE FURNISHED TO SOME OR ALL OF THE

COMPANY’S SHAREHOLDERS. SHAREHOLDERS MAY ALSO DIRECT A REQUEST TO

THE PARTICIPANTS’ PROXY SOLICITOR, D.F. KING & CO., INC., 48

WALL STREET, 22ND FLOOR, NEW YORK, NEW YORK 10005 (SHAREHOLDERS CAN

CALL TOLL-FREE: +1 (866) 227-7300).

Information about the Participants and a description of their

direct or indirect interests by security holdings or otherwise can

be found in the Definitive Proxy Statement.

1 Permission to use quotations from Egan-Jones was neither

sought nor obtained. 2 Permission to use quotations from Glass

Lewis was neither sought nor obtained. 3 Permission to use

quotations from ISS was neither sought nor obtained.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240503815335/en/

Longacre Square Partners Joe Germani / Charlotte Kiaie,

646-386-0091 MoveNSCForward@longacresquare.com D.F. King & Co.,

Inc. Edward McCarthy 212-229-2634 MoveNSCForward@dfking.com

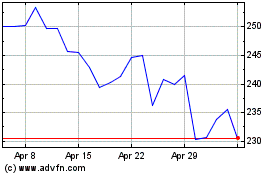

Norfolk Southern (NYSE:NSC)

Historical Stock Chart

From Apr 2024 to May 2024

Norfolk Southern (NYSE:NSC)

Historical Stock Chart

From May 2023 to May 2024