UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16 OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number 001-38072

___________________

NexGen Energy Ltd.

(Translation of registrant's name into English)

Suite 3150, 1021 - West Hastings Street

Vancouver, B.C., Canada V6E 0C3

(Address of principal executive offices)

___________________

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.)

Form 20-F ☐ Form

40-F ☑

INCORPORATION BY REFERENCE

Exhibits 99.1 to this Report on Form 6-K are hereby incorporated

by reference as Exhibits to the Registration Statement on Form F-10 of NexGen Energy Ltd. (File No. 333-266575).

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, on May 8, 2024.

| |

NEXGEN

ENERGY LTD. |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/

Benjamin Salter |

|

| |

|

Name:

Benjamin Salter |

|

| |

|

Title:

Chief Financial Officer |

|

Exhibit 99.1

Message

from the Chair of the Board chris mcfadden

Dear Valued Shareholders,

Dear Valued Shareholders,

You are invited to attend the Annual General

Meeting of Shareholders (the “Meeting”) of NexGen Energy Ltd. (“NexGen” or the “Company”),

which will be held on June 17, 2024, at 2:00 p.m. (Pacific Time) at the offices of NexGen located at 1021 West Hastings Street, Suite

3150, Vancouver, British Columbia.

I, as a fellow shareholder, am

pleased to report that NexGen made significant strides in 2023, through advancing NexGen’s carefully considered, disciplined long-term

strategy for the development of the Company’s 100%-owned Rook I Project (the “Rook I Project” or the “Project”)

into a leading global supplier of clean energy fuel for current and future generations. The Board and Executives, together with the entire

team, are very proud of the Company’s record in continually improving and setting new elite standards in every aspect of responsible

resource development in achieving NexGen’s objectives.

NexGen is delivering long-term superior, sustainable

value to shareholders and all stakeholders, while also delivering generational benefits for Saskatchewan, Canada, and the global environment

and restoring Canada as a global leader in the delivery of clean energy fuel.

Listed below are the Company’s significant

2023 achievements which can be found in more detail in this Management Information Circular:

| • | On November 9, 2023, NexGen received approval

of the Provincial Environmental Assessment for the Rook I Project from the Province of Saskatchewan - the first for a greenfield uranium

mine in over 20 years and the first ever in Canada from a non-governmental organization. |

| • | On June 15, 2023, NexGen signed a historic Benefit

Agreement with the Métis Nation - Saskatchewan Northern Region 2 (MN-S NR2) and the Métis Nation - Saskatchewan (MN-S),

resulting in the Company being among the very rare companies in the resource sector globally to have achieved 100% local Indigenous support

formally prior to Environmental Assessment approval and the start of construction. |

| • | NexGen released its third annual Sustainability

Report, which for the first time, was prepared in accordance with the Global Reporting Initiative’s (GRI) Standards and sets the

foundation for growth into new frameworks in 2024 and beyond. |

| • | The Company outperformed the S&P/TSX Global

Mining Index by 41% for the year, and by year-end, closed over $300 million of financings conducted in unique ways both via strategic

investor placements as well as through targeted block trades utilizing the Company’s ATM facility which enabled highly cost efficient

capital raising all of which solidifies the Company’s balance sheet. |

This Management Information Circular contains

important information about the Meeting and business to be conducted, including voting details, the nominated directors, the appointment

of auditors, and the executive compensation program at NexGen. Please read and familiarize yourself with the materials presented in this

package in advance of the Meeting. NexGen strongly encourages all Shareholders to participate in the election process and to vote well

in advance of the Meeting. Your vote is important.

In addition, Shareholders will have the opportunity

to access, but not participate, in the formal aspect of the Meeting by webcast or teleconference using the details set forth in the Notice

of Annual General Meeting of Shareholders included in this package.

NexGen appreciates your continued support

and participation in the Meeting.

Sincerely,

Chris McFadden

Chair of the Board of Directors

Message

from the Chief Executive Officer LEIGH CURYER

Dear Fellow Shareholders,

Dear Fellow Shareholders,

As the world embraces the critical need for safe,

secure, clean energy fuel, NexGen’s elite Rook I Project is at the forefront of this exciting and generational global movement.

Leading governments and companies have set ambitious goals to reach net zero by 2050, with many targeting 2030 to achieve their first

milestones. It is more evident than ever that we will only reach this goal with nuclear power. Nuclear energy is the only carbon-free

power source that provides highly efficient, reliable, low cost, 24/7 baseload power worldwide. NexGen is uniquely positioned to lead

the uranium mining industry as it readies for large and global expansion of demand and the need for sustainable uranium sources from sound

politically stable jurisdictions. Earlier this year, five members of the G7 formed an alliance to reduce reliance on Russian uranium.

Additionally, at COP28 this year, world leaders from 22 (now 28) countries launched a declaration to triple nuclear energy capacity by

2050. It’s clear that the demand for uranium to power nuclear reactors will continue to rise substantially. Given the geopolitical

landscape, the imperative for robust, Western-based production is unequivocal, positioning NexGen to play an indispensable role in this

new energy paradigm. This is something NexGen has preparing for since discovery in February 2014.

NexGen understands the growing supply deficit in

uranium and the structural fragility inherent in the current world mined uranium production landscape and has had the foresight to keep

future production unhedged to fully optimize future cash flows. The Company is laser focused on the advancement of the Rook I Project

which is on track to bring up to 30 million pounds of uranium to market per year by the end of this decade, potentially providing 25%

of world mined supply given current market dynamics and over 50% of Western-world supply where 75% of the demand is located.

Throughout 2023, NexGen successfully and safely

executed its strategy in all aspects of company growth and development. NexGen’s unwavering commitment to its proven company values

and dedication to excellence in everything it does has resulted in a world-class organization leading positive, necessary change in the

sector and setting new standards for safe, responsible resource development highlighted through our industry leading ESG standards. NexGen

is changing the world of nuclear fuel, so the world can successfully transition its energy preference and requirements.

The Company achieved many key strategic objectives

in 2023, including the historic milestone of obtaining 100% local Indigenous support, a significant and rare achievement for companies

in the global resource sector. Equally as precedent setting, NexGen received Provincial Environmental Assessment approval for its 100%

owned Rook I Project, making it the first company in more than 20 years to receive such approval for a greenfield uranium mine and mill

project in Canada. The approach and quality of the submission has set a new standard technically, environmentally, socially, and economically,

and this approval is critical in bringing Rook I into production and propelling NexGen into a top-ten mining Company globally. NexGen

stands to be an industry-leading uranium supplier, diversifying the nuclear fuel cycle and strengthening energy and national security

for those seeking to diversify their fuel supply chain towards a technically and jurisdictionally stable source.

NexGen’s 2023 site confirmation program made

considerable progress in preparation for the next phase of the Project. Front-end engineering design (“FEED”) was significantly

advanced by the end of the calendar year advancing on the critical path including through transitioning to detailed engineering, procurement

and major contract awards.

In parallel to advancing the Rook I Project, NexGen

embarked on a highly targeted drill program focused on high priority areas of the Company’s highly prospective land package with

the objective of making new material discoveries to support the growing nuclear sector and expanding the understanding of previously under-explored

corridors. On March 11, 2024 the Company announced discovery of intense mineralization in a Greenfields discovery 3.5 kilometres due East

of the Arrow deposit. Further drilling is planned on this priority area.

Over the course of 2023, NexGen bolstered external

relations initiatives through increased global marketing efforts, which included promoting the Company’s Energy Commitments and

focused on reaching significant, long-only funds and long-term investors aligned with NexGen’s vision and strategy. Ongoing, robust

interest from these global investors, financial analysts, and the media have validated that our disciplined, long-term approach for the

asset and the surrounding communities creates the most value for shareholders and stakeholders.

NexGen supports the continued diversification of

its shareholder base. The Company believes that broad ownership of shares has many potential benefits for shareholders, including

the possibility of increased liquidity, more effective price discovery, broader access for the Company to the capital markets and, in

some cases, qualification for inclusion in various market indices. NexGen’s listing onto the ASX in 2021 has facilitated the exposure

to a whole new class of resource savvy Australian fund managers whom have quickly recognized the unique quality of Rook I and the industry

leading approach deployed by NexGen in its development. Consequently, the increase in shareholder ownership by this region’s fund

managers has increased trading liquidity resulting in NexGen being added to the ASX 300 in February 2024.

The work completed this year has advanced the Rook

I Project and elevated the Company’s profile to institutional investors, nuclear fuel buyers, and the media globally. Not only is

bringing the Rook I Project into production good for the local community and Canada, but essential to the world as commercial nuclear

energy is critical to the energy transition and provision of power broadly. This is a testament to the Company’s vision and approach

to the sustainable development of the Rook I Project while also underscoring the need for more uranium suppliers to meet the widening

supply deficit.

We are well positioned as a leader in the clean

energy transition and our team’s expertise and readiness has placed NexGen on a clear and confident path to bringing this generational

asset into production with the best interests of all stakeholders.

Sincerely,

Leigh Curyer

President & Chief Executive Officer

NOTICE OF ANNUAL GENERAL

MEETING OF SHAREHOLDERS

| WHEN: |

WHERE |

Monday, June 17, 2024

2.00 p.m. (Pacific time) |

|

The Offices of NexGen Energy Ltd.

Suite 3150 - 1021 West Hastings Street

Vancouver, BC, V6E 0C3 |

| Shareholders will also be able to access but not participate in the formal aspect of the Meeting by webcast or teleconference using the details below: |

| WEBCAST URL: |

https://app.webinar.net/PJNKL2w4BMy |

|

CONFERENCE DIAL-IN:

To instantly join the conference call by phone, please use the following

URL to easily register yourself and be connected into the conference call automatically or dial direct.

|

| |

URL:

https://emportal.ink/3OFpx0F

Conference ID: 03740586

Toronto: 416-764-8659 / Vancouver: 778-383-7413

North American Toll Free: 1-888-664-6392

International Toll Free: Australia 1800076068 / Hong Kong 800962712 |

Please plan to vote in advance of the meeting.

The purposes of the meeting

are to:

| 1. | Receive the audited consolidated financial statements of the Company for the financial year ended December 31, 2023, together with

the report of the independent auditor thereon; |

| 2. | Set the number of directors of the Company at ten; |

| 3. | Elect the directors of the Company for the ensuing year; |

| 4. | Re-appoint KPMG LLP as independent auditor of the Company for the 2024 financial year and to authorize the directors to fix their

remuneration; and |

| 5. | Transact such other business as may properly come before the Meeting or any adjournment

or postponement thereof. |

Your Vote is Important

The nature of the business to be transacted at

the Meeting is described in further detail in the accompanying Management Information Circular (the “Circular”), which

is deemed to form part of this notice of meeting. Please read the Circular before you vote on the matters being transacted at the Meeting.

Your vote is important regardless of the number

of NexGen shares you own. Registered NexGen Shareholders who are unable to attend the Meeting or any postponement or adjournment thereof

in person are requested to complete, date, sign and return the enclosed form of proxy or, alternatively, to vote by telephone, or over

the internet, in each case in accordance with the enclosed instructions. To be used at the Meeting, the completed proxy form must be deposited

at the office of Computershare Investor Services Inc., no later than 2:00 p.m. (Pacific Time) on June 13, 2024 or, if the Meeting is adjourned

or postponed, not later than 48 hours (excluding Saturdays, Sundays and statutory holidays in the Province of British Columbia) prior

to the time set for the adjourned or postponed Meeting.

Non-registered NexGen Shareholders who receive

these materials through their broker or other intermediary should complete and send the form of proxy or voting instruction form in accordance

with the instructions provided by their broker or intermediary.

Your vote is important, and the Company encourages

you to vote promptly.

The deadline to submit your vote is 2:00 p.m.

Pacific Time on June 13, 2024.

DATED at Vancouver, British Columbia,

this 1st day of May 2024.

BY ORDER OF THE BOARD OF DIRECTORS OF

NEXGEN ENERGY LTD. |

| “Leigh Curyer” |

| President & Chief Executive Officer |

|

|

| TABLE OF CONTENTS |

|

| 2023 YEAR IN REVIEW |

11 |

| SIGNIFICANT PROGRESS |

11 |

| Permitting |

11 |

| Benefit Agreements and Community Support |

11 |

| Project Advancement |

11 |

| Exploration |

11 |

| Commercial |

12 |

| 2024 and Beyond |

12 |

| COMPENSATION HIGHLIGHTS |

12 |

| CORPORATE GOVERNANCE HIGHLIGHTS |

15 |

| MANAGEMENT INFORMATION CIRCULAR |

16 |

| INFORMATION REGARDING ORGANIZATION AND CONDUCT OF MEETING |

16 |

| Solicitation of Proxies |

16 |

| Notice-and-Access |

16 |

| Appointment of Proxyholders |

16 |

| Voting by Proxyholder |

17 |

| Registered Shareholders |

17 |

| Non-Registered Shareholders |

17 |

| Revocation of Proxies |

18 |

| CDI Holders |

18 |

| Advance Notice Provisions |

19 |

| VOTING SHARES AND PRINCIPAL SHAREHOLDERS |

19 |

| Record Date |

19 |

| Shares Outstanding and Principal Holders |

19 |

| INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON |

19 |

| INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS |

20 |

| FINANCIAL STATEMENTS |

20 |

| BUSINESS OF THE MEETING |

21 |

| ELECTION OF DIRECTORS |

21 |

| Majority Voting |

26 |

| Cease Trade Orders, Bankruptcies, Penalties or Sanctions |

27 |

| Election of Directors at the 2024 AGM |

28 |

| APPOINTMENT OF AUDITOR |

29 |

| CORPORATE GOVERNANCE |

30 |

| GOVERNANCE OVERVIEW |

31 |

| DISCLOSURE |

31 |

| About the Board |

31 |

| Director and Executive Shareholdings |

32 |

| Enterprise Risk Management |

32 |

| Cyber Security |

33 |

| Meeting Cadence and In Camera Sessions |

33 |

| Ethical Business Conduct |

33 |

| Director Independence |

34 |

| Diversity, Equity & Inclusion |

34 |

| Board Committees |

36 |

| Audit Committee |

36 |

| Compensation Committee |

37 |

| Nomination and Governance Committee |

38 |

| Sustainability Committee |

38 |

| Environmental, Social and Governance |

39 |

| Chair of the Board and CEO Position Descriptions and Director Responsibilities |

40 |

| Board Skills Matrix |

40 |

| Terms |

41 |

| Orientation and Continuing Education |

42 |

| Board Performance Assessments |

42 |

| Other Directorships |

43 |

| Attendance |

44 |

| COMPENSATION DISCUSSION AND ANALYSIS |

45 |

| COMPENSATION AT A GLANCE |

48 |

| INTRODUCTION |

48 |

| COMPANY OVERVIEW |

49 |

| THE COMPANY’S STRATEGIC FOCUS |

50 |

| The Company’s Stock Price Has Outperformed Its Peers Since Inception |

50 |

| The Company Demonstrates Efficient Use of Capital |

52 |

| COMPENSATION GOVERNANCE |

54 |

| The Role of the Compensation Committee |

54 |

| Composition of the Compensation Committee |

55 |

| Executive Compensation Decision Making Process |

55 |

| Compensation Risk Management |

56 |

| Anti-Hedging |

56 |

| Clawback Policy |

57 |

| Equity Ownership Guidelines |

57 |

| Succession Management |

57 |

| Executive Compensation Philosophy |

58 |

| Executive Compensation Objectives |

58 |

| Executive Compensation Peer Group and Benchmarking |

58 |

| Independent Compensation Consultant |

59 |

| ELEMENTS OF EXECUTIVE COMPENSATION |

60 |

| Base Salaries |

61 |

| Short-Term Incentive Awards |

61 |

| Long-Term Incentive Awards |

61 |

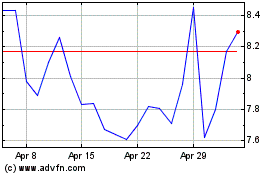

| 2023 NEXGEN PERFOMANCE SCORECARD |

62 |

| Market Performance Overview |

62 |

| 2023 Company Objectives and Achievements |

63 |

| CEO Performance |

64 |

| 2023 Assessment of Objectives |

64 |

| CEO COMPENSATION SUMMARY |

65 |

| Total Market Capitalization Return vs. Named Executive Pay |

65 |

| 2023 Compensation Mix |

66 |

| CEO Stock Option Overview |

66 |

| CEO Share Ownership and Holdings |

68 |

| Summary Compensation Table |

69 |

| Incentive Plan Awards |

70 |

| Termination and Change of Control Benefits |

71 |

| Director Compensation |

72 |

| Incentive Plan Awards |

74 |

| Securities Authorized for Issuance Under Equity Compensation Plans |

76 |

| Stock Option History |

77 |

| INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS |

78 |

| ADDITIONAL INFORMATION |

78 |

| SCHEDULE A |

80 |

| |

BOARD MANDATE |

80 |

| |

I. |

GENERAL |

80 |

| |

II. |

BOARD CHAIR |

80 |

| |

III. |

STRATEGIC PLANNING |

80 |

| |

IV. |

RISK MANAGEMENT |

80 |

| |

V. |

FINANCIAL REPORTING AND MANAGEMENT |

81 |

| |

VI. |

CORPORATE GOVERNANCE |

81 |

| |

VII. |

CODE OF BUSINESS CONDUCT AND ETHICS |

81 |

2024 ANNUAL GENERAL MEETING OF SHAREHOLDERS |  |

2023 YEAR

IN REVIEW

Uranium

is a valuable and reliable source of clean, dense energy that has the potential to

play a significant role in achieving global decarbonization goals, while also improving energy affordability, lifting millions of people

out of energy poverty, and providing long-term energy security for countries around the world. Leading nations are focused on moving

towards a lower-carbon, lower-emission economy, even as new threats to maintaining a safe, reliable and affordable energy supply have

emerged. The supply deficit for uranium is widening, with strong growing global demand and a lack of primary supply, particularly from

Organisation for Economic Co-operation and Development (“OECD”) nations. Located in one of the top mining jurisdictions

in the world that hosts a superb geological setting, Rook I is a strategic generational asset that has the potential to be large scale,

long-life, low cost and highly cash flow generative, and is uniquely positioned to be at the global epicenter of the clean energy transition.

The Company’s experienced team is applying its strategic disciplined approach to responsible resource development to provide the

world with a stable, safe and secure supply of uranium to be used in civilian nuclear power plants globally.

SIGNIFICANT PROGRESS

Permitting

| • | On November 9, 2023, receipt of Provincial Environmental

Assessment (“EA”) approval from the Government of Saskatchewan. This is a major and significant milestone and is the

first such approval for a greenfield uranium mine and mill in over 20 years and the first ever in Canada from a non-governmental organization. |

| • | Submission of responses to all Federal EA technical

review comments, and Federal acceptance of NexGen’s construction phase License application - a key step to bringing Rook I into

production. |

Benefit Agreements and Community Support

| • | On June 15, 2023, signing of the historic Benefit

Agreement with the Métis Nation - Saskatchewan Northern Region 2 (“MN-S NR2”) and the Métis Nation -

Saskatchewan (“MN-S”). NexGen is among the very rare companies in the resource sector globally to have formally achieved

100% local Indigenous support prior to the start of construction. |

| • | Initiating, funding and facilitating expanded

career development opportunities, including the establishment of new training and certification programs in collaboration with local training

institutions to build technical and professional capacity among the young workforce in the local areas for long-term, meaningful careers. |

| • | Established a community-owned and operated gravel

crushing business that provides economic opportunity beyond the Rook I Project. |

Project Advancement

| • | Completion of key critical path early works activities

including: the earthworks program, exhaust and production shaft area preparation and clearance, the commencement of the freeze hole geotechnical

drilling work, and the establishment of a 200-person temporary construction camp. |

Exploration

| • | Completed 22,114 metres of exploration drilling

in 2023, achieving a strong understanding of corridors that had not been previously explored. This new information will further refine

targeting for additional drill programs in 2024. |

| MANAGEMENT INFORMATION CIRCULAR | | PAGE 11 |

2024 ANNUAL GENERAL MEETING OF SHAREHOLDERS |  |

Commercial

| • | Received expressions of interest for over US$1

billion from leading commercial banks and export credit agencies to finance the Rook I Project. |

| • | Executed a $250 million At-The-Market (“ATM”)

program in Q1 2023, which has resulted in NexGen raising over $182 million during 2023 and more subsequently to December 31, 2023 in a

highly efficient and unique manner. This was done successfully utilizing large pre-organized block transactions which saved significantly

in terms of dilution, fees, and market impact. Given the highly successful ATM utilization, NexGen updated its ATM program to $500 million

in December 2023. |

| • | Closed a strategic US$110 million Convertible

Debenture financing with Queen’s Road Capital Investment Ltd. (“QRC”) and Washington H Soul Pattinson and Company

Limited (“WHSP”) while simultaneously converting the existing US$15 million Convertible Debenture with QRC into common

shares, both long-term supportive shareholders. |

2024 and Beyond

NexGen made significant progress in executing its strategy

in 2023. The robust, thorough, and detailed planning and successful execution contributed to continued, efficient momentum towards

full-scale production. The team is highly motivated and focused on people, processes, and planning for optimal execution and growth,

always adhering to NexGen’s core values of Honesty, Respect, Resiliency, and Accountability.

With a clear vision, a well-defined strategy, and a disciplined plan to achieve its objectives, NexGen is poised for another unprecedented

year of growth and achievements as the Company moves closer to becoming a top-10 mining company based on projected annual free cashflow

and the number one company in terms of positive impacts to all stakeholders.

COMPENSATION HIGHLIGHTS

The carefully considered compensation program

developed and overseen by the Company’s independent Compensation Committee (the “Compensation Committee”) has

been a key factor in the Company’s progress. The compensation program was specifically designed with the right mix of components

to attract, incentivize and retain the best employees to develop and execute on NexGen’s strategic plan and drive long-term, sustainable

stakeholder value. NexGen’s stock price performance and Total Shareholder Return (“TSR”) since becoming a publicly

traded company demonstrates that the shareholder value creation strategy and compensation plan is working and leading the industry.

Mercer, the Company’s compensation advisor, is

working closely with the Compensation Committee to further refine the Company’s compensation programs, ensuring they align with

the Company’s ongoing evolution and contribute to its sustained, demonstrated success. The Compensation Committee is working with

Mercer and is expected to adopt an LTI Plan (the “2024 LTI Plan”), discussed below, to provide the Company with flexibility

to grant various types of awards to ensure the Company can attract and retain high performers in the competitive marketplace and to continue

to align the interests of participants with those of the Shareholders.

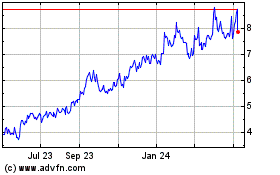

From the Company’s initial listing on the

TSX Venture Exchange in April 2013 to December 31, 2023, NexGen’s share price increased 2,475%, outperforming the S&P/TSX

Global Mining Index, S&P/TSX Composite Total Return Index, and the Global X Uranium ETF.

| MANAGEMENT INFORMATION CIRCULAR | | PAGE 12 |

2024 ANNUAL GENERAL MEETING OF SHAREHOLDERS |  |

The Board and Compensation Committee

believe that the Company’s long-term success has been significantly influenced by its historical practice of granting only stock

option awards as equity incentives. However, following shareholder engagement by management and the Board, and based on the recommendation

of the Compensation Committee, the Board is expected to adopt a Long-Term Incentive Plan (the “2024 LTI Plan”), providing

for the grant of Restricted Share Units (“RSUs”), Performance Share Units (“PSUs”), and Deferred

Share Units (“DSUs”).

The Board and Compensation Committee

remain focused on aligning pay outcomes with the execution of the Company’s overall strategy. The purpose of the 2024 LTI Plan is

to provide the Company with flexibility to grant various types of awards and to align the interests of participants with the interests

of Shareholders, while allowing NexGen to remain competitive in the marketplace. Under the 2024 LTI Plan, equity-based incentives may

be granted to certain of the Company’s directors, executive officers, employees and consultants.

All awards granted under the

2024 LTI Plan will be settled in common shares of the Company bought on the open market, with the objective of promoting equity ownership

among executives and other participants.

RSUs and PSUs, if granted under

the 2024 LTI Plan, will entitle a participant holding such award to receive common shares of the Company, upon settlement, subject to

the terms of the applicable grant agreement.

RSUs are generally expected to

become vested, if at all, following a period of continuous employment. PSUs are similar to RSUs, but their vesting is, in whole or in

part, conditioned on the attainment of specified performance metrics as may be determined by the Compensation Committee. The terms and

conditions of grants of RSUs and PSUs, including the quantity, type of award, grant date, vesting conditions, vesting periods, settlement

date and other terms and conditions with respect to these awards will be set out in the participant’s grant agreement.

It is expected that all RSUs

and PSUs granted under the 2024 LTI Plan will be subject to vesting over a three-year term from the date of grant. The number of PSUs

that will vest will vary depending on the Company’s achievement over the designated performance period of performance criteria determined

by the Compensation Committee and set forth in the applicable grant agreement. The performance criteria applicable to PSUs granted under

the 2024 LTI Plan will be based on performance criteria determined by the Compensation Committee. Subject to the achievement of the applicable

vesting conditions, including any performance criteria, the settlement of an RSU or PSU will generally occur on or as soon as reasonably

practicable following the vesting date.

DSUs, if granted under the 2024

LTI Plan, will evidence the right to receive common shares of the Company. Although DSUs may be available for grant to directors, executive

officers, employees and consultants, NexGen currently expects DSUs, if granted, to be used as a form of non-executive director compensation.

The settlement of a DSU will

generally occur following a pre-established deferral period, which will commence upon or following the participant ceasing to be a director,

executive officer, employee or consultant of NexGen, as applicable, subject to satisfaction of any applicable conditions and the applicable

grant agreement.

With respect to the Company’s current incentive

stock option plan (the “Option Plan”), the Compensation Committee and Board crafted NexGen’s option awards to

have a five-year term and two-year vesting period, enhancing the Company’s ability to retain key high-performance employees, which

is especially important during our current development stage given the unique skillsets required to execute in line with NexGen’s

strategy. Historically, all options granted by the Company immediately following an equity raising have always been issued at a higher

price than the previous price of equity raised, and historically only exercised by Executives in the 60th (final) month prior

to expiry. In many instances the proceeds from these option exercises have been used to fund the tax liabilities, with the majority of

the remaining proceeds invested by the Executives into common shares.

| MANAGEMENT INFORMATION CIRCULAR | | PAGE 13 |

2024 ANNUAL GENERAL MEETING OF SHAREHOLDERS |  |

NexGen has made significant progress in meeting

the various objectives in its carefully considered strategy to develop the Rook I Project, which has driven the Company’s strong

share price performance since inception. Accordingly, to ensure that such objectives are met, the Company also offers cash-based short-term

incentive (“STI”) and long-term incentive awards which pay out only if specific and appropriate objectives closely

tied to the strategic plan have been met by the Company and the employee. While NexGen’s historical compensation programs are strongly

correlated with the Company’s share price performance, to provide the Company with additional flexibility to grant various types

of awards and to align the interests of participants with the interests of Shareholders, while allowing NexGen to remain competitive in

the marketplace, the Board is expected to adopt the 2024 LTI Plan.

Consideration was given to a vote regarding executive

compensation (“Say on Pay”). The Board and its advisors view Say on Pay at this stage as not appropriate given the

Company is in the development stage and has a committed philosophy of attracting the very best candidates for this generational Rook I

Project. The complex and competing nature of all of the various workstreams (permitting, licensing, Indigenous engagement, exploration,

detailed engineering, procurement, contract negotiations, financing, etc.) to advance the Project at this time requires extensive knowledge

and understanding and the Company’s compensation structure must reflect the continued evolution of the Company. Say on Pay is more

relevant for companies with steady state operations like a producing company given the routine nature of workstreams involved, and it

is the Board’s intention to consider this topic for a shareholder vote once in operation and appropriate comparables can be assessed.

The Company remains committed to using carefully considered incentive programs to create superior, sustainable shareholder value.

The Compensation Committee works with Mercer, a

global, highly recognized independent Compensation advisor. This year, the Compensation Committee worked closely with Mercer in preparation

for Committee meetings and had numerous discussions to develop a comprehensive executive compensation roadmap that aligns with the Company's

evolving needs. This roadmap takes into consideration three key stages in NexGen's transformation: 1) finalizing permitting, which is

reflective of NexGen’s existing compensation framework, 2) construction, where compensation programs will shift appropriately towards

operations and 3) operational, where compensation programs will be tailored to reflect the Company as a fully operational mining entity.

| MANAGEMENT INFORMATION CIRCULAR | | PAGE 14 |

2024 ANNUAL GENERAL MEETING OF SHAREHOLDERS |  |

Full details of NexGen’s compensation programs

are contained in the Section entitled Compensation Discussion and analysis starting on page 45.

CORPORATE GOVERNANCE HIGHLIGHTS

The Board firmly believes that a strong corporate

governance regime attuned to the nature of a company and aligned with the interests of its shareholders is essential to the successful

creation of shareholder value. NexGen’s corporate governance is fully described in the section entitled “Corporate Governance”

starting on page 30.

Moreover, NexGen’s Board

and management team are dedicated to an active shareholder engagement strategy, which is crucial for ensuring that there is alignment

between the interests of the shareholders, the strategic direction of NexGen, and its overall success. This proactive engagement facilitates

a constructive dialogue, essential for refining the Company’s initiatives and enhancing communication. Over the past year, NexGen

has engaged with shareholders representing a majority of the outstanding common shares, with management and the Board playing an instrumental

role in these discussions. The insights gleaned from these interactions, coupled with advice from proxy and investor advisory firms, are

regularly presented to the Nomination & Governance Committee and Board. An in-depth analysis was conducted by Mercer (along with a

planned review of the 2024 LTI Plan), and adjustments have been made to the composition of the Board including proposing a new female

Board member as a nominee for election as a director, and the resignation of certain external boards by two directors to align on governance

concerns related to perceived over boarding.

The most important component of corporate governance

is a strong Board of Directors composed of members with the qualifications, skills and experience required to ensure that the Board develops

and oversees the right strategy to deliver shareholder value and to maintain accountability. NexGen has a long-term track record of ensuring

the Board holds the right qualifications, skills and experience necessary for the current stage of development and actively works on director

refreshment, including via its annual director evaluations, to ensure the Board maintains the appropriate mix of those qualifications,

skills, and experience. The Board is committed to diversity, including gender diversity. and as part of an ongoing process of reviewing

the composition of the Board, considers including any new or complementary skillsets as well as gender diversity.

The Board has nominated Susannah Pierce for election

as a director of the Company at the Meeting. See “Election of Directors” in this Circular. In the event of the successful

election of Ms. Pierce as a director of the Company, the total number of women on the Board would increase to three (3), representing

33% of the non-executive members of the Board should all nominees be elected as proposed. In addition to Ms. Pierce, the nominated Board

members are described in detail starting on page 21. Further, in the last six years, the Board composition has been strengthened with

the appointment of six new directors (current total 10) representing objective, fresh and continual contestability to governance.

The Board has a robust annual evaluation process

designed to assess the performance of individual Board members, its committees, and the Board as a whole.

In August of 2023, the Board adjusted the composition

of certain committees as detailed on page 43. Periodic rotation of committee members allows for fresh perspectives, while utilizing individual

director’s particular skills and experience and balancing the need for continuity.

| MANAGEMENT INFORMATION CIRCULAR | | PAGE 15 |

2024 ANNUAL GENERAL MEETING OF SHAREHOLDERS |  |

MANAGEMENT

INFORMATION CIRCULAR

INFORMATION REGARDING ORGANIZATION AND CONDUCT

OF MEETING

This Management Information Circular (the “Circular”)

is furnished in connection with the solicitation of proxies by the management of NexGen Energy Ltd. (the “Company”

or “NexGen”) for use at the annual general meeting (the “Meeting”) of its Shareholders to be held

on Monday, June 17, 2024 at the time and place and for the purposes set forth in the accompanying notice of annual general meeting of

Shareholders (the “Notice of Meeting”). Unless otherwise stated, this Circular contains information as at May 1, 2024.

References in this Circular to the Meeting include any adjournment or postponement thereof and, unless otherwise indicated, in this Circular

all references to “$” are to Canadian dollars.

Solicitation of Proxies

It is expected that proxies will be solicited

primarily by mail, but proxies may also be solicited personally, by telephone, email or by other means of electronic communication, by

directors, officers or employees of the Company, to whom no additional compensation will be paid. All costs of solicitation will be borne

by NexGen. In addition, the Company shall, upon request, reimburse brokerage firms and other custodians for their reasonable expenses

in forwarding proxies and related material to beneficial owners of common shares of the Company.

NexGen has engaged TMX Investor Solutions Inc.

(“TMX)” to assist with communicating with Shareholders in connection with these services, TMX is to receive a fee of

approximately $43,000, plus out-of-pocket expenses. The Company will bear all costs of this solicitation.

If you have any questions or require assistance

with voting, please contact TMX, by telephone at 1- 800-706-3274 toll-free in North America or (201) 806-7301 (outside of North America).

Notice-and-Access

The Company has elected to use the notice and

access mechanism (the “Notice-and-Access Provisions”) under National Instrument 54-101 - Communication with Beneficial

Owners of Securities of a Reporting Issuer (“NI 54-101”) for the delivery of this Circular to Shareholders for

the Meeting.

Under the Notice-and-Access Provisions, instead

of receiving printed copies of this Circular, Shareholders will receive a notice (“Notice”) with information on the

Meeting as well as information on how they may access this Circular electronically and how

they may vote.

The Company will not use the procedures known

as “stratification” in relation to the use of Notice-and-Access Provisions meaning that all Shareholders will receive a Notice

in accordance with the Notice-and-Access Provisions.

Shareholders can request that printed copies

of this Circular be sent to them by postal delivery, at no cost to them, up to one year after the date this Circular was filed on SEDAR+

by calling toll-free (in Canada and the United States) 1-800-841-5821 or by emailing ddang@nxe-energy.ca.

See under the heading “How to Obtain Paper Copies of the Circular” in the accompanying Notice and Access Notification

to Shareholders.

Appointment of Proxyholders

The persons named in the enclosed form of proxy

or voting instruction form are executive officers of the Company. You have the right to appoint someone other than the persons designated

in the enclosed form of proxy, who need not be a Shareholder, to attend and act on your behalf at the Meeting by printing the name of

the person you want in the blank space provided or by completing and delivering another suitable form of proxy.

| MANAGEMENT INFORMATION CIRCULAR | | PAGE 16 |

2024 ANNUAL GENERAL MEETING OF SHAREHOLDERS |  |

Voting by Proxyholder

On any ballot, the nominees named in the accompanying

proxy form will vote, withhold from voting or vote against (as applicable), your common shares in accordance with your instructions. In

respect of any matter for which a choice is not specified, the persons named in the accompanying proxy form will vote at their own discretion,

except where management recommends that Shareholders vote in favour of a matter, in which case the nominees will vote FOR the approval

of such matter.

The form of proxy confers discretionary authority

upon the nominees named therein with respect to amendments or variations to matters identified in the Notice of Meeting and with respect

to other matters which may properly come before the Meeting.

As of the date of this Circular, Management of

NexGen knows of no such amendment, variation or other matter that may come before the Meeting. However, if any amendment, variation or

other matter should properly come before the Meeting, each nominee named in the accompanying proxy form intends to vote thereon in accordance

with the nominee’s best judgment or as stated above.

Registered Shareholders

A “Registered Shareholder”

is a person whose common shares are registered in the Shareholder’s own name. Registered Shareholders who are unable to attend the

Meeting or any postponement or adjournment thereof in person are requested to complete, date, sign and return the enclosed form of proxy

or, alternatively, to vote by telephone, or over the Internet, in each case in accordance with the enclosed instructions.

To vote by telephone, Registered Shareholders

should call Computershare Investor Services Inc. at 1-866-732- VOTE (8683). Registered Shareholders will need to enter the 15-digit control

number provided on the form of proxy to identify themselves as Shareholders on the telephone voting system.

To vote over the Internet, Registered

Shareholders should go to www.investorvote.com. NexGen Shareholders will need to enter the 15-digit

control number provided on the form of proxy to identify themselves as Shareholders on the voting website.

To vote by mail, Registered Shareholders

should complete, date and sign the form of proxy and mail in the enclosed return envelope to the office of Computershare Investor Services

Inc.

Voting instructions must be received no later

than 2:00 p.m. (Pacific Time) on June 13, 2024, or, if the Meeting is adjourned or postponed,

not later than 48 hours (excluding Saturdays, Sundays and statutory holidays in either the Province of Ontario or the Province of British

Columbia) prior to the time set for the adjourned or postponed meeting.

Late proxies may be accepted or rejected by the

Chair of the Meeting in his or her discretion.

Non-Registered Shareholders

Most Shareholders of the Company are “Non-Registered

Shareholders” because the common shares they own are not registered in their name but are registered in the name of an intermediary

such as a bank, trust company, securities dealer or broker, trustee or administrator, of a self- administered RRSP, RRIF, or RESP or a

clearing agency (such as CDS Clearing and Depositary Services Inc.) of which the intermediary is a participant.

Applicable regulatory policy requires intermediaries/brokers

to whom meeting materials have been sent to seek voting instructions from Non-Registered Shareholders in advance of Shareholders’

meetings. Every intermediary has its own mailing procedures and provides its own return instructions, which should be carefully followed

in order to ensure that the Non-Registered Shareholder’s common shares are voted at the Meeting.

The majority of brokers now delegate responsibility

for obtaining instructions from Non-Registered Shareholders to Broadridge Financial Solutions, Inc. (“Broadridge”).

Broadridge typically mails a scannable voting instruction form (“VIF”), instead of the form of proxy. Non-Registered

Shareholders are requested to complete and return the VIF to Broadridge. Alternatively, Non-Registered Shareholders can call a toll-free

telephone number or access Broadridge’s dedicated voting website www.proxyvote.com.

| MANAGEMENT INFORMATION CIRCULAR | | PAGE 17 |

2024 ANNUAL GENERAL MEETING OF SHAREHOLDERS |  |

The VIF must be returned as directed by Broadridge

well in advance of the Meeting in order to have the common shares voted. Non-Registered Shareholders who receive forms of proxies or voting

materials from organizations other than Broadridge should complete and return such forms of proxies or voting materials in accordance

with the instructions on such materials in order to properly vote their common shares at the Meeting.

NexGen may utilize the Broadridge QuickVoteTM

service to assist Non-Registered Shareholders vote their shares. Those Shareholders who have not objected to NexGen knowing who they are

(non-objecting beneficial owners) may be contacted by Innisfree M&A Incorporated to conveniently obtain a vote directly over the phone.

Non-Registered Shareholders are not entitled,

as such, to vote at the Meeting in person or to deliver a form of proxy. If you are a Non-Registered Shareholder and wish to appoint yourself

as proxyholder to vote in person at the Meeting or appoint someone else to attend the Meeting and vote on your behalf, please see the

voting instructions you received or contact your intermediary/broker well in advance of the Meeting to determine how you can do so.

Non-Registered Shareholders should carefully

follow the voting instructions they receive, including those on how and when voting instructions are to be provided, in order to have

their common shares voted at the Meeting.

If you have any questions or require assistance

with voting, please contact TMX, the Company’s proxy solicitation agent, by telephone at 1-800-706-3274 (toll-free in North America)

or 1-201-806-7301 (outside of North America).

Revocation of Proxies

Only a Registered Shareholder who has submitted

a proxy may revoke it at any time prior to the exercise thereof. In addition to revocation

in any other manner permitted by law, a proxy may

be revoked by instrument in writing executed by the Registered Shareholder or such Shareholder’s legal representative, or if the

Registered Shareholder is a corporation, by its duly authorized legal representative, and deposited at the Company’s registered

office: Suite 2500, 700 West Georgia Street, Vancouver, BC V7Y 1B3 at any time up to and including the last business day preceding the

day of the Meeting at which the proxy is to be used, or with the Chair of the Meeting on the day of the Meeting prior to voting and, upon

either of such deposits, the proxy is revoked.

Non-Registered Shareholders who wish to change

their vote must, in sufficient time in advance of the Meeting, arrange for their respective intermediaries to change their vote and if

necessary, revoke the proxy on their behalf.

CDI Holders

Each person who is recorded as the holder of CHESS

Depositary Interests (“CDIs”) on May 1, 2024 in the register of holders of CDIs kept by or on behalf of NexGen (each

such person being a “Relevant CDI Holder”) is entitled to instruct CHESS Depository Nominees Pty Limited (“CDN”),

a wholly owned subsidiary company of ASX Limited that was created to fulfil the functions of a depositary nominee, or its custodian which

holds the NexGen common shares underlying their CDIs how to vote those shares on the resolutions to be considered at the Meeting. If

you are a Relevant CDI Holder and wish to give such voting instructions you must complete and submit the CDI voting instruction form

accompanying this Notice of Meeting or lodge your vote online at www.investorvote.com.au using

your secure access information contained in the CDI voting instruction form. Relevant CDI Holders can expect to receive a CDI voting

instruction form, together with the Meeting materials from Computershare, the CDI registry in Australia.

For your CDI voting instruction form to be valid,

it must be received by Computershare no later than 9:00am on June 12, 2024 (Australian Western Standard Time) in order to allow CDN or

its custodian which holds the underlying common shares sufficient time to provide voting instructions in respect of the relevant common

shares to NexGen by the proxy submission deadline of 2:00pm on June 13, 2024 (Pacific time) or, if the Meeting is adjourned or postponed,

not later than 48 hours (excluding Saturdays, Sundays and statutory holidays in either the Province of Ontario or the Province of British

Columbia) prior to the time set for the adjourned or postponed meeting, and in addition you must be a Relevant CDI Holder.

| MANAGEMENT INFORMATION CIRCULAR | | PAGE 18 |

2024 ANNUAL GENERAL MEETING OF SHAREHOLDERS |  |

Please note that holders of CDIs are not Registered

Holders of the common shares to which those CDIs relate, and therefore are not entitled to vote in person at a Meeting in their capacity

as a holder of CDIs. Relevant CDI Holders can request CDN to appoint the Relevant CDI Holder (or a person nominated by the Relevant CDI

Holder) as proxy to exercise the votes attaching to the underlying common shares represented by the Relevant CDI Holder. In such case,

a Relevant CDI Holder may, as proxy, attend and vote in person at the Meeting. If you hold your interest in CDIs through a broker, dealer

or other intermediary, you will need to follow the instructions of your intermediary and request a form of legal proxy which will grant

you the right to attend the Meeting and vote in person.

Advance Notice Provisions

On May 21, 2015, Shareholders approved an amendment

to the Company’s articles to implement advance notice provisions for the nomination of directors (the “Advance Notice

Provisions”). Under the Advance Notice Provisions, a director nomination must be made, in the case of an annual meeting of

Shareholders, at least 30 days and no more than 65 days before the date of the meeting, and in the case of a special meeting of Shareholders

(which is not also an annual meeting of Shareholders) called for the purpose of electing directors (whether or not called for other purposes),

not later than the close of business on the fifteenth (15th) day following the day on which the first public announcement of the date

of the special meeting of Shareholders was made. The Advance Notice Provisions also set forth the information that a Shareholder must

include in the notice to the Company. See the Company’s amended articles which are available under the Company’s profile

on SEDAR+ at www.sedarplus.ca for full details (filed on May 26, 2015). No director nominations

have been made by Shareholders in connection with the Meeting under the terms of the Advance Notice Provisions, and as such the only

nominations for directors at the Meeting are the nominees set forth below under “Business to be Transacted at the Meeting -

Election of Directors”.

VOTING SHARES AND PRINCIPAL SHAREHOLDERS

Record Date

The Board of Directors of NexGen (the “Board”)

has fixed May 1, 2024, as the record date, being the date for the determination of the holders of the Company’s common shares entitled

to notice of, and to vote at, the Meeting and any adjournment or postponement thereof.

Shares Outstanding and Principal Holders

As of May 1, 2024, there were a total of 539,846,319

NexGen common shares issued and outstanding. The holders of the common shares are entitled to receive notice of, and to attend, all meetings

of NexGen Shareholders and to have one vote for each common share held.

To the knowledge of the directors and executive

officers of the Company, as of the date of this Circular, no person or company beneficially owns, or controls or directs, directly or

indirectly, voting securities carrying 10% or more of the voting rights attached to any class of voting securities of NexGen.

INTEREST OF CERTAIN PERSONS IN MATTERS TO

BE ACTED UPON

The Company is unaware of any material interest,

direct or indirect, by way of beneficial ownership of securities or otherwise, of any person who has been a director or executive officer

of the Company at any time since the beginning of the Company’s last financial year, or is a proposed nominee for election as a

director (or an associate or affiliate of such director, executive officer or director nominee) in any matter to be acted upon at the

Meeting, other than the election of directors.

| MANAGEMENT INFORMATION CIRCULAR | | PAGE 19 |

2024 ANNUAL GENERAL MEETING OF SHAREHOLDERS |  |

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

The Company is unaware of any material interest,

direct or indirect, of any informed person or any proposed nominee for election as a director of the Company (or an associate or affiliate

of such informed person or director nominee) in any transaction since the beginning of the Company’s last financial year or any

proposed transaction, which has materially affected or would materially affect the Company or any of its subsidiaries.

FINANCIAL STATEMENTS

The audited consolidated financial statements

of the Company for the financial year ended December 31, 2023, and the report of the independent auditors thereon will be presented at

the Meeting. These consolidated financial statements and the related management’s discussion and analysis were sent to all Shareholders

who have requested a copy. The Company’s consolidated financial statements and related management’s discussion and analysis

for the financial year ended December 31, 2023, are also available under the Company’s profile on SEDAR+ (www.sedarplus.ca)

and on the Company’s website (www.nexgenenergy.ca).

| MANAGEMENT INFORMATION CIRCULAR | | PAGE 20 |

2024 ANNUAL GENERAL MEETING OF SHAREHOLDERS |  |

BUSINESS OF

THE MEETING

ELECTION OF DIRECTORS

The directors of the Company are elected annually

and hold office until the next annual general meeting of the Shareholders or until their successors are elected or appointed. Management

proposes to nominate the persons listed below for election as directors of the Company to serve until their successors are elected or

appointed.

Unless otherwise indicated, the persons designated

as proxyholders in the accompanying form of proxy will vote the common shares represented by such form of proxy FOR setting the number

of directors at ten and the election of the ten director nominees listed in this Circular. Management does not contemplate that any of

the nominees will be unable to serve as a director.

The following table provides information on the

ten director nominees, including: (i) their province or state and country of residence; (ii)

the date when they were appointed a director; (iii) whether they are considered to be independent; (iv) their membership on committees

of the Board; (v) their principal occupation, business or employment presently and over the preceding five (5) years; and (vi) the number

of common shares and stock options of the Company beneficially owned, controlled, or directed, directly or indirectly.

| Leigh Curyer (1) |

|

Director since 2013

Not Independent

Age: 52

|

Mr. Curyer has more

than 20 years’ experience in the resources and corporate sector. Mr. Curyer founded NexGen in 2011 and currently serves as

the President and Chief Executive Officer. From 2008 to 2011, Mr. Curyer was Head of Corporate Development for Accord Nuclear Resources

Management, assessing uranium projects worldwide for First Reserve Corporation, a global energy-focused private equity and infrastructure

investment firm. Mr. Curyer was the Chief Financial Officer and head of corporate development of Southern Cross Resources Inc. (now Uranium

One Inc.) from 2002 to 2006.

Mr. Curyer’s uranium project

assessment experience has been focused on assets located in Canada, Australia, USA, Africa, Central Asia and Europe, including operating

mines, advanced development projects and exploration prospects.

Mr. Curyer also serves as the Vice

Chairman of IsoEnergy Ltd. The Company is a significant shareholder of IsoEnergy Ltd.

Mr. Curyer has a Bachelor of Arts

in Accountancy from the University of South Australia and is a member of Chartered Accountants Australia and New Zealand. Mr. Curyer is

a resident of British Columbia, Canada. |

| Board Committees |

| Sustainability Committee |

| Principal Occupation |

| President and Chief Executive Officer of NexGen Energy Ltd. |

| Options and Common Shares |

| Options |

15,100,000 |

Common Shares |

5,200,000 |

| MANAGEMENT INFORMATION CIRCULAR | | PAGE 21 |

2024 ANNUAL GENERAL MEETING OF SHAREHOLDERS |  |

| Christopher McFadden |

|

Director since 2013

Independent

Age: 55 |

Mr. McFadden is a lawyer with more

than 25 years of experience in exploration and mining. Mr. McFadden was the Managing Director of Resolution Minerals Ltd. from

May 2023 to November 2023. He was President and Chief Executive Officer of NxGold Ltd. from February 2017 to March 2020, and, before that

the Manager, Business Development at Newcrest Mining Limited. Prior to these roles, he was Head of Commercial,

Strategy and Corporate Development for Tigers Realm Coal Limited, which is listed on the Australian Stock Exchange. Additionally, Mr.

McFadden was General Manager, Business Development of Tigers Realm Minerals Pty Ltd. Prior to commencing with the Tigers Realm Group in

2010, Mr. McFadden was a Commercial General Manager with Rio Tinto’s exploration division with responsibility for gaining entry

into new projects through negotiation with government or joint venture partners, or through acquisition.

Mr. McFadden has extensive international

experience in managing large and complex transactions and has a broad knowledge of all aspects of project evaluation and negotiation in

challenging and varied environments. Mr. McFadden currently serves on the Board of IsoEnergy Ltd. The Company is a significant shareholder

of IsoEnergy Ltd.

Mr. McFadden holds a combined law/commerce

degree from Melbourne University and an MBA from Monash University. Mr. McFadden is a resident of Victoria, Australia. |

| Board Committees |

| Chair of the Board; |

| Principal Occupation |

| Corporate Director |

| Options and Common Shares |

| Options |

2,450,000 |

Common Shares |

1,000,000 |

| Richard Patricio (2) |

|

Director since 2013

Independent

Age: 50 |

Mr. Patricio is the President and

Chief Executive Officer of Mega Uranium Ltd., having previously been its Executive Vice President from 2005 to 2015. Mega Uranium Ltd.

holds 19,476,265 common shares of NexGen.

Until April 2016,

Mr. Patricio was also the Chief Executive Officer of Pinetree Capital Ltd. (“Pinetree”), a TSX-listed investment company

specializing in early-stage resource investments. Mr. Patricio joined Pinetree in November 2005 as Vice President, Corporate and Legal

Affairs. Prior to that, Mr. Patricio practiced law at top-tier Toronto- based law firm before moving in-house with a TSX- listed issuer.

Mr. Patricio has built a number

of mining companies with global operations and holds (and has held) senior officer and director positions in several companies listed

on stock exchanges in Toronto, Australia, London and New York. He currently serves on the Board of IsoEnergy Ltd. as Chairman, Toro Energy

Limited, and the Company, all in his capacity as CEO of Mega Uranium Ltd.

Mr. Patricio received his law degree

from Osgoode Hall and was called to the Ontario bar in 2000. Mr. Patricio is a resident of Ontario, Canada. |

| Board Committees |

| Nomination and Governance Committee (Chair); Compensation Committee (Chair); Audit Committee |

| Principal Occupation |

| President and Chief Executive Officer of Mega Uranium Ltd. |

| Options and Common Shares |

| Options |

2,600,000 |

Common Shares |

1,339,900 |

| MANAGEMENT INFORMATION CIRCULAR | | PAGE 22 |

2024 ANNUAL GENERAL MEETING OF SHAREHOLDERS |  |

| Trevor Thiele |

|

Director since 2013

Independent

Age: 66 |

Mr. Thiele has more than 30 years’

experience in senior finance roles in medium to large Australian listed companies. Mr. Thiele has also been Chief Financial Officer for

companies involved in the agribusiness sector (Elders and ABB Grain Ltd., Rural Services Division) and the biotechnology sector (Bionomics

Limited). In these roles he combined his technical, accounting, and financial skills with commercial expertise thereby substantially contributing

to the growth of each of these businesses. During this time, Mr. Thiele was actively involved in initial public offerings, capital raisings,

corporate restructures, mergers and acquisitions, refinancing and joint ventures.

Mr. Thiele holds a Bachelor of Arts

in Accountancy from the University of South Australia and is a member of Chartered Accountants Australia and New Zealand. Mr. Thiele is

a resident of South Australia, Australia. |

| Board Committees |

| Audit Committee (Chair) |

| Principal Occupation |

| Corporate Director |

| Options and Common Shares |

| Options |

2,600,000 |

Common Shares |

Nil |

| Warren Gilman |

|

Director since 2017

Independent

Age: 64 |

Mr. Gilman was appointed Chairman

and CEO of Queen’s Road Capital Investment Ltd. in 2019. Prior to that he was Chairman and CEO of CEF Holdings Limited and was Vice

Chairman of CIBC World Markets. Mr. Gilman was also Managing Director and Head of Asia Pacific Region for CIBC for 10 years where he was

responsible for all of CIBC’s activities across Asia. Mr. Gilman is a mining engineer who co-founded CIBC’s Global Mining

Group in 1988. During his 26 years with CIBC, he ran the mining team in Canada, Australia and Asia and worked in the Toronto, Sydney,

Perth, Shanghai and Hong Kong offices of CIBC. He has acted as advisor to the largest mining companies in the world including BHP, Rio

Tinto, Anglo American, Noranda, Falconbridge, Sumitomo Corp., China Minmetals, Jinchuan and Zijin and has been responsible for some of

the largest equity capital markets financings in Canadian mining history.

Mr. Gilman serves on the Board of

Gold Royalty Corp in his capacity as Chairman and CEO of Queens Road Capital Investment Ltd.

He is Chairman of the International

Advisory Board of Western University and a member of the Dean’s Advisory Board of Laurentian University.

Mr. Gilman obtained his B.Sc. in Mining

Engineering at Queen’s University and his MBA from the Ivey Business School at Western University. Mr. Gilman is a resident of Hong

Kong, China. |

| Board Committees |

| Nomination and Governance Committee |

| Principal Occupation |

| Chairman and CEO of Queen’s Road Capital Investment Ltd. |

| Options and Common Shares |

| Options |

2,550,000 |

Common Shares |

750,000 |

| MANAGEMENT INFORMATION CIRCULAR | | PAGE 23 |

2024 ANNUAL GENERAL MEETING OF SHAREHOLDERS |  |

| Sybil Veenman |

|

Director since 2018

Independent

Age: 60 |

Ms. Veenman has more than 25 years

of mining industry experience, including as a senior executive and as a public company director. Previously, Ms. Veenman was a Senior

Vice-President and General Counsel and a member of the executive leadership team at Barrick Gold Corporation. In that capacity, Ms. Veenman

was responsible for overall management of legal affairs, extensively engaged in that company’s significant M&A and financing

transactions and involved in a wide range of operational, regulatory, political, and social responsibility aspects of the mining business.

Ms. Veenman currently serves as a Director

at Nasdaq-listed Royal Gold Inc., and TSX-listed Major Drilling Group International Inc.

Ms. Veenman holds a Law degree from

the University of Toronto and has completed the Institute of Corporate Directors, Directors Education Program and obtained the ICD.D designation

from the Institute. Ms. Veenman is a resident of Ontario, Canada. |

| Board Committees |

| Audit Committee; Sustainability Committee |

| Principal Occupation |

| Corporate Director |

| Options and Common Shares |

| Options |

2,550,000 |

Common Shares |

300,000 |

| Karri Howlett |

|

Director since 2018

Independent

Age: 48 |

Ms. Howlett has more than 20 years

of experience in corporate strategy, mergers and acquisitions, financial due diligence, and risk analysis. She is the Principal of Karri

Howlett Consulting which provides clients with an informed third-party perspective and a tailored process to help navigate embedding ESG,

financial, and risk management strategies.

Ms. Howlett has conducted financial

due diligence and risk analysis for several business endeavors, including business advisement and financial modelling for several mining

and energy projects, as well as mergers of financial institutions. Ms. Howlett was recently President of RESPEC Consulting Inc., which

is a geoscience and engineering consulting company based in Saskatoon, Saskatchewan.

Her extensive experience in ESG matters

makes her extremely well qualified to serve as Chair of NexGen’s Sustainability Committee.

Ms. Howlett currently sits on the

Boards of Gold Royalty Corp., and March Consulting Associates Inc., and is on the Board of Governors for the University of Regina. She

recently served on SaskPower (as Chair of the Safety, Environment and Social Responsibility Committee) from February 2013 to May 2021,

leading the development and implementation of net zero carbon emission strategies.

Ms. Howlett holds a Bachelor of Commerce

(with honors) in Finance from the University of Saskatchewan and has earned the Chartered Financial Analyst (CFA) designation and the

Chartered Director designation. Ms. Howlett is a resident of Saskatchewan, Canada. |

| Board Committees |

| Sustainability Committee (Chair); Nomination and Governance Committee |

| Principal Occupation |

| President, Karri Howlett Consulting Inc. |

| Options and Common Shares |

| Options |

2,550,000 |

Common Shares |

262,900 |

| MANAGEMENT INFORMATION CIRCULAR | | PAGE 24 |

2024 ANNUAL GENERAL MEETING OF SHAREHOLDERS |  |

| Brad Wall (3) |

|

Director since 2019

Not Independent

Age: 58 |

Mr. Wall was the 14th

Premier of Saskatchewan. Mr. Wall brings to NexGen’s Board political experience spanning over an 18-year period. During his 10-year

tenure as Premier of Saskatchewan, Mr. Wall led the province to unprecedented economic expansion, strong population and export growth,

record infrastructure investment and the first ever and continuing AAA credit for the province’s finances. Mr. Wall worked successfully

with the previous federal government to achieve nuclear cooperation agreements between Canada and both India and China opening those civilian

nuclear energy markets to Canadian uranium. He is an advocate for sustainable, inclusive economic development and provides strategic insight

to the energy sector. Mr. Wall brings to NexGen extensive national energy policy, political and economic experience and has demonstrated

a very strong commitment, results and advocacy in the best interests of Saskatchewan and Canada over his entire career. That experience

has proven to be very beneficial to the Board in dealing effectively with the various regulatory and political bodies needed to ensure

success of the Rook I Project.

.

Mr. Wall currently serves on the Boards

of Maxim Power Corp., Whitecap Resources Inc., and Helium Evolution, and is a partner in a yearling cattle ranch operation.

Mr. Wall attended the University

of Saskatchewan, graduating with an honours degree in Public Administration and an advanced certificate in Political Studies. Mr. Wall

is a resident of Saskatchewan, Canada. |

| Board Committees |

| Sustainability Committee |

| Principal Occupation |

| Corporate Director and Consultant |

| Options and Common Shares |

| Options |

2,250,000 |

Common Shares |

45,000 |

| Ivan Mullany |

|

Director since 2023

Independent

Age: 61

|

Mr. Mullany is a senior mining

executive with over 35 years of extensive leadership experience spanning project development, operational excellence, innovation, business

strategy, and governance. Most recently, with Newmont and its predecessor Goldcorp Inc. on the Senior Leadership Team, he led numerous

major projects collectively in excess of $18 Billion, during the engineering study, construction and execution stages.

Mr. Mullany’s tenured career

in the mining sector has led to exceptional international experience, leading diverse teams in multiple jurisdictions.

Mr. Mullany’s experience

in the successful execution of global mining project construction and operational excellence is a significant asset to the Board as the

Rook I Project advances into Detailed Engineering.

Mr. Mullany is a Fellow of the

Australian Institute of Mining and Metallurgy (FAusIMM) and a member of the Canadian Institute of Mining and Metallurgy (CIMM) and is

a resident of Ontario, Canada. |

| Board Committees |

| Compensation Committee; Sustainability Committee |

| Principal Occupation |

| Corporate Director |

| Options and Common Shares |

| Options |

500,000 |

Common Shares |

Nil |

| MANAGEMENT INFORMATION CIRCULAR | | PAGE 25 |

2024 ANNUAL GENERAL MEETING OF SHAREHOLDERS |  |

| Susannah Pierce |

|

|

Director nominee 2024

Age: 51

|

Ms. Pierce has more than 20 years of experience in bringing business, governments, communities, indigenous groups, and other non-governmental actors together to support the development of major capital projects to maximize investment returns.

In her current role of President and Country Chair, Shell Canada Limited, she is responsible for driving integration and coordination of business activity and corporate policy across Shell’s businesses in Canada. She previously served as Director of Corporate Affairs at LNG Canada, a joint venture of Shell, Petronas, Mitsubishi, PetroChina and Kogas, where she was responsible for the project’s federal and provincial regulatory approvals, Indigenous relations and negotiations, government relations, media relations, community consultation and communications.

Ms. Pierce currently serves as the Co-Chair of Business Council of Canada Working Group on Climate Change and Energy Transition, an Executive on the Greater Vancouver Board of Trade, and Catalyst Canada. She is the past chair of the Business Council of BC, Co-Chair of the Business Council of Alberta’s Define the Decade, and Co-Chair of the Canada Chamber of Commerce Western Executive Council. She previously served on the Board of Gemini Corp., and holds an ICD certification.

Ms. Pierce is a graduate of the Johns Hopkins School of Advanced International Studies (SAIS) and The George Washington University, and speaks English, Spanish and French.

|

| |

Board Committees |

| Not Applicable |

| Principal Occupation |

| President and Country Chair, Shell Canada |

| Options and Common Shares |

| Options |

Nil |

Common Shares |

350,000 |

| |

|

|

|

|

|

Notes:

| (1) | Mr. Curyer is not independent on the basis that he is an executive officer of the Company. |

| (2) | In addition, Mega Uranium Ltd. holds 19,476,265 common shares of NexGen. Mr. Patricio is the President

and Chief Executive Officer of Mega Uranium Ltd. The common shares of Mega Uranium Ltd. are listed on the TSX. |

| (3) | Mr. Wall is not independent on the basis that he is an executive officer of the consulting company, Flying

W Consulting, that is engaged by the Company. |

For the purposes of this Circular, unless otherwise

stated, “independence” has been assessed in accordance with National Instrument 58-101 - Disclosure of Corporate Governance

Practices (the “Disclosure Instrument”).

Majority Voting

The Company has adopted a majority voting policy,

which is available on NexGen’s website at www.nexgenenergy.ca. The policy requires that

each director nominee of the Company must be elected by at least a majority (50% + 1 vote) of the votes cast with regard to his or her

election. Any director nominee (the “nominee”) who receives a greater number of votes “withheld” from his or

her election than votes “for” such election must tender his or her resignation to the Board, to be effective upon acceptance

by the Board. The Nomination and Governance Committee will consider the tendered director’s resignation and recommend to the Board

the action to be taken with respect to such tendered resignation. Factors considered by the Committee may include: (i) the reasons, if

known, why shareholders “withheld” or were requested or recommended to “withhold” votes from the nominee, and

whether the reasons related to matters other than the qualifications or individual actions of the nominee; (ii) any alternatives for