BEIJING, Oct. 17 /Xinhua-PRNewswire/ -- New Oriental Education and

Technology Group Inc. (NYSE:EDU), the largest provider of private

educational services in China, today announced its unaudited

financial results for the fiscal quarter ended August 31, 2006,

which is the first quarter for New Oriental's fiscal year 2007(1).

Highlights for the Fiscal Quarter Ended August 31, 2006 -- Total

net revenues increased by 31.4% year-over-year to RMB429.3 million

(US$54.0 million) from RMB326.8 million in the first quarter of

fiscal year 2006. -- Net income increased by 100.8% year-over-year

to RMB165.1 million (US$20.8 million) from RMB82.2 million in the

first quarter of fiscal year 2006, and net income excluding

share-based compensation expenses (non-GAAP) increased by 57.5%

year-over-year to RMB170.7 million (US$21.5 million). -- Basic and

diluted earnings per ADS were RMB6.60 (US$0.83) and RMB5.84

(US$0.73), respectively. Excluding share-based compensation

expenses (non-GAAP), basic and diluted earnings per ADS were

RMB6.83 (US$0.86) and RMB6.04 (US$0.76), respectively. Each ADS

represents four common shares. -- Total student enrollments in

language training and test preparation courses increased by 25.9%

year-over-year to approximately 337,400 from approximately 268,000

in the first quarter of fiscal year 2006. -- Opened 7 new schools

in the fiscal quarter bringing the total number of schools and

learning centers to 32 and 115 (including the 32 schools),

respectively, as of August 31, 2006, up from 25 schools and 111

learning centers (including the 25 schools) as of May 31, 2006,

respectively. 'We are very pleased with the results of the first

quarter of our fiscal year 2007,' said New Oriental's Chairman and

Chief Executive Officer, Mr. Michael Yu. 'We saw strong growth in

our student enrollment as we continued to leverage our highly

recognized brand name, leading market position and unparalleled

national network to provide innovative and inspirational

instruction to a growing student base of all ages in China.' New

Oriental's Chief Financial Officer, Mr. Louis T. Hsieh, added, 'Our

recent successful NYSE IPO demonstrates investors' confidence in

the long-term prospects of China's private education market as well

as New Oriental's leading market position.' Mr. Hsieh continued,

'Today, New Oriental operates the largest network of private

schools and learning centers in China, with locations in 31 cities.

In the quarters ahead, we will continue to expand this geographic

network, while increasing student enrollments and educational

program and service offerings in our existing locations. We are

also exploring strategic relationships to help expand our content

distribution channels and educational programs and service

offerings.' Mr. Hsieh further noted that the first quarter of the

Company's fiscal year is typically the strongest quarter in terms

of revenue and net income as a large number of students take

advantage of the summer holiday period to take courses in private

schools. For example, in the first fiscal quarter of 2006 (June 1

to August 31, 2005), the Company generated net revenues of RMB326.8

million compared to net revenues of RMB127.2 million in the second

fiscal quarter (September 1 to November 30, 2005). In addition, net

income for the first fiscal quarter of 2006 was RMB82.2 million

compared to a net loss of RMB8.7 million in the second fiscal

quarter of 2006. Financial Results for the Fiscal Quarter Ended

August 31, 2006 For the first fiscal quarter of 2007, New Oriental

reported net revenues of RMB429.3 million (US$54.0 million),

representing a 31.4% increase year-over-year. Net revenues from

educational programs and services for the first fiscal quarter were

RMB411.9 million (US$51.8 million), representing a 30.8% increase

year-over-year. The growth was mainly driven by the increase in the

number of student enrollments in language training and test

preparation courses. Total student enrollments in language training

and test preparation courses in the first fiscal quarter of 2007

increased by 25.9% year-over-year to approximately 337,400 from

approximately 268,000 in the first quarter of fiscal year 2006.

Total operating costs and expenses for the quarter were RMB249.2

million (US$31.3 million), a 7.7% increase year-over-year. Cost of

revenues increased by 21.9% year-over-year to RMB138.6 million

(US$17.4 million), primarily due to the increased number of courses

offered to a larger student base. Selling and marketing expenses

increased by 61.4% year-over-year to RMB35.7 million (US$4.5

million), primarily due to brand promotion expenses. General and

administrative expenses decreased by 21.7% year-over-year to

RMB74.8 million (US$9.4 million), primarily due to lower

share-based compensation expenses in the first fiscal quarter of

2007 as compared to the corresponding period last year. Excluding

share-based compensation expenses, general and administrative

expenses were comparable to the same period of last fiscal year.

Total share-based compensation expenses, which were allocated to

related operating costs and expenses, decreased to RMB5.7 million

(US$0.7 million) in the first fiscal quarter of 2007 from RMB26.2

million in the first fiscal quarter of 2006. Operating margin for

the quarter was 42.0%, compared to 29.2% in the corresponding

period last year. Excluding share-based compensation expenses

(non-GAAP), operating margin for the quarter would have been 43.3%,

compared to 37.2% in the corresponding period of the prior year.

This increase was primarily due to the improved operating

efficiency as revenue growth outpaced the growth in operating costs

and expenses. Net income for the quarter was RMB165.1 million

(US$20.8 million), representing a 100.8% increase from the first

fiscal quarter of 2006. Basic and diluted earnings per share

amounted to RMB1.65 (US$0.21) and RMB1.46 (US$0.18), respectively,

and basic and diluted earnings per ADS were RMB6.60 (US$0.83) and

RMB5.84 (US$0.73), respectively. Net income excluding share-based

compensation expenses (non-GAAP) was RMB170.7 million (US$21.5

million). Basic and diluted earnings per share excluding

share-based compensation expenses (non-GAAP) were RMB1.71 (US$0.21)

and RMB1.51 (US$0.19), respectively, and basic and diluted earnings

per ADS excluding share-based compensation expenses (non-GAAP) were

RMB6.83 (US$0.86) and RMB6.04 (US$0.76), respectively. Capital

expenditures for the quarter were RMB32.3 million (US$4.1 million).

As of August 31, 2006, New Oriental had cash and cash equivalents

of RMB294.9 million (US$37.1 million). Net operating cash flow for

the first quarter of fiscal year 2007 was RMB139.3 million (US$17.5

million). Outlook for Fiscal Second Quarter 2007 New Oriental

expects its total net revenues in the second quarter of fiscal year

2007 (September 1 to November 30, 2006) to be in the range of

RMB148 million (US$18.6 million) to RMB158 million (US$19.9

million), representing year-over-year growth in the range of 16.5%

to 24.4%, respectively. This forecast reflects New Oriental's

current and preliminary view, which is subject to change. The

Company notes that due to seasonality of the Chinese education

market, the second quarter is normally the slowest period of the

fiscal year, with revenues typically significantly below those of

the first quarter. Conference Call Information New Oriental's

management will host an earnings conference call at 8 AM on October

17, 2006 U.S. Eastern Daylight Time (8 PM on October 17, 2006

Beijing/Hong Kong time). Dial-in details for the earnings

conference call are as follows: US: 1 617 213 8066 Hong Kong: 852

3002 1672 Please dial-in 10 minutes before the call is scheduled to

begin and provide the passcode to join the call. The passcode is

'New Oriental earnings call'. Additionally, a live and archived

webcast of this conference call will be available at

http://investor.neworiental.org/ . About New Oriental New Oriental

is the largest provider of private educational services in China

based on the number of program offerings, total student enrollments

and geographic presence. New Oriental offers a wide range of

educational programs, services and products consisting primarily of

English and other foreign language training, test preparation

courses for major admissions and assessment tests in the United

States, the PRC and Commonwealth countries, primary and secondary

school education, development and distribution of educational

content, software and other technology, and online education. New

Oriental's ADSs, each of which represents four common shares,

currently trade on the New York Stock Exchange under the symbol

'EDU.' Safe Harbor Statement This announcement contains

forward-looking statements. These statements are made under the

'safe harbor' provisions of the U.S. Private Securities Litigation

Reform Act of 1995. These forward-looking statements can be

identified by terminology such as 'will,' 'expects,' 'anticipates,'

'future,' 'intends,' 'plans,' 'believes,' 'estimates' and similar

statements. Among other things, the outlook for second quarter of

fiscal year 2007 and quotations from management in this

announcement, as well as New Oriental's strategic and operational

plans, contain forward-looking statements. New Oriental may also

make written or oral forward-looking statements in its periodic

reports to the U.S. Securities and Exchange Commission in its

annual report to shareholders, in press releases and other written

materials and in oral statements made by its officers, directors or

employees to third parties. Statements that are not historical

facts, including statements about New Oriental's beliefs and

expectations, are forward-looking statements. Forward- looking

statements involve inherent risks and uncertainties. A number of

factors could cause actual results to differ materially from those

contained in any forward-looking statement, including but not

limited to the following: our growth strategies; our future

business development, results of operations and financial

condition; our ability to attract students without a significant

decrease in course fees; our ability to continue to hire, train and

retain qualified teachers; our ability to maintain and enhance our

'New Oriental' brand; our ability to effectively and efficiently

manage the expansion of our school network and successfully execute

our growth strategy; the outcome of ongoing, or any future,

litigation or arbitration, including those relating to copyright

and other intellectual property rights; competition in the private

education sector in China; changes in our revenues and certain cost

or expense items as a percentage of our revenues; the expected

growth of the Chinese private education market; and Chinese

governmental policies relating to private educational services and

providers of such services. Further information regarding these and

other risks is included in our registration statement on Form F-1

and other documents filed with the Securities and Exchange

Commission. New Oriental does not undertake any obligation to

update any forward-looking statement, except as required under

applicable law. All information provided in this press release and

in the attachments is as of October 17, 2006, and New Oriental

undertakes no duty to update such information, except as required

under applicable law. About Non-GAAP Financial Measures To

supplement New Oriental's consolidated financial results presented

in accordance with GAAP, New Oriental uses the following measures

defined as non- GAAP financial measures by the SEC: operating

margin excluding share-based compensation expenses, net income

excluding share-based compensation expenses and basic and diluted

earnings per share and per ADS excluding share-based compensation

expenses. The presentation of these non-GAAP financial measures is

not intended to be considered in isolation or as a substitute for

the financial information prepared and presented in accordance with

GAAP. For more information on these non-GAAP financial measures,

please see the table captioned 'Reconciliations of non-GAAP

measures to the most comparable GAAP measures' set forth at the end

of this release. New Oriental believes that these non-GAAP

financial measures provide meaningful supplemental information

regarding its performance and liquidity by excluding share-based

expenses that may not be indicative of its operating performance

from a cash perspective. New Oriental believes that both management

and investors benefit from referring to these non-GAAP financial

measures in assessing its performance and when planning and

forecasting future periods. These non-GAAP financial measures also

facilitate management's internal comparisons to New Oriental's

historical performance and liquidity. New Oriental computes its

non-GAAP financial measures using the same consistent method from

quarter to quarter. New Oriental believes these non-GAAP financial

measures are useful to investors in allowing for greater

transparency with respect to supplemental information used by

management in its financial and operational decision-making. A

limitation of using non-GAAP net income excluding share-based

compensation expenses, and basic and diluted earnings per share and

per ADS excluding share-based compensation expenses is that these

non-GAAP measures exclude share-based compensation charge that has

been and will continue to be for the foreseeable future a

significant recurring expense in our business. Management

compensates for these limitations by providing specific information

regarding the GAAP amounts excluded from each non-GAAP measure. The

accompanying tables have more details on the reconciliations

between GAAP financial measures that are most directly comparable

to non-GAAP financial measures. (1) This announcement contains

translations of certain RMB amounts into U.S. dollars at specified

rates solely for the convenience of readers. Unless otherwise

noted, all translations from RMB to U.S. dollars are made at a rate

of RMB7.9538 to US$1.00, the effective noon buying rate as of

August 31, 2006 in The City of New York for cable transfers of RMB

as certified for customs purposes by the Federal Reserve Bank of

New York. NEW ORIENTAL EDUCATION & TECHNOLOGY GROUP INC.

CONDENSED CONSOLIDATED BALANCE SHEETS (In thousands) As of August

31 As of May 31 2006 2006 (Unaudited) (Audited) RMB USD RMB ASSETS:

Current assets: Cash and cash equivalents 294,948 37,083 261,854

Restricted cash 3,000 377 3,000 Term deposits 1,000 126 -- Accounts

receivable, net 1,542 194 3,035 Inventory 43,174 5,428 36,418

Prepaid expenses and other current assets 42,974 5,403 35,655 Total

current assets 386,638 48,611 339,962 Property, plant and

equipment, net 712,312 89,556 706,565 Land use right, net 25,318

3,183 25,456 Deposit for acquiring property and equipment -- --

1,175 Amounts due from related parties 2,691 338 8,527 Deferred tax

assets 3,870 487 5,163 Long term prepaid rent 1,038 131 1,077 Trade

mark 1,637 206 1,637 Total assets 1,133,504 142,512 1,089,562

LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities:

Short-term borrowings -- -- 35,000 Accounts payable-trade 51,140

6,430 36,183 Accrued expenses and other current liabilities 128,223

16,121 91,596 Dividend payable -- -- 772 Income tax payable 18,413

2,315 9,151 Current portion of long-term debt 42,998 5,406 47,603

Amount due to related parties 162 20 389 Deferred revenue 135,728

17,065 244,524 Total current liabilities 376,664 47,357 465,218

Long-term debt, less current portion 64,445 8,102 102,638 Total

long-term liabilities 64,445 8,102 102,638 Minority interest 200 25

200 Total liabilities 441,309 55,484 568,056 SHAREHOLDERS' EQUITY

Series A convertible preferred shares (US$0.01 par value;

11,111,111 shares authorized as of August 31, 2006 and May 31,

2006; 11,111,111 and nil shares issued and outstanding as of August

31, 2006 and May 31, 2006) (liquidation value US$22,500) 920 116

920 Common Shares (US$ 0.01 par value; 150,000,000 shares

authorized as of August 31, 2006 and May 31, 2006; 100,000,000

shares issued and outstanding as of August 31, 2006 and May 31,

2006) 8,277 1,041 8,277 Additional paid-in capital 315,208 39,630

309,519 Retained earnings 367,930 46,259 202,871 Accumulated other

comprehensive loss (140) (18) (81) Total shareholders' equity

692,195 87,028 521,506 Total liabilities and shareholders' equity

1,133,504 142,512 1,089,562 NEW ORIENTAL EDUCATION & TECHNOLOGY

GROUP INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (In

thousands except for per share and per ADS amounts) For the Three

Months Ended August 31 2006 2005 (Unaudited) (Unaudited) RMB USD

RMB Net Revenues: Educational programs and services 411,914 51,788

314,821 Books and others 17,419 2,190 12,021 Total net revenues

429,333 53,978 326,842 Operating costs and expenses (note 1): Cost

of revenues 138,637 17,430 113,773 Selling and marketing 35,732

4,492 22,141 General and administrative 74,790 9,403 95,489 Total

operating costs and expenses 249,159 31,325 231,403 Operating

income 180,174 22,653 95,439 Other income (expenses),net (1,917)

(241) (3,136) Income tax expense (13,198) (1,659) (17,901) Minority

interest, net of tax -- -- (12) Income from continuing operations

165,059 20,753 74,390 Income on discontinued operations -- -- 7,811

Net Income 165,059 20,753 82,201 Net income per share-basic 1.65

0.21 0.82 Net income per share-diluted 1.46 0.18 0.74 Net income

per ADS-basic (note 2) 6.60 0.83 3.28 Net income per ADS-diluted

(note 2) 5.84 0.73 2.96 Notes: Note 1: Share-based compensation

expenses are included in the operating costs and expenses as

follows: For the Three Months Ended August 31 2006 2005 (Unaudited)

(Unaudited) RMB USD RMB Cost of revenues 143 18 65 Selling and

marketing 99 12 793 General and administrative 5,447 685 25,367

Note 2: Each ADS represents four common shares. NEW ORIENTAL

EDUCATION & TECHNOLOGY GROUP INC. RECONCILIATION OF NON-GAAP

MEASURES TO THE MOST COMPARABLE GAAP MEASURES (In thousands except

share and per ADS amounts) For the Three Months Ended August 31

2006 2005 (Unaudited) (Unaudited) RMB USD RMB GAAP net income

165,059 20,752 82,201 Share-based compensation expense 5,689 715

26,225 Non-GAAP net income 170,748 21,467 108,426 GAAP net income

per ADS - basic (note 1) 6.60 0.83 3.28 GAAP net income per ADS -

diluted (note 1) 5.84 0.73 2.96 Non-GAAP net income per ADS - basic

(note 1) 6.83 0.86 4.34 Non-GAAP net income per ADS - diluted (note

1) 6.04 0.76 3.90 Shares used in calculated basic net income per

ADS (note 1) 100,000,000 100,000,000 100,000,000 Shares used in

calculated diluted net income per ADS (note 1) 113,131,319

113,131,319 111,111,111 Note 1: Each ADS represents four common

shares. For more information, please contact: In China: Ms. Sisi

Zhao New Oriental Education and Technology Group Inc. Tel:

+86-10-6260-5566 x8203 Email: Mr. Rory Macpherson Ogilvy Public

Relations Worldwide Tel: +86-10-8520-6553 Email: In the United

States: Mr. Thomas Smith Ogilvy Public Relations Worldwide Tel:

+1-212-880-5269 Email: DATASOURCE: New Oriental Education &

Technology Group Inc. CONTACT: In China - Ms. Sisi Zhao of New

Oriental Education and Technology Group Inc., +86-10-6260-5566

x8203, or ; or Mr. Rory Macpherson of Ogilvy Public Relations

Worldwide, +86-10-8520-6553, or ; or In the United States - Mr.

Thomas Smith of Ogilvy Public Relations Worldwide, +1-212-880-5269,

or Web Site: http://investor.neworiental.org/

Copyright

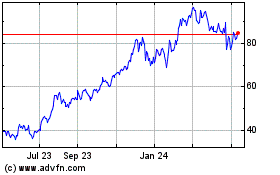

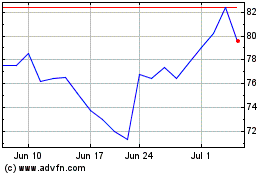

New Oriental Education a... (NYSE:EDU)

Historical Stock Chart

From May 2024 to Jun 2024

New Oriental Education a... (NYSE:EDU)

Historical Stock Chart

From Jun 2023 to Jun 2024