New Jersey Resources (NYSE: NJR) today reported earnings for the

third quarter and first nine months of fiscal 2011 and reaffirmed

its net financial earnings guidance for fiscal 2011.

A reconciliation of NJR’s net income to net financial earnings

for the three and nine months ended June 30 in fiscal years 2011

and 2010 is provided below:

Three Months Ended Nine Months Ended

June 30, June 30, (Thousands)

2011 2010

2011 2010

Net income (loss) $ 20,374 $

(10,177 )

$ 108,810 $ 115,942 Add:

Unrealized (gain) loss on

derivativeinstruments and related transactions, netof taxes

(2,875 ) 15,886

33,835 3,936

Effects of economic hedging related

tonatural gas inventory, net of taxes

(7,800 ) 5,878

(36,787 ) (16,867 )

Net financial

earnings $ 9,699 $ 11,587

$

105,858 $ 103,011

Weighted Average

Shares Outstanding Basic

41,381 41,239

41,338

41,424 Diluted

41,597 41,239

41,551 41,703

Basic

earnings (loss) per share $ 0.49 $ (0.25 )

$ 2.63 $ 2.80

Basic net financial

earnings per share $ 0.23 $ 0.28

$ 2.56 $ 2.49

Net financial earnings is a financial measure not calculated in

accordance with generally accepted accounting principles (GAAP) of

the United States as it excludes all unrealized, and certain

realized, gains and losses associated with derivative instruments.

For further discussion of this financial measure, as well as

reconciliation to the most comparable GAAP measure, please see the

explanation below under “Additional Non-GAAP Financial

Information.”

- NJR Year-to-Date Net Financial

Earnings Per Share Increase 2.8 Percent

Year-to-date net financial earnings at NJR totaled $105.9

million, or $2.56 per share, compared with $103 million, or $2.49

per share, during the same period last year. The increased earnings

were driven by improved results at New Jersey Natural Gas,

Midstream Assets and NJR Home Services as well as investment tax

credits generated from solar investments at NJR Clean Energy

Ventures. For the three-month period ended June 30, 2011, net

financial earnings were $9.7 million, compared with $11.6 million

during the same period last year. The decrease was due primarily to

expected lower results from NJR Energy Services partially offset by

improved contributions from NJR Clean Energy Ventures and NJR Home

Services.

“The steady performance of our core business, New Jersey Natural

Gas, and our solar investments have put us on a firm track to

achieve our 20th consecutive year of improved financial results,”

said Laurence M. Downes, chairman and CEO of New Jersey Resources.

“Our infrastructure-based businesses are expected to contribute up

to 90 percent of fiscal 2011 net financial earnings. As always, I

thank our employees for their leadership and dedication, which

continues to drive our ability to meet the needs of our

stakeholders.”

- Lower End of Net Financial Earnings

Guidance Raised

Subject to the risks and uncertainties identified below under

“Forward-Looking Statements,” NJR is adjusting its fiscal 2011 net

financial earnings guidance to $2.55 to $2.65, from the previously

announced range of $2.50 to $2.65 per basic share. The increase to

the lower end of the range reflects continued strong results at New

Jersey Natural Gas as well as better-than-expected results at NJR

Energy Services, resulting from recent increased volatility in the

wholesale natural gas markets due to hot weather in July and the

impact of a tax settlement. The following chart represents the

expected contributions from NJR subsidiaries:

Company

Expected Fiscal 2011 Net Financial Earnings

Contribution New Jersey Natural Gas

65 to 70 percent NJR Clean Energy Ventures

10 to 20 percent NJR Energy Services

10 to 20 percent Midstream Assets

5 to 10 percent NJR Home Services

2 to 5 percent

- New Jersey Resources Board of

Directors Declares Dividend

On July 13, 2011, the board of directors of NJR unanimously

declared a quarterly dividend on its common stock of $.36 per

share. The dividend will be paid on October 3, 2011, to shareowners

of record on September 15, 2011. NJR has paid quarterly dividends

continuously since the company’s inception in 1952.

- New Jersey Natural Gas Earnings

Remain Strong

At New Jersey Natural Gas (NJNG), the company’s regulated

utility subsidiary, fiscal 2011 year-to-date net income was $74.4

million, compared with $70.1 million for the first nine months of

2010, an increase of 6.1 percent. This increase was due primarily

to customer growth and incentive programs, as well as the continued

impact of accelerated infrastructure programs. Net income in the

third quarter of fiscal 2011 was $6 million, compared with $6.1

million in the same period last year.

During the first nine months of fiscal 2011, NJNG added 4,610

new customers, compared with 3,938 through the same period last

year, an increase of 17 percent. An additional 453 existing

non-heat customers converted to natural gas heat. In total, these

new customers are expected to contribute approximately $2.4 million

to utility gross margin annually. NJNG is on target to add

approximately 12,000 to 14,000 new customers during fiscal years

2011 and 2012 combined. (For more information on utility gross

margin, please see Non-GAAP Financial Information below.)

NJNG’s gross margin-sharing incentive programs, which include

off-system sales, capacity release, storage optimization and

financial risk management programs, generated $7.7 million of gross

margin for the nine month period ended June 30, 2011, compared with

$7.4 million for the same period last year. The increase in gross

margin was due primarily to an increase in capacity release

volumes. NJNG shares the gross margin earned from these incentive

programs with customers and shareowners, according to a gross

margin-sharing formula authorized by the New Jersey Board of Public

Utilities (BPU). On July 25, 2011, NJNG, the BPU and Rate Counsel

executed a Stipulation to extend NJNG’s margin-sharing incentive

programs for four years through October 31, 2015, under the same

terms of its previous agreement with respect to margin-sharing

percentages. This agreement also permits NJNG to annually propose a

process to evaluate and discuss alternative incentive programs. BPU

approval is expected before the beginning of fiscal 2012.

- Accelerated Infrastructure Program

Ensures Safety; Benefits State Economy

Designed to expedite previously planned capital expenditures,

NJNG’s Accelerated Infrastructure Program (i.e., AIP I and AIP II)

continues to help ensure the safety and integrity of the company’s

distribution system. Several of the 14 approved AIP I projects have

been completed to date, representing an investment of $67.8 million

of the overall approved cost of $70.8 million, with completion of

the remaining AIP I projects expected by late summer 2011.

Additional projects under AIP II, which was approved on March

30, 2011, will begin no later than December 31, 2011, with an

expected completion date of October 31, 2012. NJNG expects to

invest $60.2 million of capital investment in nine new projects and

immediately earn an overall return of 7.12 percent, which includes

a 10.3 percent return on equity.

On June 1, 2011, NJNG filed with the BPU for an increase of $4.7

million for recovery of expenditures associated with the capital

investments made under AIP I and AIP II. It is expected that these

AIP I and AIP II projects will also lend significant support to New

Jersey’s economy directly through the creation of construction jobs

and indirectly through the creation of jobs to meet the demand for

ancillary services related to the increased construction

activity.

- New Jersey Natural Gas Regulatory

Update

Recently, NJNG submitted a series of filings to the BPU, which

included changes to its Conservation Incentive Program, AIP (as

discussed above) and Basic Gas Supply Service (BGSS) that would

result in an overall decrease of 9.3 percent in the average

residential heating customer’s bill, effective October 1, 2011. Any

change in the BGSS has no effect on NJNG’s earnings.

On June 16, 2011, NJNG submitted a filing with the BPU seeking

authority to invest up to $15 million to build between seven and 10

compressed natural gas vehicle refueling stations in Monmouth,

Ocean and Morris counties.

“By making natural gas more accessible to the transportation

sector, we can give our state and its residents a cleaner, more

environmentally friendly, alternative fuel choice,” said Laurence

M. Downes, chairman and CEO of New Jersey Resources. “As demand for

alternative fuel vehicles increases, we not only reduce our

dependency on imported petroleum-based fuels, we also help to

preserve our natural resources by lowering greenhouse gas

emissions.”

The construction of the new refueling infrastructure would

support the economy through job opportunities for local equipment

manufacturers, suppliers and other businesses. If approved, NJNG

would begin construction of these stations immediately.

Costs associated with this project would be recovered as

incurred at NJNG’s weighted average cost of capital of 7.76

percent, which includes a 10.3 percent return on equity. Proceeds

from the delivery of the associated natural gas, along with any

available federal and state incentives, will be credited back to

the customers to help offset the cost of this investment.

Finally, on July 15, 2011, NJNG submitted a filing to the BPU

requesting approval to extend its highly successful The SAVEGREEN

Project® through December 31, 2012. Since its launch in 2009,

SAVEGREEN has invested over $20 million in the local economy

through rebates and incentives, including 9,400 high-efficiency

rebates, and has completed 9,300 energy audits. These customer

incentives and rebates are recovered through a rider mechanism for

up to five years and earn a return at NJNG’s weighted average cost

of capital of 7.76 percent, including a 10.3 percent return on

equity.

- NJR Clean Energy Ventures Announced

Three New Commercial Solar Projects; The Sunlight

AdvantageTM Residential Solar Lease Program Continues

to Grow

Currently, NJR Clean Energy Ventures (NJRCEV) has four

operational commercial solar projects, totaling approximately 4

megawatts. Since going into service, these buildings have generated

880 Solar Renewable Energy Certificates (SRECs).

Additionally, in the third quarter of fiscal 2011, NJRCEV

announced three new commercial solar projects with an aggregate

generating capacity of over 22 megawatts, representing a capital

investment of over $100 million.

NJRCEV will invest $18 million in its first ground-mounted solar

system, a 3.6 megawatt project in Manalapan, N.J. The power

generated by the system will be used to serve the wholesale

electric market. An additional $23.7 million will be invested to

develop, own and operate a 4.7 megawatt, ground-mounted solar

system in Vineland, N.J. The solar array is expected to produce 7.2

million kilowatt-hours annually. Both the Manalapan and Vineland

projects are expected to be operational in the fall of 2011.

NJRCEV will invest $60 million to develop a ground-mounted solar

array on the East Windsor, N.J., campus of McGraw Hill. This 14.1

megawatt system will be the largest privately-owned, net-metered

solar system in the Western Hemisphere. NJRCEV expects the project

to be completed in two phases, with 50 percent capacity expected to

be operational in December 2011, and the remainder in March

2012.

The Sunlight AdvantageTM, NJR’s residential solar lease program

has executed 466 leases since its inception in January 2011. With

an average system size of 7.6 kilowatts each, the leases represent

a potential capital investment of approximately $14.4 million, of

which approximately $9.4 million is expected to be invested in

fiscal 2011.

“We are committed to renewable energy and the opportunities it

presents for our shareowners, customers and state,” said Laurence

M. Downes, chairman and CEO of New Jersey Resources. “The

development of these three new solar sites, along with our existing

commercial and residential solar projects, is a perfect fit with

our core energy strategy.”

Fiscal year-to-date earnings for NJRCEV totaled $5.5 million of

which $6.8 million related to investment tax credits associated

with qualifying solar projects. NJR’s annual effective tax rate

will be significantly influenced by the amount of investment tax

credits earned during the fiscal year. GAAP requires NJR to

estimate its annual effective tax rate and use this rate to

calculate its year-to-date tax expense/benefit. The estimate is

based on information and assumptions, which are subject to change,

and which may have a material impact on quarterly and annual net

financial earnings. Factors considered by management in estimating

completion of projects during the fiscal year include, but are not

limited to, board of directors’ approval, execution of various

contracts, including power purchase agreements, construction

logistics, permitting and interconnection completion. See the

“Forward-Looking Statements” section of this news release for

further information regarding the inherent risks associated with

solar investments.

- NJR Energy Services Third-Quarter

Results

Net financial earnings at NJR Energy Services (NJRES), the

wholesale energy services subsidiary of NJR, were $19.4 million

during the first nine months of fiscal 2011, compared with $29.3

million in the same period last year. Net financial earnings for

the third quarter of fiscal 2011 were $213,000 compared with $3.3

million in the same period in 2010. The expected decrease in both

periods reflects the lack of opportunity to generate margin from

the optimization of transportation and storage assets due primarily

to an increased supply of natural gas in the northeast market area.

NJRES is currently expected to contribute between 10 and 20 percent

of consolidated net financial earnings in fiscal 2011. During the

third quarter of fiscal 2011, NJRES recognized a $2.4 million tax

benefit, net of federal taxes and fees, resulting from a settlement

with the state of New Jersey for tax years 2004 through 2007

regarding income earned outside the state. This settlement

effectively concludes all outstanding tax disputes related to this

matter.

- Growth Continues at Midstream

Assets

Net income for the first nine months of fiscal 2011 at Midstream

Assets, the company’s natural gas storage and pipeline segment,

were $5.7 million compared with $5.2 million during the same period

in 2010. The Midstream Assets segment consists of Steckman Ridge, a

12 Bcf working natural gas storage facility in southwestern

Pennsylvania, which contributed $3.5 million, and a 5.53 percent

equity investment in Iroquois Pipeline, which contributed $2.2

million.

- NJR Home Services Announces Higher

Results

Net financial earnings for NJR’s Retail and Other, which

consists primarily of NJR Home Services (NJRHS), the company’s

appliance service subsidiary, greatly improved during the first

nine months of fiscal 2011. Fiscal year-to-date earnings at NJRHS

were $568,000 compared with a loss of $1.1 million in the same

period last year. For the three months ended June 30, 2011,

earnings at NJRHS were $1.3 million compared with $587,000 in the

third quarter of fiscal 2010. The increase in both periods was due

primarily to aggressive marketing of comprehensive Premier Service

Plans and equipment installations as well as operational

improvements. Prior year results also included an after-tax charge

of $237,000 associated with Medicare Part D as a result of the

Patient Protection and Affordable Care Act enacted in March

2010.

Webcast Information

NJR will host a live webcast to discuss its financial results

today at 9 a.m. ET. A few minutes prior to the webcast, go to

www.njliving.com and select “New Jersey Resources” from the top

navigation bar. Choose “Investor Relations,” then click just below

the microphone under the heading “Latest Webcast” on the Investor

Relations home page.

Forward-Looking

Statements

This news release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

NJR cautions readers that the assumptions forming the basis for

forward-looking statements include many factors that are beyond

NJR’s ability to control or estimate precisely, such as estimates

of future market conditions and the behavior of other market

participants. Other factors that could cause actual results to

differ materially from the company’s expectations include, but are

not limited to, weather; economic conditions; NJR dependence on

operating subsidiaries; demographic changes in NJNG’s service

territory; rate of customer growth; volatility of natural gas

commodity prices and its impact on customer usage, NJRES operations

and the company’s risk management efforts; changes in rating agency

requirements and/or credit ratings and their effect on availability

and cost of capital to the company; the impact of volatility in the

credit markets that would result in the increased cost and/or limit

the availability of credit at NJR to fund and support physical gas

inventory purchases and other working capital needs at NJRES, and

all other non-regulated subsidiaries, as well as negatively affect

cost and access to the commercial paper market and other short-term

financing markets by NJNG to allow it to fund its commodity

purchases, capital expenditures and meet its short-term obligations

as they come; the company’s ability to comply with debt covenants;

continued failures in the market for auction rate securities; the

impact to the asset values and resulting higher costs and funding

obligations of NJR’s pension and post-employment benefit plans as a

result of downturns in the financial market, and the impacts

associated with the Patient Protection and Affordable Care Act; the

ability to maintain effective internal controls; accounting effects

and other risks associated with hedging activities and use of

derivatives contracts; commercial and wholesale credit risk,

including the availability of creditworthy customers and

counterparties and liquidity in the wholesale energy trading

market; the company’s ability to obtain governmental approvals

and/or financing for the construction, development and operation of

its non-regulated energy investments; risks associated with our

investments in solar energy projects, including the availability of

regulatory and tax incentives, logistical risk and potential delays

related to construction, permitting, regulatory approvals and

electric grid interconnection, the availability of viable projects

and NJR’s eligibility for federal investment tax credits (ITCs) and

the future market for Solar Renewable Energy Certificates (SRECs)

that are traded in a competitive marketplace in the state of New

Jersey; risks associated with the calculation of NJR’s effective

tax rate; risks associated with the management of the company’s

joint ventures and partnerships; the level and rate at which costs

and expenses are incurred and the extent to which they are allowed

to be recovered from customers through the regulatory process in

connection with constructing, operating and maintain NJNG’s natural

gas transmission and distribution system; dependence on third-party

storage and transportation facilities for natural gas supply;

operational risks incidental to handling, storing, transporting and

providing customers with natural gas; access to adequate supplies

of natural gas; the regulatory and pricing policies of federal and

state regulatory agencies; the cost of compliance with present and

future environmental law, including potential climate

change-related legislation; the ultimate outcome of pending

regulatory proceedings, the disallowance of recovery of

environmental-related expenditures and other regulatory changes;

and environmental-related and other litigation and other

uncertainties. NJR does not, by including this paragraph, assume

any obligation to review or revise any particular forward-looking

statement referenced herein in light of future events. More

detailed information about these factors is set forth under the

heading “Risk Factors” in NJR’s filings with the Securities and

Exchange Commission (SEC) including its most recent Form 10-K and

its Form 10-Q for the quarter ended March 31, 2011.

Non-GAAP Financial

Information

This press release includes the non-GAAP measures net financial

earnings (losses), financial margin and utility gross margin. A

reconciliation of these non-GAAP financial measures to the most

directly comparable financial measures calculated and reported in

accordance with GAAP, can be found below. As an indicator of the

company’s operating performance, these measures should not be

considered an alternative to, or more meaningful than, operating

income as determined in accordance with GAAP.

Net financial earnings (losses) and financial margin exclude

unrealized gains or losses on derivative instruments related to the

company’s unregulated subsidiaries and certain realized gains and

losses on derivative instruments related to natural gas that has

been placed into storage at NJRES. Volatility associated with the

change in value of these financial and physical commodity contracts

is reported in the income statement in the current period. In order

to manage its business, NJR views its results without the impacts

of the unrealized gains and losses, and certain realized gains and

losses, caused by changes in value of these financial instruments

and physical commodity contracts prior to the completion of the

planned transaction because it shows changes in value currently as

opposed to when the planned transaction ultimately is settled.

NJNG’s utility gross margin represents the results of revenues less

natural gas costs, sales and other taxes and regulatory rider

expenses, which are key components of the company’s operations that

move in relation to each other. Management uses these non-GAAP

financial measures as supplemental measures to other GAAP results

to provide a more complete understanding of the company’s

performance. Management believes these non-GAAP measures are more

reflective of the company’s business model, provide transparency to

investors and enable period-to-period comparability of financial

performance. A reconciliation of all non-GAAP financial measures to

the most directly comparable financial measures calculated and

reported in accordance with GAAP, can be found below. For a full

discussion of NJR’s non-GAAP financial measures, please see NJR’s

most recent Form 10-K, Item 7.

About New Jersey

Resources

New Jersey Resources, a Fortune 1000 company, provides safe,

reliable and natural gas services and renewable energy including

transportation, distribution and asset management in states from

the Gulf Coast to the New England regions, including the

Mid-Continent region, the West Coast and Canada, while investing in

and maintaining an extensive infrastructure to support future

growth. With over $2.5 billion in annual revenues, NJR safely and

reliably operates and maintains 6,800 miles of natural gas

transportation and distribution infrastructure to serve nearly half

a million customers; develops and manages a diverse portfolio of

1.54 Bcf/day of firm transportation and over 59 Bcf of firm storage

capacity; offers low carbon solutions of clean energy through its

commercial and residential solar programs, and provides appliance

installation, repair and contract service to nearly 150,000 homes

and businesses. Additionally, NJR holds investments in midstream

assets through equity partnerships including Steckman Ridge and

Iroquois. Through Conserve to Preserve®, NJR is helping customers

save energy and money by promoting conservation and encouraging

efficiency. For more information about NJR, visit

www.njliving.com.

RECONCILIATION OF NON-GAAP PERFORMANCE

MEASURES NEW JERSEY RESOURCES

A

reconciliation of Net income at NJR to net financial earnings, is

as follows: Three Months Ended Nine Months

Ended June 30, June 30, (Thousands)

2011

2010

2011 2010 Net income (loss)

$ 20,374 $

(10,177 )

$ 108,810 $ 115,942 Add: Unrealized (gain)

loss on derivative instruments and related transactions, net of

taxes

(2,875 ) 15,886

33,835 3,936 Effects of

economic hedging related to natural gas, net of taxes

(7,800 ) 5,878

(36,787

) (16,867 )

Net financial earnings $

9,699 $ 11,587

$ 105,858

$ 103,011

Weighted Average Shares Outstanding

Basic

41,381 41,239

41,338 41,424 Diluted

41,597 41,239

41,551

41,703

Basic net financial earnings

per share $ 0.23 $ 0.28

$

2.56 $ 2.49

NJR ENERGY

SERVICES The following table is a computation of

financial margin at Energy Services: Three Months

Ended Nine Months Ended June 30, June 30,

(Thousands)

2011 2010

2011 2010 Operating revenues

$ 500,413 $ 364,800

$ 1,504,262 $

1,207,166 Less: Gas purchases

483,017 393,166

1,461,009 1,125,160 Add: Unrealized (gain) loss on

derivative instruments and related transactions

(4,612

) 26,068

53,393 2,833 Effects of economic hedging

related to natural gas inventory

(12,335 )

10,245

(58,178 ) (26,641

)

Financial margin $ 449 $ 7,947

$ 38,468 $ 58,198

A

reconciliation of Operating income at Energy Services, the closest

GAAP financial measurement, to the financial margin is as

follows: Three Months Ended Nine Months

Ended June 30, June 30, (Thousands)

2011

2010

2011 2010 Operating income (loss)

$

13,071 $ (31,721 )

$ 31,822 $ 70,674 Add:

Operation and maintenance expense

4,055 3,268

10,535

10,246 Depreciation and amortization

15 37

46 136

Other taxes

255 50

850 950 Subtotal – Gross margin

17,396 (28,366 )

43,253 82,006 Add: Unrealized (gain)

loss on derivative instruments and related transactions

(4,612 ) 26,068

53,393 2,833 Effects of

economic hedging related to natural gas inventory

(12,335 ) 10,245

(58,178

) (26,641 )

Financial margin $

449 $ 7,947

$ 38,468 $

58,198

A reconciliation of Energy Services Net

income to net financial earnings, is as follows:

Three Months Ended Nine Months Ended June 30,

June 30, (Thousands)

2011 2010

2011 2010 Net

income (loss)

$ 10,930 $ (18,823 )

$

22,407 $ 44,262 Add: Unrealized (gain) loss on derivative

instruments and related transactions, net of taxes

(2,917

) 16,281

33,761 1,952 Effects of economic hedging

related to natural gas, net of taxes

(7,800 )

5,878

(36,787 ) (16,867 )

Net financial earnings $ 213 $ 3,336

$ 19,381 $ 29,347

RETAIL AND OTHER A reconciliation of Retail and

Other Net income to net financial earnings, is as follows:

Three Months Ended Nine Months Ended June

30, June 30, (Thousands)

2011 2010

2011

2010 Net income (loss)

$ 1,401 $ 725

$

913 $ (3,481 ) Add: Unrealized (gain) loss on derivative

instruments, net of taxes

- (411 )

- 1,840

Net financial

earnings (loss) $ 1,401 $ 314

$ 913 $ (1,641 )

NEW

JERSEY RESOURCES

CONSOLIDATED STATEMENTS OF

INCOME Three Months Ended Nine Months

Ended June 30, June 30, (Thousands, except per

share data)

2011 2010

2011 2010

OPERATING

REVENUES Utility

$ 138,149 $ 105,130

$

862,073 $ 794,311 Nonutility

510,020

374,764

1,476,235 1,213,475 Total

operating revenues

648,169 479,894

2,338,308 2,007,786

OPERATING EXPENSES

Gas purchases Utility

74,385 47,665

469,835 478,719

Nonutility

482,735 393,126

1,460,600 1,114,842

Operation and maintenance

38,811 37,077

114,123

110,386 Regulatory rider expenses

6,518 6,160

47,520

41,017 Depreciation and amortization

8,514 8,136

25,445 23,936 Energy and other taxes

10,024

6,516

60,138 50,275 Total

operating expenses

620,987 498,680

2,177,661 1,819,175

OPERATING INCOME

(LOSS) 27,182 (18,786 )

160,647 188,611 Other

income

1,176 1,311

2,426 3,458 interest expense, net

4,744 5,238

15,085

15,946

INCOME (LOSS) BEFORE INCOME TAXES AND EQUITY IN EARNINGS

OF AFFILIATES 23,614 (22,713 )

147,988 176,123

Income tax provision (benefit)

6,197 (10,555 )

48,662

68,066 Equity in earnings of affiliates

2,957

1,981

9,484 7,885

NET INCOME

(LOSS) $ 20,374 $ (10,177 )

$

108,810 $ 115,942

EARNINGS (LOSS) PER COMMON

SHARE BASIC

$ 0.49 $ (0.25 )

$ 2.63

$ 2.80 DILUTED

$ 0.49 $ (0.25 )

$ 2.62

$ 2.78

DIVIDENDS PER COMMON SHARE $

0.36 $ 0.34

$ 1.08 $ 1.02

AVERAGE SHARES OUTSTANDING BASIC

41,381 41,239

41,338 41,424 DILUTED

41,597 41,239

41,551 41,703

NEW JERSEY RESOURCES

Three Months Ended

Nine Months Ended June 30, June 30,

(Thousands, except per share data)

2011 2010

2011 2010

Operating Revenues Natural

Gas Distribution

$ 138,149 $ 105,130

$

862,073 $ 802,358 Energy Services

500,413 364,800

1,504,262 1,207,166 Midstream Assets

- -

- -

Clean Energy Ventures

328 -

328 - Retail and Other

10,951 10,058

26,903 19,803

Sub-total

649,841 479,988

2,393,566 2,029,327 Eliminations

(1,672 ) (94 )

(55,258

) (21,541 )

Total $ 648,169

$ 479,894

$ 2,338,308 $

2,007,786

Operating Income (Loss)

Natural Gas Distribution

$ 11,799 $ 11,114

$

127,800 $ 120,798 Energy Services

13,071 (31,721 )

31,822 70,674 Midstream Assets

(186 ) (138 )

(464 ) (590 ) Clean Energy Ventures

(624

) -

(2,103 ) - Retail and Other

2,034 1,209

658

(5,068 )

Sub-total 26,094 (19,536 )

157,713 185,814 Eliminations

1,088

750

2,934 2,797

Total $ 27,182 $ (18,786 )

$

160,647 $ 188,611

Equity in

Earnings of Affiliates Midstream Assets

$ 3,891 $

2,538

$ 11,871 $ 10,261 Eliminations

(934 ) (557 )

(2,387 )

(2,376 )

Total $ 2,957 $ 1,981

$ 9,484 $ 7,885

Net Income (Loss) Natural Gas Distribution

$

5,979 $ 6,109

$ 74,375 $ 70,087 Energy

Services

10,930 (18,823 )

22,407 44,262 Midstream

Assets

1,847 1,828

5,705 5,218 Clean Energy Ventures

259 -

5,484 - Retail and Other

1,401

725

913 (3,481 )

Sub-total 20,416 (10,161 )

108,884 116,086

Eliminations

(42 ) (16 )

(74 ) (144 )

Total $

20,374 $ (10,177 )

$ 108,810 $

115,942

Net Financial Earnings (Loss)

Natural Gas Distribution

$ 5,979 $ 6,109

$

74,375 $ 70,087 Energy Services

213 3,336

19,381 29,347 Midstream Assets

1,847 1,828

5,705 5,218 Clean Energy Ventures

259 -

5,484

- Retail and Other

1,401 314

913 (1,641 )

Total $

9,699 $ 11,587

$ 105,858

$ 103,011

Throughput (Bcf) NJNG, Core

Customers

9.9 8.8

63.1 57.9 NJNG, Off System/Capacity

Management

23.5 16.1

79.2 60.2 NJRES Fuel Mgmt. and

Wholesale Sales

117.9 90.6

348.5 255.0

Total

151.3 115.5

490.8

373.1

Common Stock Data

Yield at June 30

3.2 % 3.9 %

3.2 % 3.9

% Market Price High

$ 46.29 $ 39.01

$

46.29 $ 39.01 Low

$ 41.22 $ 34.07

$

38.94 $ 33.49 Close at June 30

$ 44.61 $ 35.20

$ 44.61 $ 35.20 Shares Out. at June 30

41,392

41,201

41,392 41,201 Market Cap. at June 30

$

1,846,497 $ 1,450,275

$

1,846,497 $ 1,450,275

NATURAL

GAS DISTRIBUTION Three Months Ended Nine

Months Ended (Unaudited)

June 30, June 30,

(Thousands, except customer & weather data)

2011 2010

2011 2010

Utility Gross

Margin Operating revenues

$ 138,149 $ 105,130

$ 862,073 $ 802,358 Less: Gas purchases

76,772

48,401

527,371 492,489 Energy and other taxes

7,826

4,738

53,604 43,955 Regulatory rider expense

6,518 6,183

47,520

41,103

Total Utility Gross Margin $

47,033 $ 45,808

$ 233,578

$ 224,811

Utility Gross Margin and Operating

Income Residential

$ 28,725 $ 28,556

$

152,282 $ 150,384 Commercial, Industrial & Other

8,568 8,530

38,461 38,202 Firm Transportation

8,103 6,613

34,869

28,573

Total Firm Margin 45,396 43,699

225,612 217,159 Interruptible

113

103

287 265

Total System Margin 45,509 43,802

225,899

217,424 Off System/Capacity Management/FRM/Storage Incentive

1,524 2,006

7,679

7,387

Total Utility Gross Margin 47,033

45,808

233,578 224,811 Operation and maintenance expense

26,129 25,856

78,072 77,551 Depreciation and

amortization

8,192 7,939

24,650 23,321 Other taxes

not reflected in gross margin

913 899

3,056 3,141

Operating

Income $ 11,799 $ 11,114

$

127,800 $ 120,798

Throughput

(Bcf) Residential

5.0 4.6

39.6 37.5 Commercial,

Industrial & Other

1.0 0.9

7.7 7.6 Firm

Transportation

1.7 1.3

11.0 9.0

Total Firm Throughput

7.7 6.8

58.3 54.1 Interruptible

2.2

2.0

4.8 3.8

Total System Throughput 9.9 8.8

63.1 57.9 Off

System/Capacity Management

23.5 16.1

79.2 60.2

Total

Throughput 33.4 24.9

142.3 118.1

Customers

Residential

430,468 439,659

430,468 439,659

Commercial, Industrial & Other

26,259 26,957

26,259 26,957 Firm Transportation

38,485

24,052

38,485

24,052

Total Firm Customers 495,212 490,668

495,212 490,668 Interruptible

43

45

43 45

Total System

Customers 495,255 490,713

495,255 490,713 Off

System/Capacity Management*

37 52

37 52

Total

Customers 495,292 490,765

495,292 490,765 *The number of

customers represents those active during the last month of the

period.

Degree Days Actual

389 338

4,662 4,338

Normal

551 561

4,681 4,706 Percent of Normal

70.6 % 60.2 %

99.6 %

92.2 %

ENERGY SERVICES Three

Months Ended Nine Months Ended (Unaudited)

June

30, June 30, (Thousands, except customer and megawatt)

2011 2010

2011 2010

Operating Income Operating Revenues

$ 500,413

$ 364,800

$ 1,504,262 $ 1,207,166 Gas Purchases

483,017 393,166

1,461,009 1,125,160

Gross Margin

17,396 (28,366 )

43,253 82,006 Operation and

maintenance expense

4,055 3,268

10,535 10,246

Depreciation and amortization

15 37

46 136 Energy and

other taxes

255 50

850 950

Operating Income (Loss)

$ 13,071 $ (31,721 )

$ 31,822

$ 70,674

Net Income (Loss) $

10,930 $ (18,823 )

$ 22,407 $

44,262

Financial Margin $ 449

$ 7,947

$ 38,468 $ 58,198

Net Financial Earnings $ 213 $

3,336

$ 19,381 $ 29,347

Gas Sold and Managed (Bcf) 117.9

90.6

348.5 255.0

MIDSTREAM ASSETS Equity in Earnings of

Affiliates $ 3,891 $ 2,538

$

11,871 $ 10,261

Operation and

Maintenance $ 127 $ 137

$

402 $ 586

Interest Expense

$ 803 $ 380

$ 2,428

$ 2,037

Net Income $

1,847 $ 1,828

$ 5,705 $

5,218

CLEAN ENERGY VENTURES

Operating Revenues $ 328 $

- $ 328 $ -

Operating (Loss) $ (624 ) $ -

$ (2,103 ) $ -

Net Income

$ 259 $ -

$ 5,484

$ -

Solar Renewable Energy Certificates

Generated 880 -

880 - Megawatts

Installed 0.6 -

2.7 - Megawatts

Under Construction 27.8 -

27.8 -

RETAIL AND OTHER Operating Revenues

$ 10,951 $ 10,058

$

26,903 $ 19,803

Operating Income

(Loss) $ 2,034 $ 1,209

$

658 $ (5,068 )

Net Income (Loss)

$ 1,401 $ 725

$ 913

$ (3,481 )

Net Financial Earnings (Loss)

$ 1,401 $ 314

$ 913

$ (1,641 )

Total Customers at June 30

135,937 147,893

135,937

147,893

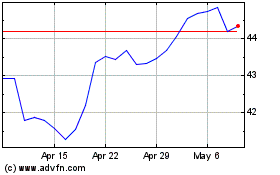

New Jersey Resources (NYSE:NJR)

Historical Stock Chart

From May 2024 to Jun 2024

New Jersey Resources (NYSE:NJR)

Historical Stock Chart

From Jun 2023 to Jun 2024