New Jersey Resources (NYSE:NJR) today reported earnings for the

third quarter and first nine months of fiscal 2010 and reaffirmed

its net financial earnings guidance.

A reconciliation of NJR’s net income to net financial earnings

for the three and nine months ended June 30 in fiscal years 2010

and 2009 is provided below:

Three Months EndedJune 30,

Nine Months EndedJune 30, (Thousands)

2010 2009

2010

2009 Net (loss) income

($10,177 )

($14,155 )

$115,942 $46,105 Add:

Unrealized loss on derivative

instruments andrelated transactions, net of taxes

15,886 6,981

3,936 39,557

Effects of economic hedging

related to natural gas, netof taxes

5,878 8,420

(16,867 ) 20,490 Net financial earnings

$11,587 $1,246

$103,011 $106,152 Weighted Average

Shares Outstanding Basic

41,239 42,049

41,424 42,175

Diluted

41,239 42,049

41,703 42,547

Basic earnings

per share ($0.25 ) ($0.34 )

$2.80 $1.09

Basic net financial earnings

per share $0.28 $0.03

$2.49 $2.52

Net financial earnings is a financial measure not calculated in

accordance with generally accepted accounting principles (GAAP) of

the United States as it excludes all unrealized, and certain

realized, gains and losses associated with derivative instruments.

For further discussion of this financial measure, as well as a

reconciliation to the most comparable GAAP measure, please see the

explanation below under “Additional Non-GAAP Financial

Information.”

- Third-Quarter Net Financial

Earnings Increase

Third-quarter net financial earnings for fiscal 2010 were $11.6

million, or $.28 per share, an increase over quarterly net

financial earnings of $1.2 million, or $.03 per share, during the

same three-month period last fiscal year. Year-to-date net

financial earnings at NJR were $103 million, or $2.49 per share,

compared with $106 million, or $2.52 per share, during the same

period last year. Improved third-quarter net financial earnings

compared with the same period in the prior fiscal year were driven

by higher results at New Jersey Natural Gas (NJNG), Midstream

Assets and NJR Energy Services (NJRES).

“We are pleased to report that all three of our business

segments generated improved results this quarter, enabling us to

reaffirm our earnings guidance for fiscal 2010,” said Laurence M.

Downes, chairman and CEO of NJR. “Our shareowners rely on us to

provide consistent results and thanks to the dedication and

commitment to excellence of our employees, who are the driving

force behind our performance, we remain on track for another year

of increased net financial earnings.”

Subject to the factors discussed at the end of this release

under “Forward-Looking Statements” and due to strong third-quarter

results, NJR is reaffirming its fiscal 2010 net financial earnings

guidance in a range of $2.45 to $2.55 per basic share. Overall, NJR

expects New Jersey Natural Gas (NJNG) to be the major contributor

to fiscal 2010 net financial earnings, accounting for 60 to 70

percent of the total. In addition, NJR estimates that the

contribution from NJRES will be approximately 15 to 25 percent and

Midstream Assets will be approximately 5 to 10 percent of total

fiscal 2010 net financial earnings.

- New Jersey Natural Gas

Earnings Remain Strong

Net income in the third quarter of fiscal 2010 at NJNG increased

to $6.1 million, compared with $4.1 million in the same period last

year. Fiscal 2010 year-to-date net income increased nearly 2

percent to $70.1 million, compared with $68.8 million during the

same period last year.

The increase is due in part to steady customer growth. During

the first nine months of fiscal 2010, NJNG has added 3,938 new

customers and an additional 441 existing customers converted to

natural gas heat and other services. This growth is expected to

contribute approximately $2 million to annual utility gross

margin.

Additionally, results at the utility have been bolstered by the

impact of several regulatory initiatives. The Accelerated

Infrastructure Program (AIP) enables NJNG to recognize its cost of

financing 14 capital projects based on its authorized weighted

average cost of capital of 7.76 percent. Through June 30, 2010,

NJNG has incurred capital costs of $21.4 million through the AIP

and total capital investment over the life of the program is

expected to be $70.8 million.

NJNG’s energy-efficiency program, known as The SAVEGREEN

Project™, is also contributing towards the utility’s results.

Spending during fiscal 2010 has totaled $7.4 million, on which NJNG

recognizes the same cost of capital referenced above through an

energy-efficiency rider on customer bills. Incentives through

SAVEGREEN complement those available from New Jersey’s Clean Energy

Program. To date, more than $3 million has been paid to customers

through rebates and special financial offers. Additionally, nearly

3,000 customers have received comprehensive home energy audits to

identify energy-saving opportunities in their homes in accordance

with NJNG’s “whole-house” approach to energy efficiency and

conservation.

NJNG’s positive results in the third quarter of fiscal 2010 were

also due in part to lower operation and maintenance expenses due

primarily to a decrease in bad debt expense and costs associated

with system maintenance.

In March, NJNG submitted a filing to the New Jersey Board of

Public Utilities (BPU) seeking approval to expand and enhance its

energy-efficiency program as well as offer renewable energy

technologies to residential and commercial customers. The filing is

currently in the discovery phase and NJNG is working

collaboratively with regulators to resolve the matter by October 1,

2010.

- Solar Projects Expected to

Add to Company’s Growth

Two new initiatives have put NJR into the electricity business

and are expected to contribute to growth over the coming years. NJR

Clean Energy Ventures (NJRCEV), a subsidiary formed to identify

opportunities in the renewable energy market and invest in

commercial roof-top and ground-mounted solar systems, recently

announced its first two agreements with Adler Development in

central New Jersey and CertainTeed in Berlin, NJ. The cost of the

projects is expected to be approximately $22 million and have been

developed with the technical expertise of United Solar, a leading

global manufacturer of UNI-SOLAR® brand light-weight, flexible,

thin-film, low impact and low profile solar panels. The rooftop

systems will be capable of generating approximately five megawatts

of clean, renewable energy and offer lower costs to tenants while

helping to reduce the facilities’ carbon footprint. Investments

made by NJRCEV will qualify for a 30 percent federal investment tax

credit. In addition, the energy produced will be eligible for Solar

Renewable Energy Certificates (SRECs), which can be sold to load

serving entities in New Jersey to meet their renewable energy

requirements. Additional return on investment will be provided by

power purchase agreement payments from tenants.

Additionally, NJR Home Services (NJRHS) has over 100 leases

signed for its residential solar leasing program launched earlier

this year. The program is making solar energy accessible and

affordable for homeowners, who are not responsible for the costs of

installation or maintenance over the 20-year lease. Monthly fees

are fixed over the life of the lease at approximately $52 per

month. The average customer will save about $100 on monthly

electricity costs. NJRHS expects to invest up to $4 million in this

program in fiscal 2010. Just as in the NJRCEV agreements, NJRHS

qualifies for 30 percent federal investment tax credit and will

generate SRECs. NJRHS may also be eligible for any rebates

available from New Jersey’s Clean Energy Program.

- Midstream Assets Continue

Growth

Net income from Midstream Assets in the third-quarter of fiscal

2010 was $1.8 million compared with $940,000 over the same period

last year. Year-to-date quarter earnings in fiscal 2010 were $5.2

million, compared with $2.1 million in fiscal 2009. Both increases

are due to earnings from Steckman Ridge, a 12 billion cubic feet

working gas storage facility located in Southwestern Pennsylvania,

which began generating storage revenues when it became commercially

operational during the third quarter of fiscal 2009.

- NJR Energy Services Reports

Higher Quarterly Results

NJR Energy Services (NJRES), NJR’s wholesale energy subsidiary,

reported net financial earnings for the third quarter of fiscal

2010 of $3.3 million compared with a loss of $4.5 million in the

same period last year. For the nine-month period ending June 30,

2010, net financial earnings were $29.3 million compared with $36

million in the same period last year. The increase in third-quarter

net financial earnings is due an increase in sales volume of

approximately 12.4 billion cubic feet coupled with higher average

price spreads for the three-month period ended June 30, 2010,

compared with the same period in the prior fiscal year.

Natural gas prices have remained significantly lower than in

prior years, reducing volatility in the wholesale market and

causing fewer opportunities for asset optimization. As a result,

NJRES is using its extensive experience managing storage and

transportation assets to offer services to exploration and

production (E&P) companies working in the Marcellus Shale and

other regions. This allows those E&P companies to focus on

their strengths, while NJRES uses its own expertise to provide

comprehensive producer services once the natural gas has been

extracted. NJRES currently has signed agreements to manage over

350,000 decatherms per day of natural gas production

Webcast

Information

NJR will host a live webcast to discuss its financial results

today at 9 a.m. ET. A few minutes prior to the webcast, go to

www.njliving.com and select “New Jersey Resources” from the top

navigation bar. Choose “Investor Relations,” then click just below

the microphone under the heading “Latest Webcast” on the Investor

Relations home page.

Forward-Looking

Statements

This news release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

NJR cautions readers that the assumptions forming the basis for

forward-looking statements include many factors that are beyond

NJR’s ability to control or estimate precisely, such as estimates

of future market conditions and the behavior of other market

participants. Other factors that could cause actual results to

differ materially from the company’s expectations include, but are

not limited to, weather; economic conditions; NJR dependence on

operating subsidiaries; demographic changes in NJNG’s service

territory; rate of customer growth; volatility of natural gas

commodity prices and its impact on customer usage and NJR Energy

Services operations and the company’s risk management efforts;

changes in rating agency requirements and/or credit ratings and

their effect on availability and cost of capital to the company;

the impact of volatility in the credit markets that would result in

the increased cost and/or limit the availability of credit at NJR

to fund and support physical gas inventory purchases and other

working capital needs at NJRES, and all other non-regulated

subsidiaries, as well as negatively affect cost and access to the

commercial paper market and other short-term financing markets by

NJNG to allow it to fund its commodity purchases, capital

expenditures and meet its short-term obligations as they come; the

company’s ability to comply with debt covenants; continued failures

in the market for auction rate securities; the impact to the asset

values and resulting higher costs and funding obligations of NJR’s

pension and post-employment benefit plans as a result of downturns

in the financial market, and the impacts associated with the

Patient Protection and Affordable Care Act; the ability to maintain

effective internal controls; accounting effects and other risks

associated with hedging activities and use of derivatives

contracts; commercial and wholesale credit risk, including the

availability of creditworthy customers and counterparties and

liquidity in the wholesale energy trading market; the company’s

ability to obtain governmental approvals and/or financing for the

construction, development and operation of its non-regulated energy

investments; risks associated with our investments in solar energy

projects, including the availability of regulatory and tax

incentives; risks associated with the management of the company’s

joint ventures and partnerships; the level and rate at which costs

and expenses are incurred and the extent to which they are allowed

to be recovered from customers through the regulatory process in

connection with constructing, operating and maintain NJNG’s natural

gas transmission and distribution system; dependence on third-party

storage and transportation facilities for natural gas supply;

operational risks incidental to handling, storing, transporting and

providing customers with natural gas; access to adequate supplies

of natural gas; the regulatory and pricing policies of federal and

state regulatory agencies; the cost of compliance with present and

future environmental law, including potential climate

change-related legislation; the ultimate outcome of pending

regulatory proceedings, the disallowance of recovery of

environmental-related expenditures and other regulatory changes;

and environmental-related and other litigation and other

uncertainties. NJR does not, by including this paragraph, assume

any obligation to review or revise any particular forward-looking

statement referenced herein in light of future events. More

detailed information about these factors is set forth under the

heading “Risk Factors” in NJR’s filings with the Securities and

Exchange Commission (SEC) including its most recent Form 10-K.

Non-GAAP Financial

Information

This press release includes the non-GAAP measures net financial

earnings (losses), financial margin and utility gross margin. A

reconciliation of these non-GAAP financial measures to the most

directly comparable financial measures calculated and reported in

accordance with GAAP, can be found below. As an indicator of the

company’s operating performance, these measures should not be

considered an alternative to, or more meaningful than, operating

income as determined in accordance with GAAP.

Net financial earnings (losses) and financial margin exclude

unrealized gains or losses on derivative instruments related to the

company’s unregulated subsidiaries and certain realized gains and

losses on derivative instruments related to natural gas that has

been placed into storage at NJRES. Volatility associated with the

change in value of these financial and physical commodity contracts

is reported in the income statement in the current period. In order

to manage its business, NJR views its results without the impacts

of the unrealized gains and losses, and certain realized gains and

losses, caused by changes in value of these financial instruments

and physical commodity contracts prior to the completion of the

planned transaction because it shows changes in value currently as

opposed to when the planned transaction ultimately is settled.

NJNG’s utility gross margin represents the results of revenues less

natural gas costs, sales and other taxes and regulatory rider

expenses, which are key components of the company’s operations that

move in relation to each other. Management uses these non-GAAP

financial measures as supplemental measures to other GAAP results

to provide a more complete understanding of the company’s

performance. Management believes these non-GAAP measures are more

reflective of the company’s business model, provide transparency to

investors and enable period-to-period comparability of financial

performance. A reconciliation of all non-GAAP financial measures to

the most directly comparable financial measures calculated and

reported in accordance with GAAP, can be found below. For a full

discussion of NJR’s non-GAAP financial measures, please see NJR’s

most recent Form 10-K, Item 7.

About New Jersey

Resources

New Jersey Resources, a Fortune 1000 company, provides reliable

energy and natural gas services including transportation,

distribution, and asset management in states from the Gulf Coast to

the New England regions, including the Mid-Continent region, the

West Coast and Canada, while investing in and maintaining an

extensive infrastructure to support future growth. With over $2.5

billion in annual revenues, NJR safely and reliably operates and

maintains 6,700 miles of natural gas transportation and

distribution infrastructure to serve nearly half a million

customers; develops and manages a diverse portfolio of nearly 2.3

Bcf/day of transportation capacity and more than 50 Bcf of storage

capacity; and provides appliance installation, repair and contract

service to approximately 148,000 homes and businesses.

Additionally, NJR holds investments in midstream assets through

equity partnerships including Steckman Ridge and Iroquois. Through

Conserve to Preserve®, NJR is helping customers save energy and

money by promoting conservation and encouraging efficiency. For

more information about NJR, visit www.njliving.com.

Reconciliation of Non-GAAP Performance Measures

NEW

JERSEY RESOURCES A

reconciliation of Net income at NJR to net financial earnings, is

as follows: Three Months EndedJune 30,

Nine Months EndedJune 30, (Thousands)

2010 2009

2010 2009 Net (loss)

income

($10,177 ) ($14,155 )

$115,942 $46,105

Add: Unrealized loss on derivative instruments and related

transactions, net of taxes

15,886 6,981

3,936 39,557

Effects of economic hedging related to natural gas, net of taxes

5,878 8,420

(16,867 ) 20,490 Net financial earnings

$11,587 $1,246

$103,011 $106,152

WEIGHTED

AVERAGE SHARES OUTSTANDING BASIC 41,239 42,049

41,424 42,175

DILUTED 41,239

42,049

41,703 42,547

Basic net financial (loss) earnings per share

$0.28 $0.03

$2.49

$2.52

ENERGY SERVICES The

following table is a computation of financial margin at Energy

Services: Three Months EndedJune 30,

Nine Months EndedJune 30, (Thousands)

2010 2009

2010 2009 Operating

revenues

$364,800 $283,439

$1,207,166 $1,219,296

Less: Gas purchases

393,166 313,395

1,125,160

1,230,061 Add: Unrealized loss on derivative instruments and

related transactions

26,068 11,612

2,833 47,777

Effects of economic hedging related to natural gas inventory

10,245 13,057

(26,641

) 32,854 Financial margin (loss)

$7,947 ($5,287 )

$58,198

69,866

A reconciliation of Operating

income at Energy Services, the closest GAAP financial measurement,

to the financial margin is as follows: Three Months

EndedJune 30, Nine Months EndedJune 30,

(Thousands)

2010 2009

2010

2009 Operating (loss) income

($31,721 )

($35,033 )

$70,674 ($25,097 ) Add: Operation and maintenance

expense

3,268 4,703

10,246 12,931 Depreciation and

amortization

37 51

136 153 Other taxes

50 323

950

1,248 Subtotal – Gross margin (loss)

($28,366

) (29,956 )

$82,006 (10,765 ) Add: Unrealized loss on

derivative instruments and related transactions

26,068

11,612

2,833 47,777 Effects of economic hedging related to

natural gas inventory

10,245 13,057

(26,641 ) 32,854

Financial margin (loss)

$7,947 ($5,287

)

$58,198 $69,866

ENERGY

SERVICES (continued) A reconciliation of Energy

Services Net income to net financial earnings, is as follows:

Three Months EndedJune 30, Nine Months

EndedJune 30, (Thousands)

2010 2009

2010 2009 Net (loss) income

($18,823

) ($20,170 )

$44,262 ($13,828 ) Add: Unrealized loss

on derivative instruments and related transactions, net of taxes

16,281 7,266

1,952 29,315 Effects of economic hedging

related to natural gas, net of taxes

5,878

8,420

(16,867 ) 20,490

Net financial earnings (loss)

$3,336

($4,484 )

$29,347 $35,977

Retail and Other A reconciliation of Retail

and Other Net income to net financial earnings, is as follows:

Three Months Ended Nine Months Ended June

30, June 30, (Thousands)

2010 2009

2010 2009 Net income (loss)

$725 $941

($3,481 ) ($10,982 ) Add: Unrealized (gain) loss on

derivative instruments, net of taxes

(411 )

(285 )

1,840 10,242 Net

financial earnings (loss)

$314 $656

($1,641 ) ($740 )

NEW JERSEY RESOURCES CONSOLIDATED

STATEMENTS OF INCOME

(Thousands, except per share data)

Three

Months EndedJune 30, Nine Months EndedJune

30, 2010 2009

2010 2009

OPERATING REVENUES Utility

$105,130 $148,826

$794,311 $958,995 Nonutility

374,764 292,226

1,213,475

1,220,877 Total operating revenues

479,894

441,052

2,007,786

2,179,872

OPERATING EXPENSES Gas purchases Utility

47,665 87,169

478,719 631,712 Nonutility

393,126 313,318

1,114,842 1,227,783 Operation and

maintenance

37,077 38,436

110,386 112,209 Regulatory

rider expenses

6,160 6,280

41,017 40,585 Depreciation

and amortization

8,136 7,880

23,936 22,749 Energy and

other taxes

6,516 11,739

50,275 67,353 Total operating expenses

498,680 464,822

1,819,175

2,102,391

OPERATING (LOSS) INCOME (18,786

) (23,770 )

188,611 77,481 Other income

1,311

1,179

3,458 3,095 Interest expense, net

5,238

5,187

15,946 15,953

(LOSS) INCOME BEFORE INCOME TAXES AND EQUITY IN EARNINGS OF

AFFILIATES (22,713 ) (27,778 )

176,123

64,623 Income tax (benefit) provision

(11,368 )

(12,146 )

64,819 21,296 Equity in earnings of affiliates,

net of tax

1,168 1,477

4,638 2,778

NET (LOSS) INCOME

($10,177 ) ($14,155 )

$115,942

$46,105

(LOSS) EARNINGS PER COMMON SHARE

BASIC ($0.25 ) ($0.34 )

$2.80 $1.09

DILUTED ($0.25 ) ($0.34 )

$2.78 $1.08

DIVIDENDS PER COMMON SHARE

$0.34 $0.31

$1.02

$0.93

AVERAGE SHARES OUTSTANDING BASIC

41,239 42,049

41,424 42,175

DILUTED

41,239 42,049

41,703

42,547

NEW JERSEY

RESOURCES (Thousands, except per share data)

Three

Months EndedJune 30, Nine Months EndedJune

30, 2010 2009

2010 2009

Operating Revenues

Natural Gas Distribution

$105,130 $148,826

$802,358

$958,995 Energy Services

364,800 283,439

1,207,166

1,219,296 Midstream Assets

- -

- - Retail and Other

10,058 8,832

19,803

3,828

Sub-total 479,988

441,097

2,029,327

2,182,119 Eliminations

(94 ) (45 )

(21,541 ) (2,247 )

Total

$479,894 $441,052

$2,007,786 $2,179,872

Operating Income (Loss) Natural Gas Distribution

$11,114 $9,709

$120,798 $121,426 Energy Services

(31,721 ) (35,033 )

70,674 (25,097 ) Midstream

Assets

(138 ) (107 )

(590 ) (330 )

Retail and Other

1,209 1,577

(5,068 ) (18,702 )

Sub-total

(19,536 ) (23,854 )

185,814

77,297 Eliminations

750

84

2,797 184

Total

($18,786 ) ($23,770 )

$188,611

$77,481

Equity in Earnings of

Affiliates Midstream Assets

$2,538 $2,295

$10,261 $4,539

Sub-total 2,538 2,295

10,261 4,539 Eliminations

(557

) 190

(2,376 ) 104

Total $1,981 $2,485

$7,885 $4,643

Net

Income (Loss) Natural Gas Distribution

$6,109 $4,134

$70,087 $68,796 Energy Services

(18,823 )

(20,170 )

44,262 (13,828 ) Midstream Assets

1,828 940

5,218 2,119 Retail and Other

725 941

(3,481 ) (10,982 )

Sub-total (10,161 ) (14,155 )

116,086 46,105 Eliminations

(16

) 0

(144 ) 0

Total ($10,177 ) ($14,155 )

$115,942 $46,105

Net

Financial Earnings (Loss) Natural Gas Distribution

$6,109 $4,134

$70,087 $68,796 Energy Services

3,336 (4,484 )

29,347 35,977 Midstream Assets

1,828 940

5,218 2,119 Retail and Other

314

656

(1,641 ) (740

)

Total $11,587 $1,246

$103,011 $106,152

Throughput

(Bcf) NJNG, Core Customers

8.8 9.5

57.9 60.6

NJNG, Off System/Capacity Management

16.1 13.6

60.2

45.9 NJRES Fuel Mgmt. and Wholesale Sales

90.6

80.6

255.0 234.6

Total 115.5 103.7

373.1 341.1

Common Stock

Data Yield at June 30

3.9 % 3.3 %

3.9

% 3.3 % Market Price High

$39.01 $37.57

$39.01

$42.37 Low

$34.07 $30.79

$33.49 $21.90 Close at June

30

$35.20 $37.04

$35.20 $37.04 Shares Out. at June 30

41,201 41,950

41,201 41,950 Market Cap. at June 30

$1,450,275 $1,553,828

$1,450,275 $1,553,828

NATURAL GAS DISTRIBUTION

(Unaudited)(Thousands, except customer & weather data)

Three

Months EndedJune 30, Nine Months EndedJune

30, 2010 2009

2010 2009

Utility Gross Margin

Operating revenues

$105,130 $148,826

$802,358

$958,995 Less: Gas purchases

48,401 87,169

492,489

631,712 Energy and other taxes

4,738 9,830

43,955

61,208 Regulatory rider expense

6,183 6,280

41,103 40,585

Total

Utility Gross Margin $45,808 $45,547

$224,811 $225,490

Utility Gross Margin and Operating Income Residential

$28,556 $28,488

$150,384 $150,235 Commercial,

Industrial & Other

8,530 9,051

38,202 40,398 Firm

Transportation

6,613 5,987

28,573 24,838

Total Firm Margin

43,699 43,526

217,159 215,471 Interruptible

103 81

265

236

Total System Margin 43,802

43,607

217,424 215,707

Off System/Capacity Management/FRM/Storage Incentive

2,006

1,940

7,387 9,783

Total Utility Gross Margin 45,808

45,547

224,811 225,490

Operation and maintenance expense

25,856 27,351

77,551 79,137 Depreciation and amortization

7,939

7,668

23,321 22,120 Other taxes not reflected in gross

margin

899 819

3,141

2,807

Operating Income $11,114

$9,709

$120,798

$121,426

Throughput (Bcf) Residential

4.6 5.8

37.5 40.5 Commercial, Industrial & Other

0.9 1.2

7.6 9.1 Firm Transportation

1.3

1.5

9.0 8.4

Total Firm Throughput 6.8 8.5

54.1 58.0

Interruptible

2.0 1.0

3.8

2.6

Total System Throughput 8.8

9.5

57.9 60.6

Off System/Capacity Management

16.1

13.6

60.2 45.9

Total

Throughput 24.9 23.1

118.1 106.5

Customers

Residential

439,659 439,442

439,659 439,442

Commercial, Industrial & Other

26,957 28,837

26,957 28,837 Firm Transportation

24,052

18,892

24,052 18,892

Total Firm Customers 490,668 487,171

490,668 487,171 Interruptible

45 44

45 44

Total System

Customers 490,713 487,215

490,713 487,215 Off System/Capacity

Management*

52 29

52

29

Total Customers 490,765

487,244

490,765

487,244 *The number of customers represents those active

during the last month of the period.

Degree Days Actual

338 475

4,338 4,753 Normal

561

563

4,706 4,707 Percent

of Normal

60.2 % 84.4 %

92.2

% 101.0 %

ENERGY SERVICES

(Unaudited)(Thousands, except customer)

Three Months

EndedJune 30, Nine Months EndedJune 30,

2010 2009

2010

2009

Operating Revenues $364,800

$283,439

$1,207,166 $1,219,296 Gas Purchases

393,166

313,395

1,125,160

1,230,061

Gross (Loss) Margin (28,366 )

(29,956 )

82,006 (10,765 ) Operation and maintenance expense

3,268 4,703

10,246 12,931 Depreciation and

amortization

37 51

136 153 Energy and other taxes

50 323

950

1,248

Operating (Loss) Income ($31,721

) ($35,033 )

$70,674

($25,097 )

Net (Loss) Income ($18,823 )

($20,170 )

$44,262 ($13,828 )

Financial Margin (Loss) $7,947

($5,287 )

$58,198 $69,866

Net Financial Earnings (Loss) $3,336

($4,484 )

$29,347 $35,977

Gas Sold and Managed (Bcf) 90.6 80.6

255.0 234.6

MIDSTREAM ASSETS Three Months EndedJune 30,

Nine Months EndedJune 30,

2010

2009

2010

2009

Equity in Earnings of Affiliates $2,538

$2,295

$10,261 $4,539

Operations and Maintenance Expense $137

$107

$586 $321

Interest Expense $380

$882

$2,037 $946

Net Income $1,828 $940

$5,218 $2,119

RETAIL

AND OTHER Three Months EndedJune 30, Nine

Months EndedJune 30,

2010

2009

2010

2009

Operating Revenues $10,058

$8,832

$19,803 $3,828

Operating Income (Loss) $1,209

$1,577

($5,068 ) ($18,702 )

Net Income (Loss) $725 $941

($3,481 ) ($10,982 )

Net Financial Earnings (Loss) $314 $656

($1,641 ) ($740 )

Total Customers at June 30, 2010 147,893

145,398

147,893 145,398

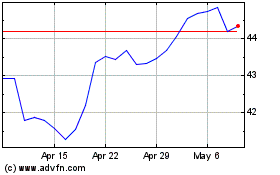

New Jersey Resources (NYSE:NJR)

Historical Stock Chart

From May 2024 to Jun 2024

New Jersey Resources (NYSE:NJR)

Historical Stock Chart

From Jun 2023 to Jun 2024