New Jersey Natural Gas Announces Price Decrease in Annual Filing

June 01 2010 - 12:24PM

Business Wire

New Jersey Natural Gas (NJNG) today submitted a series of

filings to the New Jersey Board of Public Utilities (BPU) which

would result in an overall decrease of 2.1 percent for the average

residential heating customer. The change is proposed to be

effective October 1, 2010 and is subject to BPU approval.

“Today’s filings further demonstrate our commitment to identify

savings for our customers,” said Kathleen T. Ellis, COO and

executive vice president at NJNG. “Our cost control and natural gas

purchasing strategies, coupled with lower natural gas costs, have

enabled us to decrease prices to NJNG’s customers.”

“Our Conservation Incentive Program has continued to prove

successful for our customers and company, while helping to meet New

Jersey’s goal of reduced energy usage and greenhouse gas emissions.

Additionally, our Accelerated Infrastructure Program is enhancing

the reliability of our system infrastructure and providing job

growth in the local economy.”

As a result of the filing, a typical customer using 100 therms a

month would see their bill go from $138.75 to $135.86, a savings of

$2.89. On an annual basis, a customer using 1,000 therms would see

a savings of approximately $30. This proposed decrease is in

addition to $110 million in reductions through customer refunds and

bill credits since October 2009. The average residential heating

customer received savings of approximately $241 during the time,

representing an 18 percent reduction over the course of one

year.

The majority of customers’ natural gas bills consist of two

separate charges. The first, known as the base rate charge, is the

cost of delivering natural gas service to homes and businesses. The

second, the BGSS, is a commodity charge passed through to customers

based on NJNG’s cost to acquire natural gas. NJNG proposed a

decrease to the BGSS rate that reduces the average residential

heating customer’s bill by 3.5 percent. This portion accounts for

more than 60 percent of a customer’s bill. Any change in the BGSS

does not represent a change in profits to the company.

Through its Conservation Incentive Program (CIP), NJNG is able

to more actively encourage customer conservation and

energy-efficiency improvements while stabilizing financial margins

that would be impacted by changes in usage patterns. In the filing,

NJNG proposed an increase to the CIP recovery rate for residential

heating customers, representing a 0.7 percent increase to the

average bill. From October 2009 to April 2010, customers realized

commodity cost savings of approximately $13.4 million due to their

reduced natural gas usage. In addition, they will continue to

receive annual savings of $5.5 million in fixed-cost reductions as

a result of lower demand fee charges.

The last filing submitted today was for the recovery of costs

associated with NJNG’s Accelerated Infrastructure Program (AIP),

originally approved in April 2009. Through the AIP, NJNG is able to

recover the cost associated with capital investment that expand and

enhance its delivery system while stimulating the economy and

promoting job growth. Estimated construction costs for these

projects are valued at approximately $70.8 million. Through April

2010, NJNG has spent $15.5 million and anticipates spending $41.4

million by September 2010. The impact to the average customer bill

is a 0.7 percent increase.

New Jersey Natural Gas is the principal subsidiary of New Jersey

Resources, a Fortune 1000 company, that provides reliable energy

and natural gas services including transportation, distribution and

asset management in states from the Gulf Coast to the New England

regions, including the Mid-Continent region, the West Coast and

Canada, while investing in and maintaining an extensive

infrastructure to support future growth. With over $2.5 billion in

annual revenues, NJR safely and reliably operates and maintains

6,700 miles of natural gas transportation and distribution

infrastructure to serve nearly half a million customers; develops

and manages a diverse portfolio of more than 777,000 dth/d of

transportation capacity and 52 Bcf of storage capacity; and

provides appliance installation, repair and contract service to

approximately 150,000 homes and businesses. Additionally, NJR holds

investments in midstream assets through equity partnerships

including Steckman Ridge and Iroquois. Through Conserve to

Preserve®, NJR is helping customers save energy and money by

promoting conservation and encouraging efficiency. For more

information about NJR, visit www.njliving.com.

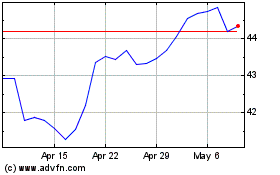

New Jersey Resources (NYSE:NJR)

Historical Stock Chart

From May 2024 to Jun 2024

New Jersey Resources (NYSE:NJR)

Historical Stock Chart

From Jun 2023 to Jun 2024