New Jersey Resources (NYSE: NJR) today reported results for the

first quarter of fiscal 2009 and increased its net financial

earnings guidance for the year to a range of $2.32 to $2.42 per

basic share from a range of $2.30 to $2.40 per basic share.

A reconciliation of net income to net financial earnings for the

first quarter of fiscal years 2009 and 2008 is provided below:

� �

Three Months Ended December 31, (Thousands) � �

2008 � 2007 Net income

$11,776 � $30,185 Add:

Unrealized loss on derivative instruments, net of taxes

4,122 3,080

Realized loss from derivative

instruments relatedto natural gas inventory, net of taxes

� �

16,580 � � 3,042 Net financial earnings � �

$32,478 � � $36,307 � Weighted Average Shares Outstanding

Basic

42,170 41,678 Diluted � �

42,495 � � 41,928 �

Basic earnings per share $0.28 � � $0.72

Basic net

financial earnings per share $0.77 � � $0.87

Net financial earnings is a financial measure not calculated in

accordance with generally accepted accounting principles (GAAP) of

the United States as it excludes all unrealized, and certain

realized, gains and losses associated with derivative instruments.

For further discussion of this financial measure, as well as a

reconciliation to the most comparable GAAP measure, please see the

explanation below under �Additional Non-GAAP Financial

Information.�

- NJR Increases Fiscal 2009 Net

Financial Earnings Guidance

Subject to the factors discussed at the end of this release

under �Forward-Looking Statements,� NJR is increasing its fiscal

2009 net financial earnings guidance to a range of $2.32 to $2.42

per basic share from a range of $2.30 to $2.40 per basic share.

�The company�s conservative business model has provided access

to capital and continued steady performance, even in the face of

the current global economic crisis,� said Laurence M. Downes,

chairman and CEO of NJR. �The fact that we are able to increase our

net financial earnings guidance for fiscal 2009 speaks volumes

about the consistent performance of our company.�

The company is increasing its net financial earnings guidance

due to stronger-than-expected utility results, driven primarily by

the positive impact of its base rate case, higher gross margin from

incentive programs and reduced borrowing costs as a result of lower

interest rates.

- New Jersey Natural Gas

Reports Strong Earnings

New Jersey Natural Gas (NJNG), the company�s utility subsidiary,

recorded a strong performance and achieved a 38 percent increase in

earnings. Net income for the first quarter of fiscal 2009 was $23.1

million compared with $16.7 million in the same period last year.

The increase was driven by the resolution of the base rate case and

higher gross margin from incentive programs while customer growth

remained steady. During the first quarter, NJNG added 1,763 new

customers, of which approximately half came from conversions, a

trend the company expects to continue. Furthermore, an additional

162 existing non-heat customers converted to natural gas heat and

other services. These new customers and conversions are expected to

contribute approximately $1.1 million annually to utility gross

margin.

- 10.7 Percent Dividend

Increase Takes Effect

In November 2008, NJR�s board of directors announced a 10.7

percent increase to the dividend, raising the quarterly rate to

$.31 per share from $.28 per share, and establishing a new annual

rate of $1.24 per share. NJR�s new annual dividend rate was

effective with the dividend payable on January 2, 2009 to

shareowners of record on December 15, 2008.

- NJR Energy Services

Forecasted to Contribute 30 to 35 Percent of Net Financial

Earnings

Net financial earnings at NJR Energy Services (NJRES), NJR�s

wholesale energy subsidiary, were $9.4 million during the first

quarter of fiscal 2009 compared with $19.1 million in the same

period last year. The expected decrease was due primarily to

narrower winter storage spreads and less contracted transportation

capacity in the Northeast. NJRES� results are seasonal in nature

and the company forecasts its net financial earnings to account for

between 30 and 35 percent of total net financial earnings for the

year. This level would be the third-highest in its history. NJRES

continues its efforts to enhance its portfolio to capture

opportunities in the changing marketplace.

Other recent highlights include:

- NJNG Proposes Economic

Stimulus Programs

On January 20, 2009, NJNG submitted a filing with the New Jersey

Board of Public Utilities (BPU) for approval of two new programs

aimed at stimulating the local economy through energy efficiency,

job creation and infrastructure spending. The Accelerated

Infrastructure Program would allow NJNG to expedite previously

planned capital improvement projects and create up to 100 jobs

while ensuring the safety and reliability of its distribution

system. The second filing, if approved, would provide programs for

customers that would promote energy efficiency and create or

sustain approximately 100 jobs while supporting the state�s effort

to reduce greenhouse gas emissions and the goals of the Energy

Master Plan. As proposed, each program would increase the average

residential customer�s bill by one half of 1 percent, or

approximately $9 annually. Both programs include the recovery of

NJNG�s overall cost of capital.

- Second Highest Send Out in

Company History

NJNG reported its second highest send out of natural gas in the

56-year history of the company on January 16, 2009. Due in part to

the utility�s disciplined spending on capital improvements, no

problems were experienced on the utility�s distribution system as

622,990 decatherms of natural gas were delivered to customers with

the highest-ever capacity flowing through the company�s

pipelines.

- NJNG Customers Receive Bill

Credit

In December 2008, NJNG notified the BPU that it would implement

a bill credit totaling approximately $30 million for residential

and small commercial sales customers, due to the decline in

wholesale natural gas prices. The bill credit is in effect for

natural gas usage between January 1, 2009, and February 28, 2009,

and is expected to save the average customer approximately 11.7

percent over the 2-month period.

Webcast

Information

NJR will host a live webcast to discuss its financial results

today at 9 a.m. ET. A few minutes prior to the webcast, go to

www.njliving.com and select �New Jersey Resources� from the top

navigation bar. Choose �Investor Relations,� then click just below

the microphone under the heading �Latest Webcast� on the Investor

Relations home page.

Forward-Looking

Statements

This news release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

NJR cautions readers that the assumptions forming the basis for

forward-looking statements include many factors that are beyond

NJR�s ability to control or estimate precisely, such as estimates

of future market conditions and the behavior of other market

participants. Other factors that could cause actual results to

differ materially from the company�s expectations include, but are

not limited to, weather, economic conditions and demographic

changes in NJNG�s service territory, rate of customer growth,

volatility of natural gas commodity prices and its impact on

customer usage and NJR Energy Services operations, changes in

rating agency requirements and/or credit ratings and their effect

on availability and cost of capital to the company, conditions in

the credit markets and their potential impact on the company�s

access to capital and borrowing costs, increased interest costs

resulting from failures in the market for auction rate securities,

the impact of the company�s risk management efforts, including

commercial and wholesale credit risks, changes in the costs of

providing pension and post-employment benefits to current and

former employees, the company�s ability to obtain governmental

approvals, property rights and/or financing for the construction,

development and operation of its non-regulated energy investments,

risks associated with the management of the company�s joint

ventures and partnerships, the impact of regulation (including the

regulation of rates), the outcome of any future base rate cases,

fluctuations in energy-related commodity prices, customer

conversions, other marketing efforts, actual energy usage patterns

of NJNG�s customers, the pace of deregulation of retail gas

markets, access to adequate supplies of natural gas, the regulatory

and pricing policies of federal and state regulatory agencies,

changes due to legislation at the federal and state level, an

adequate number of appropriate counterparties, sufficient liquidity

in the energy trading market, the disallowance of recovery of

environmental-related expenditures, environmental and other

litigation and other uncertainties, the effects and impacts of

inflation, change in accounting pronouncements issued by the

appropriate standard setting bodies and terrorist attacks or

threatened attacks on energy facilities or unrelated energy

companies. NJR does not, by including this paragraph, assume any

obligation to review or revise any particular forward-looking

statement referenced herein in light of future events. More

detailed information about these factors is set forth under the

heading �Risk Factors� in NJR�s filings with the Securities and

Exchange Commission (SEC) including its most recent Form 10-K.

Non-GAAP Financial

Information

This press release includes the non-GAAP measures net financial

earnings (losses), financial margin and utility gross margin. A

reconciliation of these non-GAAP financial measures to the most

directly comparable financial measures calculated and reported in

accordance with GAAP, can be found below. As an indicator of the

company�s operating performance, these measures should not be

considered an alternative to, or more meaningful than, operating

income as determined in accordance with GAAP.

Net financial earnings (losses) and financial margin exclude

unrealized gains or losses on derivative instruments related to the

company�s unregulated subsidiaries and certain realized gains and

losses on derivative instruments related to natural gas that has

been placed into storage at NJRES. Volatility associated with the

change in value of these financial and physical commodity contracts

is reported in the income statement in the current period. In order

to manage its business, NJR views its results without the impacts

of the unrealized gains and losses, and certain realized gains and

losses, caused by changes in value of these financial instruments

and physical commodity contracts prior to the completion of the

planned transaction because it shows changes in value currently as

opposed to when the planned transaction ultimately is settled.

NJNG�s utility gross margin represents the results of revenues less

natural gas costs, sales and other taxes and regulatory rider

expenses, which are key components of the company�s operations that

move in relation to each other. Management uses these non-GAAP

financial measures as supplemental measures to other GAAP results

to provide a more complete understanding of the company�s

performance. Management believes these non-GAAP measures are more

reflective of the company�s business model, provide transparency to

investors and enable period-to-period comparability of financial

performance. A reconciliation of all non-GAAP financial measures to

the most directly comparable financial measures calculated and

reported in accordance with GAAP, can be found below. For a full

discussion of NJR�s non-GAAP financial measures, please see NJR�s

most recent Form 10-K, Item 7.

About New Jersey

Resources

New Jersey Resources, a Fortune 1000 company, provides natural

gas and clean energy services to customers in New Jersey and in

states from the Gulf Coast to New England, and Canada. With over $3

billion in annual revenues, NJR safely and reliably delivers

natural gas through more than 6,500 miles of main to nearly half a

million customers; develops and manages a diverse portfolio of more

than 740,000 dth/d of transportation capacity and nearly 27 Bcf of

storage capacity; and provides appliance installation and service

to approximately 150,000 homes and businesses. NJR has also made

significant investments in the midstream asset sector through

equity partnerships, including Steckman Ridge and Iroquois. Through

Conserve to Preserve�, NJR is helping customers use less energy and

save money. For more information about NJR, visit

www.njliving.com.

� � �

Reconciliation of Non-GAAP Performance Measures NEW

JERSEY RESOURCES � � � � �

A reconciliation of Net income at

NJR to net financial earnings, is as follows: �

Three Months

Ended December 31, (Thousands) � �

2008 � � 2007

Net income

$11,776 $30,185 Add: Unrealized loss on

derivative instruments, net of taxes

4,122 3,080 Realized

loss from derivative instruments related to natural gas inventory,

net of taxes � �

16,580 � � 3,042 Net financial earnings � �

$32,478 � � $36,307 Weighted average shares outstanding

Basic

42,170 41,678 Diluted � �

42,495 � � 41,928 �

Basic net financial earnings per share $0.77 � �

$0.87 � � � � � �

NJR ENERGY SERVICES � � � � �

The

following table is a computation of financial margin at NJRES:

�

Three Months Ended December 31, (Thousands) � �

2008 � � 2007 Operating revenues

$463,094 $520,211

Gas purchases

467,732 494,546 Add: Unrealized (gain) loss on

derivative instruments

(2,597 ) 4,922 Net realized

loss from derivative instruments related to natural gas inventory �

�

27,194 � � 5,163 Financial margin � �

$19,959 � �

$35,750 � �

A reconciliation of Operating income at NJRES, the

closest GAAP financial measurement, to the financial margin is as

follows: Three Months Ended December 31,

(Thousands) � �

2008 � � 2007 Operating (loss) income

($9,378 ) $22,563 Add: Operation and maintenance

expense

4,360 2,840 Depreciation and amortization

51

53 Other taxes � �

329 � � 209 Subtotal � Gross margin

(4,638 ) 25,665 Add: Unrealized (gain) loss on

derivative instruments

(2,597 ) 4,922 Net realized

loss from derivative instruments related to natural gas inventory �

�

27,194 � � 5,163 Financial margin � �

$19,959 � �

$35,750 �

A reconciliation of NJRES Net income to net financial

earnings, is as follows: �

Three Months Ended

December 31, (Thousands) � �

2008 � � 2007 Net (loss)

income

($5,614 ) $13,150 Add: Unrealized (gain) loss

on derivative instruments, net of taxes

(1,583 )

2,900 Realized loss from derivative instruments related to natural

gas inventory, net of taxes � �

16,580 � � 3,042 Net

financial earnings � �

$9,383 � � $19,092 � � � � � � �

RETAIL AND OTHER � � � � �

A reconciliation of Retail and

Other Net income to net financial earnings, is as follows: �

Three Months Ended December 31, (Thousands) � �

2008 � � 2007 Net (loss) income

($5,684 ) $365

Add: Unrealized loss on derivative instruments, net of taxes � �

5,705 � � 180 Net financial earnings � �

$21 � � $545

� � �

NEW JERSEY RESOURCES

CONSOLIDATED STATEMENTS OF INCOME

�

� � � � �

Three Months Ended December 31,

(Thousands, except per share

data)

�

2008 � � 2007

OPERATING REVENUES �

$801,304

� �

$811,138

�

OPERATING EXPENSES Gas purchases

698,145 684,694

Operation and maintenance

36,408 32,179 Regulatory rider

expenses

13,561

12,165

Depreciation and amortization

7,361 9,403 Energy and other

taxes �

23,633 � � 18,160 Total operating expenses �

779,108 � � 756,601 �

OPERATING INCOME 22,196

54,537 � Other income

1,277 1,528 � Interest expense, net �

6,966 � � 7,810 �

INCOME BEFORE INCOME TAXES

16,507 48,255 � Income tax provision

5,245 18,494 �

Equity in earnings, net of tax �

514 � � 424 �

NET

INCOME �

$11,776 � � $30,185 �

EARNINGS PER COMMON

SHARE BASIC $0.28 $0.72

DILUTED �

$0.28 � � $0.72 �

DIVIDENDS PER COMMON SHARE �

$0.31 � � $0.27 �

AVERAGE SHARES OUTSTANDING

BASIC 42,170 41,678

DILUTED �

42,495 �

� 41,928 � � � �

NEW JERSEY RESOURCES � � � � � � �

Three

Months Ended (Unaudited)

December 31, (Thousands, except

per share data) � �

2008 � � � 2007 �

Operating

Revenues New Jersey Natural Gas

$340,908 $284,360 NJR

Energy Services

463,094 520,211 Retail and Other

(2,654 ) � � 6,631 �

Sub-total 801,348

� � � 811,202 � Intercompany Eliminations

(44 ) � �

(64 )

Total $801,304 � � � $811,138 �

�

� � � � � �

Operating Income (Loss) New Jersey Natural Gas

$42,186 $31,602 NJR Energy Services

(9,378 )

22,563 Retail and Other

(10,658 ) � � 372 �

Sub-total 22,150 � � � 54,537 � Intercompany

Eliminations

46 � � � � �

Total $22,196 � � �

$54,537 � � � � � � � �

Net Income (Loss) New Jersey Natural

Gas

$23,074 $16,670 NJR Energy Services

(5,614

) 13,150 Retail and Other

(5,684 ) � � 365 �

Total $11,776 � � � $30,185 �

�

� � � � �

�

Net Financial (Loss) Income New Jersey Natural Gas

$23,074 $16,670 NJR Energy Services

9,383 19,092

Retail and Other

21 � � � 545 �

Total $32,478

� � � $36,307 � � � � � � � �

Throughput (Bcf) NJNG, Core

Customers

20.4 19.9 NJNG, Off System/Capacity Management

12.2 9.7 NJRES Fuel Mgmt. and Wholesale Sales

71.1 �

� � 67.1 �

Total 103.7 � � � 96.7 � � � � � � � �

Common Stock Data Yield at December 31

3.2 %

3.2 % Market Price High

$40.22 $34.71 Low

$21.90 $31.00 Close at December 31

$39.35 $33.35

Shares Out. at December 31

42,257 41,724 Market Cap. at

December 31

$1,662,813 $1,391,356 � � � � � � � �

NEW

JERSEY NATURAL GAS � � � � � � � (Unaudited) (Thousands, except

customer & weather data) � �

2008 � � � 2007 �

Utility Gross Margin Operating revenues

$340,908

$284,360 Less: Gas purchases

230,452 190,148 Energy and

other taxes

21,587 16,363 Regulatory rider expense

13,561 � � � 12,165 �

Total Utility Gross Margin

$75,308 � � � $65,684 � � � � � � � �

Utility Gross

Margin and Operating Income Residential

$49,687 $45,400

Commercial, Industrial & Other

13,381 13,796 Firm

Transportation

8,432 � � � 4,934 �

Total Firm Margin

71,500 64,130 Interruptible

84 � � � 134 �

Total

System Margin 71,584 � � � 64,264 � Off System/Capacity

Management/FRM

3,724 � � � 1,420 �

TOTAL UTILITY GROSS

MARGIN 75,308 � � � 65,684 � Operation and maintenance

expense

24,950 23,879 Depreciation and amortization

7,161 9,233 Other taxes not reflected in gross margin

1,011 � � � 970 �

OPERATING INCOME $42,186 � �

� $31,602 � � � � � � � �

Throughput (Bcf) Residential

13.3 12.7 Commercial, Industrial & Other

3.2 2.8

Firm Transportation

3.0 � � � 2.8 �

Total Firm

Throughput 19.5 18.3 Interruptible

0.9 � � � 1.6

�

Total System Throughput 20.4 � � � 19.9 � Off

System/Capacity Management

12.2 � � � 9.7 �

TOTAL

THROUGHPUT 32.6 � � � 29.6 � � � � � � � �

Customers Residential

438,602 436,479 Commercial,

Industrial & Other

30,175 29,995 Firm Transportation

17,267 � � � 14,213 �

Total Firm Customers

486,044 480,687 Interruptible

45 � � � 45 �

Total

System Customers 486,089 � � � 480,732 � Off

System/Capacity Management

35 � � � 40 �

TOTAL

CUSTOMERS 486,124 � � � 480,772 � � � � � � � �

Degree Days Actual

1,700 1,545 Normal

1,670 �

� � 1,682 � Percent of Normal

101.8 % � � 91.9 % � �

� � � � �

NJR ENERGY SERVICES � � � � � �

Three Months

Ended (Unaudited)

December 31, (Thousands, except

customer) � �

2008 � � � 2007 �

Operating Revenues

$463,094 $520,211 Gas Purchases

467,732 � � � 494,546

�

Gross (Loss) Margin (4,638 ) 25,665

Operation and maintenance expense

4,360 2,840 Depreciation

and amortization

51 53 Energy and other taxes

329 � �

� 209 �

Operating (Loss) Income ($9,378 ) � �

$22,563 � �

Net (Loss) Income ($5,614 ) � �

$13,150 � �

Financial Margin $19,959 � � � $35,750 �

�

Net Financial Earnings $9,383 � � � $19,092 � �

Gas Sold and Managed (Bcf) 71.1 � � � 67.1 � � � � �

� � � �

RETAIL AND OTHER � � � � � � �

Operating

Revenues ($2,654 ) � � $6,631 � �

Operating

(Loss) Income ($10,658 ) � � $372 � �

Net

(Loss) Income ($5,684 ) � � $365 � �

Net

Financial Earnings $21 � � � $545 � �

Total Customers

at December 31 143,821 � � � 143,502 �

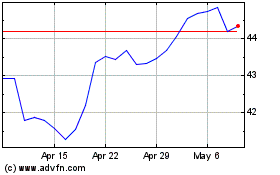

New Jersey Resources (NYSE:NJR)

Historical Stock Chart

From May 2024 to Jun 2024

New Jersey Resources (NYSE:NJR)

Historical Stock Chart

From Jun 2023 to Jun 2024