Natuzzi S.p.A. (NYSE: NTZ) Announces Consolidated First Quarter 2007 Financial Results

May 23 2007 - 5:06PM

Business Wire

The Board of Directors of Natuzzi S.p.A. (NYSE: NTZ) (�Natuzzi� or

�the Group�), the world�s leading manufacturer of

leather-upholstered furniture, today presented the consolidated

financial statements for the quarter ended on March 31, 2007. NET

SALES In the quarter ended on March 31, 2007, Natuzzi total net

sales decreased by 18.3 percent at EUR 153.8 million from EUR 188.2

million reported for the first quarter of 2006. During the same

quarter seats sold decreased by 17.0 percent with respect to one

year ago. During the first quarter of 2007 upholstery net sales

were at EUR 136.0 million, down 18.8 percent as compared to EUR

167.4 million reported for the same comparable period of last year.

Other sales (principally living-room accessories and raw material

produced by the Group and sold to third parties) decreased by 14.4

percent at EUR 17.8 million. In the three months ended on March 31,

2007, net sales in the Americas decreased on quarterly basis by

27.3 percent at EUR 46.4 million, by 14.4 percent in Europe at EUR

79.5 million, and by 5.6 percent at EUR 10.1 million in the rest of

the world. During the first three months of 2007, total net sales

to our chain of Divani & Divani by Natuzzi and Natuzzi Stores

totaled EUR 28.3 million, down by 17.3 percent with respect to the

first quarter of 2006. During the same period, six new Stores were

opened (1 in UK, 1 in Belgium, 1 in Israel, 1 in Australia, 1 in

China and 1 in the U.S.A.), whereas 1 store was closed in Italy,

thus bringing the total number of stores at 283 as of March 31,

2007. At the same date there were 547 Natuzzi Galleries worldwide.

Leather-upholstered furniture sales for the first quarter of 2007

were at EUR 120.0 million, decreasing by 16.3 percent with respect

to EUR 143.4 million reported one year ago, and fabric-upholstered

furniture sales were at EUR 16.0 million, down by 33.3 percent as

compared with the same period of 2006. Net sales for the Natuzzi

branded products decreased by 25.8 percent at EUR 81.0 million and

sales for the Italsofa products by 5.7 percent at EUR 55.0 million

over the first quarter 2006. GROSS & OPERATING RESULTS For the

three-month period ended on March 31, 2007, the Group reported a

gross profit of EUR 46.9 million, a 27.3 decrease from EUR 64.5

million in the first quarter of 2006. As a percentage of sales,

gross margin decreased at 30.5 percent from 34.3 percent reported

for the first quarter of last year mainly as a consequence of

reduced production volumes. In the same period the Group had an

operating loss of EUR 7.9 million, versus an operating income of

EUR 8.8 million in last year comparable period. FOREX AND TAXES For

the first quarter 2007, the Group reported a net foreign exchange

gain of EUR 0.5 million, versus a net foreign exchange loss of EUR

0.5 million in the first quarter of last year. During the same

quarter, the Group reported a deferred tax asset for EUR 1.1

million, as compared with income taxes of EUR 4.0 million for the

same period of 2006. NET RESULT AND GROUP EARNINGS PER COMPANY�S

SHARE For the quarter ended March 31, 2007, the Group reported net

losses of EUR 4.7 million, or EUR 0.09 losses per share (ADR),

versus net earnings of EUR 6.8 million, or EUR 0.12 earnings per

share, in the first quarter of 2006. Ernesto Greco, Chief Executive

Officer of the Group, commented �As previously anticipated, first

quarter 2007 turnover performance was affected by the challenging

business environment in all the major markets. In the US, the

business level was even more depressed, as confirmed by other major

players, mainly due to the low consumer confidence and to the sharp

decline in the house trade. In addition to that, the top line was

penalized by the minimal ending 2006 order backlog and by the

unfavorable Euro exchange rates against major currencies. This

challenging scenario still continues to have a negative effect on

our performance: Year-to-date total order flow is down high-single

digit as compared to the same period of last year and could affect

the sales performance in the coming months. Furthermore, over the

past months we have been experiencing also a price pressure in raw

materials, leather in particular, that contributed to the quarterly

gross margin decrease. Although the persistence of such tough

business conditions, we remain committed in investing in the

Natuzzi brand repositioning encouraged by the favorable acceptance

of our new models presented during last international Milan fair.

We are continuing the reorganization process of the retail

activities as well as our ongoing restructuring process of our

production to better match our cost structure with the pace of

incoming orders.� CONVERSION RATES The first quarter 2007 and 2006

dollar figures presented in this announcement were converted at an

average noon buying rate of $1.3109 per EUR and $1.2033 per EUR,

respectively. FIRST QUARTER 2007 TELECONFERENCE Pasquale Natuzzi,

Chairman of the Board, Ernesto Greco, Chief Executive Officer,

Filippo Simonetti, Chief Financial Officer, and Nicola Dell�Edera,

Finance Director, will discuss financial results, followed by a

question and answer session, in a teleconference at 10:00 a.m. New

York time (3:00 p.m. London time � 4:00 p.m. Italian time) on

Thursday May 24th, 2007. ABOUT NATUZZI S.P.A. Founded in 1959 by

Pasquale Natuzzi, Natuzzi S.p.A. designs and manufactures a broad

collection of leather-upholstered residential furniture. Italy�s

largest furniture manufacturer, Natuzzi is the global leader in the

leather segment, exporting its innovative, high-quality sofas and

armchairs to 123 markets on 5 continents. Since 1990, Natuzzi has

sold its furnishings in Italy through the popular Divani &

Divani by Natuzzi chain of 124 stores, and 1 Natuzzi Store. Outside

Italy, the Group sells to various furniture retailers, as well as

through 158 licensed Divani & Divani by Natuzzi and Natuzzi

Stores. Natuzzi S.p.A. was listed on the New York Stock Exchange on

May 13, 1993. The Group is ISO 9001 and 14001 certified.

FORWARD-LOOKING STATEMENTS Statements in this press release other

than statements of historical fact are �forward-looking

statements�. Forward�looking statements are based on management�s

current expectations and beliefs and therefore you should not place

undue reliance on them. These statements are subject to a number of

risks and uncertainties, including risks that may not be subject to

the Group�s control, that could cause actual results to differ

materially from those contained in any forward-looking statement.

These risks include, but are not limited to, fluctuations in

exchange rates, economic and weather factors affecting consumer

spending, competitive and regulatory environment, as well as other

political, economical and technological factors, and other risks

identified from time to time in the Group�s filings with the

Securities and Exchange Commission, particularly in the Group�s

annual report on Form 20-F. Forward looking statements speak as of

the date they were made, and the Group undertakes no obligation to

update publicly any of them in light of new information or future

events. NATUZZI S.P.A. AND SUBSIDIARIES Unaudited Consolidated

Statement of Earnings for the quarters ended on March 31, 2007 and

2006 on the basis of Italian GAAP (Expressed in millions of EUR

except per share data) � � � � � � � � � � Three months ended on %

Over Percent of Sales � 31-Mar-07 31-Mar-06 (Under) 31-Mar-07

31-Mar-06 Upholstery net sales 136.0� 167.4� (18.8)% 88.4% 88.9%

Other sales 17.8� 20.8� (14.4)% 11.6% 11.1% Total Net Sales 153.8�

188.2� (18.3)% 100.0% 100.0% Purchases (87.2) (79.0) (10.4)%

(56.7)% (42.0)% Labor (24.8) (27.2) 8.8% (16.1)% (14.5)%

Third-party Manufacturers (4.0) (5.6) 28.6% (2.6)% (3.0)%

Manufacturing Costs (7.7) (7.9) 2.5% (5.0)% (4.2)% Inventories, net

16.8� (4.0) 520.0% 10.9% (2.1)% Cost of Sales (106.9) (123.7) 13.6%

(69.5)% (65.7)% Gross Profit 46.9� 64.5� (27.3)% 30.5% 34.3%

Selling Expenses (43.4) (46.5) 6.7% (28.2)% (24.7)% General and

Administrative Expenses (11.4) (9.2) (23.9)% (7.4)% (4.9)%

Operating Income (Loss) (7.9) 8.8� (189.8)% (5.1)% 4.7% Interest

Income, net 0.5� 0.3� 0.3% 0.2% Foreign Exchange, net 0.5� (0.5)

0.3% (0.3)% Other Income, net 1.1� 2.2� 0.7% 1.2% Earnings (Losses)

before taxes and minority interest (5.8) 10.8� (153.7)% (3.8)% 5.7%

Income taxes 1.1� (4.0) 0.7% (2.1)% Earnings (Losses) before

minority interest (4.7) 6.8� (169.1)% (3.1)% 3.6% Minority Interest

0.0� 0.0� 0.0% 0.0% Net Earnings (Losses) (4.7) 6.8� (169.1)%

(3.1)% 3.6% Group Earnings (Losses) per Company's Share (0.09)

0.12� � � � Average Number of Shares Outstanding* 54,824,227�

54,738,538� � � � (*) Net of shares repurchased � � � � � � � � � �

� � Key Figures in U.S. dollars (millions) Three months ended on �

� � March 31, 2007 March 31, 2006 Total Net Sales 201.6� 226.5�

Gross Profit 61.5� 77.6� Operating Income (Loss) (10.4) 10.6� Net

Earnings (Losses) (6.2) 8.2� Group Earnings (Losses) per Company's

Share (0.12) 0.14� Average exchange rate (U.S. dollar per Euro) � �

1.3109� � � � 1.2033� � � GEOGRAPHIC BREAKDOWN � � � � � � � � � �

� � Sales* Seat Units Three months ended on % Over Three months

ended on % Over � � 31-Mar-07 � 31-Mar-06 � (Under) 31-Mar-07 �

31-Mar-06 � (Under) Americas 46.4� 63.8� (27.3%) 258,753� 324,922�

(20.4%) % of total 34.1% 38.1% 41.7% 43.5% Europe 79.5� 92.9�

(14.4%) 320,083� 379,159� (15.6%) % of total 58.5% 55.5% 51.6%

50.7% Rest of the world 10.1� 10.7� (5.6%) 41,266� 43,071� (4.2%) %

of total 7.4% � 6.4% � � 6.7% � 5.8% � � TOTAL 136.0� � 167.4� �

(18.8%) 620,102� � 747,152� � (17.0%) * Expressed in millions of

EUR � � � � � � � � � � � � � BREAKDOWN BY COVERING � � � � � � � �

� � � � Sales* Seat Units Three months ended on % Over Three months

ended on % Over � � 31-Mar-07 � 31-Mar-06 � (Under) 31-Mar-07 �

31-Mar-06 � (Under) Leather 120.0� 143.4� (16.3%) 535,756� 613,543�

(12.7%) % of total 88.2% 85.7% 86.4% 82.1% Fabric 16.0� 24.0�

(33.3%) 84,346� 133,609� (36.9%) % of total 11.8% 14.3% 13.6% 17.9%

Total 136.0� � 167.4� � (18.8%) 620,102� � 747,152� � (17.0%) *

(Expressed in millions of EUR) � � � � � � � � � � � � � BREAKDOWN

BY BRAND � � � � � � � � � � � � Sales* Seat Units Three months

ended on % Over Three months ended on % Over � 31-Mar-07 �

31-Mar-06 � (Under) 31-Mar-07 � 31-Mar-06 (Under) Natuzzi 81.0�

109.1� (25.8%) 285,349� 387,095� (26.3%) % of total 59.6% 65.2%

46.0% 51.8% Italsofa 55.0� 58.3� (5.7%) 334,753� 360,057� (7.0%) %

of total 40.4% 34.8% 54.0% 48.2% TOTAL 136.0� � 167.4� � (18.8%)

620,102� � 747,152� � (17.0%) * (Expressed in millions of EUR)

NATUZZI S.P.A. AND SUBSIDIARIES Unaudited Consolidated Balance

Sheet as of�� March 31, 2007 and December 31, 2006��(Expressed in

millions of EUR) � � � � 31-Mar-07 � 31-Dec-06 ASSETS Current

Assets: Cash and cash equivalents 123.6� 128.1� Marketable debt

securities 0.0� 0.0� Trade receivables, net 108.3� 119.3� Other

receivables 47.5� 44.7� Inventories 117.2� 100.3� Unrealized

foreign exchange gains 4.1� 5.5� Prepaid expenses and accrued

income 4.0� 2.0� Deferred income taxes 10.4� 7.5� Total current

assets � 415.1� � 407.4� Non-Current Assets: Net property, plant

and equipment 246.3� 246.3� Treasury shares 0.0� 0.0� Other assets

18.0� 18.7� � Deferred income taxes � 2.3� � 2.3� TOTAL ASSETS �

681.7� � 674.7� LIABILITIES AND SHAREHOLDERS' EQUITY Current

Liabilities: Short-term borrowings 11.7� 3.8� Current portion of

long-term debt 0.3� 0.3� Accounts payable-trade 82.0� 79.5�

Accounts payable-other 23.5� 22.5� Accounts payable shareholders

for dividends 0.6� 0.6� Unrealized foreign exchange losses 0.0�

0.0� Income taxes 3.9� 4.6� Salaries, wages and related liabilities

21.9� 21.7� Total current liabilities � 143.9� � 133.0� Long-Term

Liabilities: Employees� leaving entitlement 35.1� 35.3� Long-term

debt 2.4� 2.4� Deferred income taxes 0.0� 0.0� Deferred income for

capital grants 13.8� 14.1� � Other liabilities � 10.6� � 10.5�

Minority Interest � 0.6� � 0.6� Shareholders� Equity: Share capital

54.8� 54.7� Reserves 42.3� 42.3� Additional paid-in capital 8.3�

8.3� Retained earnings 369.9� 373.5� Total shareholders� equity �

475.3� � 478.8� TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 681.7�

674.7� NATUZZI S.P.A. AND SUBSIDIARIES Unaudited Consolidated

Statement of Cash Flows as of March 31, 2007 and 2006 (Expressed in

millions of EUR) � 31-Mar-07 31-Mar-06 Cash flows from operating

activities: Net earnings (losses) (4.7) 6.8� Adjustments to

reconcile net income to net cash provided by operating activities:

Depreciation and amortization 7.2� 7.6� Employees' leaving

entitlement (0.2) 0.2� Deferred income taxes (3.0) (0.8) Minority

interest 0.0� 0.0� (Gain) loss on disposal of assets 0.0� 0.1�

Unrealized foreign exchange (losses) / gain 1.4� (5.4) Deferred

income for capital grants (0.3) (0.3) Change in assets and

liabilities: Receivables, net 10.9� (1.7) Inventories (16.8) 4.0�

Prepaid expenses and accrued income (2.0) (2.0) Other assets (2.8)

(0.5) Accounts payable 2.5� 13.4� Income taxes (0.7) 1.3� Salaries,

wages and related liabilities 0.2� (1.5) Other liabilities 1.6�

2.5� � Total adjustments (2.0) 16.9� � NET CASH PROVIDED (USED) BY

OPERATING ACTIVITIES (6.7) 23.7� � Cash flows from investing

activities: Property, plant and equipment: Additions (6.0) (3.6)

Disposals 0.2� 0.0� Government grants received 0.0� 0.0� Marketable

debt securities: Proceeds from sales 0.0� 0.0� Purchase of

business, net of cash acquired 0.0� 0.0� Disposal of business 0.0�

0.0� NET CASH PROVIDED (USED) BY INVESTING ACTIVITIES (5.8) (3.6)

Cash flows from financing activities: Long term debt: Proceeds 0.0�

0.1� Repayments 0.0� 0.0� Short-term borrowings 7.9� 1.3� Dividends

paid to shareholders 0.0� 0.0� Dividends paid to minority

shareholders 0.0� 0.0� NET CASH PROVIDED (USED) BY FINANCING

ACTIVITIES 7.9� 1.4� Effect of translation adjustments on cash 0.1�

0.1� INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS (4.5) 21.6�

Cash and cash equivalents, beginning of the year 128.1� 89.7� CASH

AND CASH EQUIVALENTS, END OF THE PERIOD 123.6� � 111.3�

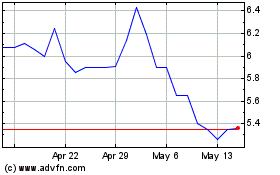

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

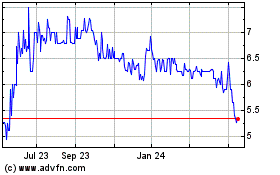

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

From Jul 2023 to Jul 2024