National Fuel Gas Supply Corporation (“Supply”) and Empire

Pipeline, Inc. (“Empire”), the operating companies that make up the

Pipeline and Storage segment of National Fuel Gas Company (NYSE:

NFG) (“National Fuel”), have announced the beginning of two Open

Seasons, making firm transportation capacity available from the

Marcellus Shale formation in the central and southwestern producing

regions of Pennsylvania.

“We are pleased to continue to offer the necessary pipeline

infrastructure and transportation services so vitally needed by the

companies producing natural gas from the Marcellus Shale

formation,” said Ronald J. Tanski, National Fuel’s President and

Chief Operating Officer. “Empire’s Tioga County Extension projects

will help meet the demands of Marcellus producers in central and

eastern Pennsylvania by providing significant additional capacity

out of the area to high value markets in New England, Canada and at

the Dawn hub. The continued enhancement of Supply’s existing

infrastructure in southwestern Pennsylvania provides a unique

opportunity to serve those Marcellus producers by moving their

production to the expanding east coast and mid-Atlantic markets. We

are confident that both projects will be well-received and look

forward to developing these projects to better serve

customers.”

Empire’s Open Season 008 offers capacity in Empire’s Tioga

County Extension Phase 2 Project (“TCE2”), which is being designed

to provide approximately 260,000 Dth per day of incremental firm

transportation from producer interconnections in Pennsylvania’s

Bradford and Tioga counties, as well as from prospective

interconnections with the Tennessee Gas Pipeline (“TGP”) 300 Line

and the proposed Penn Virginia Resources Midstream (“PVR”) pipeline

in Tioga and Lycoming counties. This transportation capacity would

provide access to diverse markets at several Empire delivery

points, including Empire’s existing interconnection with

TransCanada Pipeline at Chippawa, its planned interconnection with

the TGP 200 Line near Rochester, New York, and its existing

interconnection with Millennium Pipeline at Corning, New York.

The TCE2 project facilities would include two new compressor

stations, approximately 25 miles of 24-inch or 30-inch

high-pressure pipeline, and other enhancements along Empire’s

existing system. The new high-pressure pipeline would begin at a

new interconnection with the TGP 300 Line and/or an interconnection

with the proposed PVR pipeline, and would extend north to Jackson

Township, Pennsylvania, where it would connect with the 24-inch

pipeline that Empire expects to construct in 2011 as part of its

previously announced Tioga County Extension Phase 1 Project

(“TCE1”). TCE1, which was the subject of Empire Open Season 006, is

being designed to provide 350,000 Dth per day of incremental

transportation capacity from Jackson Township, Pennsylvania, to

Empire’s interconnect with TransCanada Pipeline at Chippawa. Empire

filed its FERC 7(c) application for the TCE1 project on August 26,

2010, and service is expected to commence September 1, 2011. Empire

has executed precedent agreements with anchor shippers Shell Energy

North America (US) L.P., and Talisman Energy USA Inc., and the

capacity is fully subscribed.

Depending on final facility design and Open Season awards, TCE2

would also provide significant short-haul capacity from the

Pennsylvania producing area to Millennium Pipeline at Corning, New

York. Empire expects that TCE2 could be placed in service as early

as September 1, 2013.

Supply’s Open Season 167 offers an additional 45,000 Dth per day

of transportation capacity in conjunction with its previously

announced Line N Phase II expansion project. The final facility

design has made this additional capacity available, from receipt

points at new and existing producer interconnects along Supply’s

Line N system in Pennsylvania’s Greene, Washington and Beaver

counties to a delivery point at Supply’s proposed interconnection

with Texas Eastern Transmission Corporation at Holbrook Station in

Greene County, Pennsylvania. Supply’s Line N Phase II facilities

would include additional compression at its Buffalo Station, along

with approximately six miles of pipeline replacement in Washington

County, Pennsylvania. The Line N Phase II project, which would have

a total maximum capacity of 195,000 Dth per day, is currently

supported by Range Resources Appalachia, LLC (“Range”), which has

executed a Precedent Agreement for 150,000 Dth per day.

Supply filed its FERC 7(c) application on June 11, 2010, for the

Line N Phase I expansion project, which is being designed to

provide 160,000 Dth per day of incremental transportation capacity.

This project is fully subscribed and has a projected in-service

date of September 1, 2011.

National Fuel is an integrated energy company with $5.1 billion

in assets comprised of the following four operating segments:

Exploration and Production, Pipeline and Storage, Utility, and

Energy Marketing. Additional information about National Fuel is

available on its website at investor.nationalfuelgas.com or through

its investor information service at 1-800-334-2188.

Certain statements contained herein, including those that are

identified by the use of the words “anticipates,” “estimates,”

“expects,” “forecasts,” “intends,” “plans,” “predicts,” “projects,”

“believes,” “seeks,” “will,” “may” and similar expressions, are

“forward-looking statements” as defined by the Private Securities

Litigation Reform Act of 1995. Forward-looking statements involve

risks and uncertainties, which could cause actual results or

outcomes to differ materially from those expressed in the

forward-looking statements. The Company’s expectations, beliefs and

projections contained herein are expressed in good faith and are

believed to have a reasonable basis, but there can be no assurance

that such expectations, beliefs or projections will result or be

achieved or accomplished. In addition to other factors, the

following are important factors that could cause actual results to

differ materially from those discussed in the forward-looking

statements: financial and economic conditions, including the

availability of credit, and their effect on the Company’s ability

to obtain financing on acceptable terms for working capital,

capital expenditures and other investments; occurrences affecting

the Company’s ability to obtain financing under credit lines or

other credit facilities or through the issuance of commercial

paper, other short-term notes or debt or equity securities,

including any downgrades in the Company’s credit ratings and

changes in interest rates and other capital market conditions;

changes in economic conditions, including global, national or

regional recessions, and their effect on the demand for, and

customers’ ability to pay for, the Company’s products and services;

the creditworthiness or performance of the Company’s key suppliers,

customers and counterparties; economic disruptions or uninsured

losses resulting from terrorist activities, acts of war, major

accidents, fires, hurricanes, other severe weather, or other

natural disasters; changes in the availability and/or price of

natural gas, and the effect of such changes on natural gas

production levels; significant differences between projected and

actual natural gas production levels; uncertainty of natural gas

reserve estimates; inability to obtain or retain sufficient

customers or commitments for planned projects; factors affecting

the Company’s ability to complete expansion projects as planned,

including among others geography, weather conditions, shortages or

unavailability of equipment and services required in construction

operations, unanticipated project delays or changes in project

costs or plans, and the need to obtain governmental approvals and

permits and comply with environmental laws and regulations; changes

in laws and regulations to which the Company is subject, including

energy, environmental, tax, safety and employment laws and

regulations; governmental/regulatory actions, initiatives and

proceedings, including those involving expansion projects,

financings, rate cases, affiliate relationships, industry

structure, and environmental/safety requirements; significant

changes in the Company’s relationship with its employees or

contractors and the potential adverse effects if labor disputes,

grievances or shortages were to occur; or the cost and effects of

legal and administrative claims against the Company. The Company

disclaims any obligation to update any forward-looking statements

to reflect events or circumstances after the date hereof.

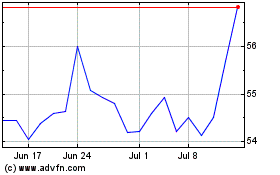

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From Apr 2024 to May 2024

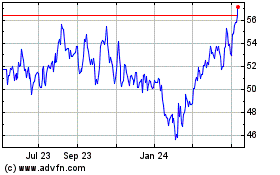

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From May 2023 to May 2024