- Current report filing (8-K)

January 13 2009 - 7:18AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 13, 2009

NATIONAL FUEL GAS COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

New Jersey

|

|

1-3880

|

|

13-1086010

|

|

(State or other jurisdiction

|

|

(Commission File Number)

|

|

(IRS Employer

|

|

of incorporation)

|

|

|

|

Identification No.)

|

|

|

|

|

|

6363 Main Street, Williamsville, New York

|

|

14221

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (716) 857-7000

Former name or former address, if changed since last report: Not Applicable

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy

the filing obligation of the registrant under any of the following provisions (

see

General

Instruction A.2. below):

|

o

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

o

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

o

|

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act

(17 CFR 240.14d-2(b))

|

|

|

|

o

|

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act

(17 CFR 240.13e-4(c))

|

Item 7.01 Regulation FD Disclosure

National Fuel Gas Company (the “Company”) will participate in the BMO Capital Markets 2009 North

American Unconventional Gas Conference on Tuesday, January 13, 2009. In connection with this

event, the Company also plans to hold meetings with certain industry analysts, money managers and

other members of the financial community. A copy of materials to be presented by the Company

during the conference and provided to participants in the Company’s meetings is furnished as part

of this Current Report as Exhibit 99.

Neither the furnishing of the presentation as an exhibit to this Current Report nor the inclusion

in such presentation of any reference to the Company’s internet address shall, under any

circumstances, be deemed to incorporate the information available at such internet address into

this Current Report. The information available at the Company’s internet address is not part of

this Current Report or any other report filed or furnished by the Company with the Securities and

Exchange Commission.

In addition to financial measures calculated in accordance with generally accepted accounting

principles (“GAAP”), the presentation furnished as part of this Current Report as Exhibit 99

contains certain non-GAAP financial measures. The Company believes that such non-GAAP financial

measures are useful to investors because they provide an alternative method for assessing the

Company’s operating results in a manner that is focused on the performance of the Company’s ongoing

operations. The Company’s management uses these non-GAAP financial measures for the same purpose,

and for planning and forecasting purposes. The presentation of non-GAAP financial measures is not

meant to be a substitute for financial measures prepared in accordance with GAAP.

Certain statements contained herein or in the presentation furnished as part of this Current

Report, including statements regarding future prospects, plans, performance and capital structure,

anticipated capital expenditures and completion of construction projects, as well as statements

that are identified by the use of the words “anticipates,” “estimates,” “expects,” “forecasts,”

“intends,” “plans,” “predicts,” “projects,” “believes,” “seeks,” “will,” “may,” and similar

expressions, are “forward-looking” statements” as defined by the Private Securities Litigation

Reform Act of 1995. There can be no assurance that the Company’s projections will in fact be

achieved nor do these projections reflect any acquisitions or divestitures that may occur in the

future. While the Company’s expectations, beliefs and projections are expressed in good faith and

are believed to have a reasonable basis, actual results may differ materially from those projected

in forward-looking statements. Furthermore, each forward-looking statement speaks only as of the

date on which it is made. In addition to other factors, the following are important factors that

could cause actual results to differ materially from those discussed in the forward-looking

statements: financial and economic conditions, including the availability of credit, and their

effect on the Company’s ability to obtain financing on acceptable terms for working capital,

capital expenditures and other investments; occurrences affecting the Company’s ability to obtain

financing under credit lines or other credit facilities or through the issuance of commercial

paper, other short-term notes or debt or equity securities, including any downgrades in the

Company’s credit ratings and changes in interest rates and other capital market conditions;

changes in economic conditions, including global, national or regional recessions, and their effect

on the demand for, and customers’ ability to pay for, the Company’s products and services; the

creditworthiness or performance of the Company’s key suppliers, customers and counterparties;

economic disruptions or uninsured losses resulting from terrorist activities, acts of war, major

accidents, fires, hurricanes, other severe weather, pest infestation or other natural disasters;

changes in actuarial assumptions, the interest rate environment and the return on plan/trust assets

related to the Company’s pension and other post-retirement benefits, which can affect future

funding obligations and costs and plan liabilities; changes in demographic patterns and weather

conditions; changes in the availability and/or price of natural gas or oil and the effect of such

changes on the accounting treatment of derivative financial instruments or the valuation of the

Company’s natural gas and oil reserves; impairments under the SEC’s full cost ceiling test for

natural gas and oil reserves; uncertainty of oil and gas reserve estimates; ability to successfully

identify, drill for and produce economically viable natural gas and oil reserves, including

shortages, delays or unavailability of equipment and services required in drilling operations;

significant changes from expectations in the Company’s actual production levels for natural gas or

oil; changes in the availability and/or price of derivative financial instruments; changes in the

price differentials between various types of oil; inability to obtain new customers or retain

existing ones; significant changes in competitive factors affecting the Company; changes in laws

and regulations to which the Company is subject, including tax, environmental, safety and

employment laws and regulations; governmental/regulatory actions, initiatives and proceedings,

including those involving acquisitions, financings, rate cases (which address, among other things,

allowed rates of return, rate design and retained natural gas), affiliate relationships, industry

structure, franchise renewal, and environmental/safety requirements; unanticipated impacts of

restructuring initiatives in the natural gas and electric industries; significant changes from

expectations in actual capital expenditures and operating expenses and unanticipated project delays

or changes in project costs or plans; the nature and projected profitability of pending and

potential projects and other investments, and the ability to obtain necessary governmental

approvals and permits; ability to successfully identify and finance acquisitions or other

investments and ability to operate and integrate existing and any subsequently acquired business or

properties; changes in the market price of timber and the impact such changes might have on the

types and quantity of timber harvested by the Company; significant changes in tax rates or policies

or in rates of inflation or interest; significant changes in the Company’s relationship with its

employees or contractors and the potential adverse effects if labor disputes, grievances or

shortages were to occur; changes in accounting principles or the application of such principles to

the Company; the cost and effects of legal and administrative claims against the Company or

activist shareholder campaigns to effect changes at the Company; increasing health care costs and

the resulting effect on health insurance premiums and on the obligation to provide other

post-retirement benefits; or increasing costs of insurance, changes in coverage and the ability to

obtain insurance. The Company disclaims any obligation to update any forward-looking statements to

reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated

events.

Item 9.01 Financial Statements and Exhibits

(c) Exhibits

|

|

|

|

|

|

|

Exhibit 99

|

|

Presentation materials for the BMO Capital Markets 2009 North

American Unconventional Gas Conference to be held on January 13, 2009

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly

caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

NATIONAL FUEL GAS COMPANY

|

|

|

|

By:

|

/s/ Paula M. Ciprich

|

|

|

|

|

Paula M. Ciprich

|

|

|

|

|

Secretary

|

|

|

|

Dated: January 13, 2009

EXHIBIT INDEX

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

99

|

|

Presentation materials for the BMO Capital Markets 2009

North American Unconventional Gas Conference to be held on

January 13, 2009

|

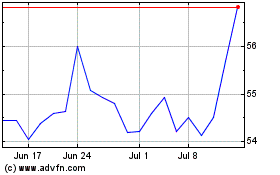

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From Oct 2024 to Nov 2024

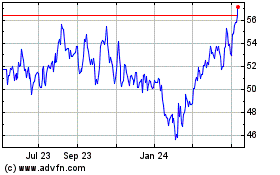

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From Nov 2023 to Nov 2024