UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

June 11, 2008

|

National Fuel Gas Company

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

New Jersey

|

1-3880

|

13-1086010

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

6363 Main Street, Williamsville, New York

|

|

14221

|

_________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

716-857-7000

|

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On June 11, 2008, the Board of Directors of National Fuel Gas Company (the "Company") approved a Director Services Agreement (the "Agreement") between the Company and Philip C. Ackerman, the Chairman of the Board of Directors of the Company and former Chief Executive Officer of the Company. Generally, the Agreement provides that, effective as of June 1, 2008, Mr. Ackerman is retired from the Company and will remain as the non-executive non-employee Chairman of the Board until June 1, 2009, or for such longer period as Mr. Ackerman, the Chief Executive Officer of the Company and the Board of Directors may mutually agree ("Chairman Services Period"). During the Chairman Services Period, Mr. Ackerman will perform the duties and responsibilities of Chairman of the Board of Directors as established under the Company’s By-Laws and Corporate Governance Guidelines, and consult with the Chief Executive Officer on matters pertaining to the administration and operation of the Company that Mr. Ackerman or the Chief Executive Officer deems appropriate. In no event will Mr. Ackerman provide, or be required to provide, services during the Chairman Services Period for more than the equivalent of fifty full time days in any calendar year (pro-rated for the partial calendar years during such period at the beginning and the end of the Chairman Services Period).

During the Chairman Services Period, Mr. Ackerman will receive an annual fee equal to $400,000. Mr. Ackerman is also eligible for Company-paid insurance coverage provided to other non-employee directors. Mr. Ackerman will not be eligible for any other compensation for his services during the Chairman Services Period, including any compensation otherwise made available to non-employee directors of the Company, any annual bonus or other incentive compensation opportunity, the award of any stock options or other equity grants, or to accrue any additional benefits under any employee benefit plans of the Company.

The Company will reimburse Mr. Ackerman for reasonable travel, lodging, meals and other appropriate expenses incurred by him in the course of rendering services under the Agreement. The Company will also provide Mr. Ackerman with suitable office space on its premises and appropriate secretarial services on an as needed basis during the Chairman Services Period.

The Agreement includes certain other customary terms and conditions, including, among others, provisions relating to confidential information, non-competition, non-solicitation of employees of the Company, and indemnification.

The foregoing description of the Agreement does not purport to be complete and is qualified in its entirety by reference to the Agreement, a copy of which has been filed as an exhibit hereto and is expressly incorporated by reference herein.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On June 11, 2008, the Board of Directors amended and restated the Company’s By-Laws, effective as of that date. The Board amended Article I, Section 4 of the By-Laws to require that additional information be set forth in any stockholders’ notice requesting the call of a special meeting of stockholders. The additional information consists of (i) the material terms of any synthetic or temporary ownership interests the requesting stockholders have regarding shares of the Company, including voting interests, swaps and other equity derivatives, securities loans, stock purchases, hedges and other economic incentives, all of which information must be updated as of the special meeting voting record date in a follow-up notice in writing to the Secretary of the Company no later than two business days after the special meeting voting record date, and (ii) any agreements, arrangements or understandings with other entities the requesting stockholders may have in connection with the business desired to be brought before the special meeting.

As required previously by Article I, Section 4 of the By-Laws, stockholders requesting the call of a special meeting of stockholders must also provide (i) a brief description of the business desired to be brought before the special meeting and the reasons for conducting such business at the special meeting, (ii) the name and record address of the stockholders proposing such business, (iii) the class and number of shares of the Company which are beneficially owned by the stockholders, and (iv) any material interest of the stockholders in such business.

The Board also amended Article I, Section 7(B) of the By-Laws to require that additional information be included in any stockholder’s notice setting forth information about the persons the stockholder proposes to nominate for election to the Board of Directors or the other business the stockholder desires to be brought before an annual meeting of stockholders. The additional information consists of (i) as to any person whom the stockholder proposes to nominate for election or reelection as a director, a description of any material relationships, including financial transactions and compensation, between such person and the stockholder, and such person’s written affirmation that such person does not have, nor will such person have, any undisclosed voting commitments or other arrangements with respect to such person’s activities as a director, and information sufficient to allow the directors to evaluate such person’s independence, (ii) as to any other business that the stockholder proposes to bring before the meeting, any agreements, arrangements or understandings with other entities the stockholder or the beneficial owner, if any, on whose behalf the proposal is made may have in connection with such business, and (iii) as to the stockholder giving the notice and the beneficial owner, if any, on whose behalf the nomination or proposal is made, the material terms of any synthetic or temporary ownership interests either has regarding shares of the Company, including voting interests, swaps and other equity derivatives, securities loans, stock purchases, hedges and other economic incentives, all of which information must be updated as of the annual meeting voting record date in a follow-up notice in writing to the Secretary of the Company no later than two business days after the annual meeting voting record date.

As required previously by Article I, Section 7(B) of the By-Laws, a stockholder’s notice setting forth information about the persons the stockholder proposes to nominate for election to the Board of Directors or the other business the stockholder desires to be brought before an annual meeting of stockholders must also include (i) as to any person whom the stockholder proposes to nominate for election or reelection as a director, the name, age and business address of such person, the principal occupation of employment of such person, the class and number of shares of the Company which are owned beneficially by such person, and all other information relating to such person that is required to be disclosed in solicitations of proxies for election of directors in an election contest, or is otherwise required, in each case under applicable Securities and Exchange Commission regulations, including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected, (ii) as to any other business that the stockholder proposes to bring before the meeting, a brief description of the business desired to be brought before the meeting, the reasons for conducting such business at the meeting, any material interest in such business of such stockholder and the beneficial owner, if any, on whose behalf the proposal is made, and (iii) as to the stockholder giving the notice and the beneficial owner, if any, on whose behalf the nomination or proposal is made, the name and address of such stockholder, as they appear on the Company’s books, and of such beneficial owner, and the class and number of shares of the Company which are owned beneficially and of record by such stockholder and such beneficial owner.

The amended provisions will apply to any stockholder’s notice received by the Company on or after June 11, 2008 requesting the call of a special meeting of stockholders or setting forth information about the persons the stockholder proposes to nominate for election to the Board of Directors or the other business the stockholder desires to be brought before an annual meeting of stockholders.

The foregoing description of the amendments to the By-Laws does not purport to be complete and is qualified in its entirety by reference to the By-Laws, a copy of which has been filed as an exhibit hereto and is expressly incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(c) Exhibits

Exhibit 3.1 - By-Laws of National Fuel Gas Company as amended and restated June 11, 2008

Exhibit 99 - Form of Director Services Agreement between National Fuel Gas Company and Philip C. Ackerman

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

National Fuel Gas Company

|

|

|

|

|

|

|

|

June 16, 2008

|

|

By:

|

|

/s/ James R. Peterson

|

|

|

|

|

|

|

|

|

|

|

|

Name: James R. Peterson

|

|

|

|

|

|

Title: Assistant Secretary

|

Exhibit Index

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

3.1

|

|

By-Laws of National Fuel Gas Company as amended and restated June 11, 2008

|

|

99

|

|

Form of Director Services Agreement between National Fuel Gas Company and Philip C. Ackerman

|

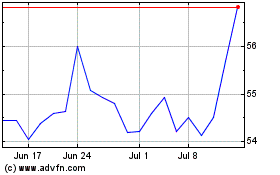

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From Oct 2024 to Nov 2024

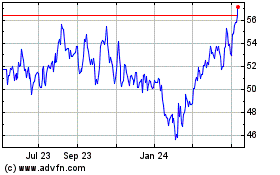

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From Nov 2023 to Nov 2024