National Fuel Gas Co (Other) (8-K)

September 26 2007 - 5:19PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

September 20, 2007

|

National Fuel Gas Company

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

New Jersey

|

1-3880

|

13-1086010

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

6363 Main Street, Williamsville, New York

|

|

14221

|

_________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

716-857-7000

|

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On September 20, 2007, the Board of Directors (the "Board") of National Fuel Gas Company (the "Company") approved amendments to the National Fuel Gas Company and Participating Subsidiaries Executive Retirement Plan (the "Executive Retirement Plan"), the National Fuel Gas Company Tophat Plan (the "Tophat Plan"), the Employment Continuation and Noncompetition Agreements among the Company, certain subsidiaries of the Company and the named executive officers of the Company, other than those who have retired (the "Employment Continuation and Noncompetition Agreements"), and the Retirement Benefit Agreement For David F. Smith (the "Retirement Benefit Agreement" and, together with the Executive Retirement Plan, the Tophat Plan and the Employment Continuation and Noncompetition Agreements, the "Agreements"). The Board approved amendments to the Agreements to comply with final regulations issued under Section 409A of the Internal Revenue Code and to make certain other changes and clarifications. The amendments will not result in a material increase in costs to the Company. The Agreements and the principal amendments to the Agreements are described briefly below.

Executive Retirement Plan

The Executive Retirement Plan is a nonqualified, noncontributory, defined-benefit retirement plan for certain senior executives of the Company or its subsidiaries. The Executive Retirement Plan provides participants with a two-part benefit: a "top hat" benefit, which restores certain benefits that cannot be provided under the Company’s basic tax-qualified retirement plan (the "Basic Retirement Plan") due to tax law limitations or to participants’ past participation in the Company’s deferred compensation plan; and a "supplemental" benefit, which provides incremental retirement benefits for participants who stay with the Company until at least age 55. In general, the amount payable to a participant under the Executive Retirement Plan depends upon the participant’s average annual cash compensation over a 60-month period preceding retirement, the participant’s length of service to the Company, and the form of benefit selected by the participant.

The Board amended the Executive Retirement Plan to address a scenario in which a participant terminates employment but does not have a separation from service as defined in regulations issued under Section 409A. In that scenario, a distribution under the Executive Retirement Plan is triggered by the date services cease, rather than the date employment ceases.

Tophat Plan

The Tophat Plan is a benefit plan that pays participants a sum intended to replace amounts which they will not receive as Company contributions under the National Fuel Gas Company Tax-Deferred Savings Plan for Non-Union Employees (the "Tax-Deferred Savings Plan") as a result of tax law limits or other tax considerations. The Tophat Plan also restores benefits lost to employees (other than employees eligible to participate in the Executive Retirement Plan) under the Basic Retirement Plan as a result of their participation in the National Fuel Gas Company Deferred Compensation Plan (the "Deferred Compensation Plan") or as a result of tax law limits or other tax considerations. In general, the amount payable to a participant under the Tophat Plan depends upon whether the participant is affected by tax law limits, participation in the Tax-Deferred Savings Plan, and, in the case of an employee not eligible to participate in the Executive Retirement Plan, the amount of compensation deferred by the employee pursuant to the Deferred Compensation Plan.

The Board amended the Tophat Plan to address a scenario in which a participant terminates employment but does not have a separation from service as defined in regulations issued under Section 409A. In that scenario, a distribution under the Tophat Plan is triggered by the date services cease, rather than the date employment ceases. The Board also amended the Tophat Plan to revise the election date for selecting the form of benefit under the plan, to eliminate a lump sum payment option as a form of benefit, and to provide certain other forms of benefit, including various annuities. Finally, unrelated to Section 409A, the Board amended the Tophat Plan to provide a tophat benefit related to retirement savings accounts payable by the Company in accordance with the Tax-Deferred Savings Plan to employees whose employment commenced on or after July 1, 2003.

Employment Continuation and Noncompetition Agreements

The Employment Continuation and Noncompetition Agreements preserve as a minimum, for the three years following a change in control of the Company, the annual salary levels and employee benefits then in effect for the executives who have entered into these agreements. The Employment Continuation and Noncompetition Agreements also provide that, in the event of certain terminations of employment, the executives will receive severance payments up to 1.99 times their respective annual base salaries and annual bonuses prior to termination. Unless an executive elects not to be bound by the noncompetition part of the agreement, an additional payment of 1.00 times salary and annual bonus prior to termination will be made at the same time. In addition, executives will receive either continuation of certain employee benefits or the value of such benefits.

The Board amended the Employment Continuation and Noncompetition Agreements to revise the circumstances under which an executive’s termination of his or her employment after a change in control of the Company will constitute a termination for "Good Reason." In particular, the Board amended the definition of "Good Reason" to conform to the definition provided in a safe harbor set forth in the regulations under Section 409A. The Board also amended the Employment Continuation and Noncompetition Agreements to reduce the period during which benefits are available after an eligible termination of employment, from three years to eighteen months. Finally, unrelated to Section 409A, the Board amended the Employment Continuation and Noncompetition Agreements to clarify (i) that the agreements remain effective in the event of an executive’s transfer of employment from one subsidiary of the Company to another subsidiary or to the Company itself, and (ii) that the Company bears an obligation to pay the executives under the agreements in the event a subsidiary of the Company fails to make the required payments.

Retirement Benefit Agreement

The Retirement Benefit Agreement, initially entered into as of September 22, 2003, provides David F. Smith, who serves as President and Chief Operating Officer of the Company and as President of National Fuel Gas Supply Corporation and Empire State Pipeline, with certain retirement benefits in the event of an actual or constructive termination without cause before March 1, 2011. In such a case, Mr. Smith would receive a retirement benefit based on the percentage of retirement benefits he would receive at March 1, 2011 under the Basic Retirement Plan and Executive Retirement Plan. However, Mr. Smith’s actual earnings and actual years of service at termination would be used in the calculation of his benefit based on the formulas in the Basic Retirement Plan and the Executive Retirement Plan.

The Board amended the Retirement Benefit Agreement to define more precisely the timing of payments to Mr. Smith’s spouse in the event the agreement is triggered and Mr. Smith dies prior to receipt of all payments due under the agreement. In addition, unrelated to Section 409A, the Board revised the Retirement Benefit Agreement to reflect that Mr. Smith is now an employee of National Fuel Gas Supply Corporation, rather than National Fuel Gas Distribution Corporation, and to provide automatic coverage in the event of future transfers of employment to the Company or to another of its wholly-owned subsidiaries.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

National Fuel Gas Company

|

|

|

|

|

|

|

|

September 26, 2007

|

|

By:

|

|

/s/ J. R. Peterson

|

|

|

|

|

|

|

|

|

|

|

|

Name: J. R. Peterson

|

|

|

|

|

|

Title: Assistant Secretary

|

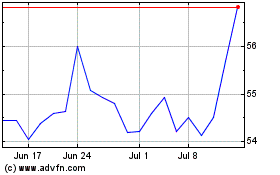

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From Oct 2024 to Nov 2024

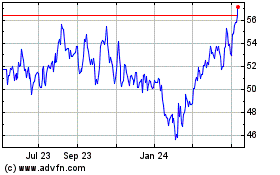

National Fuel Gas (NYSE:NFG)

Historical Stock Chart

From Nov 2023 to Nov 2024