MRC Global Down to Strong Sell - Analyst Blog

June 05 2013 - 2:30PM

Zacks

Zacks Investment Research

downgraded MRC Global Inc. (MRC) to a Zacks Rank

#5 (Strong sell) on June 4, 2013.

Why the

Downgrade?

Recent disclosures made by MRC Global on May 29 resulted in

downward revision in earnings estimates in the last 7 days. The

Zacks Consensus Estimate for 2013 has gone down by 4.0% to $2.17

while for 2014, the estimate decreased 4.8% to $2.58.

Line pipe sales in the two months ended May 31, 2013 were below the

company’s original expectations due to reduced investment

activities from its United States customers.

Management of MRC Global now expects line pipe sales to be $100

million below its original forecast and roughly 10% down on a

year-over-year basis for the second quarter 2013 while going down

roughly $300 million year over year for 2013.

Apart from the line pipe sales, OCTG sales of MRC Global are

expected to be down $70 million for the second quarter 2013 and

$200 million for 2013 compared with their respective year-ago

periods.

Considering all these factors, management revised its revenue

guidance for 2013 to $5.4-$5.8 billion from $5.75-$5.95 billion

expected earlier. For the second quarter, revenues are likely to be

within the $1.25-$1.35 billion range.

A glimpse into the first quarter 2013 results show that revenue

generation in the quarter was also weak and decreased 5.6% year

over year due to the prevailing weakness in the U.S. upstream and

midstream sectors as well as planned reduction in oil country

tubular goods (OCTG) business.

A weak revenue outlook as well as lower earnings guidance

raises skepticism over the financial results in the quarters ahead.

Currently, for MRC Global, we have an Earnings ESP (Read: Zacks

Earnings ESP: A Better Method) of -6.4% for the second quarter,

-4.2% for 2013 and -3.5% for 2014.

Other Stocks to Consider

MRC Global is a $2.7 billion company engaged in the distribution of

pipes, valves, and fittings (PVF), and related products and

services to the energy industry worldwide.

Other stocks to watch out for in

the industry are Mueller Water Products, Inc.

(MWA), with a Zacks Rank #1 (Strong Buy) while Valmont

Industries, Inc. (VMI) and W.W. Grainger,

Inc. (GWW), each has a Zacks Rank #2 (Buy).

GRAINGER W W (GWW): Free Stock Analysis Report

MRC GLOBAL INC (MRC): Free Stock Analysis Report

MUELLER WATER (MWA): Free Stock Analysis Report

VALMONT INDS (VMI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

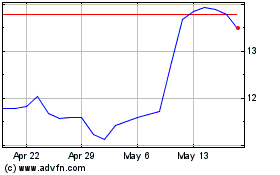

MRC Global (NYSE:MRC)

Historical Stock Chart

From Jun 2024 to Jul 2024

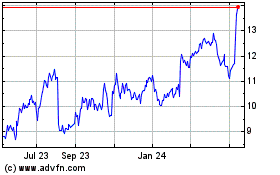

MRC Global (NYSE:MRC)

Historical Stock Chart

From Jul 2023 to Jul 2024