Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

November 12 2021 - 6:44AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2021

Commission File Number 001-33098

Mizuho Financial Group, Inc.

(Translation of registrant’s name into English)

5-5, Otemachi 1-chome

Chiyoda-ku, Tokyo 100-8176

Japan

(Address of principal

executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form

20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):82- .

THIS REPORT ON FORM 6-K SHALL BE DEEMED TO BE INCORPORATED BY

REFERENCE INTO THE PROSPECTUS FORMING A PART OF MIZUHO FINANCIAL GROUP, INC.’S REGISTRATION STATEMENT ON FORM F-3 (FILE NO. 333-233354) AND TO BE A PART OF SUCH PROSPECTUS FROM THE DATE ON WHICH THIS

REPORT IS FURNISHED, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED OR FURNISHED.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

Date: November 12, 2021

|

|

|

|

Mizuho Financial Group, Inc.

|

|

|

|

|

By:

|

|

/s/ Makoto Umemiya

|

|

Name:

|

|

Makoto Umemiya

|

|

Title:

|

|

Senior Executive Officer / Group CFO

|

November 12, 2021

To whom it may concern

|

|

|

|

|

|

|

|

|

Company Name:

|

|

Mizuho Financial Group, Inc.

|

|

|

|

Representative:

|

|

Tatsufumi Sakai,

President and Group

CEO

|

|

|

|

Head Office:

|

|

1-5-5 Otemachi, Chiyoda-ku, Tokyo

|

|

|

|

Code Number:

|

|

8411 (Tokyo Stock Exchange 1st Section)

|

Interim Dividends and Revision to the Year-end and Annual

Dividends Estimates

for the Fiscal Year Ending March 31, 2022

Mizuho Financial Group, Inc. (“MHFG”) hereby announces that MHFG resolved at the meeting of its Board of Directors held today to pay interim

dividends on its common stock, with a record date of September 30, 2021, and to revise its estimates of the year-end and annual dividends per share of common stock for the fiscal year ending

March 31, 2022, as set forth below.

|

1.

|

Interim dividends for the fiscal year ending March 31, 2022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Determined Items

|

|

|

Most recent estimates

(announced on

May 14, 2021)

|

|

|

Actual dividends for

previous fiscal year

(ended March 31, 2021)

|

|

|

Record date

|

|

September 30, 2021

|

|

|

September 30, 2021

|

|

|

September 30, 2020

|

|

|

Dividends per share of common stock

|

|

|

¥40.0

|

|

|

|

¥37.5

|

|

|

|

¥37.5

|

(*)

|

|

Total amount of dividends

|

|

|

¥101,545 million

|

|

|

|

-

|

|

|

|

¥95,209 million

|

|

|

Effective date

|

|

|

December 7, 2021

|

|

|

|

-

|

|

|

|

December 7, 2020

|

|

|

Resource of dividends

|

|

|

Retained Earnings

|

|

|

|

-

|

|

|

|

Retained Earnings

|

|

|

2.

|

Revision of year-end and annual dividends estimates for the fiscal

year ending March 31, 2022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends per share of common stock

|

|

|

|

Interim dividends

|

|

|

Year-end dividends

|

|

|

Annual dividends

|

|

|

Previous estimates (A)

|

|

|

¥37.5

|

|

|

|

¥37.5

|

|

|

|

¥75.0

|

|

|

Revised estimates (B)

|

|

|

|

|

|

|

¥40.0

|

|

|

|

¥80.0

|

|

|

Actual results for the fiscal year ending March 31, 2022 (B)

|

|

|

¥40.0

|

|

|

|

|

|

|

|

|

|

|

Net change (B – A)

|

|

|

+¥2.5

|

|

|

|

+¥2.5

|

|

|

|

+¥5.0

|

|

|

Actual results for the fiscal year ended March 31, 2021

|

|

|

¥37.5

|

(*)

|

|

|

¥37.5

|

|

|

|

¥75.0

|

(*)

|

|

|

(*)

|

MHFG conducted a share consolidation of common stock on the basis of one post-consolidation share per ten pre-consolidation shares effective as of October 1, 2020. The impact of the share consolidation is reflected in the interim dividends per share of common stock for the fiscal year ended March 31, 2021.

Without the share consolidation, the interim dividends would have been ¥3.75 per share. In addition, the impact from the share consolidation is reflected in the annual dividends per share of common stock for the fiscal year ended March 31,

2021.

|

From the fiscal year ending March 31, 2022, we have been pursuing the optimum balance between capital adequacy, growth investment and

enhancement of shareholder returns. In accordance with this new initiative, we set forth the shareholder return policy pursuant to which progressive dividends are our principal approach while also executing flexible and intermittent share buybacks;

we determine the amount of dividends based on the perspective of achieving steady growth of our stable earnings base, taking into consideration a dividend payout ratio of 40% as a guide.

Considering the financial results to date and other factors based on our shareholder return policy, we determined to pay ¥40.0 per share of

common stock as the interim dividends for the fiscal year ending March 31, 2022, an increase of ¥2.5 from the previously estimated ¥37.5. Accordingly, we revised the year-end dividend estimates

from the previously estimated ¥37.5 to ¥40.0 per share of common stock, for an increase of ¥2.5. As a result, the annual dividends are estimated to be ¥80.0 per share of common stock, an increase of ¥5.0 from the previous

estimates and the dividends paid for the fiscal year ended March 31, 2021.

End of document

This immediate release contains statements that constitute forward-looking statements within the meaning of

the United States Private Securities Litigation Reform Act of 1995, including estimates, forecasts, targets and plans. Such forward-looking statements do not represent any guarantee by management of future performance. You can also identify

forward-looking statements by discussions of strategy, plans or intentions. These statements reflect our current views with respect to future events and are subject to risks, uncertainties and assumptions. Our views regarding dividends for fiscal

2021 set forth in this immediate release are based on our assessment of information regarding the business and market environment that are available as of the date of this immediate release and assumptions regarding factors that are currently

uncertain and may impact our financial performance. Actual results may differ materially, for example, if our assessment of business and market environment and their impact on our business, financial condition and results of operations proves to be

inaccurate. Other factors that could affect our financial condition and results of operations are included in “Item 3.D. Key Information—Risk Factors” and “Item 5. Operating and Financial Review and Prospects” in our most

recent Form 20-F filed with the U.S. Securities and Exchange Commission (“SEC”), which is available in the Financial Information section of our web page at www.mizuhogroup.com and also at the

SEC’s web site at www.sec.gov. We are under no obligation, and disclaim any obligation, to update or alter our forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by the

rules of the Tokyo Stock Exchange.

|

|

|

|

|

|

|

|

|

|

|

Contact:

|

|

Mizuho Financial Group, Inc.

|

|

|

|

|

|

|

|

Corporate Communication Department

Tel: 81-3-5224-2026

|

|

|

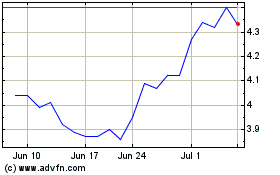

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From May 2024 to Jun 2024

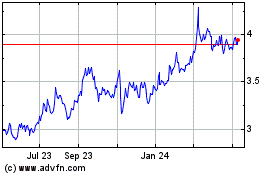

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From Jun 2023 to Jun 2024