Japanese Banks Invest in Solar Biz - Analyst Blog

February 07 2013 - 12:45PM

Zacks

According to a Bloomberg report, following the footsteps of the

U.S. banking major The Goldman Sachs Group, Inc.

(GS), some of Japan’s key banks are coming up with investments in

the country’s domestic solar power industry. Among these banks,

Mitsubishi UFJ Financial Group, Inc. (MTU),

Mizuho Financial Group, Inc. (MFG) and Sumitomo

Mitsui Financial Group Inc. (SMFG) are planning to

invest in the solar business on the anticipation of huge

returns.

Notably, in 2012, the investment in Japanese solar installations

was 223 billion yen. Therefore, these Japanese banks anticipate

investments to reach 1.8 trillion yen ($19 billion) by 2016. The

expected hike is primarily attributable to the Japanese

government’s subsidy program, which was initiated in Jul 2012.

This program is anticipated to propel Japan as the world’s

third-largest market of solar power in 2013. The incentive related

to the subsidy program is almost three times the sum that countries

like Germany offers to its solar industries.

The subsidy program had an instantaneous impact on Japan’s solar

business. Notably, domestic shipment of solar cells and modules

jumped 80% to 627 megawatts (MW) in Jul to Sep 2012 compared with

the prior-year period. Further, this prompted international biggies

such as Goldman and IBM Japan Ltd. to enter the Japanese solar

industry.

However, the opportunities in the solar industry may not last for

long as the policies will likely be reversed or terminated. The

Japanese government anticipates that the subsidies, better known as

feed-in tariffs, will be the primary factors behind enhancement of

fresh investments. But the incentives for solar energy might be

brought down to the range of 35–39 yen a kilowatt-hour (kWh), from

the existing rate of 42 yen per kWh for 20 years.

For the domestic Japanese banks, investing in the flourishing solar

industry would partially mitigate the reduction in lending that

occurred in the last 3 years. Japanese banks were highly affected

by the sluggish macroeconomic environment, which resulted in lack

of enthusiasm from the borrowers.

We believe that the solar boom will result in the banks collecting

more revenues. However, there is also fierce competition among the

banks for gaining control of the market.

GOLDMAN SACHS (GS): Free Stock Analysis Report

MIZUHO FINL-ADR (MFG): Free Stock Analysis Report

MITSUBISHI-UFJ (MTU): Free Stock Analysis Report

SUMITOMO-MITSUI (SMFG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

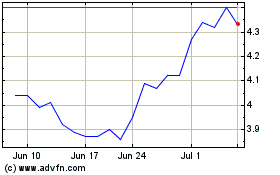

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From Jun 2024 to Jul 2024

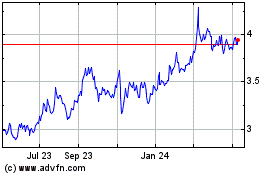

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From Jul 2023 to Jul 2024