Investment managers posted a strong first quarter Thursday, with

BlackRock Inc. (BLK) and Janus Capital Group Inc. (JNS) both

delivering better-than expected earnings, buoyed by better

performance and higher assets under management.

T. Rowe Price Group Inc.(TROW), whose results fell short of

analysts' expectations, nevertheless posted a 27% rise in first

quarter earnings.

BlackRock's profits rose 34%, driven by "strong investment

performance, robust new business in long-term products, increased

demand for BlackRock Solutions and continued expense discipline,"

the company said. BlackRock Solutions is the company's advisory

business.

Janus' first-quarter net profit jumped 21% as revenue increased

and managed assets rose due to market appreciation.

BlackRock Chairman and Chief Executive Laurence D. Fink said

clients have begun to "re-risk" by investing less in standard

equities and moving towards more volatile, alternative products.

The company, which is the world's biggest money-management firm by

assets and which was recently added to the Standard & Poor's

500 Index, said investors deployed an additional $2 billion in

BlackRock's alternative investments so far this year, to complement

investments in products like exchange-traded funds.

BlackRock posted a profit of $568 million, or $2.89 a share, up

from $423 million, or $2.17 a share, a year earlier. Excluding

transaction costs and other items, earnings rose to $2.96 a share

from $2.40.

Revenue increased 14% to $2.28 billion, including a 66% one-year

jump in performance fees.

Analysts surveyed by Thomson Reuters predicted earnings of $2.77

a share on revenue of $2.25 billion.

Assets under management rose to $3.648 trillion, up 8.5% from a

year earlier and 2.5% from the prior quarter. A $100 billion

increase in assets due to performance gains and an inflow of $34.7

billion in net new business in long-term products were partially

offset by $24.4 billion of outflows in cash management and $4.5

billion of distributions from advisory accounts, the company

said.

As of April 14, BlackRock's net new business pipeline totaled

$82.4 billion, including $60.7 billion in long-term products, the

company said.

In a conference call, Fink said BlackRock will launch an

aggressive campaign to build brand awareness worldwide, and will

build out its distribution network and manufacturing platform. He

expects the industry to go through a period of "crowding out."

Fink also noted Asian flows were "slower than we would like"

after the massive Japanese earthquake in mid-March, but the firm is

committed to building out Asia to take advantage of future

growth.

Japan's Mizuho Financial Group Inc. bought a 2% stake in

BlackRock in November last year for $500 million, in a deal that

allows BlackRock products to be marketed to Japanese individuals

and businesses through Mizuho.

In March, the company raised its quarterly dividend 38% to

$1.375 and said it expects to increase share buybacks during the

year as the strength of the company's earnings and free cash flow

allowed it sufficient resources to continue to reinvest in its

business, while further enhancing BlackRock's payout to

shareholders.

T. Rowe Price posted a profit of $194.6 million, or 72 cents a

share, up from $153 million, or 57 cents a share, a year earlier.

Net revenue increased 23% to $682.4 million.

Analysts surveyed by Thomson Reuters expected earnings of 75

cents a share on revenue of $687 million.

Operating margin rose to 45.6% from 42.9%.

Assets under management rose 5.8% to $509.9 billion compared

with the fourth quarter. Net inflows were $5.8 billion, compared

with $10.3 billion reported a year earlier and $6.9 billion in the

prior quarter.

CEO James A.C. Kennedy noted how markets were volatile during

the most recent period. "Market gains through mid-February and a

strong rally in the latter half of March sandwiched a significant

selloff in which unrest in North Africa and the Middle East, as

well as the unfolding tragedy in Japan, rattled world markets," he

said.

However, he said "improving sentiment has led investors to

largely shrug off recent geopolitical and economic

uncertainties."

In January, Kennedy touted the way the firm's investment

performance was attracting more assets from both new and existing

clients, and its assets under management again hit a new high in

the latest quarter.

Earlier this month, the company made a notable investment in

Facebook Inc., an example of how T. Rowe has been more aggressive

than other traditional investment companies in betting on hot

technology plays.

Janus posted a quarterly profit of $37.9 million, or 21 cents a

share, up from $31.3 million, or 17 cents a share, a year earlier.

The latest period included 3 cents a share in debt-retirement

charges while the prior-year result included a 12-cent net benefit

from items such as an insurance recovery and the sale of structured

investment vehicle securities. Revenue rose 7.5% to $265.4

million.

Analysts most recently forecast a profit of 20 cents a share on

$268 million in revenue.

The company also quintupled its annualized dividend to 20

cents.

Janus said Chief Financial Officer Greg Frost, who has been with

the firm since 1997, plans to leave about Aug. 1. He will be

succeeded by Bruce Koepfgen, who previously worked for insurer

Allianz SE's asset-management unit.

Janus has seen continued earnings growth of late as investment

fees and the pool of assets it manages have increased from

prior-year levels.

Assets under management ended the period at $173.5 billion, up

from $165.5 billion a year earlier and $169.5 billion in the prior

period. The increase reflected market appreciation, which was

offset by $2.7 billion in long-term net outflows.

The firm's mathematical equity and fundamental equity long-term

outflows were about $2.6 billion and $500 million, respectively.

Fixed income saw inflows of about $400 million.

- Amy Or, Dow Jones Newswires, +1 212 416 3142,

amy.or@dowjones.com

(Matt Jarzemsky contributed to this article.)

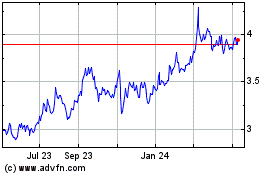

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From May 2024 to Jun 2024

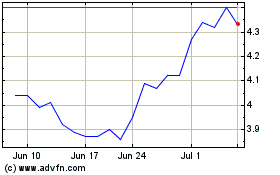

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From Jun 2023 to Jun 2024