Autoliv Enters New $1.1 Billion Revolving Credit Facility

April 18 2011 - 3:28AM

Dow Jones News

Swedish car safety firm Autoliv Inc. (ALV) said Monday it has

entered into a new $1.1 billion multi-currency revolving credit

facility agreement with a group of 14 banks.

MAIN FACTS:

-The facility has a five-year maturity, with extension options

for up to two more years.

-The new agreement is for general corporate purposes - including

the refinancing of its existing $1.1 billion syndicated facility,

which matures in November 2012.

-The active bookrunners, co-ordinators and mandated lead

arrangers are Mizuho (MFG), Nordea (NDA.SK) and SEB (SEB-A.SK).

-The other bookrunning mandated lead arrangers are BTMU, ING

(ING) and Societe Generale (GLE.FR).

-The lead arrangers are DnB Nor (DNBNOR.OS), HSBC (HBC), JP

Morgan (JPM) and Morgan Stanley (MS).

-The arrangers are Bank of China (3988.HK), Danske Bank

(DANSKE.KO), Deutsche Bank (DB) and Northern Trust (NTRS).

-The banking group reflects Autoliv's strengthened position in

Asia with four Asian banks participating.

-This financial commitment does not have any financial

covenants, i.e. performance-related restrictions, as with all of

the existing principal debt arrangements of Autoliv, Inc.

-Shares closed Friday at SEK

-By Dominic Chopping, Dow Jones Newswires; +46-8-5451-3093;

dominic.chopping@dowjones.com

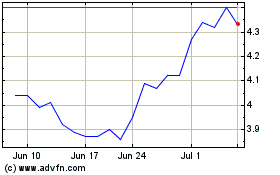

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From May 2024 to Jun 2024

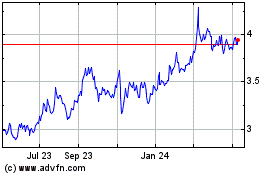

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From Jun 2023 to Jun 2024