2nd UPDATE: Vodafone Group PLC Preparing $1.1 Billion 2-Part Debt Offering

March 09 2011 - 1:24PM

Dow Jones News

Vodafone Group PLC (VOD, VOD.LN) said it would sell $1.1 billion

of new debt Wednesday.

The deal was increased from an originally planned $1

billion.

The issue will include five- and 10-year senior unsecured note

tranches and is expected to be priced later in the session via

bookrunners Barclays, BNP Paribas, Morgan Stanley and Mizuho.

The $600 million, five-year tranche was launched with a risk

premium of 85 basis points over Treasurys while the $500 million,

10-year tranche was launched at 100 basis points.

Both pieces were launched at the wide end of preliminary price

levels. Preliminary price guidance had suggested a risk premium in

the range of 80 to 85 basis points over Treasurys for the five-year

piece and a range of 95 to 100 basis points for the 10-year

tranche.

Vodafone 5.00% notes due 2013 recently traded at 97 basis points

over Treasurys, according to MarketAxess.

Vodafone's debt offering will include a make-whole call

provision, meaning that the borrower can pay off the debt early.

But because the cost to invoke this kind of covenant can be

significant, issuers rarely use the option.

Proceeds will be used for general corporate purposes, which

could include the repayment of outstanding debt securities.

The deal has been rated Baa1 by Moody's Investors Service and A-

by Standard & Poor's.

-By Kellie Geressy-Nilsen, Dow Jones Newswires; 212 416-2225;

kellie.geressy@dowjones.com

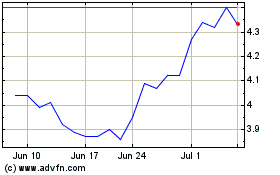

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From May 2024 to Jun 2024

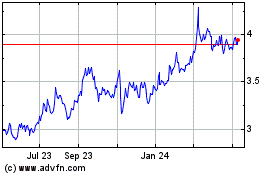

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From Jun 2023 to Jun 2024