Morgan Stanley's Gamble Pays Off -- WSJ

January 05 2019 - 3:02AM

Dow Jones News

Value of MUFG's alliance with the U.S. firm on full display in

Bristol-Myers deal

By Liz Hoffman

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 5, 2019).

When Morgan Stanley sold one-fifth of itself to Mitsubishi UFJ

Financial Group Inc. in 2008, naysayers said it had sold out too

cheaply in the panic and shackled itself to a sleepy Japanese

bank.

"People thought we'd made a mistake," Colm Kelleher, Morgan

Stanley's No. 2 executive, said recently.

Today, the alliance between Morgan Stanley and MUFG, as it is

known, has done for both banks what neither could have accomplished

alone. It has created a leading investment bank in Japan and given

Morgan Stanley the added muscle of a $2.8 trillion balance sheet to

compete with larger rivals at home, as lending takes on bigger

import on Wall Street.

The partnership's value was on clear display Thursday when

pharmaceutical giants Bristol-Myers Squibb Co. and Celgene Corp.

announced their merger. Morgan Stanley and MUFG will together lend

$33.5 billion to back the deal, one of the biggest bridge loans on

record.

Morgan Stanley couldn't write a check that size by itself. Even

behemoths like JPMorgan Chase & Co. tend to max out around $25

billion to a single borrower. Goldman Sachs Group Inc. and Barclays

PLC raised eyebrows in 2017 by each lending $20 billion to finance

CVS Health Corp.'s takeover of Aetna Inc.

By bringing in MUFG, Morgan Stanley keeps the loan's fees -- and

bragging rights -- away from U.S. rivals. Freeman Consulting

Services estimates the two firms could split up to $170 million, on

top of millions more Morgan Stanley will earn as an adviser to

Bristol-Myers.

The partnership traces to September 2008, when MUFG bought a 21%

stake in Morgan Stanley after skittish investors dumped the bank's

stock. The $9 billion investment was a badly needed lifeline and

helped calm investors who had worried Morgan Stanley would follow

Lehman Brothers into bankruptcy. Morgan Stanley shares rose after

the deal was announced.

The pair later set up two joint ventures to combine their

strengths: Morgan Stanley's in international deal-making and stock

underwriting, MUFG's in Japanese corporate and retail banking.

With an $865 billion balance sheet -- one-third the size of

JPMorgan or Bank of America Corp. -- Morgan Stanley struggles to

compete in situations where clients want money, not just advice.

MUFG's Yen306 trillion ($2.8 trillion) balance sheet has

helped.

Last year, the two firms teamed up to provide a $27 billion loan

for Cigna Corp.'s takeover of Express Scripts Holding Co., which

was Morgan Stanley's largest lending commitment until this week.

"That is not something typically you would expect from Morgan

Stanley," Mr. Kelleher said at the time. "You'd expect that from

one of the big lending banks."

In MUFG's 24% stake, Morgan Stanley Chief Executive James Gorman

also gets a steadying presence in turbulent moments -- for example,

when an activist investor took a stake in the bank in 2016.

MUFG, meanwhile, has gained a foothold on Wall Street, avoiding

the pitfalls of other Japanese banks that have struggled to crack

the U.S. market, or done so in fits and starts. "Building from

scratch takes too long," MUFG CEO Nobuyuki Hirano said in a recent

interview.

MUFG also gets to record a chunk of Morgan Stanley's profits --

up 40% since 2014 -- as its own. Mr. Hirano, who worked as a young

investment banker at Morgan Stanley covering big paper companies,

sits on Morgan Stanley's board and meets twice a year with top

executives including Messrs. Gorman and Kelleher.

The partnership has succeeded in Japan, too, where Morgan

Stanley underwrites securities and distributes to MUFG's millions

of retail clients. The firm, which ranked 10th in Japanese M&A

in 2009, has been No. 1 four of the past six years, and won roles

on high-profile initial public offerings of Japan Airlines and

Japan Post.

Mr. Gorman said in 2017 that his firm and MUFG had teamed up for

about 500 transactions globally to date since starting their

partnership. "Being partnered with...the monster in the marketplace

has been tremendously advantageous," Mr. Gorman said.

The two banks have discussed ways to broaden their partnership,

including by selling Morgan Stanley's retail brokerage services to

MUFG's customers in Japan. Morgan Stanley largely got out of

overseas wealth management in 2014 after retreating from

Europe.

Write to Liz Hoffman at liz.hoffman@wsj.com

(END) Dow Jones Newswires

January 05, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

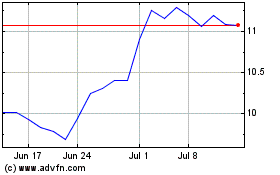

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Jun 2024 to Jul 2024

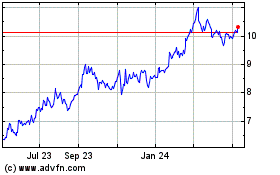

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Jul 2023 to Jul 2024