Methode Electronics, Inc. (NYSE: MEI), a global designer and

manufacturer of electro-mechanical devices, today announced

operating results for the fiscal-year 2009 fourth quarter and year

ended May 2, 2009. Due to the timing of the Company's fiscal

calendar, the 12 months ended May 2, 2009, represent 52 weeks of

results, while the 12 months ended May 3, 2008, represent 53 weeks

of results.

Fourth-Quarter Fiscal Year 2009

Methode's fourth-quarter fiscal year 2009 net sales decreased

$65.4 million, or 42.4 percent, to $89.0 million from $154.4

million in the fourth quarter of fiscal year 2008. Net income

decreased $105.5 million to a loss of $92.6 million, or $2.50 per

share, in the fourth quarter of fiscal year 2009 compared to income

of $12.9 million, or $0.34 per share, in the same period of fiscal

year 2008.

The decrease in net income in the fiscal-year 2009 fourth

quarter is due to an impairment of goodwill and intangible assets

charge of $61.7 million ($1.99 per share after tax), restructuring

charges of $10.3 million ($0.41 per share after tax), and lower

sales attributable to the continuing softness of the global

economic environment, especially the effect on the North American

automotive market, as compared to the fiscal-year 2008 fourth

quarter, which had restructuring charges of $4.7 million ($0.08 per

share after tax). Excluding the restructuring and impairment of

goodwill and intangible assets charges, Methode's net loss was $3.6

million, or $0.10 per share, in the fourth-quarter fiscal year 2009

compared to net income of $15.7 million, or $0.42 per share,

excluding restructuring charges, in the same period of fiscal year

2008.

Based on Methode's reduced market capitalization and general

business declines in the last half of fiscal year 2009, the Company

performed goodwill impairment tests in accordance with generally

accepted accounting principles as of May 2, 2009. As a result, it

was determined that the fair value of the net assets of certain

reporting units was less than the carrying value. Therefore, a

goodwill impairment charge was recorded for $45.1 million in the

fourth quarter of fiscal year 2009. Also, in accordance with

generally accepted accounting principles, the Company determined

that certain identifiable intangible assets were impaired based on

the Company's future estimates of the undiscounted cash flows,

which resulted in an impairment charge of $16.6 million in the

fourth quarter of fiscal year 2009.

In the fourth quarter of fiscal year 2009, Automotive segment

net sales were negatively impacted by the continuing softness of

the global economic environment, especially the effect on the North

American automotive industry, and by negligible Chrysler sales

volumes as compared to the prior period due to the Company's

decision to exit the Chrysler business. The transfer of the

Chrysler product was substantially completed during the second

quarter of fiscal year 2009. Additionally, as a result of the

Company's agreement with Ford Motor Company to transfer all

production at Methode's Reynosa, Mexico, facility to another

supplier, the Company's sales to Ford were further reduced in the

fourth quarter of fiscal 2009. Methode expects to complete the

transfer of this Ford business by August 2009.

In January 2008, Methode announced a restructuring of its

U.S.-based automotive operations and the decision to discontinue

producing certain legacy products in the Interconnect segment. In

March 2009, Methode announced several additional restructuring

actions to further reduce its exposure to the North American

automotive industry, and to reduce costs by consolidating

facilities and migrating manufacturing to lower cost regions. The

Company expects to complete these restructuring activities by the

end of the 2010 fiscal year and estimates that it will record

pre-tax charges in fiscal year 2010 of between $9.2 million and

$19.2 million.

Consolidated cost of products sold decreased $32.4 million, or

28.1 percent, to $82.7 million in the fiscal-year 2009 fourth

quarter, compared to $115.1 million in the same period of fiscal

year 2008. The decrease is due to lower sales volumes. Cost of

products sold as a percentage of sales was 92.9 percent and 74.6

percent in the fourth-quarter fiscal years 2009 and 2008,

respectively. The increase in cost of products sold as a percentage

of net sales in the current period is the result of manufacturing

inefficiencies caused by the significant drop in sales experienced

in the last half of fiscal year 2009.

Selling and administrative expenses decreased $3.0 million, or

18.8 percent, to $13.0 million for the fourth-quarter fiscal year

2009, compared to $16.0 million in the prior-year period. The

decrease relates to lower performance-based compensation expense

and commission expense as a result of lower sales and earnings. Due

to the significant drop in sales experienced in the last half of

fiscal year 2009, selling and administrative expenses as a

percentage of sales increased to 14.6 percent in the fourth-quarter

fiscal year 2009, compared to 10.4 percent in the same period of

fiscal year 2008.

Fiscal Year 2009 Results

For the year ended May 2, 2009, net sales decreased $125.5

million, or 22.8 percent, to $425.6 million from $551.1 million for

the year ended May 3, 2008. Net income decreased $152.3 million to

a loss of $112.5 million, or $3.05 per share, in fiscal year 2009

compared to income of $39.8 million, or $1.06 per share, in fiscal

year 2008.

The decrease in net income is due mainly to an impairment of

goodwill and intangible assets charge of $94.4 million ($2.54 per

share after tax), restructuring charges of $25.3 million ($0.68 per

share after tax), and lower sales attributable to the softening of

the global economic environment in fiscal year 2009. Fiscal year

2008 results included restructuring charges of $5.2 million ($0.08

per share after tax). Excluding the restructuring and impairment of

goodwill and intangible asset charges, Methode achieved net income

of $6.4 million, or $0.17 per share, in fiscal year 2009 compared

to $42.9 million, or $1.14 per share, excluding restructuring

charges, in fiscal year 2008.

In fiscal year 2009, net sales were negatively impacted by the

softening of the global economic environment, especially the effect

on the North American automotive industry, and by planned lower

Chrysler and Ford sales volumes in the Automotive segment.

Consolidated cost of products sold decreased $72.0 million, or

16.8 percent, to $356.4 million in fiscal year 2009, compared to

$428.4 million in fiscal year 2008. The decrease is due to lower

sales volumes. Cost of products sold as a percentage of sales was

83.7 percent and 77.7 percent in fiscal years 2009 and 2008,

respectively. The increase in cost of products sold as a percentage

of net sales in the current period is the result of manufacturing

inefficiencies caused by the significant drop in sales experienced

in the last half of fiscal year 2009.

Selling and administrative expenses decreased $4.0 million, or

6.5 percent, to $57.5 million for the fiscal year ended May 2,

2009, from $61.5 million for the fiscal year ended May 3, 2008.

Selling and administrative expense was favorably impacted by lower

performance-based compensation expense and commission expense in

fiscal year 2009 compared to fiscal year 2008. These were partially

offset by higher amortization expense from the Hetronic, VEP and

TouchSensor acquisitions. As a percentage of sales, selling and

administrative expenses increased to 13.5 percent in fiscal year

2009, compared to 11.2 percent in fiscal year 2008 as a result of

the significant drop in sales experienced in the last half of

fiscal year 2009.

For fiscal year 2009, the income tax provision was an expense of

$1.7 million compared with an expense of $9.7 million in fiscal

year 2008. In fiscal year 2009, the impairment of assets,

restructuring charges and slowing of business resulted in a loss

before income taxes generating a tax benefit. Offsetting this tax

benefit, in accordance with Statement of Financial Accounting

Standards No. 109 "Accounting for Income Taxes," the Company

recorded a valuation allowance due to the uncertainty of the future

utilization of the tax benefit. The valuation allowance was

recorded in the fourth quarter of fiscal 2009, resulting in an

income tax expense of $14.0 million compared to $2.7 million in the

same period of fiscal year 2008.

Management Comments

President and Chief Executive Officer Donald W. Duda said,

"Accounting rules mandated that goodwill and certain identifiable

intangible assets of Methode were impaired. Notwithstanding these

charges, we believe Methode's businesses are viable and well

positioned to rebound when the economy improves. During fiscal year

2009, we aggressively restructured and strengthened Methode's

global manufacturing footprint to lower our breakeven point.

Through these actions, we have significantly reduced the Company's

cost structure and cash flow needs going forward. We also continued

the acceleration of our strategy to substantially exit the legacy

North American auto business and expect to reduce our overall

automotive sales to approximately 40 percent of total revenues by

the end of fiscal 2011. These actions, along with the additional

restructuring actions taken throughout fiscal years 2008 and 2009,

will see us through these difficult times and will allow us to come

out of this downturn a leaner and stronger company. Furthermore,

Methode's margin and profit potential should benefit considerably

from our restructuring initiatives when the economy returns to

normalized levels.

"In addition, Methode's balance sheet remains strong, and we

have good liquidity. We ended the year with $54.0 million in cash,

no debt and a $75 million revolving credit facility. Additionally,

we generated $43.2 million in cash from operating activities in

fiscal year 2009, allowing us to repurchase approximately 670,000

shares of our common stock, while paying an aggregate of 26 cents

per share in dividends for the fiscal year."

Mr. Duda concluded, "Our strategy remains unchanged, with our

focus on providing user interfaces, sensors and power solutions,

and accelerating the introduction of new products utilizing our

advanced manufacturing capabilities. In fiscal 2010, we expect to

solidify our existing market positions and increase our prominence

in new markets to advance future results."

Conference Call

The Company will conduct a conference call and Webcast to review

financial and operational highlights led by its President and Chief

Executive Officer, Donald W. Duda, and Chief Financial Officer,

Douglas A. Koman, at 10:00 a.m. Central time today. To participate

in the conference call, please dial (877) 407-8031 (domestic) or

(201) 689-8031 (international) and provide passcode 326370 at least

five minutes prior to the start of the event. A simultaneous

Webcast can be accessed through the Company's Web site,

www.methode.com, by selecting the Investor Relations page and then

clicking on the "Webcast" icon. A replay of the conference call, as

well as an MP3 download, will be available shortly after the call

through July 9 by dialing (877) 660-6853 (domestic) or (201)

612-7415 and providing pass code 326370. On the Internet, a replay

will be available for seven days through the Company's Web site,

www.methode.com, by selecting the Investor Relations page and then

clicking on the "Webcast" icon.

About Methode Electronics, Inc.

Methode Electronics, Inc. (NYSE: MEI) is a global designer and

manufacturer of electro-mechanical devices with manufacturing,

design and testing facilities in the United States, Malta, Mexico,

the United Kingdom, Germany, the Czech Republic, China, Singapore,

the Philippines and India. We design, manufacture and market

devices employing electrical, electronic, wireless, radio remote

control, sensing and optical technologies to control and convey

signals through sensors, interconnections and controls. Our

business is managed on a segment basis, with those segments being

Automotive, Interconnect, Power Products and Other. Our components

are in the primary end markets of the automobile, computer,

information processing and networking equipment, voice and data

communication systems, consumer electronics, appliances, aerospace

vehicles and industrial equipment industries. Further information

can be found on Methode's Web site www.methode.com.

Forward-Looking Statements

This press release contains certain forward-looking statements,

which reflect management's expectations regarding future events and

operating performance and speak only as of the date hereof. These

forward-looking statements are subject to the safe harbor

protection provided under the securities laws. Methode undertakes

no duty to update any forward-looking statement to conform the

statement to actual results or changes in Methode's expectations on

a quarterly basis or otherwise. The forward-looking statements in

this press release involve a number of risks and uncertainties. The

factors that could cause actual results to differ materially from

our expectations are detailed in Methode's filings with the

Securities and Exchange Commission, such as our annual and

quarterly reports. Such factors may include, without limitation,

the following: (1) dependence on a small number of large customers

within the automotive industry; (2) dependence on the automotive,

appliance, computer and communications industries; (3) seasonal and

cyclical nature of some of our businesses; (4) ability to protect

our intellectual property; (5) customary risks related to

conducting global operations; (6) ability to successfully benefit

from acquisitions; (7) ability to keep pace with rapid

technological changes; (8) ability to avoid design or manufacturing

defects; (9) dependence on the availability and price of raw

materials; (10) oil prices could affect our automotive customers

future results; (11) incurrence of additional restructuring

charges, goodwill and other asset impairments.

Methode Electronics, Inc.

Financial Highlights

(In thousands, except per share data, unaudited)

Three Months Ended Fiscal Year Ended

May 2, May 3, May 2, May 3,

2009 2008 2009 2008

--------- --------- --------- ---------

Net sales $ 89,045 $ 154,360 $ 425,644 $ 551,073

Other income 759 893 3,202 1,879

Cost of products sold 82,739 115,088 356,496 428,355

Restructuring 10,281 4,709 25,278 5,159

Impairment of goodwill and

other assets 61,696 1,472 94,374 1,472

Selling and administrative

expenses 13,035 15,999 57,471 61,550

Amortization of intangibles 1,524 1,786 6,933 6,013

Income/(loss) from operations (79,471) 16,199 (111,706) 50,403

Interest, net 167 625 1,382 2,324

Other, net 746 (1,166) (479) (3,250)

Income/(loss) before income

taxes (78,558) 15,658 (110,803) 49,477

Income taxes 13,994 2,739 1,680 9,723

Net income/(loss) (92,552) 12,919 (112,483) 39,754

Basic earnings/(loss) per

common share ($ 2.50) $ 0.35 ($ 3.05) $ 1.07

Diluted earnings/(loss) per

common share ($ 2.50) $ 0.34 ($ 3.05) $ 1.06

Average Number of Common Shares

Outstanding:

Basic 36,598 37,108 36,879 37,069

Diluted 36,598 37,365 36,879 37,493

Methode Electronics, Inc.

Summary Balance Sheet

(In thousands)

May 2, May 3,

2009 2008

--------- ---------

Cash $ 54,030 $ 104,305

Accounts receivable - net 60,406 85,805

Inventories 40,426 55,949

Other current assets 26,384 14,758

--------- ---------

Total Current Assets 181,246 260,817

Property, plant and equipment - net 69,917 90,280

Goodwill - net 11,771 54,476

Intangible assets - net 20,501 41,282

Other assets 21,853 23,365

--------- ---------

Total Assets $ 305,288 $ 470,220

========= =========

Accounts payable $ 24,495 $ 42,810

Other current liabilities 29,023 33,902

--------- ---------

Total Current Liabilities 53,518 76,712

Other liabilities 19,994 20,723

Shareholders' equity 231,776 372,785

--------- ---------

Total Liabilities and Shareholders' Equity $ 305,288 $ 470,220

========= =========

Methode Electronics, Inc.

Summary Statement of Cash Flow

(In thousands)

Fiscal Year Ended

May 2, May 3,

2009 2008

---------- ----------

Operating Activities:

Net income $ (112,483) $ 39,754

Provision for depreciation 30,103 22,146

Impairment of tangible assets 10,313 1,472

Impairment of goodwill and intangible assets 94,374 -

Amortization of intangibles 6,933 6,013

Amortization of stock awards and stock options (553) 3,359

Changes in operating assets and liabilities 6,347 6,821

Other 8,134 (2,544)

---------- ----------

Net Cash Provided by Operating Activities 43,168 77,021

Investing Activities:

Purchases of property, plant and equipment (17,064) (20,018)

Proceeds from sale of building and equipment - 1,706

Acquisitions of businesses and technology (59,044) (9,647)

Joint venture dividend - (1,000)

Other (14) (27)

---------- ----------

Net Cash Used in Investing Activities (76,122) (28,986)

Financing Activities:

Repurchase of common stock (5,252) (1,249)

Proceeds from exercise of stock options 113 1,298

Tax benefit from stock options and awards (209) 383

Dividends (9,778) (7,575)

---------- ----------

Net Cash Used in Financing Activities (15,126) (7,143)

Effect of foreign exchange rate changes on cash (2,195) 3,322

---------- ----------

Increase/Decrease in Cash and Cash Equivalents (50,275) 44,214

Cash and Cash Equivalents at Beginning of Period 104,305 60,091

---------- ----------

Cash and Cash Equivalents at End of Period $ 54,030 $ 104,305

========== ==========

For Methode Electronics, Inc. - Investor Contacts: Philip Kranz

Dresner Corporate Services 312-780-7240 pkranz@dresnerco.com

Kristine Walczak Dresner Corporate Services 312-780-7205

kwalczak@dresnerco.com

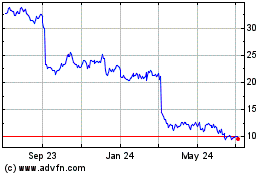

Methode Electronics (NYSE:MEI)

Historical Stock Chart

From May 2024 to Jun 2024

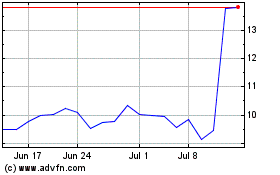

Methode Electronics (NYSE:MEI)

Historical Stock Chart

From Jun 2023 to Jun 2024