Methode Electronics, Inc. (NYSE: MEI), a global designer and

manufacturer of electro-mechanical devices, today announced

operating results for the fiscal year 2009 third-quarter and

nine-month periods ended January 31, 2009. Due to the timing of the

Company's fiscal calendar, the three months ended January 31, 2009,

represent 13 weeks of results, while the three months ended

February 2, 2008, represent 14 weeks of results. In addition, the

nine months ended January 31, 2009, represent 39 weeks of results,

while the nine months ended February 2, 2008, represent 40 weeks of

results.

Third-Quarter Fiscal Year 2009

Methode's third-quarter fiscal year 2009 net sales decreased

$57.7 million, or 41.7 percent, to $80.8 million from $138.5

million in the third-quarter fiscal year 2008. Net income decreased

$36.8 million to a loss of $27.0 million, or $0.74 per share, in

the third-quarter fiscal year 2009 compared to income of $9.8

million, or $0.26 per share, in the third-quarter fiscal year

2008.

The decrease in net income in the fiscal year 2009 third quarter

is due to an impairment of goodwill and intangible assets charge of

$32.7 million ($20.1 million after-tax, or $0.54 per share),

restructuring charges of $3.8 million ($2.5 million after tax, or

$0.07 per share), lower sales attributable to the softening of the

global economic environment, especially the effect on the North

American auto market, and higher selling and administrative

expenses related to the Hetronic acquisition compared to the fiscal

year 2008 third quarter, which had no impairment charge and

restructuring charges of $0.5 million ($0.3 million after-tax, or

$0.01 per share).

Based on Methode's reduced market capitalization and general

business declines in the third quarter, the Company performed

goodwill impairment tests in accordance with SFAS No. 142 on the

reporting units that had goodwill as of November 1, 2008. Because

of these tests, it was determined that the fair value of the net

assets of these reporting units was less than the carrying value.

As a result, a goodwill impairment charge was recorded for $18.1

million in the third quarter of fiscal year 2009.

Also, in accordance with SFAS No. 144, the Company determined

that certain identifiable intangible assets of its TouchSensor

business were impaired based on the Company's future estimates of

the undiscounted cash flows, which resulted in an impairment charge

of $14.6 million during the third quarter of fiscal year 2009.

In the third quarter of fiscal year 2009, Automotive segment net

sales were negatively impacted by the continued softening of the

global economic environment, especially the effect on the North

American auto industry, and by negligible Chrysler sales volumes

due to the Company's decision to exit this business, compared to

$13.2 million of Chrysler revenues in the same period of fiscal

year 2008. The transfer of the Chrysler product was substantially

completed during the second quarter of fiscal year 2009.

In January 2008, Methode announced a restructuring of its

U.S.-based automotive operations and the decision to discontinue

producing certain legacy products in the Interconnect segment.

Excluding the restructuring and impairment of goodwill and

intangible assets charges, Methode's net loss was $4.4 million, or

$0.13 per share, in the third-quarter fiscal year 2009 compared to

net income of $10.0 million, or $0.27 per share, in the same period

of fiscal year 2008, excluding $0.5 million, in restructuring

charges. The Company expects to complete this restructuring during

fiscal year 2010.

Consolidated cost of products sold decreased $38.5 million, or

35.3 percent, to $70.5 million in the fiscal year 2009 third

quarter, compared to $109.0 million in the same period of fiscal

year 2008. The decrease is due to lower sales volumes. Cost of

products sold as a percentage of sales was 87.3 percent and 78.7

percent in the third-quarter fiscal years 2009 and 2008,

respectively. The increase in cost of products sold as a percentage

of net sales in the current period is due to manufacturing

inefficiencies caused by the inability to adjust overhead costs in

line with the significant, sudden drop in sales experienced in the

third quarter of fiscal year 2009.

Selling and administrative expenses decreased $3.0 million, or

16.9 percent, to $14.8 million for the third-quarter fiscal year

2009, compared to $17.8 million in the prior-year period. The

decrease relates to lower bonus and commission expenses relating to

lower sales and earnings. Because of the significant, sudden drop

in sales, selling and administrative expenses as a percentage of

sales increased to 18.3 percent in the third-quarter fiscal year

2009, compared to 12.9 percent in the same period of fiscal year

2008.

Income tax rate was a benefit of 33.1 percent in the third

quarter of fiscal year 2009 compared with an income tax expense of

14.0 percent in the same period of fiscal year 2008 due to

impairment and restructuring charges and the slowing of business,

which caused a loss before income taxes in fiscal year 2009. The

effective tax rates for the third quarters of fiscal years 2009 and

2008 reflect utilization of foreign investment tax credits and the

effect of lower tax rates on earnings of the Company's foreign

operations and a higher percentage of earnings at those foreign

operations.

Nine-Month Period Ended January 31, 2009

For the nine-month period ended January 31, 2009, net sales

decreased $60.1 million, or 15.1 percent, to $336.6 million from

$396.7 million for the nine-month period ended February 2, 2008.

Net income decreased $44.3 million to a loss of $17.5 million, or

$0.47 per share, in the fiscal year 2009 nine-month period compared

to income of $26.8 million, or $0.72 per share, in the fiscal year

2008 nine-month period.

The decrease in net income is due mainly to an impairment of

goodwill and intangible assets charge of $32.7 million ($20.1

million after-tax, or $0.54 per share), restructuring charges of

$15.0 million ($9.8 million after-tax, or $0.27 per share), and

lower sales attributable to the softening of the global economic

environment in the fiscal year 2009 nine-month period, partially

offset by favorable other income. In the fiscal year 2008

nine-month period, there was no impairment charge and restructuring

charges were $0.5 million ($0.3 million after-tax, or $0.01 per

share).

In the nine-month period of fiscal year 2009, Automotive segment

net sales were negatively impacted by the softening of the global

economic environment, especially the effect on the North American

automotive industry, and by planned lower Chrysler sales volume

($14.3 million in fiscal year 2009 compared to $40.3 million in

fiscal year 2008) due to the Company's decision to exit this

business.

Excluding the restructuring and impairment of goodwill and

intangible assets charges, Methode achieved net income of $12.5

million, or $0.34 per share, in the first nine months of fiscal

year 2009 compared to $27.1 million, or $0.72 per share, in the

same period of fiscal year 2008, excluding $0.5 million in

restructuring charges.

Consolidated cost of products sold decreased $39.5 million, or

12.6 percent, to $273.8 million in the fiscal year 2009 nine-month

period, compared to $313.3 million in the same period of fiscal

year 2008. The decrease is due to lower sales volumes. Cost of

products sold as a percentage of sales was 81.3 percent and 79.0

percent in the first nine months of fiscal years 2009 and 2008,

respectively.

Selling and administrative expenses decreased $0.1 million, or

0.2 percent, to $49.7 million for the nine months ended January 31,

2009, from $49.8 million for the nine months ended February 2,

2008. Higher selling and administrative expenses related to higher

amortization expense from the Hetronic, VEP and Touchsensor

acquisitions were offset by lower commission and bonus expense in

the first nine months of fiscal year 2009 compared to the same

period in 2008. As a percentage of sales, selling and

administrative expenses increased to 14.8 percent in the first nine

months fiscal year 2009, compared to 12.6 percent in the same

period of fiscal year 2008.

Income tax rate was a benefit of 41.3 percent in the first nine

months of fiscal year 2009 compared with an income tax expense of

20.7 percent in the same period of fiscal year 2008, as

restructuring charges and decreased earnings at the Company's

U.S.-based businesses caused a loss before income taxes in fiscal

year 2009. The effective tax rates for the first nine months of

fiscal years 2009 and 2008 reflect utilization of foreign

investment tax credits and the effect of lower tax rates on

earnings of the Company's foreign operations and a higher

percentage of earnings at those foreign operations.

Additional Restructuring

The Company announced today several additional restructuring

actions to further reduce its exposure to the North American

automotive industry and to migrate manufacturing to lower cost

regions to consolidate facilities and reduce costs. After these

actions Methode's principal manufacturing operations will be in

Mexico, Malta and China.

All Ford Motor Company production at Methode's Reynosa, Mexico,

facility will be moved to another supplier. This business

contributed a substantial portion of the third quarter operating

losses. TouchSensor manufacturing currently in west suburban

Chicago, Illinois, will be moved to Monterrey, Mexico.

Additionally, the Company's operations in Shanghai, China, will be

consolidated to two facilities from three. The addition of a plant

in Morocco has been put on indefinite hold. Power Product

manufacturing for European customers will now take place in

Methode's Malta facility. The Company was awarded grant monies by

the Maltese government to assist with this expansion.

In total, this additional restructuring will affect

approximately 850 employees worldwide. The Company estimates that

it will record a pre-tax charge between $9.0 million and $18.0

million ($7.9 million and $15.1 million net of tax), or between

$0.21 and $0.40 per share, during fiscal years 2009 and 2010. The

cash portion of this charge will be between $7.0 million and $8.0

million.

Management Comments

President and Chief Executive Officer Donald W. Duda said, "The

increasingly challenging economic environment and the severe

downturn in the worldwide automotive industry have negatively

impacted our results in the third quarter of this fiscal year. In

response we have accelerated our strategy to reduce our exposure to

legacy automotive business, particularly with the Detroit

automakers. These actions, once completed, are expected to reduce

Methode's revenues derived from the automotive industry to less

than 40 percent of our overall revenue base by fiscal year 2011.

This is in stark contrast to automotive revenues of 75 percent in

fiscal year 2005."

Duda continued, "We will be exiting production for Ford at the

expiration of our manufacturing commitment at our facility in

Reynosa, Mexico, which should be completed by the end of July 2009.

Although these actions will reduce revenues in the short term, they

should improve our cash flow position and allow our management team

to concentrate on the strategic direction for Methode in fiscal

year 2010 and beyond."

Duda added, "Although the global recession will continue to

unfavorably impact the markets Methode serves in the near term, we

are taking the necessary steps to reduce our cost structure and

improve cash flow. Our long-term growth strategy continues to

emphasize developing and acquiring innovative and patented

technology, thereby providing our customers leading edge solutions

while improving Methode's overall margins. We remain optimistic

about the future of Methode, which has remained financially strong,

generating $9.0 million in operating cash flow in the third

quarter, and ending the third quarter with $54.4 million in cash

and no debt."

Conference Call

The Company will conduct a conference call and Webcast to review

financial and operational highlights led by its President and Chief

Executive Officer, Donald W. Duda, and Chief Financial Officer,

Douglas A. Koman, at 10:00 a.m. Central time today. To participate

in the conference call, please dial (877) 741-4244 (domestic) or

(719) 325-4767 (international) and provide passcode 4536039 at

least five minutes prior to the start of the event. A simultaneous

Webcast can be accessed through the Company's Web site,

www.methode.com, by selecting the Investor Relations page and then

clicking on the "Webcast" icon. A replay of the conference call, as

well as an MP3 download, will be available shortly after the call

through March 19 by dialing (888) 203-1112 (domestic) or (719)

457-0820 and providing pass code 4536039. On the Internet, a replay

will be available for seven days through the Company's Web site,

www.methode.com, by selecting the Investor Relations page and then

clicking on the "Webcast" icon.

About Methode Electronics, Inc.

Methode Electronics, Inc. (NYSE: MEI) is a global designer and

manufacturer of electro-mechanical devices with manufacturing,

design and testing facilities in the United States, Malta, Mexico,

the United Kingdom, Germany, the Czech Republic, China, Singapore,

the Philippines and India. We design, manufacture and market

devices employing electrical, electronic, wireless, radio remote

control, sensing and optical technologies to control and convey

signals through sensors, interconnections and controls. Our

business is managed on a segment basis, with those segments being

Automotive, Interconnect, Power Products and Other. Our components

are in the primary end markets of the automobile, computer,

information processing and networking equipment, voice and data

communication systems, consumer electronics, appliances, aerospace

vehicles and industrial equipment industries. Further information

can be found on Methode's Web site www.methode.com.

Forward-Looking Statements

This press release contains certain forward-looking statements,

which reflect management's expectations regarding future events and

operating performance and speak only as of the date hereof. These

forward-looking statements are subject to the safe harbor

protection, provided under the securities laws. Methode undertakes

no duty to update any forward-looking statement to conform the

statement to actual results or changes in Methode's expectations on

a quarterly basis or otherwise. The forward-looking statements in

this press release involve a number of risks and uncertainties. The

factors that could cause actual results to differ materially from

our expectations are detailed in Methode's filings with the

Securities and Exchange Commission, such as our annual and

quarterly reports. Such factors may include, without limitation,

the following: (1) dependence on a small number of large customers

within the automotive industry; (2) rising oil prices could affect

our automotive customers future results; (3) the seasonal and

cyclical nature of some of our businesses; (4) dependence on the

automotive industry; (5) dependence on the appliance, computer and

communications industries; (6) intense pricing pressures in the

automotive industry; (7) increases in raw materials prices; and (8)

customary risks related to conducting global operations.

Methode Electronics, Inc.

Financial Highlights

(In thousands, except per share data, unaudited)

Three Months Ended

January 31, February 2,

2009 2008

------------ ------------

Net sales $ 80,781 $ 138,465

Other income 751 313

Cost of products sold 70,512 109,032

Restructuring 3,796 450

Impairment of goodwill and intangible assets 32,678 -

Selling and administrative expenses 14,743 17,707

Income/(loss) from operations (40,197) 11,589

Interest, net 212 652

Other, net (346) (923)

Income/(loss) before income taxes (40,331) 11,318

Income taxes/(benefit) (13,346) 1,561

Net income/(loss) (26,985) 9,757

Basic and diluted earnings/(loss) per common

share $ (0.74) $ 0.26

Average Number of Common Shares Outstanding:

Basic 36,597 37,138

Diluted 36,597 37,492

Nine Months Ended

January 31, February 2,

2009 2008

------------ ------------

Net sales $ 336,599 $ 396,713

Other income 2,443 986

Cost of products sold 273,757 313,267

Restructuring 14,997 450

Impairment of goodwill and intangible assets 32,678 -

Selling and administrative expenses 49,846 49,778

Income/(loss) from operations (32,236) 34,204

Interest, net 1,215 1,699

Other, net 1,238 (2,084)

Income/(loss) before income taxes (29,783) 33,819

Income taxes/(benefit) (12,314) 6,984

Net income/(loss) (17,469) 26,835

Basic earnings/(loss) per common share $ (0.47) $ 0.72

Diluted earnings/(loss) per common share $ (0.47) $ 0.72

Average Number of Common Shares Outstanding:

Basic 36,964 37,066

Diluted 36,964 37,479

Methode Electronics, Inc.

Summary Balance Sheet

(In thousands)

January 31, May 3,

2009 2008

------------ ------------

Cash $ 54,427 $ 104,305

Accounts receivable - net 51,325 85,805

Inventories 62,957 55,949

Other current assets 14,359 14,758

------------ ------------

Total Current Assets 183,068 260,817

Property, plant and equipment - net 75,090 90,280

Goodwill - net 50,620 54,476

Intangible assets - net 37,920 41,282

Other assets 39,168 23,365

------------ ------------

Total Assets $ 385,866 $ 470,220

============ ============

Accounts payable $ 19,864 $ 42,810

Other current liabilities 21,604 33,902

------------ ------------

Total Current Liabilities 41,468 76,712

Other liabilities 17,988 20,723

Shareholders' equity 326,410 372,785

----------- -------------

Total Liabilities and Shareholders' Equity $ 385,866 $ 470,220

============ ============

Methode Electronics, Inc.

Summary Statement of Cash Flow

(In thousands)

Nine Months Ended

January 31, February 2,

2009 2008

------------ ------------

Operating Activities:

Net income/(loss) $ (17,469) $ 26,835

Provision for depreciation 19,937 16,332

Impairment of tangible assets 3,177 -

Impairment of goodwill and intangible

assets 32,678 -

Amortization of intangibles 5,408 4,227

Amortization of stock awards and stock

options 696 2,479

Changes in operating assets and

liabilities (6,844) 7,615

Other 798 77

------------ ------------

Net Cash Provided by Operating Activities 38,381 57,565

Investing Activities:

Purchases of property, plant and equipment (12,242) (16,702)

Proceeds from sale of building - 960

Acquisitions of businesses (58,360) (7,090)

Joint venture dividend - (1,000)

Other (425) (407)

------------ ------------

Net Cash Used in Investing Activities (71,027) (24,239)

Financing Activities:

Repurchase of common stock (5,137) -

Proceeds from exercise of stock options 110 1,268

Tax benefit from stock options and awards 46 291

Dividends (7,154) (5,680)

------------ ------------

Net Cash Used in Financing Activities (12,135) (4,121)

Effect of foreign exchange rate changes on

cash (5,097) 1,230

------------ ------------

Increase/Decrease in Cash and Cash

Equivalents (49,878) 30,435

Cash and Cash Equivalents at Beginning

of Period 104,305 60,091

------------ ------------

Cash and Cash Equivalents at End of Period $ 54,427 $ 90,526

============ ============

For Methode Electronics Inc. - Investor Contacts: Philip Kranz

Dresner Corporate Services 312-780-7240 pkranz@dresnerco.com

Kristine Walczak Dresner Corporate Services 312-780-7205

kwalczak@dresnerco.com

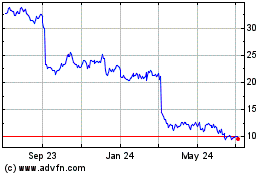

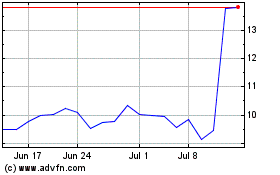

Methode Electronics (NYSE:MEI)

Historical Stock Chart

From May 2024 to Jun 2024

Methode Electronics (NYSE:MEI)

Historical Stock Chart

From Jun 2023 to Jun 2024