~ Revenue Grew Over 49% to $345.6 Million

~

~ Same-Store Sales Grew 44% ~

~ Reports Quarterly Diluted Earnings Per

Share of $0.57 ~

~ Comparable Adjusted Diluted Earnings Per

Share Increased More Than 78% ~

~ Company Raises Fiscal 2016 Guidance

~

MarineMax, Inc. (NYSE:HZO), the nation’s largest recreational

boat and yacht retailer, today announced results for its third

quarter ended June 30, 2016.

Revenue grew over 49% to $345.6 million for the quarter ended

June 30, 2016 from $231.8 million for the comparable quarter last

year. Same-store sales grew 44% which is on top of 10% growth in

the same period last year. Pretax earnings for the quarter ended

June 30, 2016 were $23.1 million compared with $14.9 million in the

same period last year, which included a $1.6 million gain from the

sale of real estate. The Company was not required to provide an

income tax provision in the same period of 2015. Reported net

income was $14.1 million, or $0.57 per diluted share, for the

quarter ended June 30, 2016 compared to reported net income of

$14.9 million or $0.59 per diluted share, including the $1.6

million or $0.06 per diluted share gain in the June 2015 quarter.

Assuming the same tax rate in both periods and excluding the

benefit of the $1.6 million gain in the June 2015 quarter,

comparable adjusted diluted earnings per share grew in excess of

78% to $0.57 compared with $0.32.

For the nine months ended June 30, 2016, revenue growth was 27%

to $714.7 million compared with $562.1 million for the comparable

period last year. Same-store sales increased more than 25%, which

is on top of 23% growth in the comparable period last year. Pretax

earnings for the nine-months ended June 30, 2016 were $28.5 million

compared with $15.5 million in the same period last year, which

included the $1.6 million gain noted above. The Company was not

required to provide an income tax provision in the same period of

2015. Reported net income was $17.4 million, or $0.70 per diluted

share, for the nine-months ended June 30, 2016 compared to reported

net income of $15.5 million or $0.61 per diluted share, including

the $1.6 million or $0.06 per diluted share gain noted above.

Assuming the same tax rate in both periods, and excluding the

benefit of the $1.6 million gain in the nine-months ended June 30,

2015, comparable adjusted diluted earnings per share for nine

months ended June 30, 2016 more than doubled to $0.70 compared with

$0.33 in the same period last year.

William H. McGill, Jr., Chairman, President, and Chief Executive

Officer, stated, “Our excellent results are a testimony to the

strength of our Team and the passion for the boating lifestyle

enjoyed by many and desired by most. The cadence throughout the

quarter was consistently strong as we drove exceptional unit and

revenue growth, as almost every category and brand contributed to

our performance. Larger boat sales were unusually strong for a June

quarter, further driving our same-store sales growth. We believe

that our results demonstrate that our customer centric strategies

are aligned with the needs of our customers, which continues to

drive our industry leading market share gains.”

Mr. McGill continued, “Our manufacturing partners are investing

considerably more in new model development than they have in many

years. Our growth has been aided by these new models as consumers

seek newer, innovative products that better enhance their boating

lifestyle. We believe the future is bright, as more new models are

developed and produced while the industry continues its recovery.

It is worth noting that our strong June quarter results are among

the best we have reported in our history, even though industry unit

sales are considerably lower than historical levels. The brand and

segment expansions we executed during the Great Recession are

driving meaningful growth, despite the current industry unit

levels. As the industry continues to recover in the coming years,

such expansion should further contribute to even greater cash flow

and earnings growth. Additionally, with our strong and improving

balance sheet, we are well positioned to capture additional growth

and take advantage of additional opportunities as they evolve.”

2016 Guidance

Based on current business conditions, retail trends and other

factors, the Company is raising its guidance expectations for fully

taxed earnings per diluted share to be in the range of $0.86 to

$0.90 for fiscal 2016 from our previously issued range of $0.68 to

$0.75. This compares to an adjusted, but fully taxed, diluted

earnings per share of $0.47 in fiscal 2015. The adjustments to

fiscal 2015 are the removal of certain gains and a deferred tax

asset valuation allowance reversal noted in previous earnings

releases. These expectations do not take into account, or give

effect, for future possible material acquisitions that may

potentially be completed by the Company during the fiscal year or

other unforeseen events.

About MarineMax

Headquartered in Clearwater, Florida, MarineMax is the nation’s

largest recreational boat and yacht retailer. Focused on premium

brands, such as Sea Ray, Boston Whaler, Meridian, Hatteras, Azimut

Yachts, Ocean Alexander, Galeon, Grady-White, Harris, Crest, Scout,

Sailfish, Sea Pro, Scarab Jet Boats, Aquila, and Nautique,

MarineMax sells new and used recreational boats and related marine

products and services as well as provides yacht brokerage and

charter services. MarineMax currently has 56 retail locations in

Alabama, California, Connecticut, Florida, Georgia, Maryland,

Massachusetts, Minnesota, Missouri, New Jersey, New York, North

Carolina, Ohio, Oklahoma, Rhode Island, and Texas and operates

MarineMax Vacations in Tortola, British Virgin Islands. MarineMax

is a New York Stock Exchange-listed company. For more information,

please visit www.marinemax.com.

Certain statements in this press release are forward-looking as

defined in the Private Securities Litigation Reform Act of 1995.

Such forward-looking statements include the Company's anticipated

financial results for the third quarter ended June 30, 2016; our

belief that our future is bright; our belief that new models will

keep driving growth; our expectation to continue our ongoing market

share gains and improved earnings performance; our belief we are

well positioned to take advantage of acquisition opportunities; and

our fiscal 2016 guidance. These statements involve certain risks

and uncertainties that may cause actual results to differ

materially from expectations as of the date of this release. These

risks include the Company’s abilities to reduce inventory, manage

expenses and accomplish its goals and strategies, the quality of

the new product offerings from the Company's manufacturing

partners, general economic conditions, as well as those within our

industry, and the level of consumer spending, the Company’s ability

to integrate acquisitions into existing operations, and numerous

other factors identified in the Company’s Form 10-K for the fiscal

year ended September 30, 2015 and other filings with the Securities

and Exchange Commission.

MarineMax, Inc. and

Subsidiaries

Condensed Consolidated Statements of

Operations

(Amounts in thousands, except share and

per share data)

(Unaudited)

Three Months Ended June 30, Nine

Months Ended June 30, 2016 2015

2016 2015 Revenue $ 345,592 $ 231,849 $

714,695 $ 562,118 Cost of sales 266,690 174,809

545,152 425,423 Gross profit 78,902

57,040 169,543 136,695 Selling, general, and administrative

expenses 54,325 41,049 136,735

117,701 Income from operations 24,577 15,991 32,808 18,994

Interest expense 1,473 1,141

4,282 3,540 Income before income tax provision 23,104

14,850 28,526 15,454 Income tax provision 9,043

— 11,154 — Net income $ 14,061 $

14,850 $ 17,372 $ 15,454 Basic net income per

common share $ 0.58 $ 0.60 $ 0.72 $ 0.63

Diluted net income per common share $ 0.57 $ 0.59 $ 0.70 $

0.61 Weighted average number of common shares used in

computing net income per common share: Basic

24,159,070 24,654,076 24,175,671

24,491,338 Diluted 24,731,389 25,316,092

24,710,227 25,175,538

Supplemental Information Net income $ 14,061 $

14,850 $ 17,372 $ 15,454 Gain on sale of property, net — (1,628 ) —

(1,628 ) Pro forma income tax provision for 2015 —

(5,175 ) — (5,406 ) Adjusted net income $ 14,061 $

8,047 $ 17,372 $ 8,420 Diluted net income per

common share $ 0.57 $ 0.59 $ 0.70 $ 0.61 Gain on sale of property,

net — (0.06 ) — (0.06 ) Pro forma income tax provision for 2015

— (0.21 ) — (0.22 ) Adjusted diluted

net income per common share $ 0.57 $ 0.32 $ 0.70 $ 0.33

MarineMax, Inc. and

Subsidiaries

Condensed Consolidated Balance

Sheets

(Amounts in thousands)

(Unaudited)

June 30, 2016 June 30,

2015 ASSETS CURRENT ASSETS: Cash and cash equivalents

$ 55,560 $ 47,448 Accounts receivable, net 27,324 23,018

Inventories, net 306,631 257,597 Prepaid expenses and other current

assets 11,319 4,978 Total current

assets 400,834 333,041 Property and equipment, net 115,346

106,279 Other long-term assets, net 13,271 5,163 Deferred tax

assets, net 16,378 — Total assets $

545,829 $ 444,483

LIABILITIES AND

STOCKHOLDERS’ EQUITY CURRENT LIABILITIES: Accounts payable $

19,342 $ 11,544 Customer deposits 18,153 13,630 Accrued expenses

27,242 22,719 Short-term borrowings 176,972

137,388 Total current liabilities 241,709 185,281

Long-term liabilities 2,463 425 Total

liabilities 244,172 185,706 STOCKHOLDERS' EQUITY: Preferred

stock — — Common stock 26 26 Additional paid-in capital 238,196

233,894 Retained earnings 92,805 42,595 Treasury stock

(29,370 ) (17,738 ) Total stockholders’ equity

301,657 258,777 Total liabilities and

stockholders’ equity $ 545,829 $ 444,483

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160726005535/en/

MarineMax, Inc.Michael H. McLamb, Chief Financial OfficerAbbey

Heimensen, Public Relations727.531.1700orIntegrated Corporate

Relations, Inc.Brad Cohen - Investor Relations, 203.682.8211Susan

Hartzell – Media Contact, 203.682.8238

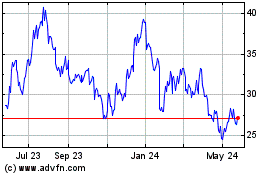

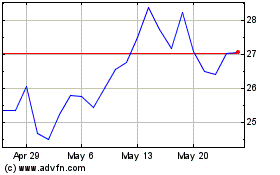

MarineMax (NYSE:HZO)

Historical Stock Chart

From Jun 2024 to Jul 2024

MarineMax (NYSE:HZO)

Historical Stock Chart

From Jul 2023 to Jul 2024