Current Report Filing (8-k)

November 19 2021 - 4:17PM

Edgar (US Regulatory)

0000887905

false

0000887905

2021-11-19

2021-11-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20459

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13

OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report: November 19, 2021

(Date of earliest event reported)

LTC PROPERTIES, INC.

(Exact name of Registrant as specified in

its charter)

|

Maryland

|

|

1-11314

|

|

71-0720518

|

|

(State or other jurisdiction of

|

|

(Commission file number)

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

|

|

Identification No)

|

2829 Townsgate Road, Suite 350

Westlake

Village, CA 91361

(Address of principal executive offices)

(805)

981-8655

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

|

|

¨

|

Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, $.01 par value

|

LTC

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. — Material Definitive Agreement

On November 19, 2021, LTC

Properties, Inc. (“LTC”) entered into a Third Amended and Restated unsecured credit agreement (the “Credit

Agreement”) to replace LTC’s previous unsecured credit agreement dated June 27, 2018. The Credit Agreement

decreases the aggregate commitment of the lenders under the prior agreement to $500 million comprised of a $400 million revolving

credit facility and two $50 million term loans. The Credit Agreement permits LTC to request increases to the revolving credit

facility and term loan commitments under the Credit Agreement up to a total of $1 billion. The Credit Agreement extends the maturity

of the revolving facility under the Credit Agreement to November 19, 2025, and provides for a one-year extension option for the

revolving facility at LTC’s discretion, subject to customary conditions. The first term loan facility under the Credit

Agreement matures on November 19, 2025 and the second term loan facility expires on November 19, 2026. As of

November 19, 2021, LTC had $59 million outstanding under the unsecured revolving credit facility and $100 million of

outstanding term loans with pricing under the new Credit Agreement at LIBOR plus 115 basis points and a facility fee of 20 basis

points.

The following banks are participants in the Credit

Agreement: Bank of Montreal, as Administrative Agent and as Sustainability Agent, BMO Capital Markets Corp., KeyBanc Capital Markets, Inc.,

Wells Fargo Securities LLC and Citizens Bank, N.A., as Co-Lead Arrangers and Joint Book Runners, KeyBank National Association, as Syndication

Agent, Wells Fargo Bank, National Association and Citizens Bank, N.A. as Co-Documentation Agents, MUFG Union Bank, N.A. as Senior Managing

Agent, and Bank of Montreal, KeyBank National Association, Wells Fargo Bank, National Association, Citizens Bank, N.A., MUFG Union Bank,

N.A., and The Huntington National Bank, as lenders.

The Credit Agreement includes customary LIBOR

replacement terms.

A copy of the Credit Agreement is filed as Exhibit 10.1

hereto, and is hereby incorporated by reference. The above summary of the Credit Agreement is qualified in its entirety by reference to

such document.

The Credit Agreement contains customary representations,

warranties, and agreements. The representations, warranties, and covenants contained in the Credit Agreement were made only for purposes

of such agreement and as of specific dates, were solely for the benefit of the parties to the Credit Agreement, and may be subject to

limitations agreed upon by such parties. The representations, warranties, and covenants in the Credit Agreement should be read only in

conjunction with the other information that LTC makes publicly available in reports, statements, and other documents filed with the Securities

and Exchange Commission.

In connection with entering into the Credit Agreement,

LTC entered into interest rate swap agreements to effectively fix the interest rate on the two term loans available under the Credit Agreement

at 2.56% and 2.69% per annum for their respective terms, based upon the Credit Agreement’s stated applicable margins.

Item 2.03. —

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The information set forth under Item 1.01 is hereby

incorporated by reference.

Item 9.01. — Financial Statements and

Exhibits

(a) Financial

Statements of Business Acquired.

None.

(b) Pro Forma

Financial Information

None.

(d) Exhibits.

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

LTC PROPERTIES, INC.

|

|

|

|

|

|

|

|

Dated: November 19, 2021

|

By:

|

/s/ WENDY L. SIMPSON

|

|

|

|

Wendy L. Simpson

|

|

|

|

Chairman and CEO

|

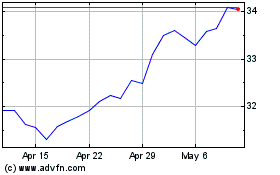

LTC Properties (NYSE:LTC)

Historical Stock Chart

From Jun 2024 to Jul 2024

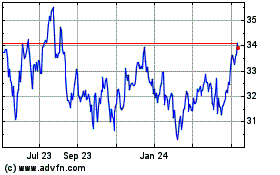

LTC Properties (NYSE:LTC)

Historical Stock Chart

From Jul 2023 to Jul 2024