-- $74 Million of Investments and New

Development Commitments Signal Continued Diversification and Focus

on Growth --

LTC Properties, Inc. (NYSE: LTC) announced today operating

results for its fourth quarter ended December 31, 2014.

Funds from Operations (“FFO”) increased 14.3% to

$22.8 million for the fourth quarter of 2014, from

$20.0 million for the comparable 2013 period. FFO per diluted

common share was $0.64 and $0.57 for the quarters ended December

31, 2014 and 2013, respectively. The increase in FFO was primarily

due to higher revenues from mortgage loan originations,

acquisitions and completed development projects. Additionally, the

2013 period included a one-time non-cash provision for loan loss

reserve related to a mortgage loan origination and write-off of

straight-line rent, partially offset by higher interest expense

related to the sale of senior unsecured notes.

Normalized FFO increased by 4.0% to $22.8 million for the

fourth quarter of 2014, from $21.9 million for the fourth

quarter of 2013. Normalized FFO per diluted common share was $0.64

and $0.62 for the quarters ended December 31, 2014 and 2013,

respectively. The increase in normalized FFO was due to higher

revenues from mortgage loan originations, acquisitions and

completed development projects, partially offset by higher interest

expense related to the sale of senior unsecured notes.

Net income available to common stockholders increased to

$20.0 million, or $0.57 per diluted share, for the fourth

quarter of 2014, from $13.7 million, or $0.40 per diluted

share, for the same period in 2013. The increase in net income

available to common stockholders was primarily due to a gain on

sale of 16 assisted living properties, as previously announced, an

increase in revenues from mortgage loan originations, acquisitions

and completed development projects. Additionally, the 2013 period

included the one-time non-cash provision as detailed above.

“2014 reflected continued growth and excellent progress on a

number of fronts, and this progress continued into 2015,” said

Wendy Simpson, LTC’s Chairman and Chief Executive Officer.

“Recently, we completed a number of transactions and further

expanded relationships with key partners. Our strategic development

objectives for 2015 and beyond call for attracting select new

operators and working closely with our existing partners, who are

familiar with our lease structure and appreciate our eagerness to

help them grow, while continuing to diversify our portfolio. LTC

has a long history of making accretive investments, and we expect

to use our considerable financial flexibility to support our

ongoing growth objectives.”

Subsequent to December 31, 2014, the Company completed the

following transactions:

- Committed $12.2 million to purchase and

complete the development of a 56-unit memory care property

currently under construction in Texas. In conjunction with this

commitment, LTC purchased the land and existing improvements for

$7.2 million, and entered into a master lease for an initial term

of 15 years with an affiliate of Thrive Senior Living (“Thrive”)

which includes an 8.75% initial cash yield escalating at

approximately 2.25% annually thereafter. The master lease provides

for the payment of a lease inducement fee of up to $1.6 million to

be amortized as a yield adjustment over the lease term. The master

lease also provides LTC a right to provide similar financing for

certain future development opportunities, the right of which the

Company has already exercised, adding to the master lease a parcel

of land purchased in South Carolina for $2.5 million, coupled with

the Company’s commitment to provide Thrive with up to

$16.5 million, including the land purchase, for the

development of an 89-unit combination assisted living and memory

care property. In conjunction with this new development, LTC

provided Thrive an additional lease inducement fee of up to $2.4

million to be amortized as a yield adjustment over the lease

term.

- Purchased and equipped a 106-bed

skilled nursing property in Wisconsin for a total of

$13.9 million by exercising its right under a $10.6 million

mortgage loan. The property was leased to an affiliate of

Fundamental as part of a master lease for an initial term of 10

years at a 10.3% initial cash yield escalating 2.5% annually

thereafter. Additionally, the Company provided a lease inducement

in the amount of $1.1 million, which will be amortized as a yield

adjustment over the lease term, to Fundamental.

- Amended a mortgage loan with an

affiliate of Prestige Healthcare securing 15 skilled nursing

properties located in Michigan to provide $20.0 million in loan

proceeds for the redevelopment of two of the properties securing

the loan, and agreed to convey to the borrower two parcels of land

held-for-use adjacent to these properties to facilitate the

projects. As consideration for the commitment and associated

conveyance, the borrower forfeited its option to prepay up to 50%

of the then outstanding loan balance. As a result of the forfeiture

of the prepayment option, the Company expects to record $1.3

million of effective interest income related to this loan during

2015.

- Originated an $11.0 million mortgage

loan with an affiliate of Prestige Healthcare, initially funding

$9.5 million with a commitment to fund the balance for approved

capital improvement projects. The loan which embodies many elements

of a triple-net lease is secured by a 157-bed skilled nursing

property in Michigan and bears interest at 9.41% for five years,

escalating annually thereafter by 2.5%. The term is 30 years with

interest-only payments, and affords LTC the option to purchase the

property under certain circumstances, including a change in

regulatory environment.

Conference Call

Information

LTC will conduct a conference call on Friday, February 27, 2015,

at 8:00 a.m. Pacific Time (11:00 a.m. Eastern Time), to provide

commentary on the Company’s performance and operating results for

the quarter ended December 31, 2014. The conference call is

accessible by telephone and the internet. Telephone access will be

available by dialing 877-510-2862 (domestically) or 412-902-4134

(internationally). To participate in the webcast, log on to the

Company’s website at www.LTCreit.com 15 minutes before the call to

download the necessary software.

An audio replay of the conference call will be available from

February 27 through March 13, 2015 and may be accessed by dialing

877-344-7529 (domestically) or 412-317-0088 (internationally) and

entering conference number 10059704. Additionally, an audio archive

will be available on the Company’s website on the “Presentations”

page of the “Investor Information” section, which is under the

“Investors” tab. The Company’s earnings release and supplemental

information package for the current period will be available on the

Company’s website on the “Press Releases” and “Presentations”

pages, respectively, of the “Investor Information” section which is

under the “Investors” tab.

About LTC

The Company is a self-administered real estate investment trust

that primarily invests in senior housing and long-term care

facilities through facility lease transactions, mortgage loans and

other investments. At December 31, 2014, LTC had 205 investments

located in 29 states comprising 97 skilled nursing properties, 92

assisted living properties, eight range of care properties, one

school, two parcels of land under development and five parcels of

land held-for-use. Assisted living properties, independent living

properties, memory care properties and combinations thereof are

included in the assisted living property type. Range of care

properties consist of properties providing skilled nursing and any

combination of assisted living, independent living and/or memory

care services. For more information on LTC Properties, Inc., visit

the Company’s website at www.LTCreit.com.

Forward Looking

Statements

This press release includes statements that are not purely

historical and are “forward looking statements” within the meaning

of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended,

including statements regarding the Company’s expectations, beliefs,

intentions or strategies regarding the future. All statements other

than historical facts contained in this press release are forward

looking statements. These forward looking statements involve a

number of risks and uncertainties. Please see our most recent

Annual Report on Form 10-K, our subsequent Quarterly Reports on

Form 10-Q, and our other publicly available filings with the

Securities and Exchange Commission for a discussion of these and

other risks and uncertainties. All forward looking statements

included in this press release are based on information available

to the Company on the date hereof, and the Company assumes no

obligation to update such forward looking statements. Although the

Company’s management believes that the assumptions and expectations

reflected in such forward looking statements are reasonable, no

assurance can be given that such expectations will prove to have

been correct. The actual results achieved by the Company may differ

materially from any forward looking statements due to the risks and

uncertainties of such statements.

LTC PROPERTIES, INC.

CONSOLIDATED STATEMENTS OF

INCOME

(amounts in thousands, except per share

amounts)

Three Months EndedDecember 31, Twelve Months EndedDecember

31, 2014 2013 2014 2013

(unaudited) (audited) Revenues: Rental income $ 26,474 $ 25,259 $

101,849 $ 98,166 Interest income from mortgage loans 4,108 3,103

16,553 6,298 Interest and other income 173 231

559 510 Total revenues

30,755 28,593 118,961

104,974 Expenses: Interest expense 3,683 2,852 13,128

11,364 Depreciation and amortization 6,594 6,237 25,529 24,389

(Recovery) provisions for doubtful accounts (46 ) 2,139 32 2,180

General and administrative expenses 3,343

2,715 11,832 11,636 Total

expenses 13,574 13,943 50,521

49,569 Operating income 17,181 14,650

68,440 55,405 Gain on sale of real estate, net 3,819

— 4,959 — Income from

continuing operations 21,000 14,650 73,399 55,405 Discontinued

operations: Income from discontinued operations — — — 805 Gain on

sale of real estate, net — — —

1,605 Net income from discontinued operations

— — — 2,410 Net income 21,000 14,650 73,399 57,815

Income allocated to participating securities (138 ) (99 ) (481 )

(383 ) Income allocated to preferred stockholders (819 )

(819 ) (3,273 ) (3,273 ) Net income available

to common stockholders $ 20,043 $ 13,732 $ 69,645

$ 54,159

Basic earnings per common

share: Continuing operations $ 0.58 $ 0.40 $ 2.01 $ 1.56

Discontinued operations $ 0.00 $ 0.00 $ 0.00 $

0.07 Net income available to common stockholders $ 0.58

$ 0.40 $ 2.01 $ 1.64

Diluted

earnings per common share: Continuing operations $ 0.57 $ 0.40

$ 1.99 $ 1.56 Discontinued operations $ 0.00 $ 0.00 $

0.00 $ 0.07 Net income available to common

stockholders $ 0.57 $ 0.40 $ 1.99 $ 1.63

Weighted average shares used to calculate earnings

per common share: Basic 34,678 34,555

34,617

33,111 Diluted 36,698

34,582 36,640 33,142

NOTE: Computations of per share amounts from continuing

operations, discontinued operations and net income are made

independently. Therefore, the sum of per share amounts from

continuing operations and discontinued operations may not agree

with the per share amounts from net income available to common

stockholders.

Supplemental Reporting

Measures

FFO, adjusted FFO (“AFFO”) and Funds Available for Distribution

(“FAD”) are supplemental measures of a real estate investment

trust’s (“REIT”) financial performance that are not defined by U.S.

generally accepted accounting principles (“GAAP”). Investors,

analysts and the Company use FFO, AFFO and FAD as supplemental

measures of operating performance. The Company believes FFO, AFFO

and FAD are helpful in evaluating the operating performance of a

REIT. Real estate values historically rise and fall with market

conditions, but cost accounting for real estate assets in

accordance with U.S. GAAP assumes that the value of real estate

assets diminishes predictably over time. We believe that by

excluding the effect of historical cost depreciation, which may be

of limited relevance in evaluating current performance, FFO, AFFO

and FAD facilitate like comparisons of operating performance

between periods. Additionally the Company believes that normalized

FFO, normalized AFFO and normalized FAD provide useful information

because they allow investors, analysts and our management to

compare the Company’s operating performance on a consistent basis

without having to account for differences caused by unanticipated

items.

FFO, as defined by the National Association of Real Estate

Investment Trusts (“NAREIT”), means net income available to common

stockholders (computed in accordance with U.S. GAAP) excluding

gains or losses on the sale of real estate and impairment

write-downs of depreciable real estate plus real estate

depreciation and amortization, and after adjustments for

unconsolidated partnerships and joint ventures. Normalized FFO

represents FFO adjusted for certain items detailed in the

reconciliations. The Company’s computation of FFO may not be

comparable to FFO reported by other REITs that do not define the

term in accordance with the current NAREIT definition or have a

different interpretation of the current NAREIT definition from that

of the Company; therefore, caution should be exercised when

comparing our Company’s FFO to that of other REITs.

We define AFFO as FFO excluding the effects of straight-line

rent and amortization of lease inducement. U.S. GAAP requires

rental revenues related to non-contingent leases that contain

specified rental increases over the life of the lease to be

recognized evenly over the life of the lease. This method results

in rental income in the early years of a lease that is higher than

actual cash received, creating a straight-line rent receivable

asset included in our consolidated balance sheet. At some point

during the lease, depending on its terms, cash rent payments exceed

the straight-line rent which results in the straight-line rent

receivable asset decreasing to zero over the remainder of the lease

term. By excluding the non-cash portion of straight-line rental

revenue and amortization of lease inducement, investors, analysts

and our management can compare AFFO between periods. Normalized

AFFO represents AFFO adjusted for certain items detailed in the

reconciliations.

We define FAD as AFFO excluding the effects of non-cash

compensation charges, capitalized interest and non-cash interest

charges. FAD is useful in analyzing the portion of cash flow that

is available for distribution to stockholders. Investors, analysts

and the Company utilize FAD as an indicator of common dividend

potential. The FAD payout ratio, which represents annual

distributions to common shareholders expressed as a percentage of

FAD, facilitates the comparison of dividend coverage between REITs.

Normalized FAD represents FAD adjusted for certain items detailed

in the reconciliations.

While the Company uses FFO, normalized FFO, normalized AFFO and

normalized FAD as supplemental performance measures of our cash

flow generated by operations and cash available for distribution to

stockholders, such measures are not representative of cash

generated from operating activities in accordance with U.S. GAAP,

and are not necessarily indicative of cash available to fund cash

needs and should not be considered an alternative to net income

available to common stockholders.

Reconciliation of FFO, Normalized FFO,

Normalized AFFO and Normalized FAD

The following table reconciles each of net income, FFO and

normalized FFO available to common stockholders, as well as

normalized AFFO and normalized FAD (unaudited, amounts in

thousands, except per share amounts):

Three Months

EndedDecember 31, Twelve Months EndedDecember 31, 2014

2013 2014 2013

Net income available to common

stockholders

$

20,043

$ 13,732 $ 69,645 $ 54,159 Add: Depreciation and amortization

(continuing and discontinued operations) 6,594 6,237 25,529 24,706

Less: Gain on sale of real estate, net (3,819 ) —

(4,959 ) (1,605 ) FFO available to common

stockholders 22,818 19,969 90,215 77,260 Add: Non-recurring

one-time items — 1,980

(1)

— 2,687

(2)

Normalized FFO available to common stockholders 22,818 21,949

90,215 79,947 Less: Non-cash rental income (792 )

(790 ) (2,161 ) (3,295 ) Normalized adjusted

FFO (AFFO) 22,026 21,159 88,054 76,652 Add: Non-cash

compensation charges 927 541 3,253 2,134 Add: Non-cash interest

related to earn-out liabilities 18 — 18 256 Less: Capitalized

interest (290 ) (214 ) (1,506 ) (932 )

Normalized funds available for distribution (FAD) $ 22,681 $

21,486 $ 89,819 $ 78,110

(1) Comprised of a $1,244 provision for

loan loss reserve on a $124,387 mortgage loan origination and an

$869 non-cash write-off of straight-line rent offset by revenue

from the Sunwest bankruptcy settlement distribution of $133.

(2) Represents a one-time severance and

accelerated restricted stock vesting charge of $707 related to the

retirement of the Company’s former Senior Vice President, Marketing

and Strategic Planning and (1) above.

Basic FFO available to common stockholders per share $ 0.66

$ 0.58 $ 2.61 $ 2.33 Diluted FFO

available to common stockholders per share $ 0.64 $ 0.57

$ 2.55 $ 2.29 Diluted FFO available to

common stockholders $ 23,775 $ 20,887 $ 93,969

$ 80,916 Weighted average shares used to calculate diluted

FFO per share available to common stockholders 36,940

36,778 36,866 35,342

Basic normalized FFO available to common stockholders per

share $ 0.66 $ 0.64 $ 2.61 $ 2.41

Diluted normalized FFO available to common stockholders per share $

0.64 $ 0.62 $ 2.55 $ 2.37

Diluted normalized FFO available to common stockholders $ 23,775

$ 22,867 $ 93,969 $ 83,603 Weighted

average shares used to calculate diluted normalized FFO per share

available to common stockholders 36,940 36,778

36,866 35,342 Basic

normalized AFFO per share $ 0.64 $ 0.61 $ 2.54

$ 2.32 Diluted normalized AFFO per share $ 0.62 $

0.60 $ 2.49 $ 2.27 Diluted normalized

AFFO $ 22,983 $ 22,077 $ 91,808 $ 80,308

Weighted average shares used to calculate diluted normalized

AFFO per share 36,940 36,778

36,866 35,342 Basic normalized FAD per

share $ 0.65 $ 0.62 $ 2.59 $ 2.36

Diluted normalized FAD per share $ 0.64 $ 0.61 $ 2.54

$ 2.31 Diluted normalized FAD $ 23,638

$ 22,404 $ 93,573 $ 81,766 Weighted average

shares used to calculate diluted normalized FAD per share

36,940 36,778 36,866

35,342

LTC PROPERTIES, INC.

CONSOLIDATED BALANCE SHEETS

(audited, amounts in thousands)

December 31, 2014 December 31, 2013

ASSETS Real

estate investments: Land $ 80,024 $ 80,993 Buildings and

improvements 869,814 856,624 Accumulated depreciation and

amortization (223,315 ) (218,700 ) Net real estate

properties 726,523 718,917

Mortgage loans receivable, net of loan

loss reserves: 2014 — $1,673; 2013 — $1,671

165,656 165,444 Real estate

investments, net 892,179 884,361 Other assets: Cash and cash

equivalents 25,237 6,778 Debt issue costs, net 3,782 2,458 Interest

receivable 597 702

Straight-line rent receivable, net of

allowance for doubtful accounts: 2014 — $731; 2013 — $1,541

32,651 29,760 Prepaid expenses and other assets 9,931 6,756 Notes

receivable 1,442 595 Total assets $

965,819 $ 931,410

LIABILITIES Bank

borrowings $ — $ 21,000 Senior unsecured notes 281,633 255,800

Bonds payable — 2,035 Accrued interest 3,556 3,424 Earn-out

liabilities 3,258 — Accrued expenses and other liabilities

17,251 16,713 Total liabilities 305,698

298,972

EQUITY Stockholders' equity:

Preferred stock $0.01 par value; 15,000

shares authorized; shares issued and outstanding: 2014 — 2,000;

2013 — 2,000

38,500 38,500

Common stock: $0.01 par value; 60,000

shares authorized; shares issued and outstanding: 2014 — 35,480;

2013 — 34,746

355 347 Capital in excess of par value 717,396 688,654 Cumulative

net income 855,247 781,848 Accumulated other comprehensive income

82 117 Cumulative distributions (951,459 ) (877,028 )

Total equity 660,121 632,438 Total liabilities and

equity $ 965,819 $ 931,410

LTC Properties, Inc.Wendy L. SimpsonPam Kessler805-981-8655

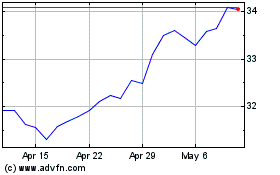

LTC Properties (NYSE:LTC)

Historical Stock Chart

From Jun 2024 to Jul 2024

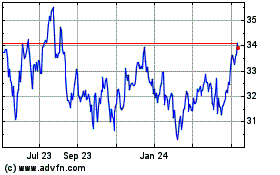

LTC Properties (NYSE:LTC)

Historical Stock Chart

From Jul 2023 to Jul 2024