LTC Properties, Inc. (NYSE: LTC) (“LTC” or the “Company”)

announces today operating results for the quarter ended September

30, 2014. The Company reported an increase of 12.8% in Funds from

Operations (“FFO”) to $22.5 million in the quarter ended

September 30, 2014, from $20.0 million in the comparable 2013

period. FFO per diluted common share was $0.64 and $0.57 for the

quarters ended September 30, 2014 and 2013, respectively.

Normalized FFO increased by 12.6% to $22.5 million in the

third quarter of 2014 from $20.0 million in the third quarter

of 2013. Normalized FFO per diluted common share was $0.64 and

$0.57 for the quarters ended September 30, 2014 and 2013,

respectively. The increase in FFO and normalized FFO was due to

higher revenues from mortgage loan originations, acquisitions and

completed property developments.

Net income available to common stockholders decreased to

$16.2 million in the third quarter of 2014, or $0.46 per

diluted share, from $16.4 million, or $0.47 per diluted share,

for the same period in 2013. The decrease in net income available

to common stockholders was primarily due to a gain on sale

recognized in 2013 and higher interest expense related to the sale

of senior unsecured notes offset by an increase in revenues from

mortgage loan originations, acquisitions and completed property

developments.

Subsequent to September 30, 2014, the Company entered into three

agreements relating to the 37 assisted living properties currently

leased to affiliates of Extendicare, Inc. (“Extendicare”) and

Enlivant as follows:

- LTC will sell 16 properties, consisting

of 615 units located in Washington, Oregon, Idaho and Arizona, to

an affiliate of Enlivant for a sales price of $26.5 million.

Accordingly, the Company expects to record a gain on sale of

approximately $3.9 million with closing expected to occur in

December 2014. Additionally, LTC gave Extendicare and Enlivant

consent to close a property located in Oregon. LTC is currently

exploring sale and lease options for this property which has a net

book value of $1.0 million.

- The Company will add 13 properties with

500 units in Indiana, Iowa, Ohio, Nebraska and New Jersey to an

existing master lease with an affiliate of Senior Lifestyle

(“Senior Lifestyle”). Beginning January 1, 2015 the initial term of

the amended and restated master lease will be 15 years and rent

will increase by $5.1 million over the current annual rent annually

by 2.6%.

- The Company re-leased seven properties

with 278 units in Texas to Veritas InCare (“Veritas”) under a new

10-year master lease. Beginning January 1, 2015 the initial rent

will be $1.5 million increasing 2.5% annually.

Extendicare and Enlivant are obligated to pay rent in accordance

with the terms of the current master leases through December 31,

2014. The initial cash yield on the 20 properties re-leased to

Senior Lifestyle and Veritas is comparable to the cash yield in

2014 under the expiring master leases with Extendicare and

Enlivant. Additionally, the master leases will provide LTC with the

potential for additional rent attributable to participation in

revenue growth at the properties over a predetermined base

amount.

Conference Call

Information

The Company will conduct a conference call on Tuesday, November

4, 2014, at 8:00 a.m. Pacific Time (11:00 a.m. Eastern Time), to

provide commentary on the Company’s performance and operating

results for the quarter ended September 30, 2014. The conference

call is accessible by telephone and the Internet. Telephone access

will be available by dialing 877-510-2862 (domestically) or

412-902-4134 (internationally). To participate in the webcast, log

on to the Company’s website at www.LTCreit.com 15 minutes before

the call to download the necessary software.

An audio replay of the conference call will be available from

November 4 through November 18, 2014 and may be accessed by dialing

877-344-7529 (domestically) or 412-317-0088 (internationally) and

entering conference number 10054900. Additionally, an audio archive

will be available on the Company’s website in the “Presentations”

page of the “Investor Information” section which is under the

“Investors” tab. The Company’s earnings release and supplemental

information package for the current period will be available on the

Company’s website in the “Press Releases” and “Presentations”

pages, respectively, of the “Investor Information” section which is

under the “Investors” tab.

About LTC

At September 30, 2014, LTC had 226 investments located in 29

states comprising of 101 skilled nursing properties, 106 assisted

living properties, nine range of care properties, one school,

four parcels of land under development and five parcels of land

held-for-use. Assisted living properties, independent living

properties, memory care properties and combinations thereof are

included in the assisted living property type. Range of care

properties consist of properties providing skilled nursing and any

combination of assisted living, independent living and/or memory

care services. The Company is a self-administered real estate

investment trust that primarily invests in senior housing and

long-term care facilities through facility lease transactions,

mortgage loans and other investments. For more information on LTC

Properties, Inc., visit the Company’s website at

www.LTCreit.com.

Forward Looking

Statements

This press release includes statements that are not purely

historical and are “forward looking statements” within the meaning

of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended,

including statements regarding the Company’s expectations, beliefs,

intentions or strategies regarding the future. All statements other

than historical facts contained in this press release are forward

looking statements. These forward looking statements involve a

number of risks and uncertainties. Please see our most recent

Annual Report on Form 10-K, our subsequent Quarterly Reports on

Form 10-Q, and our other publicly available filings with the

Securities and Exchange Commission for a discussion of these and

other risks and uncertainties. All forward looking statements

included in this press release are based on information available

to the Company on the date hereof, and the Company assumes no

obligation to update such forward looking statements. Although the

Company’s management believes that the assumptions and expectations

reflected in such forward looking statements are reasonable, no

assurance can be given that such expectations will prove to have

been correct. The actual results achieved by the Company may differ

materially from any forward looking statements due to the risks and

uncertainties of such statements.

LTC PROPERTIES, INC. CONSOLIDATED STATEMENTS OF

INCOME (unaudited amounts in thousands, except per share

amounts) Three Months Ended

Nine Months Ended September 30, September 30, 2014

2013 2014 2013 Revenues:

Rental income $ 25,098 $ 24,645 $ 75,375 $ 72,907 Interest income

from mortgage loans 4,213 1,086 12,445 3,195 Interest and other

income 230 94 386

279 Total revenues 29,541 25,825

88,206 76,381 Expenses: Interest

expense 3,170 2,581 9,445 8,512 Depreciation and amortization 6,335

6,139 18,935 18,152 General and administrative expenses

2,914 2,676 8,567 8,962

Total expenses 12,419 11,396

36,947 35,626 Operating income

17,122 14,429 51,259 40,755 Gain on sale of real estate, net

— — 1,140 — Income

from continuing operations 17,122 14,429 52,399 40,755 Discontinued

operations: Income from discontinued operations — 238 — 805 Gain on

sale of real estate, net — 2,619

— 1,605 Net income from discontinued

operations — 2,857 — 2,410 Net income 17,122 17,286 52,399

43,165 Income allocated to participating securities (123 )

(95 ) (343 ) (284 ) Income allocated to preferred stockholders

(818 ) (818 ) (2,454 ) (2,454 ) Net

income available to common stockholders $ 16,181 $ 16,373

$ 49,602 $ 40,427

Basic earnings per

common share: Continuing operations $ 0.47 $ 0.39 $ 1.43 $ 1.17

Discontinued operations $ 0.00 $ 0.08 $ 0.00 $

0.07 Net income available to common stockholders $ 0.47

$ 0.47 $ 1.43 $ 1.24

Diluted

earnings per common share: Continuing operations $ 0.46 $ 0.39

$ 1.42 $ 1.16 Discontinued operations $ 0.00 $ 0.08 $

0.00 $ 0.07 Net income available to common

stockholders $ 0.46 $ 0.47 $ 1.42 $ 1.24

Weighted average shares used to calculate earnings

per common share: Basic 34,605 34,553

34,596

32,625

Diluted

36,629 36,580 36,620

34,657

NOTE: Computations of per share amounts from continuing

operations, discontinued operations and net income are made

independently. Therefore, the sum of per share amounts from

continuing operations and discontinued operations may not agree

with the per share amounts from net income available to common

stockholders.

Supplemental Reporting

Measures

FFO, adjusted FFO (“AFFO”), and Funds Available for Distribution

(“FAD”) are supplemental measures of a real estate investment

trust’s (“REIT”) financial performance that are not defined by U.S.

generally accepted accounting principles (“GAAP”). Investors,

analysts and the Company use FFO, AFFO and FAD as supplemental

measures of operating performance. The Company believes FFO, AFFO

and FAD are helpful in evaluating the operating performance of a

REIT. Real estate values historically rise and fall with market

conditions, but cost accounting for real estate assets in

accordance with U.S. GAAP assumes that the value of real estate

assets diminishes predictably over time. We believe that by

excluding the effect of historical cost depreciation, which may be

of limited relevance in evaluating current performance, FFO, AFFO

and FAD facilitate like comparisons of operating performance

between periods. Additionally the Company believes that normalized

FFO, normalized AFFO and normalized FAD provide useful information

because they allow investors, analysts and our management to

compare the Company’s operating performance on a consistent basis

without having to account for differences caused by unanticipated

items.

FFO, as defined by the National Association of Real Estate

Investment Trusts (“NAREIT”), means net income available to common

stockholders (computed in accordance with U.S. GAAP) excluding

gains or losses on the sale of real estate and impairment

write-downs of depreciable real estate plus real estate

depreciation and amortization, and after adjustments for

unconsolidated partnerships and joint ventures. Normalized FFO

represents FFO adjusted for certain items detailed in the

reconciliations. The Company’s computation of FFO may not be

comparable to FFO reported by other REITs that do not define the

term in accordance with the current NAREIT definition or have a

different interpretation of the current NAREIT definition from that

of the Company; therefore, caution should be exercised when

comparing our Company’s FFO to that of other REITs.

We define AFFO as FFO excluding the effects of straight-line

rent and amortization of lease inducement. U.S. GAAP requires

rental revenues related to non-contingent leases that contain

specified rental increases over the life of the lease to be

recognized evenly over the life of the lease. This method results

in rental income in the early years of a lease that is higher than

actual cash received, creating a straight-line rent receivable

asset included in our consolidated balance sheet. At some point

during the lease, depending on its terms, cash rent payments exceed

the straight-line rent which results in the straight-line rent

receivable asset decreasing to zero over the remainder of the lease

term. By excluding the non-cash portion of straight-line rental

revenue and amortization of lease inducement, investors, analysts

and our management can compare AFFO between periods. Normalized

AFFO represents AFFO adjusted for certain items detailed in the

reconciliations.

We define FAD as AFFO excluding the effects of non-cash

compensation charges. FAD is useful in analyzing the portion of

cash flow that is available for distribution to stockholders.

Investors, analysts and the Company utilize FAD as an indicator of

common dividend potential. The FAD payout ratio, which represents

annual distributions to common shareholders expressed as a

percentage of FAD, facilitates the comparison of dividend coverage

between REITs. Normalized FAD represents FAD adjusted for certain

items detailed in the reconciliations.

While the Company uses FFO, normalized FFO, normalized AFFO and

normalized FAD as supplemental performance measures of our cash

flow generated by operations and cash available for distribution to

stockholders, such measures are not representative of cash

generated from operating activities in accordance with U.S. GAAP,

and are not necessarily indicative of cash available to fund cash

needs and should not be considered an alternative to net income

available to common stockholders.

Reconciliation of FFO, Normalized FFO,

Normalized AFFO and Normalized FAD

The following table reconciles each of net income, FFO and

normalized FFO available to common stockholders, as well as

normalized AFFO and normalized FAD (unaudited, amounts in

thousands, except per share amounts):

Three Months Ended Nine

Months Ended September 30, September 30, 2014

2013 2014 2013

Net income available to common

stockholders

$

16,181

$

16,373

$

49,602

$ 40,427 Add: Depreciation and amortization (continuing and

discontinued operations) 6,335 6,202 18,935 18,469 Less: Gain on

sale of real estate, net — (2,619 )

(1,140 ) (1,605 ) FFO available to common stockholders

22,516 19,956 67,397 57,291 Add: Non-cash interest related to

earn-out liabilities — 36 — 256 Add: Non-recurring one-time items

— — — 707

(1)

Normalized FFO available to common stockholders 22,516 19,992

67,397 58,254 Less: Non-cash rental income (452 )

(975 ) (1,369 ) (2,505 ) Normalized adjusted FFO

(AFFO) 22,064 19,017 66,028 55,749 Add: Non-cash compensation

charges 877 542 2,326 1,593 Less: Capitalized interest (474

) (218 ) (1,216 ) (718 ) Normalized funds

available for distribution (FAD) $ 22,467 $ 19,341 $

67,138 $ 56,624

(1) Represents the one-time severance and

accelerated restricted stock vesting charges related to the

retirement of our former Senior Vice President, Marketing and

Strategic Planning.

Basic FFO available to common

stockholders per share $ 0.65 $ 0.58 $ 1.95 $

1.76 Diluted FFO available to common stockholders per share

$ 0.64 $ 0.57 $ 1.91 $ 1.72

Diluted FFO available to common stockholders $ 23,457 $

20,869 $ 70,194 $ 60,029 Weighted average

shares used to calculate diluted FFO per share available to common

stockholders 36,869 36,779

36,841 34,858

Basic normalized FFO available to common stockholders per

share $ 0.65 $ 0.58 $ 1.95 $ 1.79

Diluted normalized FFO available to common stockholders per share $

0.64 $ 0.57 $ 1.91 $ 1.75

Diluted normalized FFO available to common stockholders $ 23,457

$ 20,905 $ 70,194 $ 60,992 Weighted

average shares used to calculate diluted normalized FFO per share

available to common stockholders 36,869 36,779

36,841 34,858

Basic normalized AFFO per share $ 0.64

$ 0.55 $ 1.91 $ 1.71 Diluted normalized AFFO

per share $ 0.62 $ 0.54 $ 1.87 $ 1.68

Diluted normalized AFFO $ 23,005 $ 19,930 $

68,825 $ 58,487 Weighted average shares used to

calculate diluted normalized AFFO per share 36,869

36,779 36,841 34,858

Basic normalized FAD per share $

0.65 $ 0.56 $ 1.94 $ 1.74 Diluted

normalized FAD per share $ 0.63 $ 0.55 $ 1.90

$ 1.70 Diluted normalized FAD $ 23,408 $

20,254 $ 69,935 $ 59,362 Weighted average

shares used to calculate diluted normalized FAD per share

36,869 36,779 36,841

34,858

LTC PROPERTIES, INC.

CONSOLIDATED BALANCE SHEETS (amounts in thousands)

September 30, 2014

December 31, 2013

ASSETS (unaudited) (audited) Real estate

investments: Land $ 79,661 $ 80,993 Buildings and improvements

886,351 856,624 Accumulated depreciation and amortization

(234,634 ) (218,700 )

Net real estate property

731,378 718,917

Mortgage loans receivable, net of

allowance for doubtfulaccounts: 2014 — $1,730; 2013 — $1,671

171,321 165,444 Real estate

investments, net 902,699 884,361 Other assets: Cash and cash

equivalents 7,589 6,778 Debt issue costs, net 2,036 2,458 Interest

receivable 661 702

Straight-line rent receivable, net of

allowance for doubtfulaccounts: 2014 — $720; 2013 — $1,541

31,581 29,760 Prepaid expenses and other assets 6,858 6,756 Notes

receivable 1,147 595 Total assets $

952,571 $ 931,410

LIABILITIES Bank

borrowings $ 19,500 $ 21,000 Senior unsecured notes 281,633 255,800

Bonds payable 1,400 2,035 Accrued interest 2,424 3,424 Accrued

expenses and other liabilities 15,937 16,713

Total liabilities 320,894 298,972

EQUITY

Stockholders' equity:

Preferred stock $0.01 par value; 15,000

shares authorized; shares issuedand outstanding: 2014 — 2,000; 2013

— 2,000

38,500 38,500

Common stock: $0.01 par value; 60,000

shares authorized;shares issued and outstanding: 2014 — 34,845;

2013 — 34,746

348 347 Capital in excess of par value 691,249 688,654 Cumulative

net income 834,247 781,848 Accumulated other comprehensive income

91 117 Cumulative distributions (932,758 ) (877,028 )

Total equity 631,677 632,438 Total liabilities and

equity $ 952,571 $ 931,410

LTC Properties, Inc.Wendy L. SimpsonPam Kessler805-981-8655

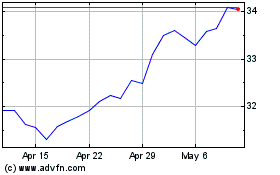

LTC Properties (NYSE:LTC)

Historical Stock Chart

From Jun 2024 to Jul 2024

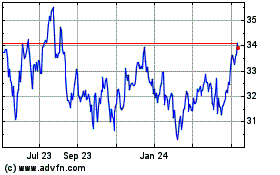

LTC Properties (NYSE:LTC)

Historical Stock Chart

From Jul 2023 to Jul 2024