Kirby Corporation Announces 2004 Third Quarter and Nine Months

Results - Earnings per share for the 2004 third quarter increased

to $.53 from $.46 in the 2003 third quarter and to $1.44 for the

first nine months of 2004 from $1.22 in the 2003 first nine months

HOUSTON, Oct. 27 /PRNewswire-FirstCall/ -- Kirby Corporation

(NYSE:KEX) ("Kirby") today announced net earnings for the third

quarter ended September 30, 2004 of $13,250,000, or $.53 per share,

an 18% improvement compared with $11,211,000, or $.46 per share,

for the third quarter of 2003. The 2004 third quarter net earnings

were in line with Kirby's published earnings guidance range of $.50

to $.54 per share. Consolidated revenues for the 2004 third quarter

were $173,389,000, a 12% increase compared with $154,507,000 for

the 2003 third quarter. Kirby reported record net earnings for the

first nine months of 2004 of $36,048,000, or $1.44 per share, a 21%

increase compared with $29,868,000, or $1.22 per share, for the

first nine months of 2003. Consolidated revenues for the first nine

months of 2004 were $501,580,000, a 9% increase compared with

$461,446,000 for the first nine months of 2003. Marine

transportation revenues and operating income for the 2004 third

quarter increased 14% and 25%, respectively, compared with the

third quarter of 2003. For the first nine months of 2004, marine

transportation revenues and operating income increased 10% and 20%,

respectively, when compared with the first nine months of 2003. The

favorable results reflected strong petrochemical volumes as

customers continued to run their plants at high utilization rates.

Black oil volumes were strong, driven by high volumes of heavy

refinery residual oil by-products, and refined products volumes

reflected typical Midwest summer demand. Agricultural chemical

volumes remained weak despite low Midwest inventory levels. The

marine transportation 2004 third quarter and first nine months

results were impacted by the following: -- Hurricane Ivan -- Made

landfall near Gulf Shores, Alabama on September 16 and resulted in

customer petrochemical plant and refinery closures, diversion of

marine equipment and closure of the Gulf Intracoastal Waterway

along the projected path of the storm. The initial projected path

was from New Orleans to the Florida panhandle. Hurricane Ivan

impacted the inland marine operations, as well as the operations of

the 35% owned offshore partnership with a Florida utility, lowering

Kirby's results by an estimated $.02 per share. -- Diesel Fuel --

The average price per gallon of diesel fuel consumed increased to

$1.16 for the 2004 third quarter compared with $1.00 for the first

six months of 2004. Higher fuel prices lowered Kirby's results by

an estimated $.01 per share. -- McAlpine Lock Closure -- Major lock

on the Ohio River closed for repair for 12 days in August, stopping

all waterborne traffic with a destination upriver of Louisville,

Kentucky, including Cincinnati and Pittsburgh. The closure of the

lock lowered Kirby's results by an estimated $.01 per share, less

than initially forecasted. -- Sale of Liquid Products Terminal --

Sale of the 50% owned Shreveport, La. terminal resulting in a third

quarter 2004 loss on the sale of $.015 per share. This loss is

reflected in equity in earnings of marine affiliates. The diesel

engine services segment's third quarter 2004 revenues were in line

with the 2003 third quarter revenues. Operating income improved by

7%, principally from increased sales of higher margin power

generation parts. The segment's Midwest dry cargo river market was

enhanced with the April 2004 purchase of the diesel engine services

operations of Walker Paducah Corp. The segment's power generation

market benefited from direct parts sales to a major power customer,

while the rail market benefited from overall strong direct parts

sales. The Gulf Coast offshore oil service market, and East Coast

and West Coast marine markets remained weak, thereby negatively

affecting the segment's 2004 third quarter results. Equity in

earnings of marine affiliates for the 2004 third quarter was a loss

of $782,000, and included the loss on the sale of the terminal and

the negative impacts on the Company's 35% owned offshore

partnership from Hurricanes Ivan, Frances and Jeanne. Joe Pyne,

Kirby's President and Chief Executive Officer, commented, "Despite

some challenges in the third quarter with respect to hurricanes,

fuel, lock closures and the sale of the terminal, business levels

allowed us to continue to perform well. Had it not been for these

challenges, we would have been comfortably above the high end of

our forecasted range. We are forecasting net earnings for the 2004

fourth quarter in the $.50 to $.54 per share range. This guidance

compares with net earnings of $.45 per share reported for the 2003

fourth quarter. Our 2004 fourth quarter guidance range is based on

firm petrochemical and black oil volumes, normal winter upriver

refined products volumes, stronger imported agricultural chemical

volumes and increased delay days resulting from anticipated winter

weather conditions." Mr. Pyne further commented, "For the 2004

year, Kirby's earnings per share guidance is $1.94 to $1.98. This

guidance compares with 2003 year earnings per share of $1.67.

Capital spending guidance for 2004 has been revised to $90 to $93

million from $85 to $90 million and includes approximately $42.5

million for the construction of 16 new 30,000 barrel petrochemical

tank barges and 10 new 30,000 barrel black oil tank barges. The

increased capital spending guidance reflects higher steel prices,

progress payments on barges scheduled for delivery in 2005 and the

timing of capital upgrades on existing equipment." This earnings

press release includes marine transportation performance measures

for both the 2004 and 2003 third quarters and first nine months.

The performance measures include ton miles, revenues per ton mile,

towboats operated and delay days. Comparable performance measures

for the 2003 and 2002 years and quarters are available at Kirby's

web site under the caption Performance Measurements in the Investor

Relations section. Kirby's homepage can be accessed by visiting

http://www.kirbycorp.com/ . A conference call is scheduled at 9:00

a.m. central time tomorrow, Thursday, October 28, 2004, to discuss

the 2004 third quarter and first nine months, and the outlook for

the 2004 fourth quarter and full year. The conference call number

is 888-328-2514 for domestic callers and 706-679-3262 for

international callers. The leader's name is Steve Holcomb. An audio

playback will be available at approximately 11:00 a.m. central time

on October 29 through 6:00 p.m. on Friday, November 26, 2004, by

dialing 800-642-1687 for domestic callers and 706-645-9291 for

international callers. The conference ID number is 1755171. The

conference call can also be accessed by visiting Kirby's homepage

at http://www.kirbycorp.com/ or at

http://audioevent.mshow.com/191510 . A replay will be available on

each of those web sites following the conference call. The

financial and other information to be discussed in the conference

call is available in this press release and in a Form 8-K filed

with the Securities and Exchange Commission. This press release and

the Form 8-K include a non- GAAP financial measure, EBITDA, which

Kirby defines as net earnings before interest expense, taxes on

income, depreciation and amortization. A reconciliation of EBITDA

for the 2004 and 2003 third quarters and first nine months with

GAAP net earnings for the same periods is included in the Condensed

Consolidated Financial Information in this press release. Kirby

Corporation, based in Houston, Texas, operates inland tank barges

and towing vessels, transporting petrochemicals, black oil

products, refined petroleum products and agricultural chemicals

throughout the United States inland waterway system. Through the

diesel engine services segment, Kirby provides after-market service

for large medium-speed diesel engines used in marine, power

generation and industrial, and railroad applications. Statements

contained in this press release with respect to the future are

forward-looking statements. These statements reflect management's

reasonable judgment with respect to future events. Forward-looking

statements involve risks and uncertainties. Actual results could

differ materially from those anticipated as a result of various

factors, including cyclical or other downturns in demand,

significant pricing competition, unanticipated additions to

industry capacity, changes in the Jones Act or in U.S. maritime

policy and practice, fuel costs, interest rates, weather

conditions, and timing, magnitude and the number of acquisitions

made by Kirby. A listing of additional risk factors can be found in

Kirby's annual report on Form 10-K for the year ended December 31,

2003, filed with the Securities and Exchange Commission. CONFERENCE

CALL INFORMATION Date: Thursday, October 28, 2004 Time: 9:00 a.m.

central time U.S.: 888-328-2514 Int'l: 706-679-3262 Leader: Steve

Holcomb Passcode: Kirby Webcast: http://www.kirbycorp.com/ or

http://audioevent.mshow.com/191510 A summary of the results for the

third quarter and first nine months follows: CONDENSED CONSOLIDATED

STATEMENTS OF EARNINGS Third Quarter Nine Months 2004 2003 2004

2003 (unaudited, $ in thousands except per share amounts) Revenues:

Marine transportation $153,114 $134,396 $437,672 $396,617 Diesel

engine services 20,275 20,111 63,908 64,829 173,389 154,507 501,580

461,446 Costs and expenses: Costs of sales and operating expenses

108,690 98,800 320,008 300,804 Selling, general and administrative

21,331 18,069 60,775 54,381 Taxes, other than on income 3,398 3,385

10,800 9,921 Depreciation and other amortization 14,015 13,369

41,403 38,495 Loss (gain) on disposition of assets 43 (71) 241 62

147,477 133,552 433,227 403,663 Operating income 25,912 20,955

68,353 57,783 Equity in earnings (loss) of marine affiliates (782)

1,022 534 2,209 Other expense (415) (134) (737) (736) Interest

expense (3,344) (3,761) (10,008) (11,082) Earnings before taxes on

income 21,371 18,082 58,142 48,174 Provision for taxes on income

(8,121) (6,871) (22,094) (18,306) Net earnings $13,250 $11,211

$36,048 $29,868 Net earnings per share of common stock: Basic $.54

$.46 $1.48 $1.24 Diluted $.53 $.46 $1.44 $1.22 Common stock

outstanding (in thousands): Basic 24,507 24,166 24,435 24,112

Diluted 25,190 24,545 25,066 24,429 CONDENSED CONSOLIDATED

FINANCIAL INFORMATION Third Quarter Nine Months 2004 2003 2004 2003

(unaudited, $ in thousands except per share amounts) EBITDA: (A)

Net earnings $13,250 $11,211 $36,048 $29,868 Interest expense 3,344

3,761 10,008 11,082 Provision for taxes on income 8,121 6,871

22,094 18,306 Depreciation and other amortization 14,015 13,369

41,403 38,495 $38,730 $35,212 $109,553 $97,751 EBITDA per share -

diluted (A) $1.54 $1.43 $4.37 $4.00 Capital expenditures $19,750

$14,464 $75,810 $52,187 Acquisitions of businesses and marine

equipment $--- $--- $11,085 $37,816 September 30, 2004 2003

(unaudited, $ in thousands) Long-term debt, including current

portion $251,397 $270,049 Stockholders' equity $414,634 $356,590

Debt to capitalization ratio 37.7% 43.1% MARINE TRANSPORTATION

STATEMENTS OF EARNINGS Third Quarter Nine Months 2004 2003 2004

2003 (unaudited, $ in thousands) Marine transportation revenues

$153,114 $134,396 $437,672 $396,617 Costs and expenses: Costs of

sales and operating expenses 93,579 83,492 272,626 251,713 Selling,

general and administrative 16,887 14,216 47,619 42,836 Taxes, other

than on income 3,293 3,206 10,475 9,450 Depreciation and other

amortization 13,286 12,654 39,148 36,304 127,045 113,568 369,868

340,303 Operating income $26,069 $20,828 $67,804 $56,314 Operating

margins 17.0% 15.5% 15.5% 14.2% DIESEL ENGINE SERVICES STATEMENTS

OF EARNINGS Third Quarter Nine Months 2004 2003 2004 2003

(unaudited, $ in thousands) Diesel engine services revenues $20,275

$20,111 $63,908 $64,829 Costs and expenses: Costs of sales and

operating expenses 15,102 15,246 47,269 48,951 Selling, general and

administrative 3,041 2,859 9,092 8,607 Taxes, other than income 95

81 268 241 Depreciation and amortization 264 272 883 788 18,502

18,458 57,512 58,587 Operating income $1,773 $1,653 $6,396 $6,242

Operating margins 8.7% 8.2% 10.0% 9.6% OTHER COSTS AND EXPENSES

Third Quarter Nine Months 2004 2003 2004 2003 (unaudited, $ in

thousands) General corporate expenses $1,887 $1,597 $5,606 $4,711

Loss (gain) on disposition of assets $43 $(71) $241 $62 MARINE

TRANSPORTATION PERFORMANCE MEASUREMENTS Third Quarter Nine Months

2004 2003 2004 2003 Ton Miles (in millions) (B) 4,238 4,021 12,294

11,467 Revenue/Ton Mile (cents/tm) (C) 3.6 3.3 3.6 3.5 Towboats

operated (average) (D) 237 222 235 226 Delay Days (E) 1,658 1,001

5,839 4,852 Average cost per gallon of fuel consumed $1.16 $.86

$1.04 $.89 Tank barges: Active 888 882 Inactive 49 70 Barrel

capacities (in millions): Active 16.4 16.0 Inactive .9 1.3 (A)

Kirby has historically evaluated its operating performance using

numerous measures, one of which is EBITDA, a non-GAAP financial

measure. Kirby defines EBITDA as net earnings before interest

expense, taxes on income, depreciation and amortization. EBITDA is

presented because of its wide acceptance as a financial indicator.

EBITDA is one of the performance measures used in Kirby's incentive

bonus plan. EBITDA is also used by rating agencies in determining

Kirby's credit rating and by analysts publishing research reports

on Kirby, as well as by investors and investment bankers generally

in valuing companies. EBITDA is not a calculation based on

generally accepted accounting principles and should not be

considered as an alternative to, but should only be considered in

conjunction with, Kirby's GAAP financial information. (B) Ton miles

indicate fleet productivity by measuring the distance (in miles) a

loaded tank barge is moved. Example: A typical 30,000 barrel tank

barge loaded with 3,300 tons of liquid cargo is moved 100 miles,

thus generating 330,000 ton miles. (C) Marine transportation

revenues divided by ton miles. Example: Third quarter 2004 revenues

of $153,114,000 divided by 4,238,000,000 ton miles = 3.6 cents. (D)

Towboats operated are the average number of owned and chartered

towboats operated during the period. (E) Delay days measures the

lost time incurred by a tow (towboat and tank barges) during

transit. The measure includes transit delays caused by weather,

lock congestion and other navigational factors. DATASOURCE: Kirby

Corporation CONTACT: Steve Holcomb of Kirby Corporation,

+1-713-435-1135 Web site: http://www.kirbycorp.com/

http://audioevent.mshow.com/191510

Copyright

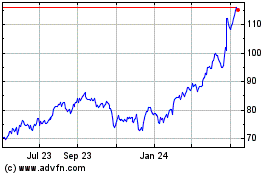

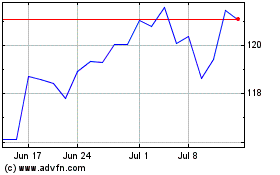

Kirby (NYSE:KEX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Kirby (NYSE:KEX)

Historical Stock Chart

From Jul 2023 to Jul 2024