- 2009 first quarter earnings per share were $.52 compared with

$.68 earned in the 2008 first quarter HOUSTON, April 29

/PRNewswire-FirstCall/ -- Kirby Corporation ("Kirby") (NYSE:KEX)

today announced net earnings for the first quarter ended March 31,

2009 of $28.0 million, or $.52 per share, compared with net

earnings of $36.6 million, or $.68 per share, for the 2008 first

quarter. The 2009 first quarter net earnings included a $4.0

million before taxes, or $.05 per share, charge for early

retirements and staff reductions. Kirby's published 2009 first

quarter earnings guidance range was $.45 to $.55 per share.

Consolidated revenues for the 2009 first quarter were $277.7

million compared with revenues of $330.6 million reported for the

2008 first quarter. Joe Pyne, Kirby's President and Chief Executive

Officer commented, "The current economic recession and its impact

on both our marine transportation and diesel engine services

businesses ended our current string of 20 consecutive quarters with

year over year net earnings increases. Our transportation volumes

across all segments softened, driven by the deteriorating economic

conditions, resulting in lower revenue and operating income,

partially offset by favorable first quarter winter weather

conditions. Our diesel engine services segment saw service levels

and direct parts sales further weaken in the first quarter in the

Gulf Coast oil service, inland marine and railroad markets, as

customers deferred maintenance." Mr. Pyne further commented, "As a

result of the lower demand during the 2009 first quarter for both

our marine transportation and diesel engine services segments, we

have taken specific steps to reduce overhead and lower

expenditures. The shore staffs of the marine transportation and

diesel engine services segments were reduced by approximately 6%

through early retirement incentives and staff reductions. A charge

of $4.0 million before taxes, $2.6 million for marine

transportation and $1.4 million for diesel engine services, or $.05

per share, was taken in the 2009 first quarter. We estimate that

the early retirements and staff reductions will result in savings

of $.02 per share for the 2009 year and $.08 per share for 2010. In

addition, we froze all officer and management salaries at 2008

levels, significantly reduced the number of chartered towboats we

operate, moved several owned towboats and tank barges to inactive

status and reduced maintenance on that equipment. We will continue

to monitor our staffing, horsepower and maintenance requirements

and will take the necessary steps to ensure that Kirby is operating

as prudently and efficiently as possible during this period of

economic uncertainty." Segment Results - Marine Transportation

Marine transportation revenues and operating income for the 2009

first quarter decreased 16% and 17%, respectively, compared with

the first quarter of 2008. All four transportation markets,

petrochemicals, black oil products, refined petroleum products and

agricultural chemicals, saw demand for the movement of products

soften. In addition, lower diesel fuel prices resulted in a

reduction in revenues when compared with the 2008 first quarter.

With the continued high volatility of diesel fuel prices, the

timing impact was a negative $.03 per share for the 2009 first

quarter. Some small improvement in upriver demand of more finished

petrochemical products was realized in the 2009 first quarter as

Midwest industries restarted their plants. However, Gulf

Intracoastal Waterway petrochemical products demand declined as

anticipated, resulting in excess tank barge capacity and lower spot

market pricing. Also, as anticipated, demand for the movement of

black oil products, refined products and agricultural chemicals was

below prior year levels. Partially offsetting the impact of the

lower demand was a 48% improvement in delay days when compared with

the 2008 first quarter, the result of favorable 2009 first quarter

winter weather operating conditions. Despite lower demand, the

segment's operating margin was 21.1% compared with 21.3% for the

first quarter of 2008, reflecting the reduction of chartered

towboats, frozen officer and management salaries, reduced

maintenance on inactive equipment, ongoing cost reduction

initiatives and favorable winter weather operating conditions,

partially offset by the charge for early retirements and staff

reductions. The marine transportation segment operated an average

of 232 towboats during the 2009 first quarter compared with an

average of 260 towboats during the 2008 first quarter and 250

during the 2008 fourth quarter. As demand softened during the 2008

fourth quarter and 2009 first quarter, Kirby released chartered

towboats and laid-up certain owned towboats in an effort to balance

horsepower needs with current requirements. As of April 29, 2009,

Kirby was operating 221 towboats and will continue to downsize the

towboat fleet if warranted by market changes. Segment Results -

Diesel Engine Services Diesel engine services revenues and

operating income for the 2009 first quarter decreased 15% and 54%,

respectively, compared with the 2008 first quarter. Demand for

service and direct parts sales in the Gulf Coast marine

medium-speed and high-speed markets weakened considerably as Gulf

Coast oil service and inland marine customers deferred maintenance

as their activities slowed. The medium-speed railroad market was

also weak as industrial and shortline railroad customers deferred

maintenance in response to the economic slowdown. The diesel engine

services operating margin was 8.7% for the 2009 first quarter

compared with 16.0% for the 2008 first quarter, reflecting lower

service and parts sales and resulting lower utilization, and the

early retirements and staff reductions noted above. Excluding the

early retirements and staff reductions charge, the diesel engine

services operating margin would have been 11.1%. Cash Flow Strong

cash flow for the 2009 first quarter, aided by a reduction in

accounts receivable, was used to fund capital expenditures of $64.8

million, including $48.5 million for new tank barge and towboat

construction and $16.3 million for upgrades to the existing fleet,

and to reduce its revolving line of credit by $21.0 million. Total

debt as of March 31, 2009 was $226.3 million and Kirby's

debt-to-capitalization ratio was 19.7%, down from 21.7% at December

31, 2008 and 25.9% at March 31, 2008. Outlook Commenting on the

2009 second quarter, Mr. Pyne said, "For the 2009 second quarter,

our earnings guidance is $.52 to $.62 per share, reflecting a 16%

to 30% decrease compared with $.74 per share for the 2008 second

quarter. For the 2009 year, we are maintaining our lower earnings

per share guidance of $2.40 but reducing our higher guidance to

$2.55 from $2.65. We have seen some short-term improvement in

upriver movements in our marine transportation segment, but we

enter the 2009 second quarter with lower utilization rates than the

first quarter and with spot market rates which continue to decline.

We have seen some short-term improvement in our diesel engine

services Gulf Coast oil service and inland marine markets. Our 2009

capital spending guidance range was lowered slightly to $180 to

$190 million, which includes approximately $135 million for the

construction of 46 new tank barges and five towboats." Conference

Call A conference call is scheduled at 10:00 a.m. central time

tomorrow, Thursday, April 30, 2009, to discuss the 2009 first

quarter performance as well as the outlook for the 2009 second

quarter and year. The conference call number is 800-446-1671 for

domestic callers and 847-413-3362 for international callers. The

leader's name is Steve Holcomb. The confirmation number is

24377163. An audio playback will be available at 1:00 p.m. central

time on Thursday, April 30, through 5:00 p.m. central time on

Friday, May 29, by dialing 888-843-8996 for domestic and

630-652-3044 for international callers. A live audio webcast of the

conference call will be available to the public and a replay

available after the call by visiting Kirby's website at

http://www.kirbycorp.com/. GAAP to Non-GAAP Financial Measures The

financial and other information to be discussed in the conference

call is available in this press release and in a Form 8-K filed

with the Securities and Exchange Commission. This press release and

the Form 8-K include a non-GAAP financial measure, EBITDA, which

Kirby defines as net earnings attributable to Kirby before interest

expense, taxes on income, depreciation and amortization. A

reconciliation of EBITDA with GAAP net earnings attributable to

Kirby is included in this press release. This earnings press

release includes marine transportation performance measures,

consisting of ton miles, revenue per ton mile, towboats operated

and delay days. Comparable performance measures for the 2008 and

2007 years and quarters are available at Kirby's web site,

http://www.kirbycorp.com/, under the caption Performance

Measurements in the Investor Relations section. About Kirby

Corporation Kirby Corporation, based in Houston, Texas, operates

inland tank barges and towing vessels, transporting petrochemicals,

black oil products, refined petroleum products and agricultural

chemicals throughout the United States' inland waterway system.

Kirby also owns and operates four ocean-going barge and tug units

transporting dry-bulk commodities in United States coastwise trade.

Through the diesel engine services segment, Kirby provides

after-market service for medium-speed and high-speed diesel engines

and reduction gears used in marine, power generation and railroad

applications. Statements contained in this press release with

respect to the future are forward-looking statements. These

statements reflect management's reasonable judgment with respect to

future events. Forward-looking statements involve risks and

uncertainties. Actual results could differ materially from those

anticipated as a result of various factors, including cyclical or

other downturns in demand, significant pricing competition,

unanticipated additions to industry capacity, changes in the Jones

Act or in U.S. maritime policy and practice, fuel costs, interest

rates, weather conditions, and timing, magnitude and number of

acquisitions made by Kirby. Forward-looking statements are based on

currently available information and Kirby assumes no obligation to

update any such statements. A list of additional risk factors can

be found in Kirby's annual report on Form 10-K for the year ended

December 31, 2008 filed with the Securities and Exchange

Commission. CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS First

Quarter 2009 2008 (unaudited, $ in thousands except per share

amounts) Revenues: Marine transportation $219,021 $261,228 Diesel

engine services 58,640 69,342 277,661 330,570 Costs and expenses:

Costs of sales and operating expenses 169,094 208,346 Selling,

general and administrative 34,810 32,872 Taxes, other than on

income 3,085 3,533 Depreciation and amortization 22,276 22,327 Loss

(gain) on disposition of assets (244) 58 229,021 267,136 Operating

income 48,640 63,434 Other income (expense) 95 (96) Interest

expense (2,813) (3,782) Earnings before taxes on income 45,922

59,556 Provision for taxes on income (17,458) (22,748) Net earnings

28,464 36,808 Less: Net earnings attributable to noncontrolling

interests (458) (161) Net earnings attributable to Kirby $28,006

$36,647 Net earnings per share attributable to Kirby common

shareholders: Basic $0.53 $0.69 Diluted $0.52 $0.68 Common stock

outstanding (in thousands): Basic 53,195 53,222 Diluted 53,858

54,051 CONDENSED CONSOLIDATED FINANCIAL INFORMATION First Quarter

2009 2008 (unaudited, $ in thousands) EBITDA: (1) Net earnings

attributable to Kirby $28,006 $36,647 Interest expense 2,813 3,782

Provision for taxes on income 17,458 22,748 Depreciation and

amortization 22,276 22,327 $70,553 $85,504 Capital expenditures

$64,845 $48,753 Acquisition of marine equipment $- $1,800 March 31,

2009 2008 (unaudited, $in thousands) Long-term debt, including

current portion $226,292 $283,230 Total equity $924,994 $810,294

Debt to capitalization ratio 19.7% 25.9% MARINE TRANSPORTATION

STATEMENTS OF EARNINGS First Quarter 2009 2008 (unaudited, $ in

thousands) Marine transportation revenues $219,021 $261,228 Costs

and expenses: Costs of sales and operating expenses 125,865 159,649

Selling, general and administrative 23,465 22,308 Taxes, other than

on income 2,791 3,235 Depreciation and amortization 20,682 20,520

172,803 205,712 Operating income $46,218 $55,516 Operating margins

21.1% 21.3% DIESEL ENGINE SERVICES STATEMENTS OF EARNINGS First

Quarter 2009 2008 (unaudited, $ in thousands) Diesel engine

services revenues $58,640 $69,342 Costs and expenses: Costs of

sales and operating expenses 43,229 48,697 Selling, general and

administrative 8,963 7,832 Taxes, other than on income 283 274

Depreciation and amortization 1,078 1,434 53,553 58,237 Operating

income $5,087 $11,105 Operating margins 8.7% 16.0% OTHER COSTS AND

EXPENSES First Quarter 2009 2008 (unaudited, $in thousands) General

corporate expenses $2,909 $3,129 Loss (gain) on disposition of

assets $(244) $58 MARINE TRANSPORTATION PERFORMANCE MEASUREMENTS

First Quarter 2009 2008 Ton Miles (in millions) (2) 2,780 3,806

Revenue/Ton Mile (cents/tm) (3) 7.6 6.6 Towboats operated (average)

(4) 232 260 Delay Days (5) 1,564 2,998 Average cost per gallon of

fuel consumed $1.56 $2.71 Tank barges: Active 897 912 Inactive 92

63 Barrel Capacities (in millions): Active 17.2 17.3 Inactive 1.6

1.2 (1) Kirby has historically evaluated its operating performance

using numerous measures, one of which is EBITDA, a non-GAAP

financial measure. Kirby defines EBITDA as net earnings

attributable to Kirby before interest expense, taxes on income,

depreciation and amortization. EBITDA is presented because of its

wide acceptance as a financial indicator. EBITDA is one of the

performance measures used in Kirby's incentive bonus plan. EBITDA

is also used by rating agencies in determining Kirby's credit

rating and by analysts publishing research reports on Kirby, as

well as by investors and investment bankers generally in valuing

companies. EBITDA is not a calculation based on generally accepted

accounting principles and should not be considered as an

alternative to, but should only be considered in conjunction with,

Kirby's GAAP financial information. (2) Ton miles indicate fleet

productivity by measuring the distance (in miles) a loaded tank

barge is moved. Example: A typical 30,000 barrel tank barge loaded

with 3,300 tons of liquid cargo is moved 100 miles, thus generating

330,000 ton miles. (3) Inland marine transportation revenues

divided by ton miles. Example: First quarter 2009 inland marine

revenues of $210,507,000 divided by 2,780,000,000 marine

transportation ton miles = 7.6 cents. (4) Towboats operated are the

average number of owned and chartered towboats operated during the

period. (5) Delay days measures the lost time incurred by a tow

(towboat and one or more tank barges) during transit. The measure

includes transit delays caused by weather, lock congestion and

other navigational factors. DATASOURCE: Kirby Corporation CONTACT:

Steve Holcomb of Kirby Corporation, +1-713-435-1135 Web Site:

http://www.kirbycorp.com/

Copyright

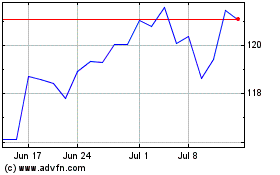

Kirby (NYSE:KEX)

Historical Stock Chart

From Jun 2024 to Jul 2024

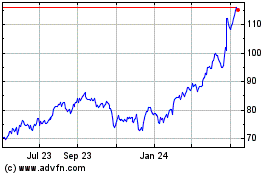

Kirby (NYSE:KEX)

Historical Stock Chart

From Jul 2023 to Jul 2024