Kirby Corporation Comments on a Recent Public Announcement by a Major Customer

June 25 2008 - 9:00AM

PR Newswire (US)

Recent announcement by a major customer is anticipated to have

minimal impact on petrochemical volumes transported HOUSTON, June

25 /PRNewswire-FirstCall/ -- Kirby Corporation ("Kirby") (NYSE:KEX)

commented today on a recent public announcement by a major

petrochemical customer which plans to temporarily idle or reduce

production of some products it manufactures at locations in the

United States and Europe. Kirby anticipates a minimal impact on

petrochemical volumes transported for that customer. Kirby also

confirmed its 2008 second quarter earnings guidance of $.69 to $.74

per share, a 23% to 32% increase when compared with $.56 per share

earned in the 2007 second quarter, and confirmed its 2008 year

guidance of $2.74 to $2.89 per share, a 20% to 26% increase

compared with $2.29 per share earned in 2007. Joe Pyne, Kirby's

President and Chief Executive Officer commented, "Our marine

transportation and diesel engine services business levels remain

favorable. The recent flooding on the Mississippi River System

above St. Louis is anticipated to have a minimal impact on our

second quarter results." Kirby Corporation, based in Houston,

Texas, operates inland tank barges and towing vessels, transporting

petrochemicals, black oil products, refined petroleum products and

agricultural chemicals throughout the United States' inland

waterway system. Kirby also owns and operates four ocean-going

barge and tug units transporting dry-bulk commodities in United

States coastwise trade. Through the diesel engine services segment,

Kirby provides after-market service for medium-speed and high-speed

diesel engines and reduction gears used in marine, power generation

and railroad applications. Statements contained in this press

release with respect to the future are forward-looking statements.

These statements reflect management's reasonable judgment with

respect to future events. Forward-looking statements involve risks

and uncertainties. Actual results could differ materially from

those anticipated as a result of various factors, including

cyclical or other downturns in demand, significant pricing

competition, unanticipated additions to industry capacity, changes

in the Jones Act or in U.S. maritime policy and practice, fuel

costs, interest rates, weather conditions, and timing, magnitude

and the number of acquisitions made by Kirby. Forward-looking

statements are based on currently available information and Kirby

assumes no obligation to update any such statements. A list of

additional risk factors can be found in Kirby's annual report on

Form 10-K for the year ended December 31, 2007, filed with the

Securities and Exchange Commission. DATASOURCE: Kirby Corporation

CONTACT: Steve Holcomb of Kirby Corporation, +1-713-435-1135 Web

site: http://www.kirbycorp.com/

Copyright

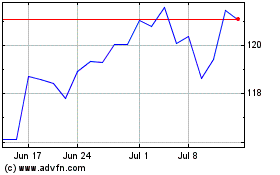

Kirby (NYSE:KEX)

Historical Stock Chart

From Jul 2024 to Jul 2024

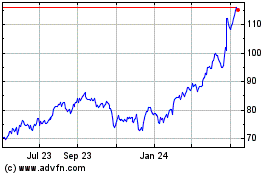

Kirby (NYSE:KEX)

Historical Stock Chart

From Jul 2023 to Jul 2024