* 2006 third quarter earnings per share were $.48, a 41% increase

compared with $.34 earned in the 2005 third quarter HOUSTON, Oct.

25 /PRNewswire-FirstCall/ -- Kirby Corporation (NYSE:KEX) ("Kirby")

today announced record net earnings for the third quarter ended

September 30, 2006 of $25,600,000, or $.48 per share, compared with

$17,285,000, or $.34 per share, for the third quarter of 2005. The

2005 third quarter results included an estimated $.05 per share

negative impact from Hurricanes Katrina and Rita. Consolidated

revenues for the 2006 third quarter were $264,612,000, a 33%

increase compared with $198,741,000 for the 2005 third quarter.

Kirby reported record net earnings for the first nine months of

2006 of $71,513,000, or $1.34 per share, compared with $49,011,000,

or $.95 per share, for the first nine months of 2005. Consolidated

revenues for the first nine months of 2006 were $732,807,000, a 26%

increase compared with $582,461,000 for the 2005 first nine months.

Marine transportation revenues and operating income for the 2006

third quarter increased 23% and 42%, respectively, compared with

the third quarter of 2005. For the first nine months of 2006,

revenues and operating income increased 21% and 37%, respectively,

compared with the 2005 first nine months. The results for both

periods reflected continued strong petrochemical, black oil

products and refined products volumes. Pricing continued to reflect

higher rates on contract renewals and spot market pricing. The 2006

third quarter and first nine months results were impacted by a

continued tight vessel personnel labor pool and Gulf Coast charter

towboat market, principally due to the effects of 2005 Hurricanes

Katrina and Rita. The tight Gulf Coast labor pool and towboat

market resulted in higher vessel personnel wages and higher rates

for chartered towboats. In addition, the tight vessel labor market

has resulted in higher training costs as Kirby has increased the

number of vessel trainees at all levels. The marine transportation

operating margin for the 2006 third quarter was 19.4% compared with

16.7% for the third quarter of 2005. Diesel engine services

revenues and operating income for the 2006 third quarter increased

102% and 154%, respectively, compared with the 2005 third quarter.

For the first nine months of 2006, revenues and operating income

increased 56% and 96%, respectively, compared with the 2005 first

nine months. The record diesel engine services results reflected

the accretive acquisition of Global Power Holding Company

("Global") on June 7, 2006 and the acquisition of the assets of

Marine Engine Specialists, Inc. ("MES") on July 21, 2006, as well

as continued strong marine, offshore oil service, power generation

and railroad markets. Higher service rates and parts pricing

implemented during 2005 and in the 2006 first nine months also

positively impacted the 2006 third quarter and first nine months

results. The operating margin for the 2006 third quarter was 15.3%

compared with 12.2% for the third quarter of 2005. In the 2006

third quarter, Kirby purchased 163,000 shares of its common stock

at a total purchase price of $4,789,000, for an average purchase

price of $29.40 per share. Kirby has 2,258,000 shares available

under its current Board of Directors repurchase authorization. Joe

Pyne, Kirby's President and Chief Executive Officer, commented,

"The business fundamentals that exist in our marine transportation

and diesel engine services businesses remain the best we have seen

in many years. During the third quarter, we continued to see strong

utilization of our tank barge fleet, with essentially no spare

capacity. Pricing continued to improve during the quarter. Our

medium-speed diesel engine services business continued to perform

at record levels, and we added accretive earnings from the Global

and MES acquisitions." Mr. Pyne continued, "Our guidance is based

on strong marine transportation and diesel engine services markets.

We also expect the vessel labor and charter towboat shortages to

remain tight during the fourth quarter. These costs will continue

to increase in 2007 at a rate above inflation, but not at 2006

levels. As multiple-year contracts are escalated and single-year

term contracts are renewed, we should be made whole. Spot market

rates already reflect recovery of the increased costs. If we had

not incurred the increased labor costs and charter towboat rate

increases our earnings would have been higher." Mr. Pyne further

commented, "Our 2006 fourth quarter guidance is $.40 to $.45 per

share, and anticipates some deterioration of operating conditions

caused by winter weather, which historically increases delay days

and decreases efficiency. Our guidance represents a 5% to 18%

increase over reported 2005 fourth quarter net earnings of $.38 per

share. For 2006, we are tightening our net earnings guidance to

$1.74 to $1.79, reflecting a 31% to 35% increase over the 2005 net

earnings of $1.33 per share. Capital spending guidance for 2006 is

in the $138 to $143 million range and includes approximately $60

million for the construction of twenty-three 30,000 barrel and two

10,000 barrel tank barges, and four towboats. For 2007, currently

scheduled new construction consists of twenty 30,000 barrel tank

barges and four towboats at a cost of approximately $56 million.

Delivery is scheduled throughout 2007 and into early 2008." This

earnings press release includes marine transportation performance

measures for both the 2006 and 2005 third quarters and first nine

months. The performance measures include ton miles, revenues per

ton mile, towboats operated and delay days. Comparable performance

measures for the 2005 and 2004 years and quarters are available at

Kirby's web site under the caption Performance Measurements in the

Investor Relations section. Kirby's homepage can be accessed by

visiting http://www.kirbycorp.com/ . A conference call is scheduled

at 10:00 a.m. central time tomorrow, Thursday, October 26, 2006, to

discuss the 2006 third quarter and first nine months, and the

outlook for the 2006 fourth quarter and year. The conference call

number is 888-328-2514 for domestic callers and 706-679-3262 for

international callers. The leader's name is Steve Holcomb. An audio

playback will be available at 12:00 p.m. central time on October 26

through 6:00 p.m. on Friday, November 24, 2006, by dialing

800-642-1687 for domestic callers and 706-645-9291 for

international callers. The conference ID number is 8803755. The

conference call can also be accessed by visiting Kirby's homepage

at http://www.kirbycorp.com/ or at

http://audioevent.mshow.com/311107 . A replay will be available on

each of those web sites following the conference call. The

financial and other information to be discussed in the conference

call is available in this press release and in a Form 8-K filed

with the Securities and Exchange Commission. This press release and

the Form 8-K include a non- GAAP financial measure, EBITDA, which

Kirby defines as net earnings before interest expense, taxes on

income, depreciation and amortization. A reconciliation of EBITDA

for the 2006 and 2005 third quarters and first nine months with

GAAP net earnings for the same periods is included in the Condensed

Consolidated Financial Information in this press release. Kirby

Corporation, based in Houston, Texas, operates inland tank barges

and towing vessels, transporting petrochemicals, black oil

products, refined petroleum products and agricultural chemicals

throughout the United States inland waterway system. Kirby also

owns and operates four ocean-going barge and tug units transporting

dry-bulk commodities in United States coastwise trade. Through the

diesel engine services segment, Kirby provides after- market

service for large medium-speed and high-speed diesel engines and

reduction gears used in marine, power generation and railroad

applications. Statements contained in this press release with

respect to the future are forward-looking statements. These

statements reflect management's reasonable judgment with respect to

future events. Forward-looking statements involve risks and

uncertainties. Actual results could differ materially from those

anticipated as a result of various factors, including cyclical or

other downturns in demand, significant pricing competition,

unanticipated additions to industry capacity, changes in the Jones

Act or in U.S. maritime policy and practice, fuel costs, interest

rates, weather conditions, and timing, magnitude and number of

acquisitions made by Kirby. Forward-looking statements are based on

currently available information and Kirby assumes no obligation to

update any such statements. A list of additional risk factors can

be found in Kirby's annual report on Form 10-K for the year ended

December 31, 2005, filed with the Securities and Exchange

Commission. CONFERENCE CALL INFORMATION Date: Thursday, October 26,

2006 Leader: Steve Holcomb Time: 10:00 a.m. central time Passcode:

Kirby U.S.: 888-328-2514 Int'l: 706-679-3262 Website:

http://www.kirbycorp.com/ or http://audioevent.mshow.com/311107 A

summary of the results for the third quarter and first nine months

follows: CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS Third

Quarter Nine Months 2006 2005 2006 2005 (unaudited, $ in thousands

except per share amounts) Revenues: Marine transportation $211,080

$172,259 $ 604,551 $500,211 Diesel engine services 53,532 26,482

128,256 82,250 264,612 198,741 732,807 582,461 Costs and expenses:

Costs of sales and operating expenses 169,407 130,265 471,380

378,459 Selling, general and administrative 29,321 21,600 79,600

64,787 Taxes, other than on income 3,289 3,203 9,879 9,298

Depreciation and amortization 16,689 13,725 47,294 42,670 Loss

(gain) on disposition of assets (255) 24 (1,197) (1,963) 218,451

168,817 606,956 493,251 Operating income 46,161 29,924 125,851

89,210 Equity in earnings of marine affiliates 88 1,395 641 1,399

Loss on debt retirement --- --- --- (1,144) Other expense (389)

(443) (457) (1,159) Interest expense (4,503) (2,997) (10,505)

(9,256) Earnings before taxes on income 41,357 27,879 115,530

79,050 Provision for taxes on income (15,757) (10,594) (44,017)

(30,039) Net earnings $ 25,600 $17,285 $71,513 $49,011 Net earnings

per share of common stock: Basic $.49 $.35 $ 1.36 $.98 Diluted $.48

$.34 $ 1.34 $.95 Common stock outstanding (in thousands): Basic

52,587 50,068 52,400 49,918 Diluted 53,392 51,564 53,269 51,338

CONDENSED CONSOLIDATED FINANCIAL INFORMATION Third Quarter Nine

Months 2006 2005 2006 2005 (unaudited, $ in thousands except per

share amounts) EBITDA: (A) Net earnings $25,600 $17,285 $71,513

$49,011 Interest expense 4,503 2,997 10,505 9,256 Provision for

taxes on income 15,757 10,594 44,017 30,039 Depreciation and

amortization 16,689 13,725 47,294 42,670 $62,549 $44,601 $173,329

$130,976 Capital expenditures $45,728 $29,555 $110,114 $93,118

Acquisitions of businesses and marine equipment $22,652 $---

$139,425 $7,000 September 30, 2006 2005 (unaudited, $ in thousands)

Long-term debt, including current portion $326,810 $205,737

Stockholders' equity $627,229 $495,247 Debt to capitalization ratio

34.3% 29.3% MARINE TRANSPORTATION STATEMENTS OF EARNINGS Third

Quarter Nine Months 2006 2005 2006 2005 (unaudited, $ in thousands)

Marine transportation revenues $211,080 $172,259 $604,551 $500,211

Costs and expenses: Costs of sales and operating expenses 132,599

110,776 381,077 317,223 Selling, general and administrative 19,067

16,663 56,006 50,235 Taxes, other than on income 3,009 3,077 9,153

8,884 Depreciation and amortization 15,492 12,999 44,463 40,521

170,167 143,515 490,699 416,863 Operating income $40,913 $28,744

$113,852 $83,348 Operating margins 19.4% 16.7% 18.8% 16.7% DIESEL

ENGINE SERVICES STATEMENTS OF EARNINGS Third Quarter Nine Months

2006 2005 2006 2005 (unaudited, $ in thousands) Diesel engine

services revenues $53,532 $26,482 $128,256 $82,250 Costs and

expenses: Costs of sales and operating expenses 36,808 19,489

90,293 61,231 Selling, general and administrative 7,588 3,391

16,150 9,741 Taxes, other than income 120 91 343 296 Depreciation

and amortization 824 280 1,638 841 45,340 23,251 108,424 72,109

Operating income $8,192 $3,231 $19,832 $10,141 Operating margins

15.3% 12.2% 15.5% 12.3% OTHER COSTS AND EXPENSES Third Quarter Nine

Months 2006 2005 2006 2005 (unaudited, $ in thousands) General

corporate expenses $3,199 $2,027 $9,030 $6,242 Loss (gain) on

disposition of assets $(255) $24 $(1,197) $(1,963) MARINE

TRANSPORTATION PERFORMANCE MEASUREMENTS Third Quarter Nine Months

2006 2005 2006 2005 Ton Miles (in millions)(B) 4,045 4,027 11,936

11,900 Revenue/Ton Mile (cents/tm) (C) 5.0 4.3 4.8 4.2 Towboats

operated (average)(D) 242 243 241 242 Delay Days(E) 1,200 2,080

5,049 7,159 Average cost per gallon of fuel consumed $2.08 $1.75

$1.97 $1.55 Tank barges: Active 903 889 Inactive 53 71 Barrel

capacities (in millions): Active 17.0 16.6 Inactive 1.0 1.4 (A)

Kirby has historically evaluated its operating performance using

numerous measures, one of which is EBITDA, a non-GAAP financial

measure. Kirby defines EBITDA as net earnings before interest

expense, taxes on income, depreciation and amortization. EBITDA is

presented because of its wide acceptance as a financial indicator.

EBITDA is one of the performance measures used in Kirby's incentive

bonus plan. EBITDA is also used by rating agencies in determining

Kirby's credit rating and by analysts publishing research reports

on Kirby, as well as by investors and investment bankers generally

in valuing companies. EBITDA is not a calculation based on

generally accepted accounting principles and should not be

considered as an alternative to, but should only be considered in

conjunction with, Kirby's GAAP financial information. (B) Ton miles

indicate fleet productivity by measuring the distance (in miles) a

loaded tank barge is moved. For example: A typical 30,000 barrel

tank barge loaded with 3,300 tons of liquid cargo is moved 100

miles, thus generating 330,000 ton miles. (C) Inland marine

transportation revenues divided by ton miles. Example: Third

quarter 2006 inland marine revenues of $200,497,000 divided by

4,045,000,000 ton miles = 5.0 cents (D) Towboats operated are the

average number of owned and chartered towboats operated during the

period. (E) Delay days measures the lost time incurred by a tow

(towboat and one or more tank barges) during transit. The measure

includes transit delays caused by weather, lock congestion and

other navigational factors. DATASOURCE: Kirby Corporation CONTACT:

Steve Holcomb of Kirby Corporation, +1-713-435-1135 Web site:

http://www.kirbycorp.com/ http://audioevent.mshow.com/311107

Copyright

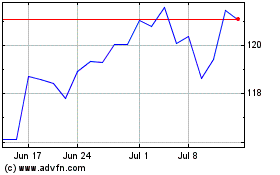

Kirby (NYSE:KEX)

Historical Stock Chart

From Jul 2024 to Jul 2024

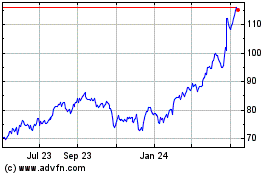

Kirby (NYSE:KEX)

Historical Stock Chart

From Jul 2023 to Jul 2024