Kirby Corporation Announces Placement of $200 Million Senior Notes

May 31 2005 - 5:11PM

PR Newswire (US)

Kirby Corporation Announces Placement of $200 Million Senior Notes

- $200 million of senior notes at LIBOR plus 0.5% due 2013 HOUSTON,

May 31 /PRNewswire-FirstCall/ -- Kirby Corporation (NYSE:KEX)

("Kirby") today announced the private placement of $200 million of

senior notes ("2005 Senior Notes") with the assistance of Banc of

America Securities LLC. The unsecured floating rate 2005 Senior

Notes have an interest rate equal to the London Interbank Offered

Rate ("LIBOR") plus 0.5%. No principal payments are required until

maturity in February 2013. The 2005 Senior Notes are callable, at

Kirby's option, with a 2% prepayment premium during the first year,

1% during the second year and at par thereafter. Proceeds of the

2005 Senior Notes were used to repay Kirby's $200 million of senior

notes ("2003 Senior Notes") due February 2013. The 2003 Senior

Notes had an interest rate equal to LIBOR plus 1.2%. With the early

extinguishment of the 2003 Senior Notes, Kirby will expense in the

2005 second quarter approximately $1.1 million, or $.03 per share

after taxes, of unamortized financing costs associated with the

2003 Senior Notes. Joe Pyne, Kirby's President and Chief Executive

Officer, commented, "The new $200 million private placement loan

will replace Kirby's 2003 Senior Notes and will result in $1.4

million of annual interest savings at the current level

outstanding. Kirby also has a $150 million bank revolving line of

credit which is substantially unused at this time." Mr. Pyne

further commented, "Kirby's earnings per share guidance ranges for

the second quarter of 2005 and for the full year are unchanged at

$.65 to $.70 and $2.45 to $2.55, respectively." Kirby Corporation,

based in Houston, Texas, operates inland tank barges and towing

vessels, transporting petrochemicals, black oil products, refined

petroleum products and agricultural chemicals throughout the United

States inland waterway system. Through the diesel engine services

segment, Kirby provides after-market service for large medium-speed

and high-speed diesel engines and reduction gears used in marine,

power generation and railroad applications. Statements contained in

this press release with respect to the future are forward-looking

statements. These statements reflect management's reasonable

judgment with respect to future events. Forward-looking statements

involve risks and uncertainties. Actual results could differ

materially from those anticipated as a result of various factors,

including cyclical or other downturns in demand, significant

pricing competition, unanticipated additions to industry capacity,

changes in the Jones Act or in U.S. maritime policy and practice,

fuel costs, interest rates, weather conditions, and timing,

magnitude and the number of acquisitions made by Kirby. A list of

additional risk factors can be found in Kirby's annual report on

Form 10-K for the year ended December 31, 2004, filed with the

Securities and Exchange Commission. DATASOURCE: Kirby Corporation

CONTACT: Steve Holcomb of Kirby Corporation, +1-713-435-1135 Web

site: http://www.kirbycorp.com/

Copyright

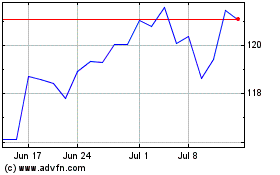

Kirby (NYSE:KEX)

Historical Stock Chart

From Jun 2024 to Jul 2024

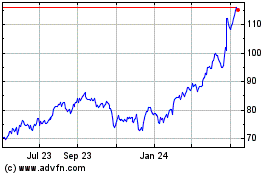

Kirby (NYSE:KEX)

Historical Stock Chart

From Jul 2023 to Jul 2024