Kirby Corporation Announces Record Results for the 2005 First

Quarter - 2005 first quarter earnings per share were $.52, an

increase of 44% over $.36 reported for the 2004 first quarter

HOUSTON, April 27 /PRNewswire-FirstCall/ -- Kirby Corporation

(NYSE:KEX) ("Kirby") today announced record net earnings for the

first quarter ended March 31, 2005 of $13,279,000, or $.52 per

share, compared with net earnings of $9,020,000, or $.36 per share,

for the 2004 first quarter. The 2005 first quarter results were in

line with Kirby's April 14, 2005 announcement that earnings would

exceed $.50 per share and above Kirby's original published earnings

guidance range of $.42 to $.48 per share. Consolidated revenues for

the 2005 first quarter were a record $184,444,000, an increase of

17% over $157,315,000 reported for the 2004 first quarter. Revenues

for the marine transportation segment for the 2005 first quarter

increased 16% and operating income increased 42% compared with the

first quarter of 2004. The higher results reflected strong

petrochemical and black oil volumes, improved weather conditions in

March, the impact of contract rate increases during 2004 and in the

2005 first quarter, and higher spot market prices. Spot market

rates for most product lines averaged 4% to 5% higher than the 2004

fourth quarter. In addition, effective January 1, 2005, escalators

for labor and the producer price index on contracts over a year in

duration positively impacted the first quarter. The diesel engine

services segment for the 2005 first quarter reported 25% higher

revenues and operating income increased 42% compared with the

corresponding 2004 quarter. The higher results reflect strong

in-house and in-field service activity and direct parts sales in

the majority of its markets, and the acquisition of the diesel

engine service operation and parts inventory of Walker Paducah

Corp. in April 2004. The U.S. Midwest and East Coast marine

markets, the U.S. railroad market, the offshore oil service market

and the power generation market all reflected improved activity.

The operating margin for the 2005 first quarter was 12.6% compared

with 11.2% for the 2004 first quarter. Equity in earnings (loss) of

marine affiliates consists primarily of a 35% owned offshore

partnership, operating four offshore dry-cargo barge and tug units,

and a 33% interest in Osprey Line, LLC, a barge feeder service for

cargo containers along the Gulf Intracoastal Waterway, several

ports above Baton Rouge on the Mississippi River, as well as

coastal service along the Gulf of Mexico. Equity in earnings (loss)

of marine affiliates was a loss of $703,000 for the 2005 first

quarter, reflecting a heavy shipyard schedule for the Company's 35%

owned offshore partnership and start-up costs for Osprey's coastal

service along the Gulf of Mexico, which began its service late last

year. Joe Pyne, President and Chief Executive Officer of Kirby,

commented, "The first quarter is normally the most difficult

quarter for Kirby. During January and February, stronger customer

demand, particularly in the petrochemical and black oil markets,

was negatively impacted by poor navigational conditions, creating

pent-up demand for movements in March. Although total first quarter

navigation delay days were higher than in 2004, weather and river

conditions improved significantly in March, which allowed for

better asset utilization and more efficient use of horsepower.

Total ton miles were about the same as the first quarter of 2004,

but product mix, contract and spot rate increases, and fuel cost

recovery resulted in a 16% growth in marine transportation revenue

and a 42% increase in operating income." Commenting on the 2005

second quarter market conditions and guidance, Mr. Pyne said, "We

expect our petrochemical and black oil markets to remain strong. We

anticipate a normal seasonal improvement in our upriver refined

products market and seasonal agricultural chemical volumes. For the

2005 second quarter, our earnings per share guidance is $.65 to

$.70, compared with $.55 per share reported for the 2004 second

quarter. For the 2005 year, we increased our guidance to $2.45 to

$2.55 per share from previous guidance of $2.20 to $2.30 per share.

This guidance compares with 2004 net earnings of $1.97 per share.

Capital spending guidance for 2005 remains in the $110 to $120

million range and includes approximately $65 million for the

construction of 18 double hull 30,000 barrel capacity inland tank

barges and 20 double hull 10,000 barrel capacity inland tank

barges. The $65 million estimate for the construction of new tank

barges is subject to the fluctuation of steel prices." This

earnings press release includes marine transportation performance

measures for both the 2005 and 2004 first quarters. The performance

measures include ton miles, revenues per ton mile, towboats

operated and delay days. Comparable performance measures for the

2004 and 2003 years and quarters are available at Kirby's web site

under the caption Performance Measurements in the Investor

Relations section. Kirby's homepage can be accessed by visiting

http://www.kirbycorp.com/ . A conference call is scheduled at 10:00

a.m. central time tomorrow, Thursday, April 28, 2005, to discuss

the 2005 first quarter and outlook for the 2005 second quarter and

year. The conference call number is 888-328-2514 for domestic

callers and 706-679-3262 for international callers. The leader's

name is Steve Holcomb. An audio playback will be available starting

at approximately 12:00 p.m. central time on Thursday, April 28,

through 6:00 p.m. central time on Friday, May 27, 2005, by dialing

800-642-1687 for domestic callers and 706-645-9291 for

international callers. The conference ID number is 5580272. The

conference call can also be accessed by visiting Kirby's homepage

at http://www.kirbycorp.com/ or at

http://audioevent.mshow.com/229462 . A replay will be available on

each of those web sites following the conference call. The

financial and other information to be discussed in the conference

call is available in this press release and in a Form 8-K filed

with the Securities and Exchange Commission. This press release and

the Form 8-K include a non- GAAP financial measure, EBITDA, which

Kirby defines as net earnings before interest expense, taxes on

income, depreciation and amortization. A reconciliation of EBITDA

for the 2005 and 2004 first quarters with GAAP net earnings for the

same periods is included in the Condensed Consolidated Financial

Information in this press release. Kirby Corporation, based in

Houston, Texas, operates inland tank barges and towing vessels,

transporting petrochemicals, black oil products, refined petroleum

products and agricultural chemicals throughout the United States

inland waterway system. Through the diesel engine services segment,

Kirby provides after-market service for large medium-speed and

high-speed diesel engines and reduction gears used in marine, power

generation and railroad applications. Statements contained in this

press release with respect to the future are forward-looking

statements. These statements reflect management's reasonable

judgment with respect to future events. Forward-looking statements

involve risks and uncertainties. Actual results could differ

materially from those anticipated as a result of various factors,

including cyclical or other downturns in demand, significant

pricing competition, unanticipated additions to industry capacity,

changes in the Jones Act or in U.S. maritime policy and practice,

fuel costs, interest rates, weather conditions, and timing,

magnitude and number of acquisitions made by Kirby. Forward-looking

statements are based on currently available information and Kirby

assumes on obligation to update any such statements. A list of

additional risk factors can be found in Kirby's annual report on

Form 10-K for the year ended December 31, 2004, filed with the

Securities and Exchange Commission. CONFERENCE CALL INFORMATION

Date: Thursday, April 28, 2005 Leader: Steve Holcomb Time: 10:00

a.m. central time Passcode: Kirby U.S.: 888-328-2514 Int'l:

706-679-3262 Website: http://www.kirbycorp.com/ or

http://audioevent.mshow.com/229462 A summary of the results for the

first quarter follows. CONDENSED CONSOLIDATED STATEMENTS OF

EARNINGS First Quarter 2005 2004 (unaudited, $ in thousands except

per share amounts) Revenues: Marine transportation $157,210

$135,493 Diesel engine services 27,234 21,822 184,444 157,315 Costs

and expenses: Costs of sales and operating expenses 119,927 102,927

Selling, general and administrative 20,959 19,965 Taxes, other than

on income 3,186 3,252 Depreciation and amortization 14,981 13,797

Loss (gain) on disposition of assets (192) 2 158,861 139,943

Operating income 25,583 17,372 Equity in earnings (loss) of marine

affiliates (703) 822 Other expense (316) (271) Interest expense

(3,146) (3,374) Earnings before taxes on income 21,418 14,549

Provision for taxes on income (8,139) (5,529) Net earnings $ 13,279

$ 9,020 Net earnings per share of common stock: Basic $ 0.53 $ 0.37

Diluted $ 0.52 $ 0.36 Common stock outstanding (in thousands):

Basic 24,854 24,345 Diluted 25,578 24,913 CONDENSED CONSOLIDATED

FINANCIAL INFORMATION First Quarter 2005 2004 (unaudited, $ in

thousands except per share amounts) EBITDA: (A) Net earnings $

13,279 $ 9,020 Interest expense 3,146 3,374 Provision for taxes on

income 8,139 5,529 Depreciation and amortization 14,981 13,797 $

39,545 $ 31,720 Capital expenditures $ 24,023 $ 24,047 Acquisition

of marine equipment $--- $ 1,110 March 31, 2005 2004 (unaudited, $

in thousands) Long-term debt, including current portion $ 205,139 $

250,409 Stockholders' equity $ 454,672 $ 381,674 Debt to

capitalization ratio 31.1% 39.6% MARINE TRANSPORTATION STATEMENTS

OF EARNINGS First Quarter 2005 2004 (unaudited, $ in thousands)

Marine transportation revenues $ 157,210 $ 135,493 Costs and

expenses: Costs of sales and operating expenses 99,652 86,966

Selling, general and administrative 16,312 15,504 Taxes, other than

on income 3,050 3,133 Depreciation and amortization 14,275 13,016

133,289 118,619 Operating income $ 23,921 $ 16,874 Operating

margins 15.2% 12.5% DIESEL ENGINE SERVICES STATEMENTS OF EARNINGS

First Quarter 2005 2004 (unaudited, $ in thousands) Diesel engine

services revenues $ 27,234 $ 21,822 Costs and expenses: Costs of

sales and operating expenses 20,269 15,934 Selling, general and

administrative 3,110 3,034 Taxes, other than on income 110 82

Depreciation and amortization 278 333 23,767 19,383 Operating

income $ 3,467 $ 2,439 Operating margins 12.7% 11.2% OTHER COSTS

AND EXPENSES First Quarter 2005 2004 (unaudited, $ in thousands)

General corporate expenses $ 1,997 $ 1,939 Loss (gain) on

disposition of assets $ (192) $ 2 MARINE TRANSPORTATION PERFORMANCE

MEASUREMENTS First Quarter 2005 2004 Ton Miles (in millions) (B)

3,738 3,735 Revenue/Ton Mile (cents/tm) (C) 4.2 3.6 Towboats

operated (average) (D) 239 233 Delay Days (E) 3,289 2,359 Average

cost per gallon of fuel consumed $ 1.32 $ .99 Tank barges: Active

878 874 Inactive 64 71 Barrel Capacities (in millions): Active 16.3

16.0 Inactive 1.2 1.3 (A) Kirby has historically evaluated its

operating performance using numerous measures, one of which is

EBITDA, a non-GAAP financial measure. Kirby defines EBITDA as net

earnings before interest expense, taxes on income, depreciation and

amortization. EBITDA is presented because of its wide acceptance as

a financial indicator. EBITDA is one of the performance measures

used in Kirby's incentive bonus plan. EBITDA is also used by rating

agencies in determining Kirby's credit rating and by analysts

publishing research reports on Kirby, as well as by investors and

investment bankers generally in valuing companies. EBITDA is not a

calculation based on generally accepted accounting principles and

should not be considered as an alternative to, but should only be

considered in conjunction with, Kirby's GAAP financial information.

(B) Ton miles indicate fleet productivity by measuring the distance

(in miles) a loaded tank barge is moved. Example: A typical 30,000

barrel tank barge loaded with 3,300 tons of liquid cargo is moved

100 miles, thus generating 330,000 ton miles. (C) Marine

transportation revenues divided by ton miles. Example: First

quarter 2005 revenues of $157,210,000 divided by 3,738,000,000 ton

miles = 4.2 cents. (D) Towboats operated are the average number of

owned and chartered towboats operated during the period. (E) Delay

days measures the lost time incurred by a tow (towboat and tank

barges) during transit. The measure includes transit delays caused

by weather, lock congestion and other navigational factors.

DATASOURCE: Kirby Corporation CONTACT: Steve Holcomb of Kirby

Corporation, +1-713-435-1135 Web site: http://www.kirbycorp.com/

http://audioevent.mshow.com/229462

Copyright

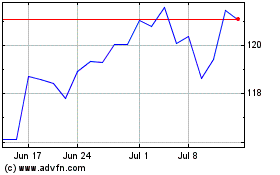

Kirby (NYSE:KEX)

Historical Stock Chart

From Jul 2024 to Jul 2024

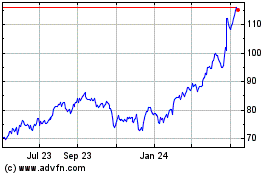

Kirby (NYSE:KEX)

Historical Stock Chart

From Jul 2023 to Jul 2024