URS Suffers Loss on Goodwill Charge - Analyst Blog

February 28 2012 - 9:15AM

Zacks

URS Corp. (URS)

reported fourth-quarter fiscal 2011 earnings per share of 37 cents

compared with 75 cents in fourth-quarter 2010. The Zacks Consensus

Estimate was way up higher at 98 cents.

During the quarter, the company

recorded a goodwill impairment charge of 43 cents per share.

Earnings for the quarter also include a non-cash, after-tax charge

of $0.02 per share, related to the retirement of the company’s

prior credit facility and a $0.07 per share, after-tax charge

related to the restructuring of URS’ international operations in

Europe. Excluding these charges, earnings per share would have been

89 cents in the quarter.

For 2011, the company reported a

loss per share of $6.03 compared with earnings per share of $3.54

in 2010. The Zacks Consensus Estimate was earnings of $3.63.

Excluding 2 cents per share related

to the retirement of the company’s prior credit facility, 7 cents

per share of after-tax charge related to the restructuring of URS’

international operations in Europe and 1 cent per share of

after-tax charge related to acquisition expenses, earnings per

share for the year were $3.53.

Total Revenue

Total revenue in the quarter was

$2.39 billion compared with $2.38 billion in the prior-year

quarter.

For 2011, total revenue was $9.55

billion compared with $9.18 billion a year ago. URS Corp.’s backlog

was $14.3 billion at the end of 2011 compared with $16.6 billion at

the end of 2010.

Segment Result

Infrastructure and

Environment revenue in the quarter was $943.8 million

compared with $895.1 million in the prior-year quarter.

Federal Services revenue was $726.5 million

compared with $647.8 million a year ago. Energy and

Construction revenue was $722.9 million compared with

$837.2 million in the prior-year period.

Income and

Expenses

Operating income in the quarter was

$114.1 million compared with $122.4 million in the prior-year

quarter. General and administrative expenses were $19.6 million

compared with $15.9 million a year ago.

Balance Sheet and Cash

Flow

Cash and cash equivalents were

$436.0 million at the end of the year compared with $573.8 million

at the end of 2010. Long-term debt was $737.0 million compared with

$641.3 million and shareowners equity was $3.48 billion compared

with $4.20 billion at the end of 2010.

Outlook

The company expects its 2012

revenue to be in the range of $9.9 billion to $10.1 billion and EPS

in the band of $3.95 and $4.05.

URS Corp. was originally

incorporated in California on May 1, 1957 as Broadview Research

Corporation. On May 18, 1976, it was re-incorporated in Delaware

under the name URS Corporation. The name “URS Corporation” was

formally adopted on February 21, 1990. URS Corp. provides

engineering, construction and technical services. As such, it

offers a broad range of program management, planning, design,

engineering, construction and construction management, operations

and maintenance, and decommissioning and closure services to public

agencies and private sector clients globally. It is also a major

U.S. federal government contractor in the areas of systems

engineering and technical assistance, and operations and

maintenance. Major competitors of URS are AECOM Technology

Corporation (ACM), Fluor Corporation

(FLR) and KBR Inc. (KBR).

We currently maintain our Neutral

rating on URS Corp. with a Zacks #2 Rank (short-term Buy

recommendation) over the next one-to-three months.

AECOM TECH CORP (ACM): Free Stock Analysis Report

FLUOR CORP-NEW (FLR): Free Stock Analysis Report

KBR INC (KBR): Free Stock Analysis Report

URS CORP (URS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

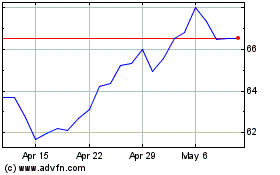

KBR (NYSE:KBR)

Historical Stock Chart

From Apr 2024 to May 2024

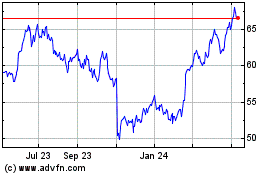

KBR (NYSE:KBR)

Historical Stock Chart

From May 2023 to May 2024