KBR Acquires Roberts and Schaefer Company

December 21 2010 - 9:28AM

Business Wire

KBR (NYSE: KBR) announced that it has acquired Chicago-based

Roberts & Schaefer Company. Roberts & Schaefer, a

subsidiary of Elgin National Industries, is a global leader in

engineering, procurement and construction (EPC) services for bulk

material handling and processing systems. The company provides

services and associated processing infrastructure to customers in

the mining and minerals, power, industrial, refining, aggregates,

precious and base metals industries. The purchase price is $280

million, plus preliminary net working capital of $12 million with

final adjustment after closing.

In addition to its Chicago headquarters, Roberts & Schaefer

has major operations in locations that include Salt Lake City,

Utah; Brisbane, Australia; Gliwice, Poland; Jakarta, Indonesia; and

Ahmedabad, India. Roberts & Schaefer also includes Soros, a

provider of material handling solutions for port and marine

applications, and Separator, providing services to coal, minerals

and power markets in Eastern Europe.

“We are pleased to add the capabilities and talented staff of

Roberts & Schaefer to KBR. This acquisition enhances our

strategy to be a leading services provider in commodity markets and

we feel the addition of Roberts & Schaeffer to our existing

engineering and construction platform enables KBR to significantly

broaden our services offerings to a wide range of commodity,

material handling and process customers,” said William P. Utt, KBR

Chairman, President and CEO.

Roberts & Schaefer’s internationally-differentiated

technical offerings bring bulk materials handling capabilities to

KBR’s existing minerals business. The company will also add ports

and marine infrastructure capabilities for KBR’s clients. These

combined operations will enable KBR to participate in mining and

power developments from pre-feasibility to feasibility, through

design, and construction, creating a pit-to-port and port-to-boiler

capability. Roberts & Schaefer will complement KBR’s existing

competencies in mine infrastructure, project management and

implementation.

“This acquisition signals KBR’s continuing commitment to expand

its global footprint across several commodity markets,” said Mark

Williams, Group President, KBR Infrastructure, Government and

Power. “This is a significant step towards providing our clients

with a more diverse and differentiated service offering."

KBR is a global engineering, construction and services company

supporting the energy, hydrocarbon, government services, minerals,

civil infrastructure, power and industrial markets. For more

information, visit www.kbr.com.

Elgin National Industries is a portfolio company of OCM/GFI

Power Opportunities Fund II, L.P., a private equity fund co-managed

by Los-Angeles-based Oaktree Capital Management and GFI Energy

Ventures.

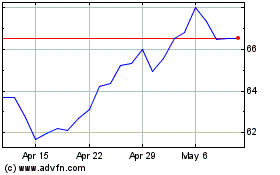

KBR (NYSE:KBR)

Historical Stock Chart

From Apr 2024 to May 2024

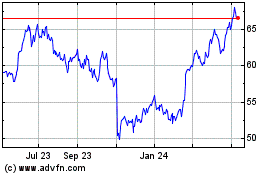

KBR (NYSE:KBR)

Historical Stock Chart

From May 2023 to May 2024