Kayne Anderson MLP Investment Company Provides an Update on Recent Events Related to the Company’s Auction Rate Preferred S...

December 16 2009 - 7:43PM

Business Wire

Kayne Anderson MLP Investment Company (the “Company”) today

provided an update on recent events related to the Company’s

Auction Rate Preferred Securities (“ARPS”).

On December 14, 2009, Karpus Investment Management (“KIM”) sent

the Company a letter indicating that KIM was nominating one

director to be solely elected by the holders of the Company’s

preferred shareholders at the Company’s next annual meeting. The

Company is disappointed that KIM has resorted to this course of

action. The Company recently assured KIM that the Company’s Board

of Directors is actively considering refinancing alternatives for

its ARPS. The Company and its Board of Directors has been in

discussions with its underwriters as well as other larger ARPS

share-holders to develop a solution that balances the interests of

both common and preferred shareholders.

In its previous correspondence with KIM, the Company reminded

KIM that each member of its Board of Directors holds a fiduciary

duty to the corporation as a whole, regardless of which group of

shareholders elected such director. As such, in determining any

course of action with respect to the ARPS, the Board of Directors

must assess the benefit or detriment to both the common and

preferred shareholders and cannot do something that benefits the

preferred shareholders at the expense of the common

shareholders.

According to the Schedule 13D filing made by KIM on December 14,

2009, KIM began purchasing the Company’s ARPS in November 2008,

nine months after the collapse of the Auction Rate Market and at a

significant discount to the liquidation value of the ARPS. KIM

first contacted the Company on December 2, 2009, to express its

disappointment with the progress the Company has made on

refinancing the ARPS. KIM then filed a Schedule 13D just 12 days

after making initial contact with the Company. KIM indicated to the

Company that it wants to propose the candidacy of a new director

that would “represent the interests of KYN’s preferred

shareholders.” KIM also asserted that it does not believe that the

“preferred directors’ fiduciary duty lies with both the preferred

and common shareholders.” The Company and its legal counsel

strongly believe that, based on applicable corporate law, KIM is

incorrect in this assertion. Further, the Company has and will

continue to observe all of its legal obligations with respect to

the ARPS and has remained in compliance with all covenants

associated with the ARPS.

Kayne Anderson MLP Investment Company is a non-diversified,

closed-end management investment company registered under the

Investment Company Act of 1940, whose common stock is traded on the

NYSE. The Company's investment objective is to obtain a high

after-tax total return by investing at least 85% of its total

assets in energy-related master limited partnerships and their

affiliates, and in other companies that, as their principal

business, operate assets used in the gathering, transporting,

processing, storing, refining, distributing, mining or marketing of

natural gas, natural gas liquids (including propane), crude oil,

refined petroleum products or coal.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS: This press

release contains "forward-looking statements" as defined under the

U.S. federal securities laws. Generally, the words "believe,"

"expect," "intend," "estimate," "anticipate," "project," "will" and

similar expressions identify forward-looking statements, which

generally are not historical in nature. Forward-looking statements

are subject to certain risks and uncertainties that could cause

actual results to differ from the Company's historical experience

and its present expectations or projections indicated in any

forward-looking statements. These risks include, but are not

limited to, changes in economic and political conditions;

regulatory and legal changes; MLP industry risk; leverage risk;

valuation risk; interest rate risk; tax risk; and other risks

discussed in the Company's filings with the SEC. You should not

place undue reliance on forward-looking statements, which speak

only as of the date they are made. The Company undertakes no

obligation to publicly update or revise any forward-looking

statements made herein. There is no assurance that the Company's

investment objectives will be attained.

Kayne Anderson Energy In... (NYSE:KYN)

Historical Stock Chart

From May 2024 to Jun 2024

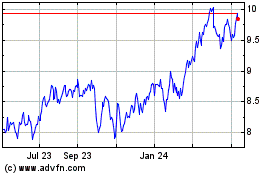

Kayne Anderson Energy In... (NYSE:KYN)

Historical Stock Chart

From Jun 2023 to Jun 2024