Earnings Preview: Omnicom Group - Analyst Blog

February 10 2012 - 9:00AM

Zacks

Omnicom Group Inc.

(OMC) will report its

fourth-quarter and FY11 earnings on Tuesday, February 14, 2012.

The current Zacks Consensus

Estimate for earnings per share (EPS) is 95 cents, representing an

annualized growth rate of 13.99%.

With respect to earnings surprises,

over the trailing four quarters, OMC outperformed the Zacks

Consensus Estimate in all the quarters. The average earnings

surprise was 6.66%, implying that the company outperformed the

Zacks Consensus Estimate by the same magnitude over the last four

quarters.

Third-Quarter

Highlights

On October 18, Omnicom Group posted

decent operating results for the third quarter of 2011.

Omnicom’s net income in the quarter

grew 16.7% year over year to $203.7 million from $174.6 million in

the third quarter of 2010. Earnings per share (EPS) expanded by

26.3% from 57 cents in the year-ago quarter to 72 cents in the

reported quarter. EPS also beats the Zacks Consensus Estimate of 70

cents.

Total revenue was $3,380.9 million,

up 12.9% year over year from $2,994.6 million in the corresponding

quarter of the previous year. Revenue surpassed the Zacks Consensus

Estimate of $3,293.0 million. Domestic and International revenue

rose 5.3% and 21.8% to reach $1,703.2 million and $1,677.7 million,

respectively.

Agreement of Estimate

Revisions

In the last 30 days, one analyst

increased the company’s earnings per share (EPS) estimate for the

fourth quarter of 2011 while three analysts decreased the same for

the quarter. However, for fiscal 2011, one analyst raised its

estimate while two decreased the same. For fiscal 2012, two

analysts increased estimate in the last 30 days, while 3 decreased

the same.

Magnitude of Estimate

Revisions

Estimates over the last 30 days

remained static at 95 cents for the fourth quarter of 2011,

representing a year-over-year growth of 13.99%.

Estimate for fiscal 2011 remained

static at $3.30 over the last 30 days. For fiscal 2012, the average

remained static at $3.65, as the positive and negative movements of

the analyst estimates had an offsetting effect on each other over

the last 30 days. These estimates represented a year-over-year

growth of 22.35% for 2011 and 10.42% for 2012.

Recently, Omnicom Group Inc.

announced the increase of the company's quarterly cash dividend by

20%, raising it from 25 cents to 30 cents per outstanding share of

the company’s common stock.

The company’s board has declared a

dividend of 30 cents per share, which is payable on April 2, 2012

to Omnicom Group common shareholders of record at the close of

business as of March 5, 2012.

Our Take

Omnicom is likely to foresee

revenue growth, on the backdrop of improving US and international

ad market, fueled by rising consumer spending. Moreover, the

company’s customized, cost effective business mix alongside

acquisitions and client base expansion appear favorable.

Omnicom is one of the largest

advertising, marketing and corporate communications companies in

the world extending customized mix of traditional media

advertising; customer relationship management (CRM), public

relations (PR), and specialty communications services in all the

major markets across the globe. It directly competes with its

peers, such as The Interpublic Group of Companies

Inc. (IPG), Publicis Groupe SA (PUBGY.PK)

and WPP plc (WPPGY).

We currently maintain a long-term

Neutral recommendation on the stock. The company has a Zacks #3

Rank, which translates into a short-term Hold rating (1-3

months).

INTERPUBLIC GRP (IPG): Free Stock Analysis Report

OMNICOM GRP (OMC): Free Stock Analysis Report

PUBLICIS GP-ADR (PUBGY): Free Stock Analysis Report

WPP GRP PLC (WPPGY): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

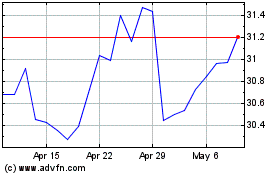

Interpublic Group of Com... (NYSE:IPG)

Historical Stock Chart

From May 2024 to Jun 2024

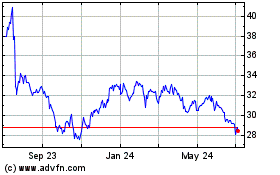

Interpublic Group of Com... (NYSE:IPG)

Historical Stock Chart

From Jun 2023 to Jun 2024