Graham Holdings Company (NYSE: GHC) today reported its financial

results for the first quarter of 2024. The Company also filed its

Form 10-Q today for the quarter ended March 31, 2024 with the

Securities and Exchange Commission.

Division Operating

Results

Revenue for the first quarter of 2024 was $1,152.7 million, up

12% from $1,031.5 million in the first quarter of 2023. Revenues

increased at education, healthcare and automotive, partially offset

by declines at manufacturing and other businesses. The Company

reported operating income of $35.4 million for the first quarter of

2024, compared to $27.7 million for the first quarter of 2023. The

improvement in operating results is due to increases at education,

television broadcasting and healthcare, and reduced losses at other

businesses, partially offset by declines at manufacturing and

automotive. The Company reported adjusted operating cash flow

(non-GAAP) for 2024 of $82.8 million for the first quarter of 2024,

compared to $71.6 million for the first quarter of 2023. Adjusted

operating cash flow improved at education, television broadcasting,

healthcare and other businesses, partially offset by declines at

manufacturing and automotive. Capital expenditures totaled $21.5

million and $22.3 million for the first quarter of 2024 and 2023,

respectively.

Acquisitions and Dispositions of

Businesses

There were no significant business acquisitions or dispositions

during the first quarter of 2024.

Debt, Cash and Marketable Equity

Securities

At March 31, 2024, the Company had $815.6 million in borrowings

outstanding at an average interest rate of 6.4%, including $108.1

million outstanding on its $300 million revolving credit facility.

Cash, marketable equity securities and other investments totaled

$981.9 million at March 31, 2024.

Overall, the Company recognized $104.2 million and $18.0 million

in net gains on marketable equity securities in the first quarter

of 2024 and 2023, respectively.

Common Stock Repurchases

During the first quarter of 2024, the Company purchased a total

of 28,606 shares of its Class B common stock at a cost of $20.0

million. At March 31, 2024, there were 4,450,593 shares

outstanding. On May 4, 2023, the Board of Directors authorized the

Company to acquire up to 500,000 shares of its Class B common

stock; the Company has remaining authorization for 207,797 shares

as of March 31, 2024.

Overall Company Results

The Company reported net income attributable to common shares of

$124.4 million ($27.72 per share) for the first quarter of 2024,

compared to $52.3 million ($10.88 per share) for the first quarter

of 2023.

The results for the first quarter of 2024 and 2023 were affected

by a number of items as described in the Non-GAAP Financial

Information schedule attached to this release. Excluding these

items, net income attributable to common shares was $50.4 million

($11.24 per share) for the first quarter of 2024, compared to $40.2

million ($8.36 per share) for the first quarter of 2023.

* * * * * * * * * * * *

Forward-Looking

Statements

All public statements made by the Company and its

representatives that are not statements of historical fact,

including certain statements in this press release, in the

Company’s Annual Report on Form 10-K and in the Company’s 2023

Annual Report to Stockholders, are “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. Forward-looking statements are based on expectations,

forecasts, and assumptions by the Company’s management and involve

a number of risks, uncertainties, and other factors that could

cause actual results to differ from those stated, including,

without limitation, comments about expectations related to

acquisitions or dispositions or related business activities, the

Company’s business strategies and objectives, the prospects for

growth in the Company’s various business operations, the Company’s

future financial performance, and the risks and uncertainties

described in Item 1A of the Company’s Annual Report on Form 10-K.

Accordingly, undue reliance should not be placed on any

forward-looking statement made by or on behalf of the Company. The

Company assumes no obligation to update any forward-looking

statement after the date on which such statement is made, even if

new information subsequently becomes available.

GRAHAM HOLDINGS COMPANY

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

Three Months Ended

March 31

%

(in thousands, except per share

amounts)

2024

2023

Change

Operating revenues

$

1,152,662

$

1,031,546

12

Operating expenses

1,083,942

969,176

12

Depreciation of property, plant and

equipment

22,527

20,025

12

Amortization of intangible assets

10,751

13,944

(23

)

Impairment of long-lived assets

—

745

—

Operating income

35,442

27,656

28

Equity in earnings of affiliates, net

2,331

4,661

(50

)

Interest income

2,178

1,204

81

Interest expense

(19,328

)

(14,294

)

35

Non-operating pension and postretirement

benefit income, net

42,417

31,845

33

Gain on marketable equity securities,

net

104,152

18,022

—

Other income, net

1,647

3,083

(47

)

Income before income taxes

168,839

72,177

—

Provision for income taxes

43,500

19,200

—

Net income

125,339

52,977

—

Net income attributable to

noncontrolling interests

(959

)

(705

)

36

Net Income Attributable to Graham

Holdings Company Common Stockholders

$

124,380

$

52,272

—

Per Share Information Attributable to

Graham Holdings Company Common Stockholders

Basic net income per common share

$

27.87

$

10.91

—

Basic average number of common shares

outstanding

4,432

4,759

Diluted net income per common share

$

27.72

$

10.88

—

Diluted average number of common shares

outstanding

4,457

4,776

GRAHAM HOLDINGS COMPANY

BUSINESS

DIVISION INFORMATION

(Unaudited)

Three Months Ended

March 31

%

(in thousands)

2024

2023

Change

Operating Revenues

Education

$

422,598

$

378,041

12

Television broadcasting

113,058

112,877

0

Manufacturing

101,903

114,584

(11

)

Healthcare

128,201

102,059

26

Automotive

303,840

232,561

31

Other businesses

83,298

92,008

(9

)

Corporate office

576

—

—

Intersegment elimination

(812

)

(584

)

—

$

1,152,662

$

1,031,546

12

Operating Expenses

Education

$

392,011

$

355,001

10

Television broadcasting

83,425

84,294

(1

)

Manufacturing

98,834

107,256

(8

)

Healthcare

122,110

99,123

23

Automotive

294,188

221,718

33

Other businesses

112,252

123,009

(9

)

Corporate office

15,212

14,073

8

Intersegment elimination

(812

)

(584

)

—

$

1,117,220

$

1,003,890

11

Operating Income (Loss)

Education

$

30,587

$

23,040

33

Television broadcasting

29,633

28,583

4

Manufacturing

3,069

7,328

(58

)

Healthcare

6,091

2,936

—

Automotive

9,652

10,843

(11

)

Other businesses

(28,954

)

(31,001

)

7

Corporate office

(14,636

)

(14,073

)

(4

)

$

35,442

$

27,656

28

Amortization of Intangible Assets and

Impairment of Long-Lived Assets

Education

$

2,974

$

4,416

(33

)

Television broadcasting

1,350

1,362

(1

)

Manufacturing

3,120

4,862

(36

)

Healthcare

636

954

(33

)

Automotive

—

—

—

Other businesses

2,671

3,095

(14

)

Corporate office

—

—

—

$

10,751

$

14,689

(27

)

Operating Income (Loss) before

Amortization of Intangible Assets and Impairment of Long-Lived

Assets

Education

$

33,561

$

27,456

22

Television broadcasting

30,983

29,945

3

Manufacturing

6,189

12,190

(49

)

Healthcare

6,727

3,890

73

Automotive

9,652

10,843

(11

)

Other businesses

(26,283

)

(27,906

)

6

Corporate office

(14,636

)

(14,073

)

(4

)

$

46,193

$

42,345

9

Three Months Ended

March 31

%

(in thousands)

2024

2023

Change

Depreciation

Education

$

9,305

$

8,968

4

Television broadcasting

2,868

3,036

(6

)

Manufacturing

2,715

2,282

19

Healthcare

1,594

1,104

44

Automotive

1,713

1,113

54

Other businesses

4,183

3,369

24

Corporate office

149

153

(3

)

$

22,527

$

20,025

12

Pension Expense

Education

$

4,110

$

2,198

87

Television broadcasting

1,639

860

91

Manufacturing

627

275

—

Healthcare

4,758

4,357

9

Automotive

15

5

—

Other businesses

1,940

572

—

Corporate office

945

976

(3

)

$

14,034

$

9,243

52

Adjusted Operating Cash Flow

(non-GAAP)(1)

Education

$

46,976

$

38,622

22

Television broadcasting

35,490

33,841

5

Manufacturing

9,531

14,747

(35

)

Healthcare

13,079

9,351

40

Automotive

11,380

11,961

(5

)

Other businesses

(20,160

)

(23,965

)

16

Corporate office

(13,542

)

(12,944

)

(5

)

$

82,754

$

71,613

16

____________

(1)

Adjusted Operating Cash Flow (non-GAAP) is

calculated as Operating Income (Loss) before Amortization of

Intangible Assets and Impairment of Long-Lived Assets plus

Depreciation Expense and Pension Expense.

GRAHAM HOLDINGS COMPANY

EDUCATION

DIVISION INFORMATION

(Unaudited)

Three Months Ended

March 31

%

(in thousands)

2024

2023

Change

Operating Revenues

Kaplan international

$

269,798

$

227,076

19

Higher education

80,122

78,341

2

Supplemental education

72,122

73,587

(2

)

Kaplan corporate and other

2,588

2,372

9

Intersegment elimination

(2,032

)

(3,335

)

—

$

422,598

$

378,041

12

Operating Expenses

Kaplan international

$

238,486

$

205,775

16

Higher education

74,603

71,258

5

Supplemental education

67,542

69,836

(3

)

Kaplan corporate and other

10,173

7,210

41

Amortization of intangible assets

2,974

3,939

(24

)

Impairment of long-lived assets

—

477

—

Intersegment elimination

(1,767

)

(3,494

)

—

$

392,011

$

355,001

10

Operating Income (Loss)

Kaplan international

$

31,312

$

21,301

47

Higher education

5,519

7,083

(22

)

Supplemental education

4,580

3,751

22

Kaplan corporate and other

(7,585

)

(4,838

)

(57

)

Amortization of intangible assets

(2,974

)

(3,939

)

24

Impairment of long-lived assets

—

(477

)

—

Intersegment elimination

(265

)

159

—

$

30,587

$

23,040

33

Operating Income (Loss) before

Amortization of Intangible Assets and Impairment of Long-Lived

Assets

Kaplan international

$

31,312

$

21,301

47

Higher education

5,519

7,083

(22

)

Supplemental education

4,580

3,751

22

Kaplan corporate and other

(7,585

)

(4,838

)

(57

)

Intersegment elimination

(265

)

159

—

$

33,561

$

27,456

22

Depreciation

Kaplan international

$

7,356

$

6,330

16

Higher education

903

1,102

(18

)

Supplemental education

1,019

1,509

(32

)

Kaplan corporate and other

27

27

0

$

9,305

$

8,968

4

Pension Expense

Kaplan international

$

163

$

80

—

Higher education

1,781

922

93

Supplemental education

1,818

1,024

78

Kaplan corporate and other

348

172

—

$

4,110

$

2,198

87

Adjusted Operating Cash Flow

(non-GAAP)(1)

Kaplan international

$

38,831

$

27,711

40

Higher education

8,203

9,107

(10

)

Supplemental education

7,417

6,284

18

Kaplan corporate and other

(7,210

)

(4,639

)

(55

)

Intersegment elimination

(265

)

159

—

$

46,976

$

38,622

22

____________

(1)

Adjusted Operating Cash Flow (non-GAAP) is

calculated as Operating Income (Loss) before Amortization of

Intangible Assets and Impairment of Long-Lived Assets plus

Depreciation Expense and Pension Expense.

NON-GAAP FINANCIAL INFORMATION GRAHAM HOLDINGS COMPANY

(Unaudited)

In addition to the results reported in accordance with

accounting principles generally accepted in the United States

(GAAP) included in this press release, the Company has provided

information regarding Adjusted Operating Cash Flow and Net income

excluding certain items described below, reconciled to the most

directly comparable GAAP measures. Management believes that these

non-GAAP measures, when read in conjunction with the Company’s GAAP

financials, provide useful information to investors by

offering:

- the ability to make meaningful period-to-period comparisons of

the Company’s ongoing results;

- the ability to identify trends in the Company’s underlying

business; and

- a better understanding of how management plans and measures the

Company’s underlying business.

Adjusted Operating Cash Flow and Net income, excluding certain

items, should not be considered substitutes or alternatives to

computations calculated in accordance with and required by GAAP.

These non-GAAP financial measures should be read only in

conjunction with financial information presented on a GAAP

basis.

The gains and losses on marketable equity securities relate to

the change in the fair value (quoted prices) of its portfolio of

equity securities. The mandatorily redeemable noncontrolling

interest represents the ownership portion of a group of minority

shareholders at a subsidiary of the Company's Healthcare business.

The Company measures the redemption value of this minority

ownership on a quarterly basis with changes in the fair value

recorded as interest expense or income, which is included in net

income for the period. The effect of gains and losses on marketable

equity securities and net interest expense related to fair value

adjustments of the mandatorily redeemable noncontrolling interest

are not directly related to the core performance of the Company’s

business operations since these items do not directly relate to the

sale of the Company’s services or products. The accounting

principles generally accepted in the United States (“GAAP”) require

that the Company include the gains and losses on marketable equity

securities and net interest expense related to fair value

adjustments of the mandatorily redeemable noncontrolling interest

in net income on the Condensed Consolidated Statements of

Operations. The Company excludes the gains and losses on marketable

equity securities and net interest expense related to fair value

adjustments of the mandatorily redeemable noncontrolling interest

from the non-GAAP adjusted net income because these items are

independent of the Company’s core operations and not indicative of

the performance of the Company’s business operations.

The following tables reconcile the non-GAAP financial measures

for Net income, excluding certain items, to the most directly

comparable GAAP measures:

Three Months Ended March

31

2024

2023

Income

Income

before

Income

Net

before

Income

Net

income

Taxes

Income

income

Taxes

Income

(in thousands, except per share

amounts)

taxes

taxes

Amounts attributable to Graham Holdings

Company Common Stockholders

As reported

$

168,839

$

43,500

$

125,339

$

72,177

$

19,200

$

52,977

Attributable to noncontrolling

interests

(959

)

(705

)

Attributable to Graham Holdings Company

Stockholders

124,380

52,272

Adjustments:

Charges related to non-operating

Separation Incentive Programs

418

107

311

4,129

1,062

3,067

Net gains on marketable equity

securities

(104,152

)

(26,668

)

(77,484

)

(18,022

)

(4,744

)

(13,278

)

Net losses (earnings) of affiliates whose

operations are not managed by the Company

1,486

380

1,106

(1,812

)

(477

)

(1,335

)

Non-operating loss (gain) from write-up,

sale and impairment of cost method investments

406

104

302

(2,615

)

(660

)

(1,955

)

Interest expense related to the fair value

adjustment of the mandatorily redeemable noncontrolling

interest

1,876

95

1,781

1,468

75

1,393

Net Income, adjusted (non-GAAP)

$

50,396

$

40,164

Per share information attributable to

Graham Holdings Company Common Stockholders

Diluted income per common share, as

reported

$

27.72

$

10.88

Adjustments:

Charges related to non-operating

Separation Incentive Programs

0.07

0.64

Net gains on marketable equity

securities

(17.27

)

(2.76

)

Net losses (earnings) of affiliates whose

operations are not managed by the Company

0.25

(0.28

)

Non-operating loss (gain) from write-up,

sale and impairment of cost method investments

0.07

(0.41

)

Interest expense related to the fair value

adjustment of the mandatorily redeemable noncontrolling

interest

0.40

0.29

Diluted income per common share, adjusted

(non-GAAP)

$

11.24

$

8.36

The adjusted diluted per share amounts may

not compute due to rounding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240501571011/en/

Wallace R. Cooney (703) 345-6470

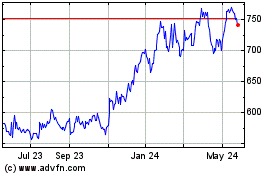

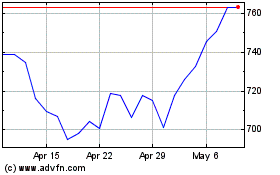

Graham (NYSE:GHC)

Historical Stock Chart

From Oct 2024 to Oct 2024

Graham (NYSE:GHC)

Historical Stock Chart

From Oct 2023 to Oct 2024