Short-Term Outlook for Gold Bullish as Lawmakers Seek to Find Solution for Upcoming "Fiscal Cliff"

November 26 2012 - 8:20AM

Marketwired

Gold stocks surged Wednesday as gold futures gained nearly $20 an

ounce to settle at a 1-month high on optimism that lawmakers could

make a deal which would avoid the upcoming "fiscal cliff." The

Market Vectors Gold Miners ETF (GDX) spiked 1.5 percent last

Wednesday. The Paragon Report examines investing opportunities in

the Gold Industry and provides equity research on Gold Fields Ltd.

(NYSE: GFI) and Golden Star Resources Ltd. (NYSE: GSS) (TSX: GSC).

Access to the full company reports can be found at:

www.ParagonReport.com/GFI www.ParagonReport.com/GSS

The "fiscal cliff" is a combination of government spending cuts

and tax increases set to take effect at the beginning of 2013

unless lawmakers reach a compromise on a new budget deal. The

Treasury Department has recently reported that the October deficit,

which is the first month of the new fiscal year, grew 22 percent to

$120 billion. Gold historically has gained in times of economic

uncertainty as investors look to it as a safe haven.

"Unless there is a clear agreement between the Democrats and

Republicans on the solution to the so-called U.S. fiscal cliff, the

short-term direction is bullish for gold," said Chintan Karnani,

chief analyst at Insignia Consultants.

Paragon Report releases regular market updates on the Gold

Industry so investors can stay ahead of the crowd and make the best

investment decisions to maximize their returns. Take a few minutes

to register with us free at www.ParagonReport.com and get exclusive

access to our numerous stock reports and industry newsletters.

Gold Fields is one of the world's largest un-hedged producers of

gold with attributable annualized production of 3.5 million gold

equivalent ounces from eight operating mines in Australia, Ghana,

Peru and South Africa. The company expects attributable gold

production to be 810,000 gold equivalent ounces in the third

quarter.

Golden Star Resources holds the largest land package in one of

the world's largest and most prolific gold producing regions. The

Company holds a 90% equity interest in Golden Star Ltd and Golden

Star Ltd., which respectively own the Bogoso/Prestea and Wassa/HBB

open-pit gold mines in Ghana, West Africa. The company reported

gold sales increased 9 percent to 80,826 ounces in the third

quarter.

The Paragon Report has not been compensated by any of the

above-mentioned publicly traded companies. Paragon Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at: http://www.paragonreport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

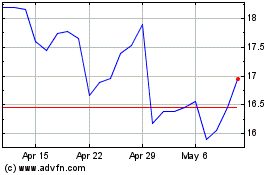

Gold Fields (NYSE:GFI)

Historical Stock Chart

From Jun 2024 to Jul 2024

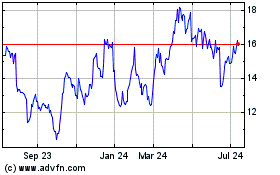

Gold Fields (NYSE:GFI)

Historical Stock Chart

From Jul 2023 to Jul 2024